What's inside

Industry news

- European network airlines filling premium cabins

- Corporate travel budget booster

- Supply chain issues and labour shortages

Global air traffic summary

Airline financial performance

Market responses

Q3 debt capital markets deals

Jet fuel market update

Key market insights

European network airlines filling premium cabins

Disproportionately contributing to the financial recovery of the full-service network carriers is the fact that premium cabins are busy. Not just with corporate travellers, as they would have been pre-pandemic, but also with affluent leisure travellers boosted with savings made during the pandemic.

International Airlines Group (IAG) reported over €900m in net profit for the first half of 2023, noting very strong leisure demand, including in first and business class which compensated for weakness in the corporate market. IAG expects corporate travel of between 80-85% of pre-pandemic levels this year.

Lufthansa Group reported in August that robust demand for premium travel helped the company to a 13% increase in passenger yields from April to June this year versus 2022. The company added that it expects corporate travel demand to reach 70% of its pre-pandemic level by year-end. Premium leisure passenger numbers are near full recovery, demonstrating a faster recovery than non-premium leisure.

Air France-KLM reported that second-quarter yields on its premium sales were around 20% higher than pre-pandemic levels, noting high demand on routes across the north and south Atlantic. While premium travel is booming, corporate travel has been slow to return to pre-pandemic levels. Specifically, short-haul corporate travel has taken a hit, with Aer Lingus reporting poor sales to and from Heathrow and Air France-KLM noting that domestic business travel had shifted to trains and is not expected to return.

Corporate travel budget booster

However, industry figures and the business community are more bullish, expecting business travel to return to pre-pandemic levels and noting the correlation between business travel and people returning to the office. A recent Morning Consult survey reported that 32% of corporate travel decision-makers expect their workplace to increase travel budgets in the coming year, against 13% who said they would decrease. Until the return of high-spending corporate travellers, premium leisure is filling the void and this could prove to be a new long-term trend.

Supply chain issues and labour shortages at OEMs are reversing the balance of power from airlines to lessors

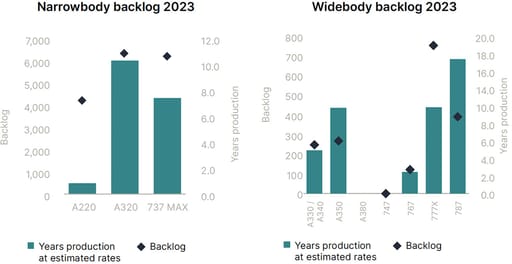

The latest order book figures from Airbus and Boeing indicate that demand for all in-production aircraft types has ramped up beyond earlier expectations as we come out of the pandemic. The commercial aircraft backlog as of mid-2023 totalled approximately 12,800 orders (10-12 years at current production rates).

While narrowbody aircraft are leading the way in terms of volume (85% of the backlog), the new generation of widebodies is also seeing a significant number of orders which has generated a healthy backlog. The challenge faced by all original equipment manufacturers (OEM)s is how to deliver that backlog in the face of supply chain delays, rising costs, labour shortages and logistical issues.

Slow deliveries, supply chain issues in the OEM and MRO sphere, low reliability in the latest new generation engines and the rise in demand for air travel in all segments are having an impact. Together, they have created a situation where the current generation aircraft, primarily narrowbody, are seeing a surge in demand in the secondary market and thus driving a rise in market values and lease rates. With less than 6% of the Boeing 737-800 fleet still parked, noting that there will always be a small percentage of any product out of service but not scrapped, aircraft lessors are now back in the driving seat when it comes to setting lease rates and terms.

| 12,800 | Backlog of commercial aircraft orders (at mid-2023) |

| 10-12 years | Time needed to complete back orders (at current production rates) |

| 85% | Of order backlog that is for narrowbody aircraft |

Tables turn on who dictates lease terms

For many years, airlines have dictated what they will pay and in the exit from the pandemic, many leases were extended or set at rates which were not sustainable but merely saved the lessor from having to pay to park them. The situation has reversed where placements are now being contested, extensions are not automatic and operators are finding that aircraft coming up for end of lease may be moved to a new lessee at an improved lease rate.

The combination of unexpected passenger demand, production delays and certification delays has created an opportunity for owners of current generation mid-life aircraft to make hay while the sun shines and place aircraft on leases at rates that were not anticipated in recent years.

