The brave new world of Non-Fungible Tokens (NFTs) is so unpredictable that when Everydays, a digital work by the American digital artist Mike “Beeple” Winkelmann, fetched a staggering ETH 42,329 ($69 million) at auction, the doyens of the art world, and Winkelman himself, were taken by complete surprise.

Even Christie’s, the global art auction house that offered the work for sale, had no idea what value to place on this NFT when it went under the hammer in March. So there was no reserve price or estimate for the work and bidding began at $100.

The auction was run entirely on the Ethereum blockchain, with settlement governed by a smart contract. If your eyes have started to glaze over, let’s break that down:

The ABCs of NFTs

What is Ethereum?

Ethereum is a technology platform for digital money, global payments and applications. The market capitalisation of Ethereum’s native cryptocurrency, ETH, is the second largest in the crypto asset space after Bitcoin.

What is blockchain?

Blockchain is a decentralised digital ledger that documents transactions across a global network of computer systems. It provides a failproof way of verifying and recording information.

What is a smart contract?

A smart contract on blockchain is defined by Investopedia as “a self-executing contract with the terms of the agreement between buyer and seller being directly written into lines of code”.

But back to Beeple. Just how exactly did a simple jpeg sell for the price of a high-end luxury yacht? Well, that’s been the subject of a great many articles, podcasts and public rants. Hardly surprising that it’s also led to a boom in the market for NFTs.

Before we venture further through this digital looking glass, it is worth arming ourselves with a few more nuggets of jargon.

Graphic designer Beeple’s "Everydays: The First 5000 Days" consists of many tiny images he created every day for 5000 days to mark the passing of time. It sold for a record-breaking for $69 million, making him one of “the three most valuable living artists” according to Christie’s. (Credit: Alamy stock photo)

What are NFTs?

In economics, fungible goods are items that can be exchanged with another asset or good of the exact same type and value – money being the most obvious example. When something is non-fungible, it cannot be swapped in this way, because it is unique, like real estate, art or other collectibles.

In the realm of digital art however, it’s very easy to replicate works online. Which raises the problem of unique ownership. It’s easy enough for me to prove my ownership of a Picasso if the original is hanging on my living room wall. But what if there is no original, because a theoretically infinite number of copies are floating around in cyberspace, each one completely identical, down to the last bit?

That’s where the NFT comes in: a one-of-a-kind digital asset that acts as a certificate of ownership for virtual items. Put simply, the NFT is to digital artwork what a title deed is to real estate.

Most NFTs are registered and secured by the Ethereum blockchain and can consist of many different kinds of digital end-products, from jpegs and gifs to Mp4s and other files that can be turned into an ‘asset’. An NFT can only be owned by one person at a time. No one can modify the record of ownership.

Headline-grabbing NFTs

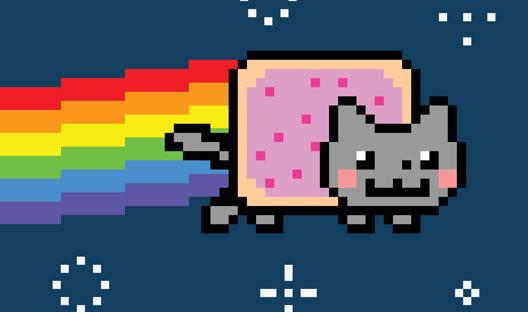

Nyan Cat

You Tube meme sensation Nyan Cat – a pixelated flying feline, was turned into a gif by its creator Chris Torres that sold as an NFT for $531,000. (Credit: Alamy)

Sophia the humanoid robot

In Hong Kong in March 2021, a digital artwork created by humanoid robot Sophia, was sold on auction for $688,888 in the form of an NFT. (Credit: Tyrone Siu/Reuters)

Larva Labs' CryptoPunks

In May 2021, a collection of nine of Larva Labs’ CryptoPunks NFTs was sold at Christie’s in New York for $16.9 million. (Credit: Dia Dipasupil/Getty Images)

Jack Dorsey's tweet

Twitter founder Jack Dorsey sold his first tweet, "just setting up my twttr", as an NFT for $2.9 million. (Credit: Joe Raedle/Getty Images)

How does blockchain technology create NFTs?

Blockchain technology can assign ownership and property rights to digital objects by associating a unique string of code with that digital asset and registering this on a public ledger. That string of code is generated, or “minted”, according to a complex mathematical formula that takes into account every preceding entry – every previous link in the blockchain.

In theory, anyone can mint an NFT. But a few dedicated “minters” have sprung up, including Rarible and OpenSea, to make life easier for content creators who want to make their digital works available for sale on blockchain marketplaces, where they are typically priced in cryptocurrency (primarily ETH).

NFT marketplaces ensure transparency

Marketplaces are not only an essential part of the NFT universe; they are the virtual space where NFTs live even after they are sold. The biggest Marketplace is OpenSea but there are many others, including Nifty Gate, SuperRare and Foundation.

