01 Oct 2018

Sell in May? No way!

As the S&P 500 Index extends the longest bull market run in history, some remain concerned about an inevitable fall. But it would require a slowdown of epic proportions to trigger a slump.

It’s not often you hear large crowds chanting “Europe! Europe!” In fact probably for about three days every two years at the Ryder Cup. I don’t suppose we’ll hear much of it at the Conservative Party conference, although I’m sure even the hardest of Brexiteers will find some political capital in tweeting their congratulations to the plucky underdogs who stuck it to the yanks!

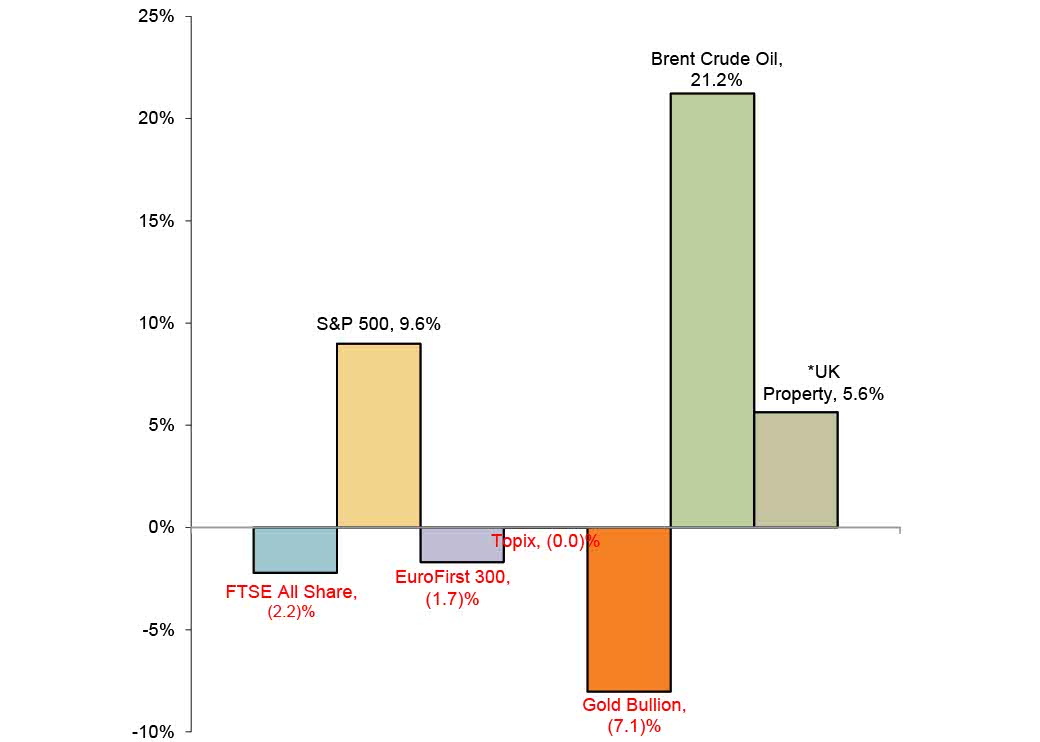

As we head into the final quarter of the year, it’s time to take stock of the past three months. It’s been a pretty decent one for investors, defying the usual seasonal exhortation to bank profits ahead of the summer.

Global equity indices show a total return of 5.7%, although there was quite a gap between the leaders and laggards. The US has continued to show the way, returning an impressive 9.2% to sterling investors, with 1.5% of that coming from the combination of a stronger dollar and weaker pound.

