Get Focus insights straight to your inbox

Go to Google Earth and look at Chile. It’s one long sliver of dry in the lee of the Andes, in stark contrast to the eastern slopes of those mountains in Argentina. The Chilean coastline stretches 4,300km south to north, nearly all of it wild and windswept, much like our west coast. It’s also extremely dry – 12 years into a drought that has turned the normally semi-arid region north of Santiago into a dustbowl, killed large parts of the country’s livestock herd, wiped out bee populations and reduced water supplies for agriculture and urban communities. Water is a serious problem for the country, and there aren’t many solutions either; underground aquifers are running dry, and Chile’s mountainous topography makes its uneconomic to transfer water over large distances.

The effects of climate change are clearly visible in Chile, but it is not alone. Drought and water scarcity impact an estimated 40% of the world’s population, and as many as 700 million people are at risk of being displaced because of drought by 2030. Access to safe, clean water is a basic human right: it is vital for human health, agriculture, industry, and energy production. Yet inadequate water supply and sanitation, growing populations, more water-intensive patterns of growth, volatile weather patterns and pollution are coming together to make water one of the greatest risks to economic progress, the elimination of poverty and sustainable development.

Drought and water scarcity impact an estimated 40% of the world’s population, and as many as 700 million people are at risk of being displaced because of drought by 2030.

The challenge of ensuring sustainable water supply for all is the central objective of the United Nations’ Sustainable Development Goal (SDG) 6 – Clean Water and Sanitation – and it’s one the global mining industry has aligned itself closely with, as there are social, environmental and economic consequences for not doing so. Mining companies are exposed to a broad spectrum of water-related risks because of the nature and location of their operations.

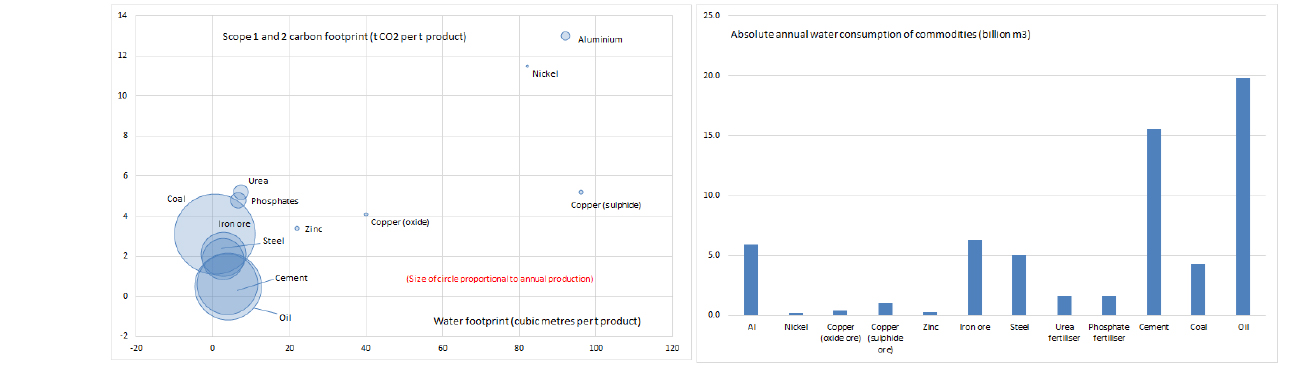

The water intensity of mined commodities varies immensely, with metals like aluminium and copper using a lot more water per tonne of output than is the case with bulk commodities like iron ore, cement, coal and fertilisers. However, adjusting for the volume of production shows the latter to be significantly more important to the world’s water resource, with combined annual water consumption of bulks more than 10 times higher than is the case with base metals. Water consumed every year in the production of oil, cement, coal, iron ore and steel is equivalent to the annual water consumption of Russia, twice that of South Korea and five times that of Greece.

Figure 1: Water intensities of different commodities

Source: IW&I research, company reports, September 2021.

