Investec Wealth & Investment (UK) is now part of Rathbones Group Plc. Find out what this means.

You’ve likely noticed that things have become more expensive over the past year, whether it’s the weekly supermarket shop, filling up at the petrol station, or perhaps buying some garden furniture to make the most of the summer months.

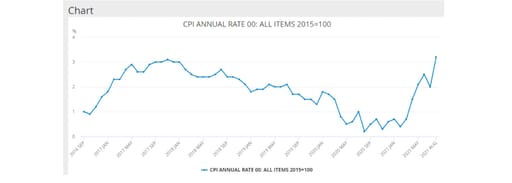

The UK inflation rate saw a sharp rise in the year to August 2021, with the headline figure hitting 3.2%. This is well above the 2% target set by the Bank of England and, as shown in the chart below, is the sharpest rise we have seen in the past five years.

Source: ons.gov.uk

What’s driving the rise in inflation?

There are several factors behind these rising prices, including strong consumer demand as we have come out of lockdown, supply chain issues, shortages of semiconductors, increased shipping costs, bottlenecks at ports and, in the UK, shortages of workers in certain industries such as hospitality and road haulage.

With Covid-19 still affecting parts of the world to varying degrees, the above issues are likely to persist, at least in the short term. In China, this August, we saw just one Covid-19 case partially shut down one of the world busiest container ports, having a huge knock-on effect globally.

All of the above has meant higher costs that are either absorbed by a company or passed onto the consumer.

Will inflation continue to rise and what effect will it have?

Economists and central banks are trying to determine if the current bout of inflation is transitory or if it is here to stay. Inflation breakeven rates suggest that it will be transitory, however, we’ll be keeping a close eye on this as it will have implications for economic growth, the tapering of quantitative easing, and the future path of interest rate rises. If inflation is persistently higher than the Bank of England target, interest rates may have to rise more quickly than currently anticipated.

How does this affect your portfolio?

In client portfolios, we will always hold some exposure to assets that can benefit in a higher inflationary environment, such as equities, index-linked bonds, gold, and infrastructure. However, our core principles are to maintain well-diversified portfolios for clients that will deliver sustainable returns over the longer economic, market and investment cycles.

If you have any concerns or would like more information on how your portfolio protects against inflation, speak to your investment manager.

About the author

To contact or read more about Jason Hallam visit his biography here.

Investec Wealth & Investment (UK) is a trading name of Investec Wealth & Investment Limited which is a subsidiary of Rathbones Group Plc. Investec Wealth & Investment Limited is authorised and regulated by the Financial Conduct Authority and is registered in England. Registered No. 2122340. Registered Office: 30 Gresham Street. London. EC2V 7QN.