On most marketplaces each NFT’s unique code is linked to a ledger that shows when it was made, who has previously owned it and the amount of cryptocurrency that was used to acquire it. It is this form of transparency that makes NFTs so valued.

Apart from the infinite replicability of digital files, another rationale for tokenisation of digital assets is that they tend to be traded more frequently than regular artworks. Unlike your average Flemish masterpiece, a popular NFT might be sold twice in a day, so it’s vital that its sale records are transparent and that the artist can benefit from its resale (usually 10%).

The source code for the World Wide Web, written by Sir Tim Berners-Lee in 1991, was sold as an NFT by Sotheby's for $5.4 million. (Credit: Noam Galai/Getty Images)

A “land grab” in the NFT space

“There is something of a land grab going on in the NFT space, where we see for the first time ever the ability to assign and prove ownership of digital goods not managed by a central intermediary. Digital content creators now have a direct route to market and the ability to monetise their creations,” explains Chris Becker, blockchain lead at Investec.

Since the dawn of the Internet, the gatekeepers of digital value creation have typically been large technology and media companies whose business models centre on gathering audiences and, in turn, advertising revenue. This revenue is directed mostly to the platform, not the content creators responsible for attracting the crowds – a dynamic which many artists consider fundamentally unjust.

Since the dawn of the Internet, the gatekeepers of digital value creation have typically been large technology and media companies whose business models centre on gathering audiences and, in turn, advertising revenue.

“Content creators in the digital era have drawn the short end of the stick,” says Becker. “Blockchain and NFTs are a game changer as they eliminate large tech intermediaries from all the verticals of digital content creation and distribution. NFTs put the power back in the hands of content creators, and the most popular marketplaces are being built as public utilities, not for private gain.”

Art seems to be the first use-case and realisation of this disintermediation, says Becker, but the disruption in other verticals such as music may soon become more apparent.

NFTs put the power back in the hands of content creators, and the most popular marketplaces are being built as public utilities, not for private gain.

Will the NFT bubble burst?

Love them or loathe them, the volumes of NFT sales surged to $2.5 billion in the first six months of 2021, according to data from OpenSea and other marketplaces.

While this pales in comparison to the $50.1 billion in annual sales of mainstream art and antiques in 2020 (UBS Global Art Report 2021), the fact that the market cap has grown nearly ninefold between 2018 and 2020 has pricked up the ears of the art world and investors alike.

Becker believes that there is an element of “speculation and greed” currently pushing up the prices of NFTs. “In the world of NFT art there are likely to be early projects that take on a cultural significance of being the first of a kind, such as the CryptoPunks. Only time will tell how the market values a project like this over the long term.”

If the NFT market continues to grow, it could become a new asset class, Becker adds, which would have knock-on implications for banking and wealth management services.

“Would we be able to recognise these assets that have a market price within a client’s financial position as collateral for credit? Would we be able to plan a client’s wealth requirements and will around these digital assets that can be transferred to next of kin, unlike other forms of digital assets that do not have a market value? There is a lot of innovation happening in the blockchain space directly around this, which we are watching with interest.”

How are NFTs different to mainstream art?

The NFT world is in a galaxy far, far away from the traditional art market. Though both are sold at art auctions, the overlap between NFTs and the more traditional art world is peripheral and will likely remain so for some time to come.

For starters, the sale of NFTs not only cuts out big tech; it also cuts out another middleman: the gallerist or art dealer. Sales of NFTs can only happen via a blockchain marketplace, because that’s how ownership is authenticated.

You can’t take an NFT ‘home’ after you buy it – rather it lives in your Ethereum (or other blockchain) ‘wallet’ – and in order for it to exist in all its tokenised glory it tends to be on view in your chosen marketplace, which also enables other NFT collectors to make you an offer on it. You can, of course, opt not to leave it open for sale, but reselling NFTs and even swapping them is part of the culture.

So NFTs typically remain in the public sphere even after they're sold. This has naturally cultivated a culture where the collectors are as visible as the artists, even though most collectors, like the artists, choose anonymity by adopting a pseudonym. These monikers have become another characteristic of the NFT space that separates it so clearly from the regular art market, where the value of the art has traditionally been closely tied to the identity of the artist. The national identity of artists creating NFTs is almost completely hidden, along with their gender, age and other demographic information.

Digital artwork on display at the CrypTOKYO Blockchain Art Exhibition 2021, the first NFT fair in Japan, which took place in June in UltraSuperNew Gallery in Shibuya City. (Photo by Stanislav Kogiku/SOPA Images/LightRocket via Getty Images)

No limit to an NFT artist’s expression

“Having a pseudonym gives you more room. You can explore different styles after you have created a following. I also want to separate myself from the work and keep myself a mystery so that the work is at the forefront,” says vonMash, a 30-year-old Joburg-based multimedia artist who is about to make a leap into the world of NFTs.