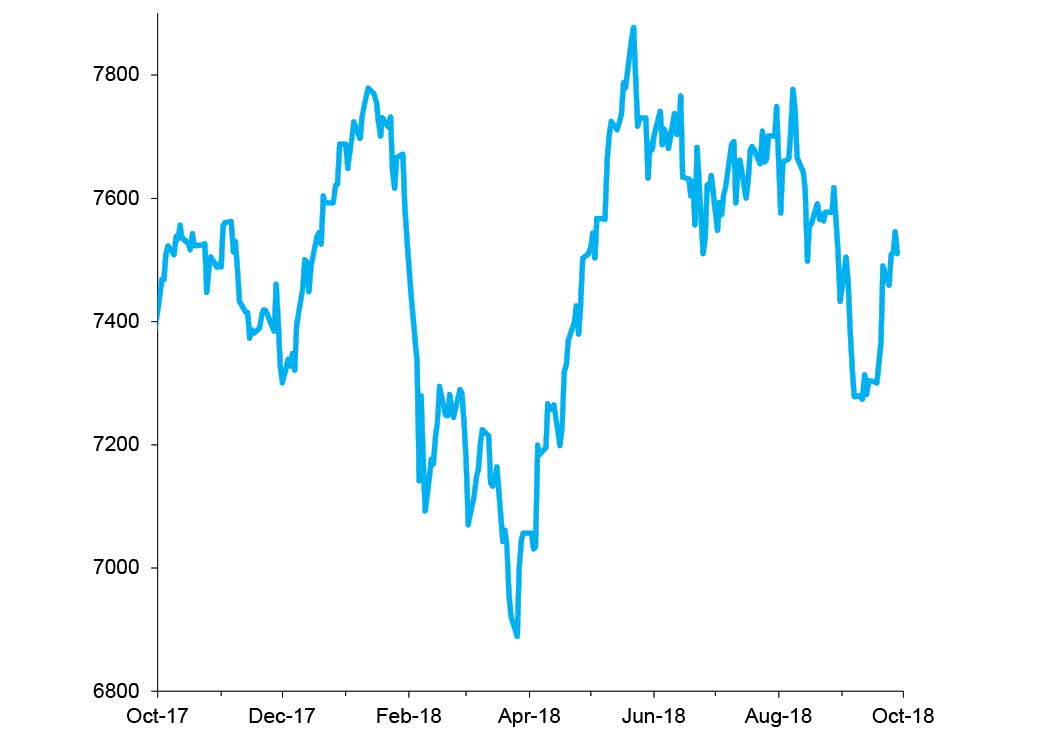

The S&P 500 Index is now extending the longest bull market in history, after it passed the previous milestone of 3453 days on 22 August.

That has some people worried that an inevitable bust is coming, but, barring some unforeseeable exogenous shock, the recession that might trigger a big reversal is just beyond the investment horizon, somewhere it seems to have been for quite a long time now.

Given that the US economy has grown more than 4% in the past two reported quarters, it would require a slowdown of epic proportions to occur. The Atlanta Fed’s GDPNow forecast for the third quarter has finally edged back to 3.6%. Consensus estimates for this year are running at 2.9%, with 2.5% for next year and 1.9% in 2020.

The US performance is firmly grounded in growth, with corporate earnings forecast to rise around 22% this year. Of course, some of that is coming courtesy of Donald Trump’s fiscal stimulus, which is something of a one-off factor, one would think, and earnings growth is forecast to decelerate to around 10% in 2019 – still healthy.

Neither can we rule out a more negative outcome from the trade disputes, although there is some encouragement for activity on the American continent in last night’s eleventh-hour agreement between the US, Mexico and Canada – although they hardly put much effort into the name of the accord, the United States Mexico Canada Agreement!

FTSE 100 Weekly Winners

| Randgold Resources | 10.7% |

| Sky | 9.1% |

| Next | 5.7% |

| AstraZeneca | 5.2% |

| Micro Focus International | 5.0% |

| Compass Group | 4.8% |

| ITV | 4.3% |

Source: FactSet

FTSE 100 Weekly Losers

| Melrose Industries | -9.3% |

| RSA Insurance Group | -8.7% |

| Paddy Power Betfair | -6.1% |

| easyJet | -5.8% |

| DCC | -5.7% |

| Standard Life Aberdeen | -5.4% |

| GVC Holdings | -5.4% |

Source: FactSet

Japan was another good performer, returning just over 3%, with a strong underlying market overcoming a weaker yen for overseas investors. As we have commented in the past, Japan’s market is full of interesting value situations, with many companies sitting on cash piles or stakes in subsidiaries just waiting to be unlocked.

