Key focus points

- The MPC raised the repo rate by 25bps to 4.25% as expected.

- In a unanimous decision, the MPC raised the repo rate by 25bps to 4.0% as expected.

- The interest rate path in the QPM is mild considering the latest inflation outlook, adding one 25bps rate hike in 2023.

- The tone of MPC statement, discussion in the Q&A and QPM interest rate forecast was dovish relative to market expectations embedded in the FRA curve.

- The hawkish surprise was two of the five MPC members in favour of a 50bps rate hike.

- The BER’s inflation expectations survey revealed Inflation expectations remain contained in 1Q 22.

- Risks to the inflation forecast is to the upside.

Market backdrop

The MPC meeting took place against a backdrop of heightened uncertainty about the direction of the oil price, global growth and inflation and a more aggressive frontloaded rate hiking trajectory by the Fed. The rand, however, has been resilient, supported by higher commodity prices.

Key message from the MPC

“Economic and financial conditions are expected to remain more volatile for the foreseeable future. In this uncertain environment, policy decisions will continue to be data dependent and sensitive to the balance of risks to the outlook.” Our interpretation and analysis of the SARB’s new forecast, MPC statement and Q&A session are that there is a high level of uncertainty attached to the medium-term forecast. The acceleration in the headline inflation trajectory to above the upper target of 6% in 2Q 22 should be temporary and should return to the mid-point of the target band in 2023. Risks to inflation remains to the upside. These include inflation expectations, which tend to be backward looking, and wage settlements, especially in the public sector. National Treasury has carried over the R20bn gratuity paid in 2021, with wage negotiations having commenced in 2Q 22. The uncertain outlook and upside risks to the forecast imply that policy decisions will remain data dependent. We think that the warning shot from two of the five members in favour of a 50bps rate hike, speaks to upside risks to the inflation materialising. The Governor of the SARB warned against “inflation exceptionalism in South Africa” when inflation is accelerating in the rest of the world. The MPC remains focused on inflation expectations and second-round effects embedded in core CPI inflation.

Inflation forecast revised higher

Near term vs medium term forecast: The SARB revised its inflation forecast higher for 2022, from 4.9% to 5.8% (ICIB 5.6%) and 4.6% from 4.5% in 2023. Inflation is forecast to peak in 2Q 22 at an average of 6.2% (previously 5.0%). However, we think this does not assume an increase in the fuel price of nearly R2/l. The Minister of Finance said the government is looking at ways to keep the fuel price unchanged in April and May. The under recovery in March is currently averaging R1.95/l. We estimate that subsidising the fuel price by R1/l could cost the fiscus R2bn per month. The Minister of Finance has flagged changes to the basic price formula and margins.

In 2022, there is likely to be a divergence between headline and core CPI inflation. Core CPI inflation is forecast to average 5.0% (previously 4.4%), whereas headline CPI inflation is forecast to average 4.6%. Base effects could have a meaningful effect on the trajectory of headline inflation in 2023, on the assumption that the oil price recedes from an average forecast of $103/bbl (previously $78/bbl) in 2022 to $80/bbl.

Growth forecast revised higher in 2022 and risks to the outlook are balanced

The SARB revised its real GDP growth forecast to 2.0% from 1.7% for 2022. This, however, is mainly on account of (1) base effects arising from a better than expected outcome of real GDP growth in 4Q 21 (1.2% q-o-q) and a stronger terms of trade in 2022. The medium-term forecasts, at 1.9% (previously 1.8%) and 1.9% (previously 1.9%) respectively, remain mostly unchanged for 2023 and 2024.

Current account surplus revised higher

A key dynamic in 2022 will be the developments around the merchandise trade balance, with higher commodity prices providing a buffer against potential volatile global capital flows to emerging economies. The SARB revised its surplus on the current account to 3.0% from 0.4% of GDP. The starting point of the rand in the SARB’s inflation forecast, at R15.41/$ compared to R15.60/$ at the previous meeting, is deemed to be below its equilibrium level. The rand is currently trading at R14.54/$, rallying from R14.72/$ before the meeting.

Risks to the inflation forecast are assessed to be on upside:

Upside risks emanate from the following:

- Food and fuel prices.

- Currency volatility and capital flow reversals.

Interest rate outlook

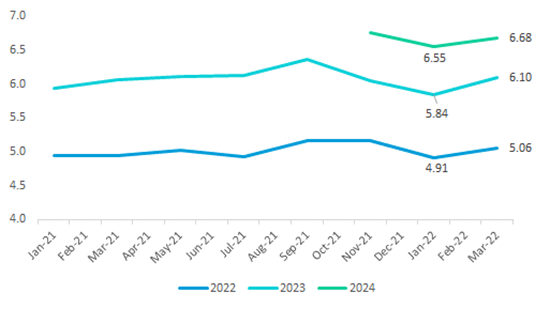

The revision to the interest rate trajectory in the QPM was mild. The repo rate is forecast to increase by a further 75bps in 2022 (unchanged from the previous forecast), 100bps in 2023 (previously 75bps) and 50bps in 2024. The terminal rate remains mostly unchanged at 6.68% (previously 6.55%). ICIB forecasts a further 75bps compared to our previous forecast of 50ps. This assumes a 25bps rate hike at three of the remaining four meetings.

Figure 1 SARB's CPI inflation forecast

Source: SARB, ICIB

Figure 2 Mild revision in QPM interest rate trajectory

Source: SARB, ICIB