Your career is starting to accelerate and you’ve got a mortgage on your first home with a bit of help from the bank of Mum and Dad. Your income is on the up and you may be already planning on setting up your own business. But life is hectic and words like Financial Planning and pensions are rarely front of mind. But this is the age when being smart about your long-term future can pay real dividends later in life. With the power of compound growth, investing even relatively modest amounts of disposable money on a regular basis can have a huge impact on your future wealth.

Investec Wealth & Investment (UK) is now part of Rathbones Group Plc. Find out what this means.

Whatever age you are, wherever you are on life’s journey, it’s human nature to live in the moment and cope with whatever challenges life throws at you. In fact, the majority of us never plan further than a few days or weeks ahead or even take the time to look at how our investments, pensions and savings are performing from one year to the next.

As a result, your goals and financial needs will be constantly evolving, and as we live longer, healthier lives it raises many questions as to what we do with the extra time we have and how we can afford to do the things we want to do. Should we reinvent ourselves by learning new skills? Do we take several career breaks? Do we retire early or keep on working? Whatever your goals, whatever your questions, our ambition is to help you take stock not just of your finances, but more importantly your ambitions and plans for the future. Because if you know where you’re headed, we can put the right plan in place to help you get there.

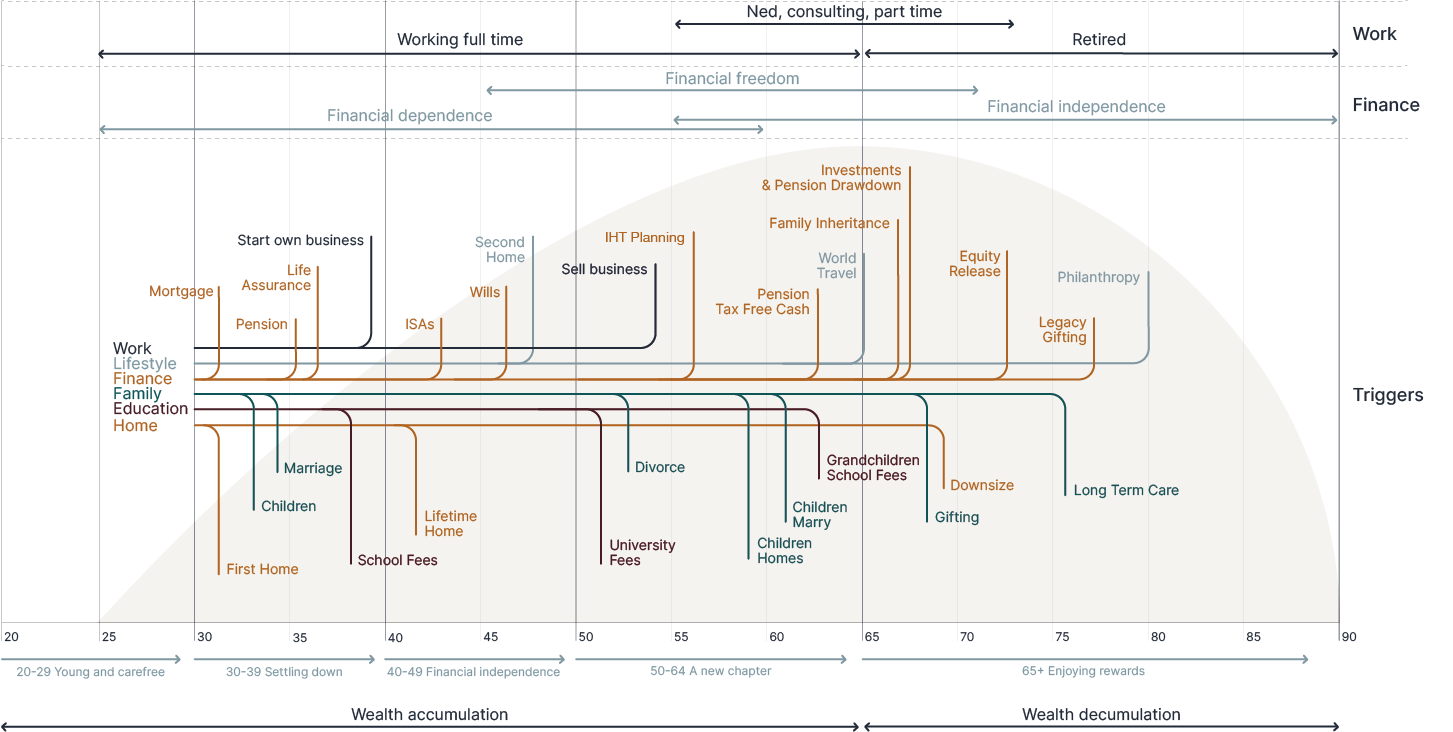

Introducing the Life Stage Map

We all take life at our own pace and we all have our unique journeys, but when we look at life as a whole, the vast majority of us will enter largely predictable stages during the course of our lives.

Our Life Stage Map plots these financial and life triggers and can help you to think about what your future may hold and together helps us plan for your future. Whatever stage of life you’re at, we can help guide you through the opportunities and challenges you face.

Young and Carefree

Settling Down

Your wild nights, if not behind you, are now more infrequent and you’d rather be out cycling or meeting your friends on a Sunday morning than nursing another hangover. You may have a long-term partner. You may be married or thinking of marriage. And you may also have started, or be thinking about starting a family. Your career or business is really taking off and you’re making good money, and you may have received a small inheritance. Yet life suddenly looks a lot more expensive. This is a time when you’ll be asking: How much can I afford to put away for my future? Should I be investing, and if so, what should I be investing my money in? How do I protect my family if my career was interrupted? Making the right financial decisions now will help you build a brighter future.

Fulfilling personal goals is seen as the most important priority by wealthy women (40%)

compared to men who see pure performance as their leading objective (30%).

* Women & Wealth, EY 2017

Financial Independence