Water is used for opencast and underground mining, processing, dust suppression, refrigeration and cooling, as well as supporting infrastructure like offices and accommodation. Careful water resource management during commodity production is an extremely important business imperative, but it’s a difficult, full-time job that involves multiple stakeholders, including governments and neighboring communities. It’s also fast emerging as a key consideration when making investment decisions about companies, alongside other factors like greenhouse gas footprints and energy consumption intensities.

At Investec Wealth & Investment, we keep track of a number of water stewardship variables, and frequently include them in discussions when meeting with management. In addition, some of them are now included in both short- and long-term management incentive plans.

These are the five variables:

1. Company alignment with approved water stewardship reporting standards. These days, water management is carefully embedded into most mining company business plans, and nearly all companies adhere to the requirements of the ICMM (International Council for Mining and Metals) guidelines on water reporting and the Global Reporting Initiative (GRI) on water balances. Most of them are signatories to the United Nations Global Compact CEO Water Mandate, which is a CEO-led initiative committed to reducing water stress by 2050.

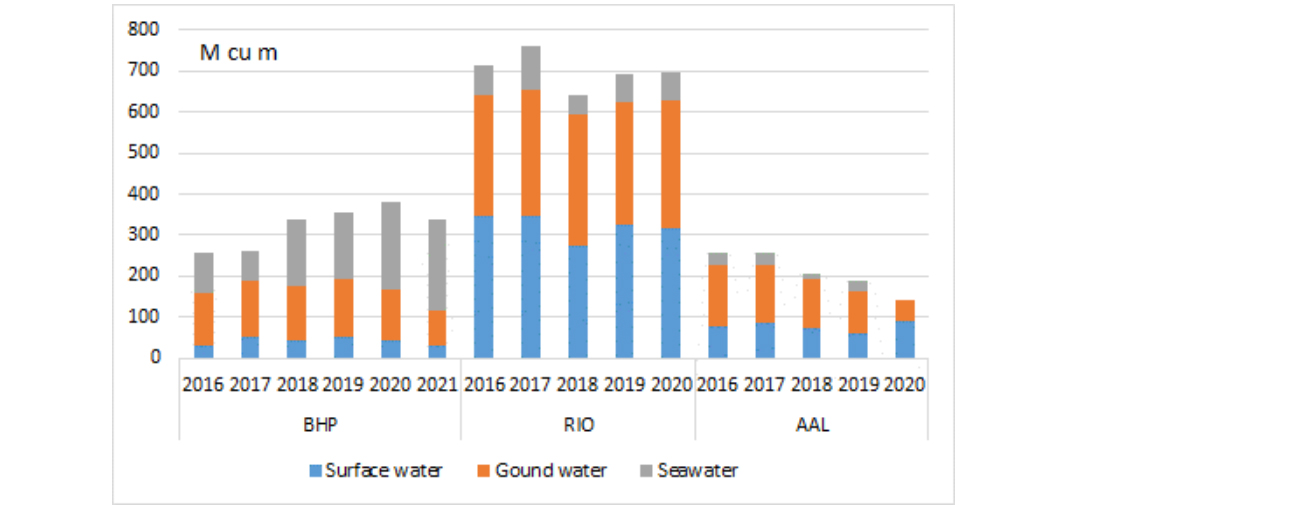

2. The trajectory and nature of total water consumption. Mining companies get their water from a variety of sources, including ground (aquifers, boreholes), surface (rivers and dams) and seawater. There is a concerted effort to lower freshwater withdrawals, both through the use of desalinated water and more water-efficient mining and processing. Nowhere is there a water success story like that in Chile, where it’s sorely needed.

BHP and its partners at the Escondida copper operations in Chile have spent more than US$4bn over 15 years constructing extensive – and the world’s largest – desalination facilities at the Port of Coloso and connecting the water supply via a 180km pipeline to the mine, located in Chile’s Atacama desert at an altitude of 3,200m. This water supply has allowed the Escondida mine to eliminate drawdown of water from aquifers, almost 10 years ahead of plan. BHP has also set up its new Chilean copper mine, Spence, to operate with 100% desalinated water. As a consequence, as shown in Figure 2, the proportion of desalinated water used in BHP’s operations has grown significantly in the last three years.

Figure 2: Water consumption trends for BHP, Rio Tinto and Anglo American

Source: IW&I research, company reports, September 2021.

