Private equity deal value in continental Europe has significantly increased in 2018, while the UK has struggled to maintain its position as the largest European market by deal value, according to provisional full-year data from CMBOR at Imperial College Business School, sponsored by Equistone Partners Europe and Investec Corporate and Investment Banking.

The number of private equity-backed acquisitions in continental Europe has risen for each of the past five years to 523 in 2018, with a total value of €79.3bn for 2018 representing a 15% increase on 2017.

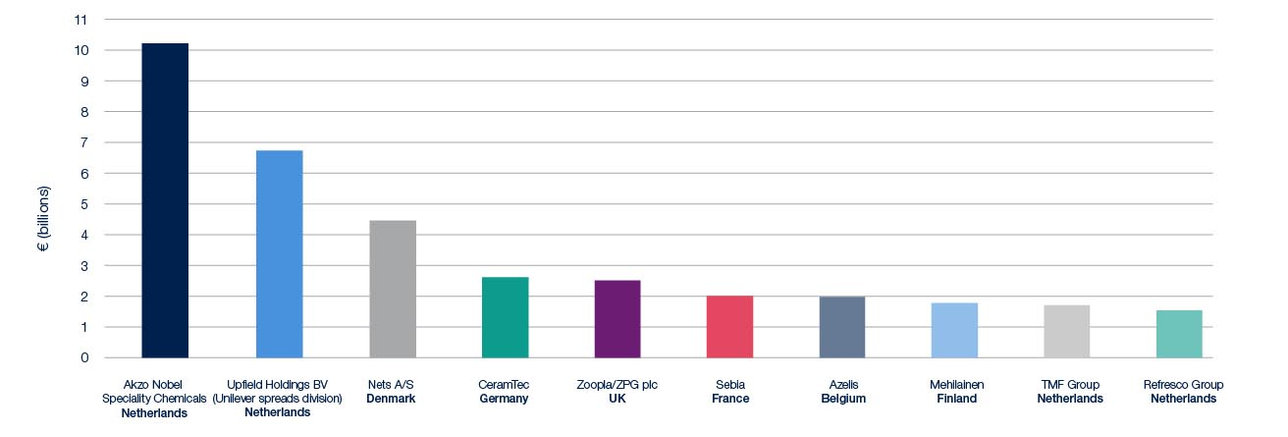

The largest private equity buy-out in Europe was the €10.1bn deal involving Akzo Nobel Speciality Chemicals, the Dutch makers of Dulux paint

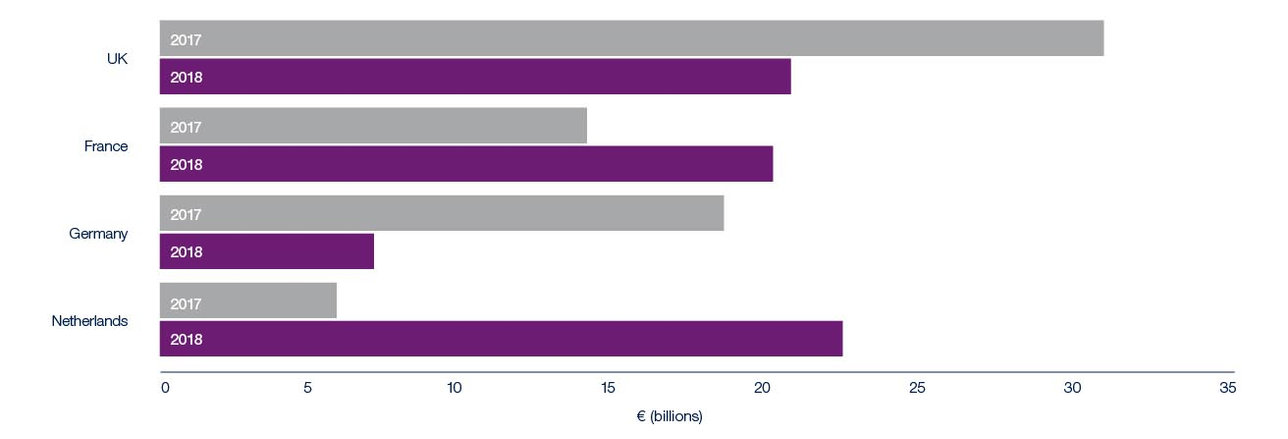

By contrast, while the number of UK buyouts declined only slightly from 196 in 2017 to 187 in 2018, the value of those deals fell steeply, from €31.3bn to €21.4bn, primarily due to a decline in the number of deals with an enterprise value of more than €500m.