Boeing has suffered further production delays to the 787 and the 777X is still not certified. Airbus is producing low single-digit numbers of A330/A350 aircraft a month. So, even in the widebody space the 777-300 and A330-300 are seeing improvements in lease rates and market values that were not expected one or two years ago. Most of the new leases are extensions of expired leases as opposed to new placements in the widebody market, but there are still large numbers of transitions.

There continues to be strong demand among banks, alternative lenders and investors to finance tier 1 airlines and new tech aircraft. Margins in that segment, therefore, continue to tighten and we expect the trend to continue. For lessors relying on limited recourse financing, often a high balloon and/or flat amortisation profile are key to hitting return hurdles. Leveraging on our asset and structuring expertise, then combining the capability of Investec Bank’s balance sheet and third-party capital, Investec connects the most efficient capital with financing opportunities, thereby offering competitive solutions to airline/lessor borrowers and generating optimised returns for investors.

Derek Wong, Head of Aviation Debt Fund

There continues to be strong demand among banks, alternative lenders and investors to finance tier 1 airlines and new tech aircraft.

Derek Wong adds: “Margins in that segment, therefore, continue to tighten and we expect the trend to continue. For lessors relying on limited recourse financing, often a high balloon and/or flat amortisation profile are key to hitting return hurdles. Leveraging on our asset and structuring expertise, then combining the capability of Investec Bank’s balance sheet and third-party capital, Investec connects the most efficient capital with financing opportunities, thereby offering competitive solutions to airline/lessor borrowers and generating optimised returns for investors.”

Investor appetite has recently switched from assets with longer-term leases attached to those with stub leases or no lease at all attached. This is in order to capitalise on the rapid increase in spot-lease rates for current generation and next generation narrowbody aircraft. This trend is expected to continue for some time, due to the supply chain issues at the OEMs which are likely to take a significant time to resolve.

Paul Da Vall, Head of Aviation Equity Funds

Investor appetite has recently switched from assets with longer-term leases attached to those with stub leases or no lease at all attached.

Paul Da Val adds: “This is in order to capitalise on the rapid increase in spot-lease rates for current generation and next generation narrowbody aircraft. This trend is expected to continue for some time, due to the supply chain issues at the OEMs which are likely to take a significant time to resolve.”

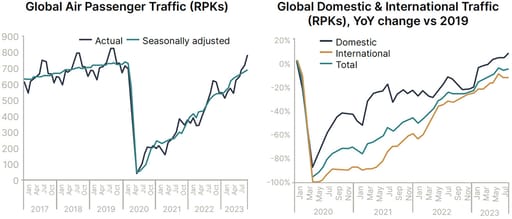

Trends

Global air travel continued its steady recovery in July and numbers are now 96% of pre-pandemic levels. Air traffic measured by Revenue Passenger Kilometres (RPKs), an indicator of global passenger demand, grew by 26% year-on-year (YoY) to July 2023. Capacity, as measured by Available Seat Kilometres (ASKs), increased 24% YoY, with industry-wide passenger load factors trending at near pre-pandemic levels (85%) for the month. The industry-wide improvement in load factors is a positive indicator of demand for air travel and of increasing profitable operations for airlines.

Domestic air travel has now in aggregate fully recovered and is at all-time highs, with RPKs 8% ahead and ASKs 10% ahead of pre-pandemic July 2019 levels. The growth was attributable to the strong performance of the major markets, particularly China, where it is being driven by domestic tourism.

International air travel has continued its steady growth trajectory. Globally, traffic grew 30% YoY to July 2023 and is now 89% of pre-pandemic levels. However, momentum steadied in July as regions faced various challenges. Asia-Pacific, in particular, has shown a slow rebound in intra- and inter-regional tourism. North American airlines have outperformed pre-pandemic international levels with an average load factor of 90%. International RPKs flown by European airlines were 92% of pre-pandemic levels with challenges from strikes and exceptional weather conditions causing traffic disruptions. Latin American airlines are almost at full recovery with international RPKs at 98% pre-pandemic levels.

Jet fuel prices remain elevated which is adding pressure to airline costs. To date, airlines have been able to pass on these costs by increasing airfares. At a global level, the increase in airfares aligns with the rise in inflation. Forward-looking ticket sales indicate that the recovery momentum is expected to continue in the near term. This is despite current economic challenges faced by households, elevated fares due to high jet fuel prices and a generally high rate of inflation.

