Covid-19: A guide to the support available to your business

22 April 2020

Investec experts summarise government measures and outline practical steps to make your business more resilient in this turbulent time.

7 min read

Several cases of pneumonia were reported in Wuhan City, in the Hubei Province of China, on 31 December. One week later, Chinese authorities confirmed that they had identified a new virus, temporarily calling it 2019 Novel Coronavirus. Now dubbed Covid-19, symptoms include fatigue, difficulty in breathing, coughing and a high temperature. The virus was probably first transmitted from an animal but is now spreading from person-to-person.

While the initial infections were mostly in China, the outbreak has spread globally with thousands of cases around the world and Europe now being described as the new virus epicentre. On 11 March the World Health Organization declared the outbreak a pandemic. This came two days after a crash in global financial markets and when Italian officials imposed a national quarantine on the entire country.

Concerned with the spread of the outbreak, Chancellor Rishi Sunak unveiled a layer of fiscal stimulus including making an initial £330bn of guarantees – equivalent to 15% of UK GDP. This included a new scheme in tandem with the Bank of England, named the Covid-19 Corporate Financing Facility (CCFF), which would allow banks to bridge Covid-19 related disruptions to their cashflow.

After initial complaints that the initiall scheme fell short of requirements, Mr Sunak overhauled the Coronavirus Business Interruption Loan Scheme, originally announced in his Budget on 11 March. Previously firms with an annual turnover of less than £45mn were only able to access government-backed loans once they had been rejected for a commercial loan from their bank. This requirement has been scrapped, alongside rules that will prevent lenders from asking company owners to guarantee loans up to £250k with their own personal property.

Additionally, he has established a new Coronavirus Large Business Interruption Loan Scheme to enable firms with a turnover between £45mn and £500mn to access government-backed loans of up to £25mn. Meanwhile at the Bank of England, we have had some clarity as to the composition of the £200bn increase in QE announced by the Monetary Policy Committee last month. At least £10bn will be directed at corporate bonds, doubling the £10bn already undertaken since the first announcement in August 2016.

Business rates for shops, cinemas, restaurants and music venues in England with a rateable value below £51,000 have also been suspended for a year.

Mr Sunak has also unveiled support for self-employed workers in the UK. The new scheme will be backdated to March and cover up to 80% of self-employed people’s average profit for the past three years (up to a cap of £2,500), broadly similar to the amount of support offered to employers to furlough rather than layoff staff.

Individuals who made an annual profit of less than £50,000 and make the majority of their income from self-employment will be eligible but will require them to prove that COVID-19 has affected their businesses. Based on the Treasury’s calculations, this will cover around 95% of those who earn most of their income from self-employment (or 3.8mn) and will cost approximately £3bn a month.

“Mr Sunak overhauled the Coronavirus Business Interruption Loan Scheme, scrapping rules that require lenders to ask company owners to guarantee loans up to £250,000 with their own personal property.”

One notable omission is owner-managers of companies who pay themselves mostly through dividends. Mr Sunak stated that this is because it is impossible to distinguish between dividends derived from an individual’s work from those made from passive investments.

Banks have also agreed to give struggling customers a three-month mortgage holiday. In his concluding remarks, the chancellor stated that there would be challenging times ahead and warned that the government would not be able to protect every single job or save every single business.

Mr Sunak gave reassurances that the government would give the National Health Service all it needs to deal with the virus. This week the government announced that it was writing off £13.4bn of historic NHS debt, and Covid-19 related policies were front and centre of the Budget, with Mr Sunak unveiling a £30bn package to combat the coronavirus.

The government has also announced so-called social distancing tactics like some other European countries, along with schools closing for the majority on 20 March. Stricter measures have been put in place, as the UK is now on unofficial lockdown.

The Bank of England announced it cut its main interest rate from 0.25% to 0.10% in a unanimous vote. It also announced a step up in the targeted QE total (gilts and corporate bonds) by £200bn to £645bn; most of the additional purchases will be UK government bonds.

The BOE's Monetary Policy Committee also voted unanimously that the central bank should enlarge the Term Funding Scheme aimed mainly at small and mid-sized enterprises that was launched on 11 March, known as the TFSME scheme.

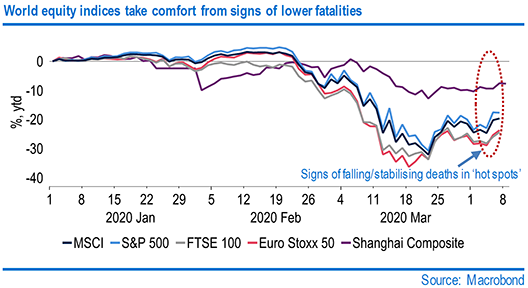

Equity markets have taken on board the relatively positive news of a recent decline in daily deaths across the current ‘hot spots’ for the crisis. US stocks have now returned to a bull market, completing two full cycles in just 6 weeks. The S&P 500 index recovered in the run-up to Easter, gaining more than 22% since its low on 23 March; 20% is typically considered to be the threshold for entering a bull market. However, note that stocks still remain some 20% cheaper than the record highs reached on 19 February.