We also believe that innovation forced upon the Japanese by dint of its shrinking population (think robotics, for example) is a positive factor. There was also some good political news (in contrast to pretty much anywhere else on the planet), with Prime Minister Abe seeing off a leadership challenge within his party. He is now set fair until 2021, and to continue with his policies to stimulate the economy.

Europe managed to grind out a 1.8% return, with little influence from currency movements.

Europe managed to grind out a 1.8% return, with little influence from currency movements in the end. There is one major obstacle for Europe to overcome in the short term, one that has been lurking for the whole summer, and that is the Italian budget for 2019.

This was identified this as one of the potential major market movers for the autumn, and the Five Star/Lega government presented its demands, as it were, at the end of last week. Having been elected on a populist mandate with promises of fiscal stimulus, it was to some degree honour-bound to splurge the cash.

An original, potentially catastrophic, deficit projection of 6% (based upon costing all their manifesto promises) was watered down to 2.4%, but this was still higher than the market felt comfortable with, leading to a sharp sell-off for Italian government bonds and, consequently, Italian banks, which hold a lot of the debt.

This is the so-called “doom loop”, in which the government’s finances, the financial system and the economy all go down the Swanee together. There is, in all probability, some posturing and brinkmanship at play, and there are now another two weeks for Italy to reach a compromise with the European Commission. However, this remains a very dangerous situation, where ideology could get in the way of practicality.

Speaking of which, the UK (along with Italy and Spain) brought up the rear in terms of developed market performance. We have spoken before about the index composition problem, with the UK having a mere 1% Technology sector weighting (and Sage, which has had a poor run recently, being a significant proportion of that).

UK assets remain somewhat friendless, having been dumped into the “too difficult to manage” basket by global investors.

Although the Healthcare and Oil sectors managed to provide a bit of impetus, UK assets remain somewhat friendless, having been dumped into the “too difficult to manage” basket by global investors. It is hard to see this mood changing without some real progress in Brexit negotiations, although this sets up the possibility of being able to buy UK-listed assets on the cheap just because of where they are listed.

Unfortunately, even if Brexit is resolved (by a “No Deal”), that could open the door to another general election and to a Labour-controlled government, neither of which is going to make the UK look any more attractive.

In Emerging Markets, despite China and Hong Kong continuing to lose ground in the face of a slower Chinese economy and trade war fears, it is notable that equities in, for example, Korea, Taiwan, Thailand and Vietnam all showed positive returns, suggesting that some value has become available in the region.

Year to Date Market Performance

Source: FactSet

*IPD Total Return to July 2018

FTSE 100 Index, Past 12 Months

Source: FactSet

This newsletter is for professional financial advisers only and is not intended to be a financial promotion for retail clients. The information in this document is for private circulation and is believed to be correct but cannot be guaranteed. Opinions, interpretations and conclusions represent our judgement as of this date and are subject to change. The Company and its related Companies, directors, employees and clients may have positions or engage in transactions in any of the securities mentioned. Past performance is not necessarily a guide to future performance. The value of shares, and the income derived from them, may fall as well as rise. The information contained in this publication does not constitute a personal recommendation and the investment or investment services referred to may not be suitable for all investors. Copyright Investec Wealth & Investment Limited. Reproduction prohibited without permission.

Member firm of the London Stock Exchange. Authorised and regulated by the Financial Conduct Authority.

Investec Wealth & Investment Limited is registered in England.

Registered No. 2122340. Registered Office: 30 Gresham Street, London EC2V 7QN.

Search articles in