The outlook for the global industry, according to IATA’s near-term forecast remains for total passenger numbers to return to 2019 levels in early 2024 and to double by 2040. However, IATA notes that macroeconomic uncertainties remain on the downside. While global consumer price inflation has likely peaked, the higher price level continues to affect household disposable income, an impact so far mitigated by historically tight labour markets. If the global economy slows over the coming quarters, unemployment rates may rise putting downward pressure on the demand for air travel. On the supply side, airlines continue to face higher costs globally as well as capacity constraints throughout the whole air transport value chain.

Global Air Traffic versus pre pandemic July 2019

(as measured by RPKs)

96%

108%

89%

85%

Airline financial performance

At a global level sees IATA is forecasting the industry will return to profitability in 2023, underpinned by firm consumer demand and a complete re-opening of markets in Asia-Pacific. Regionally, North American carriers lead the pack and are expected to post a net profit of more than $10bn in 2023. European and Middle East airlines are also likely to be profitable in 2023, with other regions continuing to show an improved financial performance, moving towards a return to profitability.

The positive financial outlook for the industry is supported by IATA’s latest business confidence survey. Some 73% of respondents indicated that they expect profitability to improve further over the next 12 months.

How has the market responded?

In July, Pratt & Whitney reported another production snag that will impact at least 1,200 of its geared turbofan engines that power Airbus’ A320neo jets. The snag will require up to 60 days to inspect and fix after microscopic contaminates were found in a metal used in part of the engine core. The company noted that it was looking to minimise the impact and support its customers. Major customers that took delivery of affected A320neo jets include Spirit, JetBlue, Hawaiian and Wizz. The snag comes at a particularly awkward time when airlines are grappling with shortages of pilots, air traffic controllers and new aircraft, making it harder to add capacity.

In August, Lufthansa announced that it had confirmed plans to reactivate the last two of its eight remaining A380s, due to a significant increase in passenger demand and the delayed delivery of ordered aircraft. Like the other six, the superjumbos will be based at its Munich hub. The two aircraft are the first A380s delivered to the German flag carrier (in 2010) and are currently in storage in Spain. In 2020, Lufthansa had announced the aircraft’s permanent retirement as newer twin-engine widebodies, like the Boeing 777 and Airbus A350, were less costly to operate and easier to fill with passengers. However, as Lufthansa acknowledged, aircraft shipping delays and the renewed post-pandemic passenger demand have forced it to bring back the A380. Lufthansa joins British Airways, Singapore Airlines, Qatar and Qantas in putting the superjumbo back to work. In addition, Emirates, with an active fleet of 97 A380s, in September announced that it plans to continue to operate the type until the late 2030s or possibly early 2040s.

In August, Standard Chartered announced that it was selling its global aviation finance leasing business to Saudi Arabia-based AviLease, for about $3.6bn as a drive to streamline its operations. Standard Chartered anticipates a profit of around $300m from the sale and for its common equity tier-one ratio to improve by about 19 basis points. Dublin-based Standard Chartered Aviation Finance, ranked as the 21st largest lessor (AFJ 2022 ranking) owns and manages more than 120 aircraft and offers services that include jet fuel hedging, debt financing and aircraft remarketing. AviLease is backed by the Saudi Public Investment Fund (PIF), which is also in the process of establishing startup carrier Riyadh Air to serve Riyadh, which has ambitions to become a global business hub. Standard Chartered put both its aviation leasing and aviation lending businesses up for sale at the start of the year. In August, PK Finance, a subsidiary of Apollo, reached an agreement to acquire the majority of a $920m portfolio of secured aviation loans from Standard Chartered.

In September, AerCap, the world’s largest lessor, agreed to a $645m settlement with insurance company NSK, in relation to a claim over Russia’s refusal to return 17 aircraft and five spare engines leased to Aeroflot. The aircraft would become the property of Russian state-owned NSK. The agreement is significant in the ongoing issue impacting over 400 Western-built aircraft which are stranded after the Ukraine invasion. AerCap said it had secured permission from the US Treasury and Commerce departments to complete the deal, which it said was “consistent with other applicable sanctions regimes”. AerCap shares rose by about 5% in premarket trading. The deal looks set to lower the bill facing insurers, who are fighting court cases over who should pay for losses of up to $10bn.

