Key focus points

- The MPC raised the repo rate by 25bps to 4.0%.

- The decision was not unanimous, with four MPC members in favour of a 25bps rate and one member for rates to remain unchanged.

- Inflation expectations remain contained.

- The tone of the statement was less hawkish than market expectations.

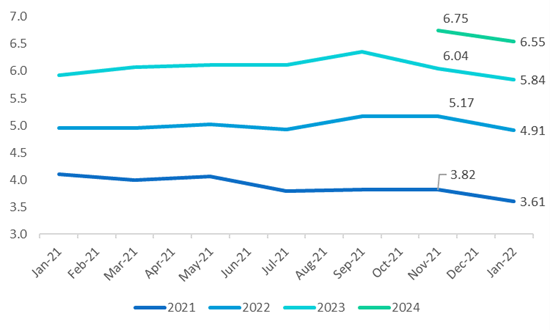

- The QPM interest rate forecast was lowered by 25bps over the forecast period to 6.55% (previously 6.75%) by end 2024.

Market backdrop

The MPC meeting took place in the context of a more hawkish FOMC, a repricing of implied Fed funds rate expectations (five rate hikes are anticipated in 2022) and an increase in global equity market volatility. However, commodity prices have rallied and emerging market currencies such as the rand have traded orderly.

Key message from the MPC

“A gradual rate hiking cycle will be sufficient to keep inflation expectations well anchored and moderate the future path of interest rates.” However, the uncertain outlook (as highlighted in the risks to the inflation forecast below) means that policy decisions will remain data dependent. ICIB forecasts the MPC to raise the repo rate four times by 25bps (including this hike), totalling 100bps in 2022.

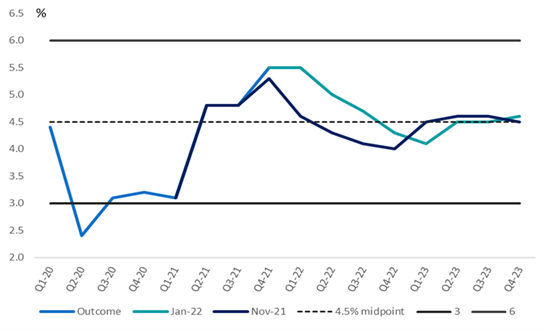

Inflation forecast revised higher

The SARB revised its inflation forecast higher for 2022, from 4.3% to 4.9%. Headline CPI inflation is forecast to peak at an average of 5.5% in 1Q 22 before descending to 4.3% in 4Q 22 owing mainly to base effects; and averaging 4.5% in 2023. The revised forecast is similar to ICIB’s projection. The MPC remains focused on inflation expectations and second-round effects embedded in core CPI inflation. The BER’s latest quarterly survey for Q4 2021 shows a mild increase from 4.4% to 4.8% in 2022 and 4.5% to 4.7% in 2023.

Growth forecast assesses risks to the outlook to be balanced

The SARB left its real GDP growth forecast unchanged at 1.7% for 2022. This is marginally below the IMF’s latest forecast of 1.9% and National Treasury’s November 2021 MTBPS forecast of 1.8%. The SARB neutral assessment follows the November 2021 forecast that flagged downside risks. However, growth remains faster than the potential GDP growth of 0.8%.

Current account and fiscal balance risks have diminished somewhat

A key dynamic in 2022 will be developments around the merchandise trade balance. A large surplus, estimated at R480bn, in 2021, has provided a buffer to emerging market currencies such as the rand. Foreign portfolio flows have been volatile and at times, dried up as market expectations about the inflation outlook diverged from the Fed’s forecast. The SARB’s January 2022 forecast has adopted a more salient outlook for the current account, forecasting a small surplus of 0.4% of GDP from a deficit of 0.6% previously. The rally in commodity prices in the New Year has been a contributory factor. The SARB also flagged an easing in fiscal risk. The implication is that sovereign risk announcements from the rating agencies is not major event risk as previously. The starting point of the rand in the SARB’s inflation forecast, at R15.65/$ compared to R15.10/$ at the previous meeting, is deemed to be below its equilibrium level.

Figure 1 SARB CPI inflation forecast

Source: SARB, ICIB

Figure 2 Progression of QPM year end repo rate forecast to contain headline CPI inflation at 4.5% over the medium term

Source: SARB, ICIB