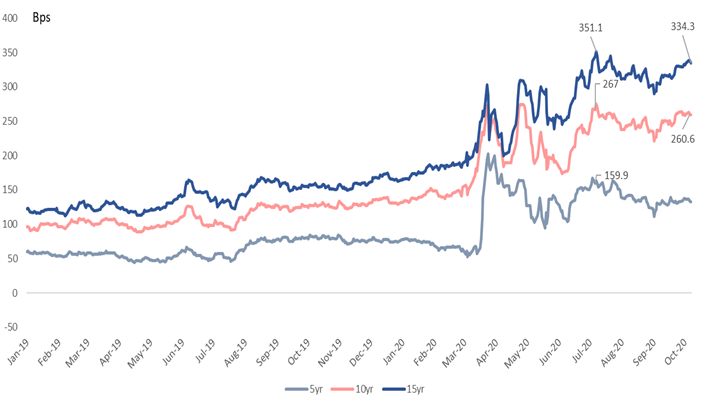

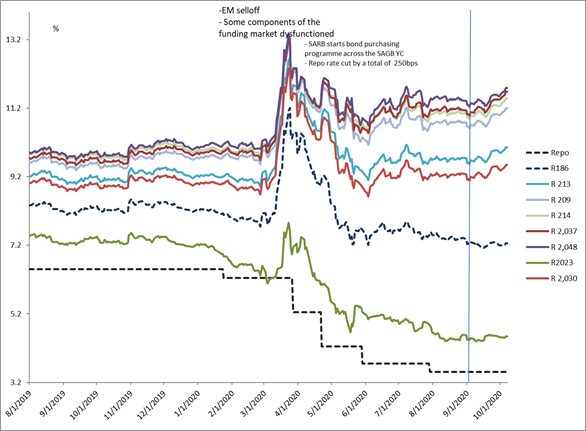

The SARB this morning published its balance sheet for September. It showed that its ownership of SAGBs increased from R38.7bn to R39.4bn. The amount reflects the market value. With yields rising during the course of the month, SAGB purchases probably amounted to about R1.0bn. The SAGB yield curve has steepened since mid-September ahead of the MTBPS (so far scheduled for 21 October). Non-residents are keeping to the sidelines which means the banks and local fund managers are accumulating the large supply of SAGBs and ILB’s coming auctioned every week. Steve indicated that turnover in the bond market is not high but the dysfunctional trading conditions in March, marked by a massive widening in bid-offer spreads, is not evident with spreads at 4bps.

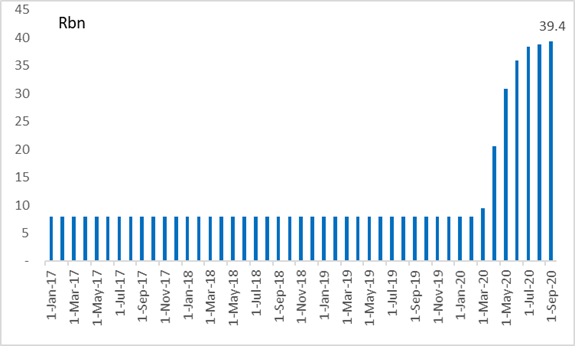

Figure 1: SARB ownership of SAGBs

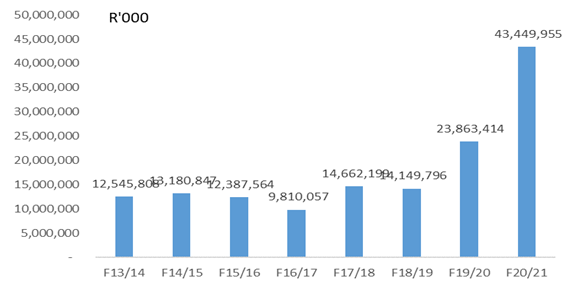

Figure 2: Government bond issuance average per FY (F20/21: Ave from April to Sep’20)

Figure 3: Mid-long and long dated bond yields have again started to rise from mid-September

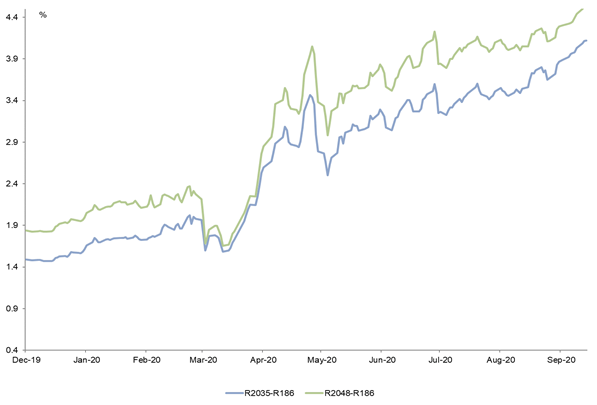

Figure 4: Long-dated spreads have reached record highs (as the yield on the R186 has declined but longer dated yields increased)

Figure 5: Asset swap spreads: Moving sideways out to five years but steepened in mid-long and long-end of the curve