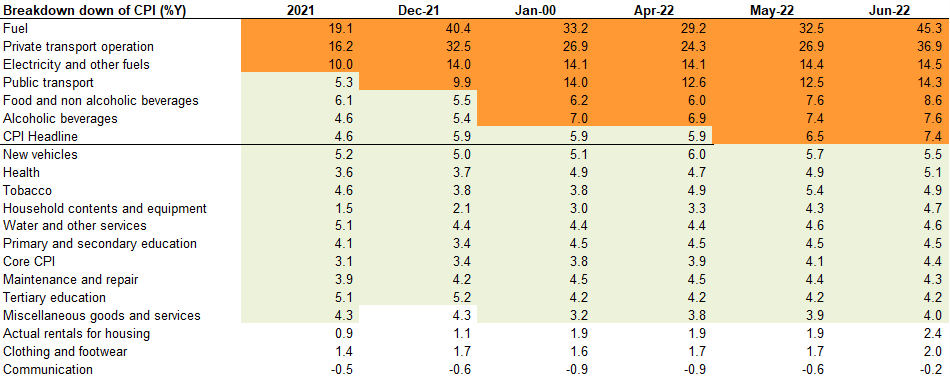

In June, headline CPI inflation again surprised the upside, rising by 7.4% from 6.5%, the highest level since May 2009. The outcome exceeded Bloomberg consensus expectations of 7.3% and ICIB's forecast of 7.2%.

Food and energy prices remain the key drivers, rising by 1.3% (P 2.2%m/m) and 9.4% (P7.8%y/y). The food index's sub-categories such as grains (+2.6% from 8.4%), oils and fats (+5.9% from 26.5%), continued to record steep prices increase over the month, although the rate of increase has started to moderate. Food price inflation increased by 9.0%y/y compared to 6.8% in the previous month, the highest since 2016. The fuel price, which increased by 10.7% to R24.17c/l, is 45.3% higher than the same period in 2021. The rise in the fuel price resulted in a material increase in public sector transport prices, which rose by 7.8% m/m.

Core CPI inflation (excl food, fuel, and energy), a proxy for second round inflation, increased by 4.4% from 4.1%. The outcome was marginally ahead of market expectations of 4.3%. The annual rate of increase remains below the midpoint of the target band of 4.5% but is expected to rise above 5.0% in 2023. Services inflation, the main driver of lower core CPI inflation over the past year, has increased by 3.9%y/y from 3.6%y/y. The main contributors were higher owner occupant (similar to the US's shelter inflation) and rental inflation, rising by 2.4% (P1.9%) and 3.0% (2.7%). We estimate that a weaker ZAR's pass-through effect is 0.13 to 0.15ppt over four to five quarters.1.9%).

The higher than expected outcome of June's CPI inflation rate has raised the trajectory of our inflation forecast. We still expect inflation to peak in August 2022, but the annual rate of increase could be as high as 7.7%. After that, a meaningful reduction in the fuel price and base effects could allow for disinflation and a year-end rate of around 6.0%. We have raised our 2022 average to 6.6% from 6.4%.

The outcome most likely cements a 50bp increase at the July MPC meeting, with the press conference starting at 15h today. However, the probability of a 75bp rate increase has increased. Our subjective probability is 40%.

Figure 1 More CPI goods price inflation categories have recorded increases > 6%