Mid-September, Cirium raised its market lease rates for passenger A320ceo and A321ceo by up to 20%, with most activity around mid-life aircraft. The company noted that “the increases are driven by delivery delays of new aircraft as well as continued engine problems for the latest generation of single aisles, hampering their productivity and jeopardising schedules”. Cirium added that airlines are beginning to accept that they will pay higher lease rates to secure capacity amid the tight market.

Late September, the Air France-KLM group announced firm orders for 50 widebody A350 aircraft, and purchase rights for 40 more in a bid to upgrade the long-haul fleets of its airlines, with deliveries expected from 2026 through to 2030. The order is in addition to the existing order of 41 A350s for Air France, 22 of which have been delivered to date. The new-technology aircraft are intended to replace the group’s older A330s and B777s.

Early October, British Airways’ parent IAG regained its investment-grade credit rating from S&P. The rating agency raised the airline’s long-term rating from BB+ to BBB-, citing improved cashflow and robust passenger demand. S&P noted that “IAG’s higher-than-expected air passenger fares, underpinned by efficient cost management, translate into higher-than-forecast profit margins and earnings this year”. IAG returns to investment-grade status for the first time since it was downgraded in May 2020 as the pandemic took hold. IAG is the first among the network European carriers to return to investment grade, with rival carrier Lufthansa still rated speculative grade by S&P and Moody’s, and Air France-KLM not rated by either.

Recent debt capital market deals, include

- 14 July, Air France-KLM priced EUR500m of secured perpetual notes. The issuance has a coupon of 6.900% for the first three years, followed by step-ups and caps. The issuance will be redeemable after three years and the proceeds will be used for general corporate purposes.

- 18 July, SMBC Aviation Capital priced a $1.0bn 10-year unsecured note. The issuance has a coupon of 5.700% with a T+195 bps spread. It priced at 99.610 cents, with a yield of 5.745%, and was rated BBB+ and A-by Fitch and S&P, respectively. Proceeds from the issuance will be used for general corporate purposes.

- 18 July, Aircastle issued a $650m five-year unsecured note. The transaction has a 5.800% coupon with a T + 260 bps spread. It priced at 98.815 cents, with a yield of 6.544%, and was rated BBB-, Baa3, and BBB-by Fitch, Moody’s, and S&P, respectively. Proceeds from the issuance will be used for general corporate purposes.

- 19 July, Azul issued $1.66bn of unsecured bonds across three issuances. These have sizes of $800m, $568m and $294m; tenors of five seven, and six years, respectively, and coupons of 11.930%, 10.880%, and 11.500%, respectively. They are all rated B-, B3, and B- by Fitch, Moody’s, and S&P, respectively. Proceeds from the issuance will be used for general corporate purposes.

- o 25 July, Embraer issued a $750m seven-year unsecured note. The transaction has a coupon of 7.000%, a yield of 7.125%, and priced at 99.320 cents. The transaction was rated BB+ by both Fitch and S&P, and the proceeds will be used for general corporate purposes.

- 2 August, Global Crossing Airlines issued $35m of six-year senior secured notes. The note has a coupon of 15.000% and includes an upfront fee of 1.75%. Proceeds from the issuance will be used for general corporate purposes.

- 22 August, Cathay Pacific announced it would seek $2.5bn of fresh capital via an issuance of medium-term notes. The funds will be used for general corporate purposes.

- o 31 August, Genesis Aircraft Services placed a $215m senior secured limited recourse term loan with a mid-to-end of life portfolio. The transaction was privately rated by DBRS. The collateral consists of 28 narrowbody aircraft across 17 lessees and 11 countries, with a weighted average age of 18.6 years. The issuance will be used to refinance certain existing debt facilities.

- 18 September, Macquarie issued a $500m 5.5-year unsecured note. The issuance has a coupon of 8.125% and a spread of 372 bps. It was rated BB and BB+ by Fitch and S&P. Proceeds from the issuance will be used for debt refinancing.

- 25 September, AerCap issued a $900m 3.3-year and a $850m seven-year unsecured note. The issuances have a coupon and spread of 6.100% and 150 bps, and 6.150% and 185 bps, respectively. The notes are rated BBB, Baa2, and BBB by Fitch, Moody’s, and S&P, respectively. The funds will be used for general corporate purposes.

- 26 September, Thai AirAsia issued THB1.2bn of 2.5-year secured notes. The issuance has a coupon of 6.900% and will be used for debt refinancing.

