Cash management is crucial to unlocking post-pandemic growth

02 November 2021

With many companies already shoring up funds to protect against future economic shocks.

6 min read

An Investec-commissioned survey revealed that companies are overwhelmingly boosting their cash reserves following the pandemic in preparation for future disruptions.

In times of financial and economic stress, having more cash at their disposal can allow companies to mitigate uncertainty and manage unforeseen events. Indeed, during times of stress, cash can act as a dynamic asset class providing ongoing liquidity, funding and returns to help boost business resilience.

At the height of the pandemic, it was important for chief financial officers, treasurers and financial directors to ensure they managed cash and liquidity efficiently across the whole business. This meant putting in place a cash management and treasury policy aligned with individual company risk tolerance while ensuring the business was strategically maximising flexibility and liquidity where possible.

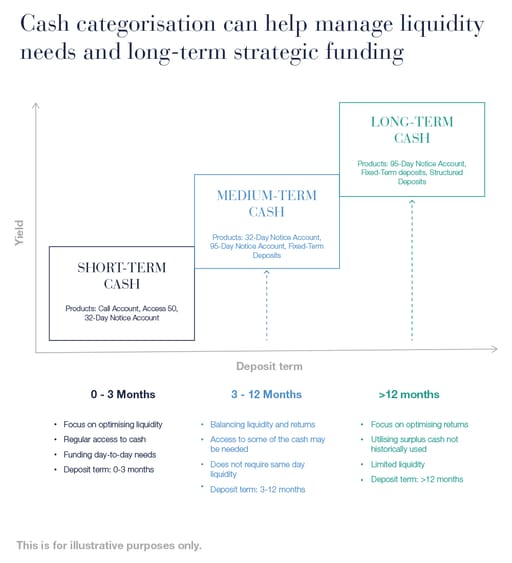

However, we think of cash as having two core functions. The first is the use of money for regular day-to-day activities of a business to serve ongoing costs and commitments, such as payments to suppliers. The second is the provision of long-term strategic cash solutions that can enable flexibility.

A prudent cash management strategy should provide sufficient access to your assets when needed and have an aligned framework around longer-term goals and objectives.

To make sure your cash management strategy will propel your business in times of growth and prepare you for the next period of uncertainty, we set out some of the key questions to consider.

Cash is the oxygen for all businesses and is crucial to sustainable growth. It is important to evaluate your treasury policy as the economic picture evolves to ensure efficient oversight of cash management.

For some businesses, a treasury policy may only extend to foreign-exchange cash management around hedging. However, we believe a more holistic approach can help businesses obtain the most from their money. This means having oversight and a strategic mandate to manage ongoing liquidity provision and long-term strategic funding. This can give you a better overall picture of risk and indicate whether you are putting your cash to work most efficiently.

Are you comfortable with the credit status of your banks? We are seeing clients become more attuned to who they leave their funds with. It is crucially important to take stock of the counterparty risk within your cash management strategy.

Are the key stakeholders aware and comfortable with your banking institutions’ current credit ratings and liquidity positions? As a treasurer, CFO or finance director, should you review this?

When assessing credit ratings, it is prudent to use multiple indicators as measures of risk. For example, what is the credit quality of the institution, and, crucially, what is the probability of default? You should also assess the capital adequacy of institutions where you have put your cash – are there appropriate buffers to ensure your money will be protected? At Investec, we are on hand to guide you through this complexity.

We believe the foundational pillar of a sound cash management strategy is diversification. This means assessing whether you are allocating just based on the highest rate or carefully diversifying exposure across a spectrum of institutions to optimise the mix of return streams.

By diversifying your cash portfolio, we can help you optimise risk and return outcomes depending on your risk threshold. Attaining high yields is important, but banks that offer higher yields are usually paying a premium because of the increased level of risk you are taking on. We believe having a basket of different yield sources with varying maturities is prudent and making sure you are conservative when accessing products from unrated providers.

When appraising your treasury policy, it is vital to forecast as accurately as possible. This will help you decide how much cash you want to strategically allocate and determine appropriate terms and maturities on interest-bearing accounts that suit your medium and longer-term goals.

Again, we think businesses should focus on day-to-day operations and the longer horizon funding and liquidity goals. Companies must also take precautions and have contingency liquidity for unforeseen events over the coming years as further disruption across supply chains is likely.

By reconciling both the short-term and longer-term needs of your business, you can unlock efficiencies and flexibility. By taking this holistic view of cash management, businesses may also find more tailored solutions best suit their needs.

For example, our Access 50 account allows you to place 50% of your initial deposit on an instant access basis and the remaining 50% on 32-day terms within the same product, providing a considerable premium above that of stand-alone instant access deposits. This helps you strengthen your cash position, capture yields and still maintain appropriate liquidity in the event of further disruption. These types of accounts were popular during the global financial crisis when companies were seeking returns while still being able to call on cash.

As supply chain issues persist, along with shortages in critical areas like energy and labour, cash will continue to be of paramount importance. For cash to work more efficiently, companies should seek guidance and diversify counterparty risk and sources of yield.

Companies should remember there are specialised business-focused banks with strong credit ratings away from the high street names that can deliver relatively strong returns.

To optimise cash management, treasurers, CFOs and financial directors should look to more holistic planning and guidance to ensure they are matching day-to-day cash management forecasts with longer-term strategic funding and liquidity goals. At the heart of a sustainable and robust business lies a healthy cash management plan.

Many businesses also have the temptation to raise capital to navigate uncertainties ahead or power growth plans. While additional capital might be imperative in some cases, it is essential to weigh up the future cost of borrowing on loans or the impact of equity raising, depending on the method envisaged.

While it is almost impossible to predict black swan events such as the pandemic, every business will face challenges for which a cash buffer is essential. But a holistic cash management strategy is much more than a defence against uncertainty - it is the bedrock of future growth.