President Trump however was more confident, stating that once re-opened the “economy will boom, perhaps like never before”.

Sentiment has been aided by greater talk of a move away from some social distancing and lockdown restrictions in certain locations. In France, Spain, Belgium, Finland and Italy, where deaths and new cases are falling, expert committees are examining how to ease lockdown measures while avoiding a second jump in cases.

Meanwhile Austria announced some shops would re-open and Denmark announced its primary schools would re-open very shortly. However, in the Eurozone, ECB President Christine Lagarde has pleaded for governments to come to terms with one another and manage this economic crisis.

On 31 March the Federal Reserve announced the establishment of a new lending facility to further boost market liquidity. The scheme is a “temporary repurchase agreement facility for foreign and international monetary authorities”, coined the FIMA Repo Facility.

‘FIMA’ consists of other central banks and monetary authorities with accounts at the New York Fed. Account holders can temporarily exchange US Treasury securities for dollars, in an aim to support the smooth functioning of financial markets and thus help maintain the supply of credit.

The facility was available from 6 April, continuing for at least six months. The announcement from the Fed is the latest in a string of policy action from major central banks.

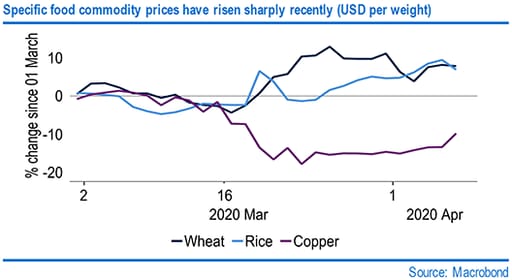

The depth of the global recession this year looks set to impart an overall disinflationary shock to the world economy, despite an expected rebound in H2 this year. But right now this picture is not uniform. Since mid-March, specific food prices have risen sharply (Chart 3), reflecting COVID-19 related factors.

In particular, there has been a surge in demand for wheat and rice based products and some reports of hoarding by specific countries. Supply considerations appear to have been modest.

Unless this shift in household preferences turns out to be permanent, a degree of destocking seems likely to put downward pressure on these commodity prices, at least when the fallout from the coronavirus pandemic begins to subside.

In the US, President Donald Trump signed the c. $2.2trn bill into law on 3 April, while restrictive measures in the US were extended. Mr Trump has warned of gravely difficult times ahead, with models estimating over 100,000 American Covid-19 induced deaths in a best-case scenario. However, in slightly contradictory move, Trump announced that reopening guidelines for some states will be announced shortly.

However, despite widespread lockdowns, consumer confidence appears to have held up relatively well with surveys in the US, the UK and the Euro area posting only very modest declines in March. Although these have proven to be lagging indicators in the past by only deteriorating after the economy has turned and unemployment has begun to rise. Indeed, non-essential retailers have suffered the brunt of the decline, most notably clothing and footwear stores which saw a record 34.8% fall over the month. Interestingly, this was also the only store type that did not see an increase in the value of their online sales.

PMI data from IHS Markit suggests that the services sector has taken the brunt of the containment measures in most geographies, in-turn dragging down composite readings to record lows.

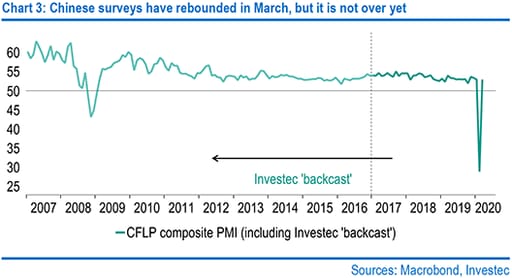

However, China now appears to be slowly getting back to business as usual. The ‘official’ PMIs from China’s National Bureau of Statistics showed record gains from last month’s abysmal readings, rebounding to pre-virus levels.

Note though that the PMIs are diffusion indices, with the 50 mark separating an expansion from a contraction in activity. As such, this does not signal that the economy is back to normal but that activity has improved marginally after February’s sharp fall.

China's recovery is in part because a lot of manufacturing in China happens far from the centre of the outbreak in Wuhan. The manufacturing hub of Guangzhou in the south-east of the country is about 650 miles (1,050km) from Wuhan – the equivalent of London to Berlin. While that’s good, the effect on the supply chain will be felt for months.

It’s likely that the US will likely see a drop in imports from China – particularly the $200 billion commitment to import US agricultural goods in Phase 1 of the US-China trade deal. We suspect China will be looking to bolster its economy in coming months, so we’ll see a reduction in hostilities.

Some pundits question whether businesses will continue to use China as a global manufacturing hub. Trump has already put the country on notice. It might be that India, Vietnam or Mexico could produce the same cheap parts with less risk. At the very least, an over-reliance on China is bad for business moving forward.

The silver lining is that China’s drastic measures seem to have paid off – new cases are in decline. But China has been through this before with the 2002-2003 outbreak of severe acute respiratory syndrome (SARS). The rest of the world has not. The next few weeks will be crucial.