Receive Focus insights straight to your inbox

Here, experts from the Investec Global Investment Strategy Group (GISG) offer their insights into the factors informing their risk positioning for the quarter, the medium-term global outlook, how it will impact the South African economy, and what icebergs may lie ahead.

Executive view of the quarter

Investec Wealth & Investment’s Global Investment Strategy Group (GISG) has retained its modestly “risk-off” stance going into the fourth quarter. This is based on the view that the world is largely still enjoying synchronised growth in all of its key economic blocks (the US, Europe, and China-centric emerging markets) for the first time since the Great Financial Crisis.

However, the combination of a soft spot in Europe, a strengthening US dollar and a highly aggressive US stance on trade has cast its durability into doubt.

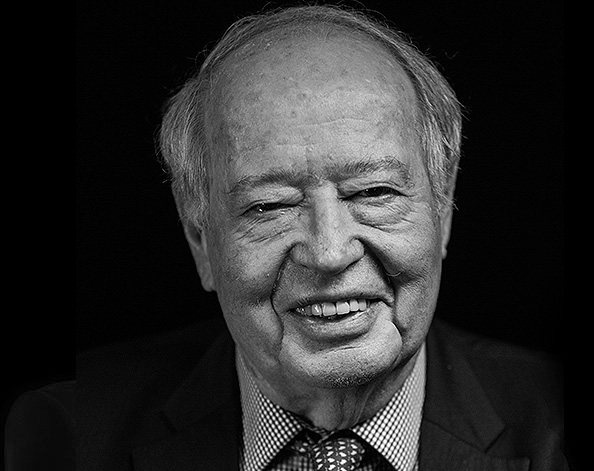

"Going into the fourth quarter of 2018, we as the South African Asset Allocation Committee are more upbeat – SA risk assets are at similar, if not better, valuation levels than they were before Cyril Ramaphosa won the ANC leadership race last December," says Paul McKeaveney, Chairman of the Asset Allocation Committee, Investec Wealth & Investment SA.

"Outside of the 'fragile five' (Argentina, Brazil, Indonesia, South Africa, and Turkey) the world is largely still enjoying synchronised growth in all of its key economic blocks (the US, Europe, and China-centric emerging markets) for the first time since the Great Financial Crisis," says John Haynes, Chairman of the Global Investment Strategy Group, and head of research at Investec Wealth & Investment UK.

Our view is that China is, at worst, going to reveal a very soft landing for its economy. Satisfactory growth will be sustained, as will the demand for metals and minerals, for which China has become the largest buyer by far.

Insights from the GISG

Key investor insights from the Q4 report

In the Q4 report, the GISG offers comprehensive insight into global investment trends and potential icebergs. Here are some of the key take outs:

About the author

Patrick Lawlor

Editor

Patrick writes and edits content for Investec Wealth & Investment, and Corporate and Institutional Banking, including editing the Daily View, Monthly View, and One Magazine - an online publication for Investec's Wealth clients. Patrick was a financial journalist for many years for publications such as Financial Mail, Finweek, and Business Report. He holds a BA and a PDM (Bus.Admin.) both from Wits University.