10 Dec 2021

The evolution of ESG investment

A lesson I learned in the nineties that applies now, more than ever

I was studying for my MA in Economics at Heriot-Watt University, Edinburgh, when I learned an important lesson, that I found rather confusing at the time. I had expressed an interest in pursuing a career in investment management, and my professor encouraged me to base my dissertation on the economic case for ethical investment. He taught me, “There is a lot more to investing than just making money!”

The aim of my research was to establish if investment guided by conscience could be successful, or if it naturally came at the expense of returns? Also, could investors really have a role in shaping society and making the world a better place?

My findings on ethical investment

Ethical investment is largely based on negative screening. This is simply avoiding companies that operate in areas that the investor is ethically opposed to, such as armament, tobacco, or alcohol companies. Whilst the concept of ethical investment has been around for decades (led by the Quaker movement in the USA and the Methodist Church in the UK) this was still a niche area of the investment market.

I was encouraged by my findings. Ethical screening did not necessarily mean that investment returns were lower! I was able to find many examples of ethical funds that had performed as well, or better, than unconstrained funds.

It seemed to me that the biggest challenge was how to get the screening process right? For example, if you wish to avoid companies that produce tobacco and alcohol, should you also avoid companies that sell these products? Or provide raw materials to help in their production? Also, I could not see how ethical investing could build up the “lobbying” strength to convince companies to change their ways.

The evolution of ethical investment into ESG

Over time, conscience-led investing has evolved. ESG (environmental, social, and governance) has emerged from, and taken over, ethical investment and sees a greater emphasis on positive screening techniques – looking to support companies with strong environmental and societal focus and encourage all companies to behave better.

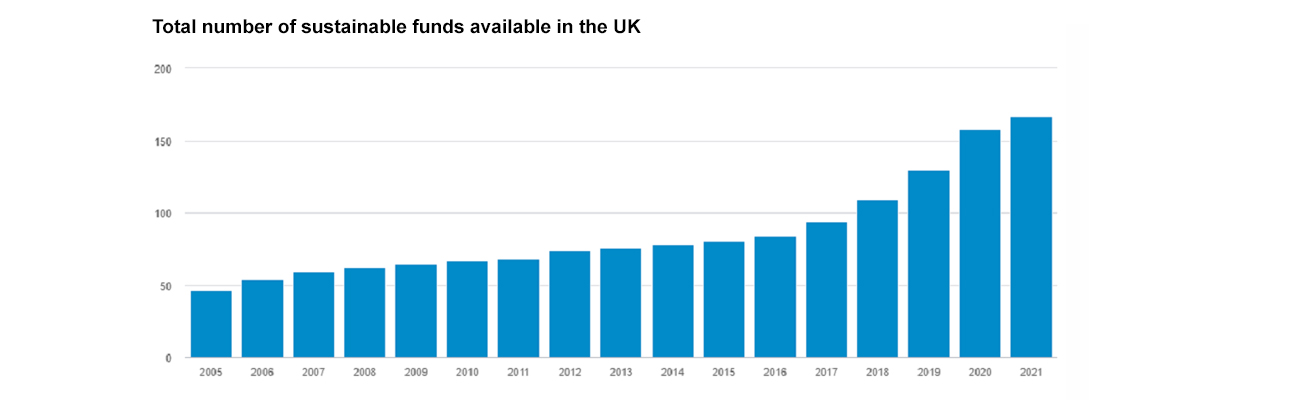

Sustainable funds – those that ESG analysis as part of their investment selection process – are now rapidly growing in number, as demonstrated in the table below.

Source: Morningstar as at February 2021, includes UK domicilled funds identified as sustainable within all IA sectors

ESG investment today and in the future

The trend towards ESG is accelerating. As we emerge from the Covid pandemic there is increasing awareness of the social damage that has been caused. Investors are looking to assert their influence on companies to ensure that they “do the right thing” - that they treat their staff, customers, suppliers, and environment well. The transfer of wealth of the “baby boom” generation to millennials will see this pressure intensify.

Companies are not only engaging with ESG in examining how they operate, they are also benefitting from this, be it through decreased costs as they move to more efficient energy supplies or increased productivity and enhanced staff loyalty as they improve conditions for their workforce.

There is no doubt ESG is here to stay and will only become a more dominant theme in investment; it is no longer a niche market, it is at the heart of how companies and investors are behaving. It seems to me that now, more than ever, investment is more than just making money!

The value of investments, and the income from them, can go down as well as up and you may not get back the capital that you invest.

Find out more

Whether you are looking to invest for the first time, or have an investment portfolio already, if you don’t know where to begin, or know exactly what you are looking for, we can help. Contact your local Investec experts in Liverpool today, to discover how we can help you to fulfil your financial goals, and live life the way you want to.