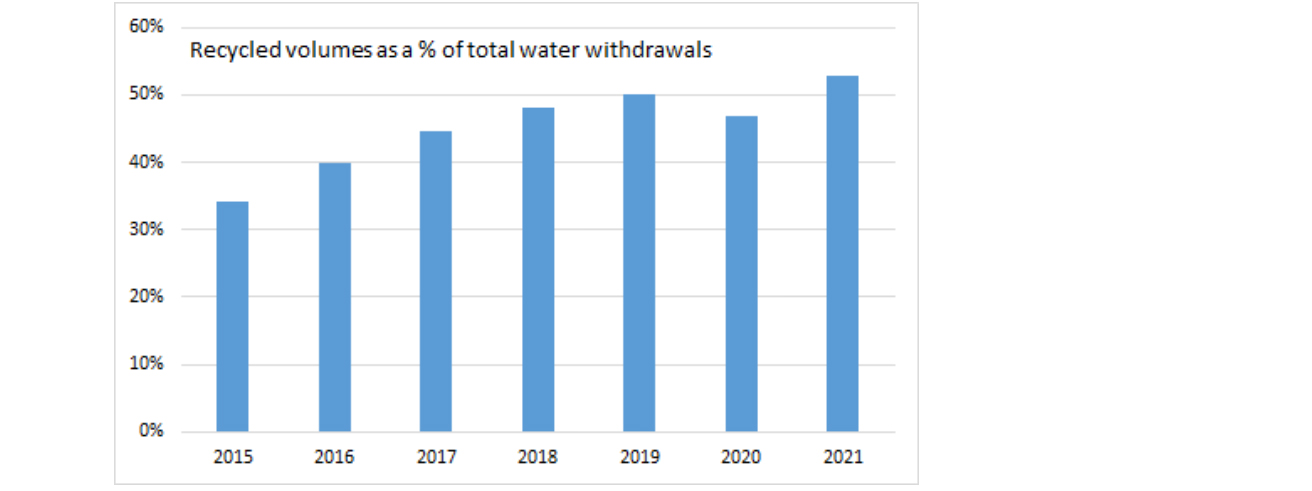

3. Water recycle rates. In addition to lowering total water consumption, mining companies have become better at recycling or reusing water over the years. There is quite a bit of variability in recycle rates between the businesses due to the varying nature and location of their operations, but the direction of travel for nearly all of them is positive. Underground aquifers often have spiritual or cultural significance and returning water (or not using it at all) has become increasingly important.

Figure 3: Mining industry average recycle rates

Source: IW&I research, company reports, September 2021

Note: 2021 uses actual BHP full year and implied figures for Rio Tinto and Anglo American

4. How technology is used to lower water consumption. Anglo American has pledged to lower water use in its operations by 50% by 2030, which is a bold target in the context of the requirements of the UN Global Compact CEO Water Mandate (50% by 2050). Indeed, it has been pushing the concept of the water-less mine for years. The company is developing some interesting technology to achieve this goal, as part of its FutureSmart Mining initiative, including:

- Coarse particle screening, which allows water to be released from much larger particles, saving up to 30% water use.

- Hydraulic dry stacking, which eliminates the need for wet tailings, instead creating stable, dry and economically viable land.

- Novel leaching, where new leaching chemistries have been introduced to dramatically lower water and energy intensity of extraction, even in much lower grade ores.

In conclusion, we believe big business has a crucial role to play in the achievement of the goals set out under SDG 6, and that the mining sector is one of the best positioned to help. In its 2020 Global Water Report, the CDP (Climate Disclosure Project) showed how the cost of inaction on water stress is up to five times the cost of action, and it’s a subject likely to get a fair amount of airtime at the upcoming COP26 meeting in Glasgow. Mining is in the spotlight, as the production of commodities is very water intensive, but we are encouraged by what the industry has and is doing to make a tangible difference to the protection of the world’s vital water resource.

Responsible Investing and Sustainability at Investec Wealth & Investment

As Sustainability is core to our fundamental investment approach, we have integrated ESG considerations into our investment decision making and broader investment process.