Jet fuel market update

After climbing reasonably steadily through September, reaching a high close to $98 per barrel ($/b), in spite of falling equity markets and rising bond yields, oil suffered a sharp price correction at the start of October. This move was brought about by a sudden acceleration in the trend of rising bond yields/falling equities that caused Brent to rapidly shed the gains of September, falling to a low of under 84 $/b.

Many investors who had recently started to move back into oil on all the talk of prices potentially reaching 100 $/b, headed for the exit as the oil price fell. The market did take some consolation from Saudi Arabia confirming that its additional voluntary cuts will remain in place, but clearly with the absence of a longer-term plan (ie we don’t know what OPEC+/Saudi Arabia policy will be for next year) and the uncertain demand outlook into 2024, the market is wary.

Brent Front Contract

Oil markets have been plunged into fresh uncertainty by the tragic events in Israel on 7 October 2023. In the near term, the main risk to oil supply appears to be Iran where production has been growing this year, perhaps helped by some informal progress in relations with the US, which could now be at risk.

Of much greater potential concern though, is the fact that about 20% of the world output is shipped down Iran’s western coastline and through the Strait of Hormuz at the end of the Arabian Gulf. This is a chokepoint for world oil markets that Iran has often threatened to close to shipping. Any reduction in shipping capacity through the strait would be a serious issue for oil markets and something that is not currently being priced in.

However, a threat alone is unlikely to make much difference as that threat has been made many times before. Much will depend on how Israel’s land offensive proceeds when it gets underway and the extent of civilian casualties in Gaza as that will influence the approach of Arab oil states, such as Saudi Arabia. For now, the market is concerned, but not yet very worried.

Of much greater potential concern though, is the fact that about 20% of the world output is shipped down Iran’s western coastline and through the Strait of Hormuz at the end of the Arabian Gulf. This is a chokepoint for world oil markets that Iran has often threatened to close to shipping.

Investec Aviation Finance

$10 billion

7 years

$1.3bn capital deployed

Partnership approach

Disclaimer

This presentation and any attachments (including any e-mail that accompanies it) (together “this presentation”) is for general information only and is the property of Investec Bank plc (“Investec”). It is of a confidential nature and all information disclosed herein should be treated accordingly.

Making this presentation available in no circumstances whatsoever implies the existence of an offer or commitment or contract by or with Investec, or any of its affiliated entities, or any of its or their respective subsidiaries, directors, officers, representatives, employees, advisers or agents (“Affiliates”) for any purpose.

This presentation as well as any other related documents or information do not purport to be all inclusive or to contain all the information that you may need. There is no obligation of any kind on Investec or its Affiliates to update this presentation. No representation or warranty, express or implied, is or will be made in relation to, and no responsibility or liability is or will be accepted by Investec or its Affiliates as to, or in relation to, the accuracy, reliability, or completeness of any information contained in this presentation and Investec (for itself and on behalf of its Affiliates) hereby expressly disclaims any and all responsibility or liability (other than in respect of a fraudulent misrepresentation) for the accuracy, reliability and completeness of such information. All projections, estimations, forecasts, budgets and the like in this presentation are illustrative exercises involving significant elements of judgement and analysis and using the assumptions described herein, which assumptions, judgements and analyses may or may not prove to be correct. The actual outcome may be materially affected by changes in e.g. economic and/or other circumstances. Therefore, in particular, but without prejudice to the generality of the foregoing, no representation or warranty is given as to the achievability or reasonableness or any projection of the future, budgets, forecasts, management targets or estimates, prospects or returns. You should not do anything (including entry into any transaction of any kind) or forebear to do anything on the basis of this presentation. Before entering into any arrangement, commitment or transaction you should take steps to ensure that you understand the transaction and have made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances, including the possible risks and benefits of entering into such a transaction. No information, representations or opinions set out or expressed in this presentation will form the basis of any contract. You will have been required to acknowledge in an engagement letter, or will be required to acknowledge in any eventual engagement letter, (as applicable) that you have not relied on or been induced to enter into engaging Investec by any representation or warranty, except as expressly provided in such engagement letter. Investec expressly reserve the right, without giving reasons therefore, at any time and in any respect, to amend or terminate discussions with you without prior notice and disclaim hereby expressly any liability for any losses, costs or expenses incurred by that client.

Investec Bank plc whose registered office is at 30 Gresham Street, London EC2V 7QP is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority, registered no.172330.