Earlier this year, we spoke to 110 High Net Worth Individuals who are either investing in, or developing, UK real estate, with a total net worth of £12.2 billion.

Included as part of the research are the comments of Alex James, Head of Private Client Commercial Advisory at Knight Frank; Gary Sacks, Chairman and CEO of London focused developer City & Docklands; Paul Foster, Founder of regional property investment and asset management company Craigard; and Hayley Scott, who is part of the Real Estate Private Client team here at Investec.

Their comments echo the quantitative findings, namely that the breadth of opportunity for investors is enormous across the UK and that Covid-19 has permanently altered the real estate landscape. In line with the sophisticated and trailblazing traits of this cohort, ESG is now also very much embedded into private investors’ decision-making. Of course, investors are wary about potential obstacles too, such as high inflation – which is a dominant topic of conversation, impacting both development business plans and profit on cost targets.

Among our key findings from private clients in 2022 are:

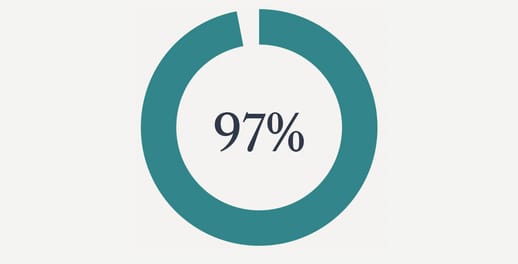

London is the most appealing location for UK real estate investment, with 97% of respondents seeing London as very or slightly appealing. It is followed by Bristol, which scored 93% respectively.

Residential for sale and rent are the asset classes viewed as the most appealing from an investment perspective over the next five years.

More than three times as many private clients believe that an opportunistic real estate strategy offers the best relative risk adjusted return today (29%) versus three years ago (9%).

Private clients are seeking only marginally higher profit on cost returns, due to headwinds such as high land values, rising development costs and inflationary pressures.

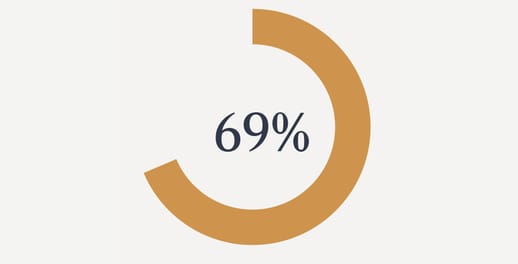

69% of private clients believe a VAT regime that penalises refurbishment over new builds is an environmentally unsound policy.