You’ve made big inroads towards paying off your mortgage and possibly invested in a holiday home or buy-to-let property. You’re still paying for your children’s education but can see light at the end of the tunnel. Your career is near its peak or you’ve begun to think about selling your business. You and your partner have started contemplating a future of being empty nesters and escaping the rat race. This is the time of life when it’s key to be planning your retirement. To be asking questions like: Am I saving enough? Can I afford to fulfil my lifelong ambitions? From optimising pension and ISA allowances to predicting your future outgoings, our role is to help you achieve financial freedom. The freedom to choose the future you want.

A New Chapter

Your mortgage is paid off, the kids have gone, you’re tired of your job and you’re asking yourself what’s next? Is this the time you start that business you’ve always dreamed of? Do you put your feet up and get your handicap down or are your friends all still working? Not so long ago many people would have retired quietly, but attitudes have changed. This can be a time to kick off an exciting new chapter. It’s also a time to get your finances in order. You’ll need answers to key questions like: Can I afford to retire early? Will I be able to maintain my current lifestyle? Have we got enough to help support our kids? Will I need to support my parents if they go into care? What’s the best way to take an income in retirement? Should I be planning how to reduce Inheritance Tax? As you could potentially live another 50 years, this is a crucial time to seek financial advice to ensure you’re able to maintain your lifestyle and fulfil your goals.

Enjoying the Rewards

You’re financially independent. You only work if you want to. You’re focused on working through your bucket list. Life is good, you have time to do the things you always wanted to do and time to spend with friends and family. It’s also time to start thinking about how you pass on wealth to your family, friends or charitable causes, rather than the coffers of HMRC. However, passing on your wealth is often as complex emotionally as it is financially. Will I leave an Inheritance Tax liability? Do we treat our children or family members equally? Should we gift money now when they need it most? Whatever your questions, or goals for your money, getting financial advice will help you transfer your money in a way and at a time that will create maximum benefit for your beneficiaries.

How Financial Planning can help you

Whether it’s building your wealth to fulfil your life’s ambitions, preparing for a long and enjoyable retirement, or investing for your children’s future, Financial Planning will help you understand where life can take you.

Ready to have a conversation?

If you’d like to have an informal, no obligation, conversation, or have any questions about planning your financial future, please get in touch.

Investec Wealth & Investment (UK) is a trading name of Investec Wealth & Investment Limited which is a subsidiary of Rathbones Group Plc. Investec Wealth & Investment Limited is authorised and regulated by the Financial Conduct Authority and is registered in England. Registered No. 2122340. Registered Office: 30 Gresham Street. London. EC2V 7QN.