Fed Powell Jackson Hole – To the point

Chair Fed Powell delivered his widely anticipated Jackson Hole speech Friday afternoon. The speech was different from previous speeches. The focus was on inflation only compared to broad topics that touch on the changing structure of the economy or the conduct of monetary policy. The speech lasted eight minutes and Mr. Powell opened his speech by saying it would be shorter, with a narrowed focus and the message direct.

What was different this time in the context of high inflation

Growth sacrifice: The message was hawkish with the starting point that the burden of high inflation falls heaviest on those who are least able to bear it. For inflation to return to the target of 2%, monetary policy must be more restrictive (the current Fed funds rate at 2.5% is in line with the long run neutral rate). However, this could lead to some pain for households and businesses. Previously, Chair Powell and the Fed’s SEP forecasts believed this could transpire with a limited impact on the employment rate and allow for a soft landing. This dented the Fed’s credibility as, historically; lower inflation is rarely achieved without some growth sacrifice as this requires an increase in excess capacity.

Outlook for interest rates: The market has been pricing in a dovish Fed pivot, i.e., slower/negative growth in 2023 could lead to the Fed starting to cut rates in H2 23. Chair Powell’s speech this perception by stating that “restoring price stability will likely require maintaining a restrictive policy stance for some time.” He cited the inflation/interest rate dynamics of the 1970s. Inflation became entrenched for nearly 20 years. The Fed hiked rates but eased monetary policy too early (before an aggressive tightening in 1980). “The historical record cautious strongly against prematurely loosening policy.” The June SEP forecasts show the median federal funds rate slightly below 4% through the end of 2023.

Takeaways

- The concern is that inflation’s persistence could be underestimated. Slow response may require higher costs to control inflation. The costs would involve a deeper contraction in growth. Chair Powell did not use the word recession but the market assesses the risk of a recession at 50%.

- The rate hiking cycle will continue. Smaller rate hikes are only likely once headline inflation has started to moderate.

o US incoming data in September are important inputs for the September 21 FOMC meeting:

2/9 Non-farm payrolls (Aug), unemployment rate, hourly wage increases

13/9 CPI (Aug)

QT is increased to $90bn ($60bn UST and $35bn MBS) from $47.5bn

- What else are we watching this week:

o 31/8 EZ CPI inflation

o South Africa:

30/8 Exchequer balance (Jul)

31/8 Trade balance (Jul)

9/1 ABSA manufacturing PMI and vehicle sales (Aug)

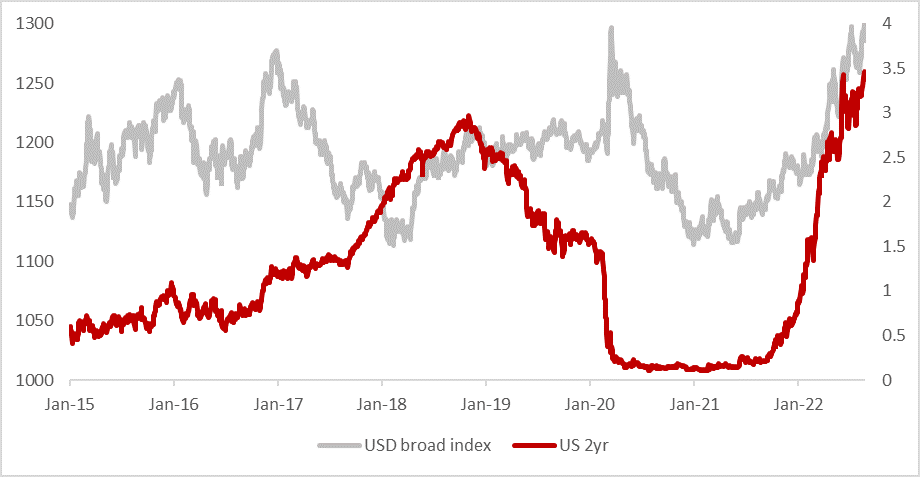

Market reaction: Front-end rates reprice higher and USD remains on the front foot. This will keep EM currencies such as the ZAR on the back foot and the SARB will remain on high alert, as interest rate differentials are informing its decision on the magnitude of rate hikes.

Figure 1 Front-end rates are repricing higher and USD remains on the front foot