A digital artist known for his African futuristic imagery, vonMash has been head hunted by a well-established marketplace. He hadn’t heard of NFTs until last year and is considering minting his digital works. Up until now he sold as digital prints, which carry little value in the traditional art world, so NFTs were an attractive new avenue.

Like many artists making NFTs, vonMash didn’t study art but rather opted for multimedia design. As a result, NFTs are often animated or have sounds, music or other 3D features.

“It is limitless. I can do photography, I can create graphics, I can create sound. I didn’t want to be confined to web design. I wanted to express myself in a lot of ways. I wanted to distinguish myself from other artists, not a lot of artists can work with all of these mediums,” says vonMash.

A share certificate is held next to a Banksy screenprint, Girl With A Balloon, priced at $340,000, on show at the launch of the ARTCELS blue-chip art portfolio at the House Of Fine Art (HOFA) Gallery in central London. The art portfolio will offer shares-based partial ownership using NFTs - digital tokens tied to assets that can be bought, sold and traded. Picture date: Thursday 22 April 2021. (Photo by Yui Mok/PA Images via Getty Images)

The value of the visuals

It is said that appreciating NFTs requires an understanding of the possibilities that design technology offers and how these artists are exploiting them. Novel visual or audio tricks that would probably go unnoticed by an untrained eye in the traditional art world are valued in the marketplace.

Best-selling NFTs include series of cartoon-like characters or animals dressed in different outfits such as monkeys (Bored Ape Yacht Club), cats (Cool Cats NFT), penguins (Pudgy Penguins) or koala bears (Koala Intelligence Agency). Animated futuristic visual spheres with robots, skulls and other popular iconography are also popular.

Novel visual or audio tricks that would probably go unnoticed by an untrained eye in the traditional art world are valued in the marketplace.

Though vonMash does use regular paint and collage, the end-product of his art is a digital file, and the ‘hand’ of the artist is hidden. Deliberate pixilation and references to computer games are common.

Another distinguishing factor of NFTs is that their value is often tied to the fact that they are part of a very large collection or series, which is defined by a fixed characteristic. The CryptoPunks, for example, or, more accurately, the Larva Labs artists who create them, have generated a following for pixilated avatars that reference early or crude digital portraits of people.

Among the few recognisable names in traditional art circles who is doing well on the NFT circuit is Damian Hirst. Digital versions of Hirst’s Spot series, paintings of near-perfect painted dots, are selling for around $35,000 (£25,660) apiece, placing him in the top 20 of highest-selling artists on OpenSea.

A generational thing?

Ahead of the Investec Cape Town Art Fair, we spoke to galleries in South Africa about the NFT scene there.

The Worldart gallery in Cape Town will be selling NFTs on its website shortly, with the opening of a solo exhibition by Juan Stockenstroom. Six paintings by this artist will be paired with NFT versions, according to Charl Bezuidenhout, the gallery director.

The gallery is trying to convert collectors who prize paintings to embrace NFTs, says Bezuidenhout. Given that there is little crossover between those who buy art and those who covet NFTs, he seems to have his work cut out for him. But following the high-profile NFT sales like those by Christie's, he’s not the only gallerist up for the challenge.

“If it is going to be part of the art market and is collectable, we need to do homework to make sure that if we sell them, it is done properly,” says Susie Goodman, executive director at Strauss & Co, the South African auction house.

The blockchain’s ability to verify provenance and authenticity is very attractive to the art world, says Marelize Van Zyl, senior art specialist at Aspire Art Auction house. But she suggests that the sale of NFTs via South African auction houses is a long way off given how risk averse the South African art buyer is.

The blockchain’s ability to verify provenance and authenticity is very attractive to the art world.

“We are only breaking ground on contemporary art here. So I think for us it will be a while before we get to that stage where we are selling digital art. Photography is still difficult to sell to locals,” says Van Zyl.

NFTs are geared for a new, younger generation, posits Ashleigh McLean, director of Cape Town’s Whatiftheworld gallery. “I don’t have an interest in NFTs. I think they are cold and soulless, but that could be a generational thing. I would have thought that with us now being forced to live more online, we would crave the unique: one special, tactile thing to be physically connected to. Maybe some people realised you need to let go of these physical things.”

Find out more about Investec

Private clients

From private banking to wealth management and investment services, you can receive tailored financial solutions, whether you are aiming to actively grow your wealth or seek optimal returns on your capital. We can help fuel your success by building a relationship with you for the long term.

Corporates and businesses

Access a comprehensive range of solutions spanning capital, advice and treasury risk management. As an international corporate and investment banking business, we work with growth-orientated companies, institutions and private equity funds.

Intermediaries

Whatever your clients’ goals and ambitions, our flexible range of intuitive, market-leading products and services help you deliver on their needs, enhance your reputation and reduce your admin burden, freeing up more time for you to focus on financial planning.