2019 concludes a decade of the highest temperatures on record and increased carbon dioxide emissions and rising sea levels will affect human wellbeing.

The United Nations Secretary-General António Guterres told delegates at the UN Climate Change Summit in his opening address that well-regulated markets could help address the environmental crisis. “To put a price on carbon is vital if we are to have any chance of limiting global temperature rise and avoiding runaway climate change,” he said.

How are commercial renewable energy solutions helping?

Market forces do have a history of accomplishing change in a very short time, often surpassing even optimistic expectations. The UK’s adoption of wind energy in the past ten years has grown phenomenally. In 2008, UK wind farms generated 5.4GWh of electricity. In 2019 they were responsible for 20% of total electricity generation.

In addition, energy storage and battery advances have benefited from mainstream corporate and venture capital investment activity in recent times assisted by attractive government subsidies.

The effect is global. China now possesses 70% of global installed solar capacity. In 2018 alone, it expanded its solar production capacity by 81%, even as government incentives were reduced. Similarly dramatic stories of solar power adoption in countries from the US to India are causing energy agencies to accelerate their plans for phasing out coal and other fossil fuels.

Battery storage technology growth

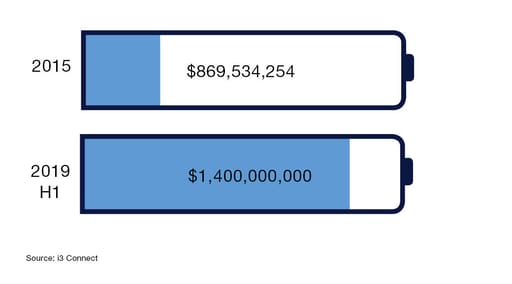

Battery technology has made a quick shift to the forefront of corporate and venture capital investment activity. Epitomised by the vast increase in investment shown over H1 in 2019 compared to 2015.

Why are aligned markets so important?

The shift towards renewable energy is critical, not only for individual businesses, but also for nations that compete in a globalised economy. Some renewable energy solutions are starting to have a lower cost than fossil fuels.

This is not just a competitive issue between developed economies, either. Inexpensive solar panels installed in rural India and Africa are enabling financially disadvantaged communities to advance, even when they lack large scale energy distribution infrastructure.

Kenya, it should be noted, produced 85% of its power last year from renewables – largely by positioning itself as “one of the foremost destinations in the region for private energy investment,” according to the World Bank.

The market is responding in other ways, too. Smart energy grids and storage technology are advancing and enabling distributed energy models to evolve. Many of the improvements allow greater flexibility in the distribution and storage for the growing amounts of wind and solar energy, both of which are reliant on the intermittent availability of wind and sunshine.

What about carbon pricing?

Applying a cost to greenhouse gas emissions could encourage countries to limit the amount of pollution produced. This would mean companies do the same as they are granted government permits to operate. The idea is that the emissions credits could be traded and therefore reducing greenhouse gas emissions would have an economic benefit.

The Paris Climate Agreement backs use of a cap-and-trade system. At the 2019 UN Climate Change Summit Gutteres said: “I strongly hope that COP25 will be able to agree on the guidelines for the implementation of Article 6 of the Paris Agreement.”

At present, carbon pricing is not used globally and manufacturers can outsource their work to locations where there is no charge for emissions. But there are risks for companies that attempt to side-step climate responsibilities in this way. Countries could apply targeted tariffs to companies that side-step emissions controls in future.

Why are consumers and investors so important?

Corporations, institutional investors and sovereign wealth funds are all aware of the potential to profit while contributing towards climate change solutions through their investment choices. The hydrocarbons industry is starting to embrace its responsibilities here, too – one recent example being Shell, which has made a significant investment in renewable power through its acquisition of First Energy in 2017, as well as having implemented a programme to plant forests to offset carbon emissions.

Institutional shareholders in particular are keen to invest in businesses that offer this combination of promising growth along with excellent ESG credentials.

In all cases, authenticity is crucial. Not least because press articles have targeted companies that claim to have green credentials but have high emissions. This incongruence this could affect consumer sentiment.

16-year-old Greta Thunberg is among many who have been actively speaking about the climate crisis.

How can regulation support responsible markets?

Governments must also fund critical research into the key drivers of climate change and new technology that could be useful, in cases where this work is too expensive and high risk for the private sector alone. This could include providing seed capital, technical assistance and market exposure to small start-ups that offer promising approaches to solving global environmental challenges.

In the UK, The Faraday Institution is focused on electrochemical energy storage research and skills development. It brings together scientists and industry partners to help reduce the cost, weight and volume of batteries, as well as their performance and reliability.

Competition and market solutions can accelerate the adoption of the most effective ideas and technologies for mitigating and even reversing the effects of global warming.

Where do we go from here?

Make no mistake: 2019 has been a watershed year for the global climate crisis. Companies who continue to ignore it risk missing out on the rewards that result from an industrial shift. At the same time, they risk alienating an entire generation of investors and consumers while exacerbating a global crisis that jeopardises their own ability to generate returns.

Competition and market solutions will accelerate the adoption of the most effective ideas for reducing and reversing the effects of

global warming. But for markets to be able to deliver, effective regulation is a needed to spur investment, learning and technological breakthrough that that will ensure a future for the next generation.

The wider the application of appropriate regulations, the more certainty markets will have on the benefits of embracing climate-friendly investment policies – and the more effective they will be in responding to the climate change crisis.