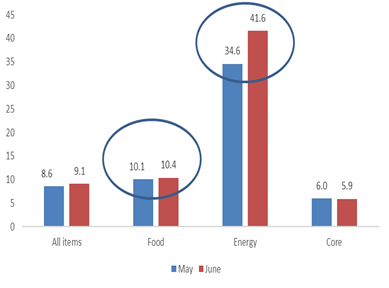

US inflation recorded another upside surprise in June, accelerating by 9.1% from 8.6%, the highest level since November 1982. Bloomberg consensus expected 8.8%. Core CPI inflation was also higher, rising by 5.9% from 6.0%, compared to market expectations of 5.7%. The main contributor to the higher headline CPI inflation outcome was gas prices, rising by 41.6%y/y (previously 34.6%). Food price inflation remained elevated, rising from 10.1% to 10.4%. Whereas core commodity prices inflation has started to ease from very high levels (7.2% from 8.5%), core CPI inflation continued to ascend. This can be ascribed to higher transport costs and shelter inflation. Shelter inflation, a proxy for house prices, increased to 5.5% from 5.1%.

However, energy-driven headline CPI inflation will likely start moderating in the coming months. The oil price has declined below $100/bbl, driven by recession concerns. Shelter inflation, however, could be stickier because of a house supply shortage has not yet resulted in a meaningful reduction in house price despite a rise in mortgage bond rates.

Unsurprisingly, the market reacted very negatively to the inflation print. After a strong June labour market report (NFP +372 000 vs F275 000 and an unemployment rate of 3.6%), the inflation outcome likely cemented a 75bp rate hike at the July 27 FOMC rate. While the market was biased towards a 75bp rate hike, expectations of the terminal rate have moderated in the past two weeks. However, it has returned to 3.66% in 1Q 23. However, the aggressive rate hiking path anticipated by the Fed, which could cause a recession (expected to be shallow), could be followed by rate cuts as early as 2H23, according to market expectations (see Figure 8). The market is pricing in 82bp (July FOMC), 67bp (Sep), 39bp (Nov), and 15bp (Dec). The size of the rate hike in September is contingent on the monthly increase in CPI inflation. If CPI m/m% increasing does not show signs of moderation, the implied Fed’s fed funds rate hike could be validated.

For South Africa, the MPC meeting on July 21 is the next key event. The SARB’s inflation is likely to have deteriorated because of the higher-than-expected outcome of May’s CPI inflation rate (6.5% from 5.9%). There are three developments to monitor:

- The first is June’s CPI inflation rate, scheduled for 20/7 – we expect headline CPI inflation to accelerate to 7.1% from 6.5%;

- Core CPI inflation has remained relatively muted (4.1% in May) – the key question is the pass through from higher input costs in the context of weak demand. May’s retail sales declined by 1.0%m/m (previously 0.6%m/m).

- BER’s 2Q 22 inflation survey.

- ICIB forecast a 50bp rate increase to 5.0%. The SARB’s QPM model forecasts a terminal rate of nearly 7% in 4Q 24. A key change has been an accelerated pace of rate hikes compared to the SARB’s earlier forecast of a measured rate hiking cycle from 2022 to 2024.

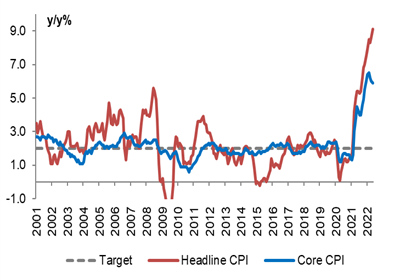

Figure 1 Headline and core CPI inflation

- The headline and core CPI inflation is expected to converge in the coming months

- Lower gasoline prices will lead to a moderation in headline CPI inflation

- But shelter inflation is likely to remain sticky

Figure 2 Gas prices remain the main contributor to rising inflation

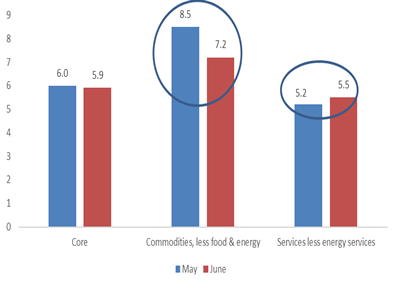

Figure 3 Core commodity CPI inflation is moderating but core services CPI is rising