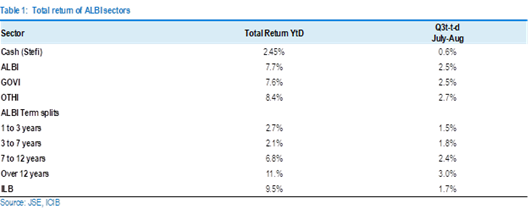

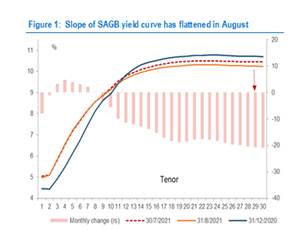

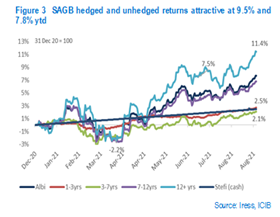

The SAGB yield curve flattened in August following the July unrest in KZN and Gauteng. But mid-long and long-dated spreads remain above their early June levels, when confidence levels were revived by progress made in President Ramaphosa’s economic reforms. The yield on the 10-year generic SAGB yield has declined by 10bps to 9.14%, which remains nearly 20bps above the low of 8.95% in early June. The yield on the R2048 has receded by 25bps to 10.31%, which is similar to June’s low. Three developments contributed to the flattening of the curve. We ascribed the flattening of the SAGB yield curve to the following dynamics:

The risk premium as measured by South Africa’s five-year CDS spreads have declined. The likely catalyst was the rebased and benchmarked GDP data, which led to an upward revision in 2020’s nominal GDP of 11%. The consequence was a significant improvement in the gross debt/GDP ratio of between 7 – 9ppt. The new starting point for the MTEF trajectory from F20/21 is ~71.6% of GDP (previously 80.3%E) rising in F23/24 to ~79.0% (previously 87.3%). While the growth outlook beyond 2021 remains concerning, we think sovereign rating risk has dissipated. While fiscal space remains limited, even with the reduction in SAGB bond supply, we think the lower debt/GDP trajectory represents a “marginal structural improvement” and we have lowered our fair value estimate of the 10-year SAGB yield from 9.0% - 9.50% to 8.80% to 9.30%. South Africa’s five-year CDS spread has rallied from 209bps to 185bps over the past week, taking it back to June levels.

The July MPC meeting downplayed expectations of an imminent rise in the policy rate (1) following rumours of a downward adjustment in the inflation target band of 3 to 6% (which were taken out of context), and (2) emerging central banks embarking on a tightening cycle owing to rising inflation. With South Africa’s CPI inflation rate contained, although intermediate inflation has accelerated to 17.6% in July, ICIB expects the MPC to keep rates on hold for the remainder of 2021. The key focus points at the September MPC meeting are the effect of the revised GDP data on the SARB’s potential GDP growth rate, the output gap and the neutral policy rate. The FRA curve has priced in rates hikes totalling 125bps by the end of 2022, which is 50bps more than ICIB’s forecast.

The key takeaways from Fed Chair Powell’s Jackson Hole Symposium are the progress made in the labour market recovery towards maximum employment and an expected transient acceleration in inflation, which could lead to an announcement of tapering of bond purchases at the September (which is not the market consensus expectation) with the November or December FOMC meetings the most likely dates, and tapering commencing in early 2022. However, the timeline remains unclear. The Fed Chair also delinked the start of tapering from a normalisation in interest rates, which would anchor the US Treasury yield curve for a protracted period of time. Market pricing of interest rate expectations remain unchanged, with risk-on sentiment revived after the USD index retreated by 1% which supported EM FX such as the ZAR. The two-year generic US Treasury yield receded 4bps to 0.20%. The 10-year US Treasury yield, however, is trading between 1.30% to 1.34%, from a low of 1.19% in early July. The August US non-farm payroll report and CPI releases bring with them volatility risk should outcomes be above consensus forecasts.

An additional focus has been developments in the European government bond market, where sovereign yields have risen, i.e. the 10-year generic German bund yield has risen from -0.50% to -0.36%. German inflation has accelerated to 3.4% in August from 3.1%, the highest level since 2008. The ECB meeting in September will be closely monitored to assess the ECB’s willingness to continue with its current PEPP with a total of EUR1 850bn beyond March 2022.