However, pockets of the UK market have shown particular resilience. London and the South-east of England have had a material year-on-year rise in both deal volume (from 74 in 2017 to 98 in 2018) and combined value (£9.3bn to £13.7bn), offsetting declines in almost every other region.

Largest buy-outs by deal

The volume of deals valued under £250m in the UK has remained stable (171 in both 2017 and 2018) and the cumulative value of deals in this range fell only slightly, from £6.1bn to £5.9bn. The three largest UK deals of 2018 were public-to-private transactions, where private equity firms capitalised on higher levels of turbulence in public markets to acquire listed assets.

“After an exceptional 2017, UK deal activity is showing the effect of Brexit uncertainty,” said Christian Hess, head of the Financial Sponsor Transaction Group at Investec. “However, the silver linings are there to see if you look for them. Compared to the turbulence of public markets, the UK private equity drop is actually relatively small, highlighting a certain robustness in private markets.

“Values have fallen sharply but volumes are only down 5% year-on-year in 2018. Given the very public travails of the UK political environment right now, that actually looks like quite a solid performance with the flight to quality that you would expect.

“When macroeconomic uncertainties ease, we would expect an uptick because the conditions in the UK are otherwise amenable in terms of availability of equity and debt capital and demand for funding.”

France has built on a solid track record, increasing both deal count (from 104 in 2017 to 114 in 2018) and cumulative value (from €14.9bn last year to €20.1bn this year) to the point where it is very close to matching the UK by value.

Christiian Marriott, Partner and head of investor relations at Equistone Partners Europe, said: “It confirms that the shackles have been lifted in France since Macron’s election. The market has become a more attractive proposition to a wider array of investors, increasing liquidity on both the buy-side and the sell-side.

The most recent unrest reminds us that Macron is fighting some tough battles in domestic terms, but overall the movement towards economic liberalisation is encouraging for private equity activity.”

While deal volumes in Germany have continued to grow year-on-year, deal values fell sharply from €18.7bn in 2017 to €7.1bn in 2018.

The Netherlands recorded an extremely strong year in 2018, accounting for almost a quarter of total European deal value at €23.5bn – more than any other country, displacing the UK in the top position for the first time since 2011.

Total value of private equity-backed acquisitions by country

The country saw four of the 10 largest buyouts: AzkoNobel Speciality Chemicals, Upfield Holdings (Unilever’s spreads division), TMF Group and Refresco Group, the first two of which alone were together worth €16.9bn.

In fact, of the top 10 largest European buyouts of 2018, just one (Zoopla/ZPG plc) was in the UK, compared with UK buyouts occupying eight places across the past three years’ respective top-10 rankings.

However, despite the lack of UK mega deals, there was a much more resilient picture in the lower mid-market. Steve O’Hare, head of the UK investment team at Equistone, said: “In contrast to the decline in the mega-deal market, the level of activity in deals valued below £250m has been consistent with the prior year, which is hugely encouraging as these deals are the bedrock of the UK buyout market.

“There has been a steady supply of attractive companies with high-quality management teams - three of which we’ve backed.”

The trend from H1 2018 of declining exit values relative to buyouts continued in H2, with €93.0bn in exits in 2018 falling short of the €100bn landmark reached each year since 2014 and meaning that buyout values surpassed exit values for the first time since 2009.

Private equity-backed initial public offerings (IPOs) fell by more than two-thirds by volume and by half in terms of value to a total of €7.5bn in 2018, against a background of turbulent public markets and a difficult market for IPOs more generally.

At a sector level, retail saw its fourth year of decline, falling from €9.8bn in 2015 to €1.0bn in 2018. Food and drink saw its strongest year since 2009 by a considerable margin, climbing to €10.6bn in 2018 from €1.8bn the preceding year and accounting for most of the gap left by retail.