The world of work has been revolutionised in the space of a generation. Previous norms like jobs for life, working nine to five and the 40-hour week now seem like relics from ancient history.

Traditional attitudes to retirement have also become just as outdated as the typing pool or the fax machine. The current baby boomer generation is no longer content with the idea of a sudden shift from working full-time to not working at all.

A recent study published found that retired people were twice as likely to feel depressed than those who were still working

Actuaries know that if you reach retirement age then your chances of living healthily to a ripe old age are great. In fact, nowadays our post-work lives can last as long as our working lives. Yet psychologists tell us that everyone needs some kind of purpose in life otherwise it can be very difficult to cope with the boredom, loss of status, and lack of mental stimulation that arise from a cliff-edge retirement.

A recent study published found that retired people were twice as likely to feel depressed than those who were still working.i Harvard’s School of Public Health also found that those who retire completely had a 40% greater chance of having a heart attack than their peers who continued working. Faced with such compelling insights, there is a growing realisation that there is much more to retirement planning than just getting the finances right.

A cultural shift in attitudes is taking place: people are increasingly treating retirement as a gradual process rather than as an artificial finishing line imposed by others. The government banned compulsory retirement ages in 2011 and it seems that the baby boomer generation is embracing the huge freedoms and opportunities that this fluid approach offers.

Working past retirement? Or getting genuine satisfaction from life?

Valuable lessons can be learned from Japan which has the world’s oldest population both in demographic terms and in the longevity of its citizens. Nearly 33% of Japanese are over the age of 65 compared to 18% in the UK. With shrinking birth rates, Japan has been rethinking its attitudes to retirement. Today, almost a quarter of people over 65 in Japan are still working, the highest proportion in the G7 group on industrial nations.

The Japanese are famous for introducing the world to their word karoshi, which means, literally, death by overwork. Its coinage reflects the intensity of the nation’s ‘salaryman’ working culture.

The Japanese word for retirement is taishoku, but they also have a concept called ikagai which serves as an inspiration for British baby boomers contemplating retirement options.

There is no direct equivalent of ikagai in English, but the best translation would be “the reason I get out of bed in the morning” or “the thing that I live for”. Your ikagai is what you are passionate about, the thing that gives you genuine satisfaction and that gives your life meaning. Studies of the extremely long-lived and happy citizens of Okinawa show that if you are engaged in something you enjoy, then you have no desire to retire. This feeling of contentment goes far beyond financial security. It is a happiness that comes from being inspired every day.

Old and outdated? Or skilled, experienced and resourceful?

That philosophy is perfect for the new approach to flexible retirement in the UK where half of us intend to work past the state pension age. More than a quarter of us would prefer to reduce our hours while staying in our current job, while a fifth of us would like to earn a living from our hobby or by starting our own business.ii Keeping a foot in the world of work keeps you physically and mentally active, gets you out of the house and provides a useful source of income.

Apart from that it is also the case that many of us simply enjoy working. With proper planning there is no reason why the dream of a good work/life balance in later life – not all work and not all play – cannot become a reality.

Nearly 25% of workers aged 50 and over are self-employed. When you move to workers aged 70 and over, the number that are self-employed jumps to 50%

The good news is that there is strong evidence that people in their fifties and beyond are actually very good at business. Their mature attitudes, rich experience and resilience in coping with challenges are all big advantages. As the US journalist and satirist, PJ O’Rourke so eloquently put it: “Age and guile beats youth, innocence and a bad haircut”.

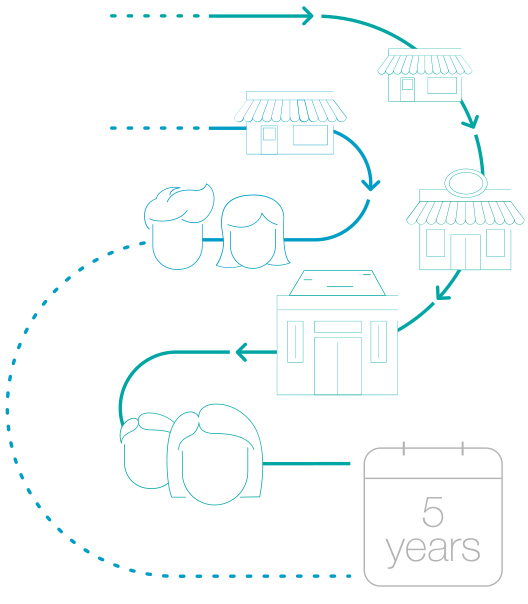

This business acumen is proven out in the numbers. Nearly 25% of workers aged 50 and over are self-employed. When you move to workers aged 70 and over, the number that are self-employed jumps to 50%.iii

But perhaps more impressively, according to Age UK, more than 70% of businesses started by people in their fifties survive for at least five years. This compared with just over a quarter of those started by younger entrepreneurs.

Even if you don’t want to take the plunge with a new business, the chances are your current employer will be delighted to keep you on while reducing your hours. Flexible working is becoming common as employers are reluctant to lose valuable staff and their wealth of knowledge, experience and contacts.

Playing it safe? Or blossoming in new ways?

If you do decide to launch your own business as an alternative to retiring, then it is worth respecting the ikagai philosophy: the secret of happiness and fulfilment is to stick with your existing passions or skills.

The number of options is exciting: use your experience and expertise to become a consultant or non-executive director; if you love movies and television, you could become a film extra; animal lovers can set up as pet-sitters and dog-walkers; local history buffs can get their Blue Badge and become tourist guides. If you’re good with language, then you’ll be in demand as a proof-reader or editor.

Of course, many baby boomers are affluent and don’t need to work in retirement. Indeed, one in five are actually millionaires according to the Office of National Statistics.

In that case you might choose to give something back to society by volunteering and helping others. This is a great British tradition and part of the country’s fabric. According to the UK Civil Society Almanac, more than 20 million people in the UK volunteered through organisations and formal groups. iv

The number of options is exciting: use your experience and expertise to become a consultant or non-executive director

The national Do-it.org volunteering database fills a volunteering opportunity every 45 seconds. These range from home visitors and gardening volunteers to drivers and hosts for the National Trust. Professional people can put their financial, management and people expertise to great use as trustees and treasurers of charities.

Financial security? Or long, happy lives?

As our concept of retirement becomes more flexible and fluid, the opportunities for work-life balance, satisfaction, and financial security grow. Embracing the ikagai philosophy will help us all avoid the common traditional retirement woes of ill-health, boredom, and withering self-esteem and allow us to enjoy longer, happier lives.

i Journal of Population Ageing

ii Prudential, June 2018

iii Survey by Age UK

iv UK Civil Society Almanac 2019

See how Retirement Planning could benefit you

Find out how we could help plan your ideal retirement.

Browse articles in