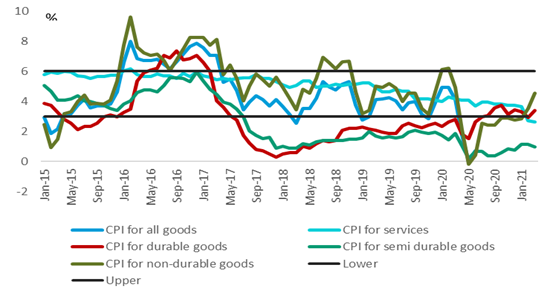

In March 2021, headline CPI inflation accelerated from 2.9% to 3.2%. The outcome was marginally below Bloomberg consensus expectations of 3.3% and in line with ICIB’s forecast. Core CPI inflation receded to 2.5% from 2.6%, undershooting expectations of an increase of 2.7%.

The key areas of interest were food, fuel, education, rentals, and domestic workers’ wages because March being a high survey month.

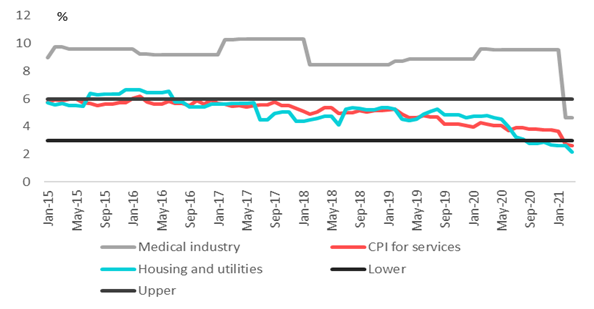

General price increases in goods and services remained subdued in March. This was reflected in the deceleration in core CPI inflation. Nontradeable inflation measured by rental and owner equivalent rentals receded from an already low annual rate of increase in December 2020 of 1.2% to 0.6%. This category has been a key contributor to the moderation in core CPI inflation from 2020. The survey also measured the annual increase in primary/secondary tertiary education. The inflation rate for primary education has slowed down from 7.5% in 2020 and a five-year average of 7.5% to 3.4%, whereas tertiary education fees increased from 4.7% to 5.1%. The increase in domestic workers’ wages slowed down to 2.1% from 3.4%, reflecting the pressure on disposable incomes and the rise in unemployment in the informal and formal sectors of the economy.

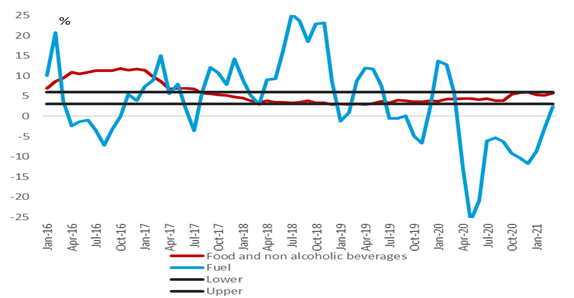

The key drivers of the acceleration of headline CPI inflation remained food and fuel. Food price inflation accelerated from 5.4% to 5.9% (March 2020 at 4.4%). The m/m rate of increase of 0.8% was higher when compared to the gains of 0.3% and 0.8% in the previous two months. The main contributors to the rise were grain, fish, vegetables, meat, dairy products, and fats & oils, which were countered only marginally by a decline in fruit prices. The increase in the fuel price of 65c/l in March raised the annual growth rate to 2.3%. This was the first time since March 2020 that the fuel price was higher than a year ago.

Inflation and interest rate outlook: While the SARB focuses on headline inflation in setting monetary policy, core CPI inflation is an indicator of second-round inflation effects. The path of headline CPI and core inflation are expected to diverge in coming months. Headline CPI inflation is expected to accelerate to the mid-point of the target band of 4.5% on account of base effects and external factors, i.e., fuel, food, and administered price increases (electricity tariffs). In contrast, core CPI inflation could remain more subdued on account of the lack of demand-pull pressures. The March MPC statement and April 2021 Monetary Policy Review revealed that the MPC had adopted a neutral stance on monetary policy. With inflation above 4.0% and the repo rate at 3.5%, negative real interest rates will be maintained for some time to support the growth recovery. ICIB’s baseline forecast remains for the SARB to commence with policy normalization only in early January 2022, with the risk to the forecast an earlier rate hike in Q4 21. However, the pace of the economic recovery remains important in the context of potential GDP growth of ~0.9%. The SARB’s forecast shows a negative output gap until 2023.

Figure 1 Services inflation continued to moderate, with rental inflation witnessing a further slowdown

Source: StatsSA, ICIB

Figure 2 Food and fuel price inflation

Source: StatsSA, ICIB

Figure 3 Breakdown of headline CPI inflation

Source: StatsSA, ICIB