Of key interest is whether global developments since the September MPC meeting, could sway the MPC to moderate its pace of rate hikes from 75bp to 50bp. There was a hawkish bias in the 75bp delivered at the September meeting, as 2 of 5 MPC members were in favour of a 100bp rate hike.

The headline CPI inflation forecast is likely to be revised higher, as some of the factors flagged in the balance of risk assessment, materialised. But incoming demand indicators in 3Q, have lost momentum. Inflation expectations, measured by 5- and 10-year breakeven inflation rates, have receded considerably from 7.0% to 5.7% and 7.0% to 6.3% respectively. (The BER’s 4Q 22 inflation expectation survey will be released in January 23).

October’s CPI inflation rate is scheduled for release on Wednesday, 23rd November, the day before the MPC meeting on November 24. Headline CPI inflation is expected to have stabilised with Bloomberg consensus forecasts at 7.4% from 7.5% (ICIB 7.5%). Core CPI inflation, is expected to trend higher, rising to 4.9% from 4.7%.

ICIB is of the view that the pace of normalising interest rates could start to moderate at the September MPC meeting. Headline inflation has peaked, and advanced economies (AE) central banks have started to focus on the lagged effect from monetary policy to the real economy. Many AE banks have

surprised either with smaller rate hikes in their respective October interest rate meetings or delivered the large hikes, but signalled a moderation in the pace of rate hikes.

• The ECB hiked by 50bp, but provided dovish forward guidance

• The BOE raised the policy rate by 50bp, but warned that the terminal rate could be lower than implied market rates of 4.64%

• The Fed delivered its fourth consecutive hike of 75bp, and indicated there could be a moderation in the pace of rate hikes. This was due to the lagged effct by which monetary policy impacts the economy. The Fed also warned that the terminal rate could be higher than the 4.6% in the September 22 median dot plot forecast.

Forecast: ICIB forecasts a 50bp rate hike, in a vote of 3-2; Bloomberg consensus expectations are for a 75bp rate hikes and the implied forward rates are pricing in a 50bp rate rise.

More to go, but at a more tempered pace.

September’s upside balance of risk assessment to inflation has played out:

The balance of risk assessment, deemed to be to the upside at the September MPC meeting, was the key factor that swayed the MPC to implement a hawkish rate hike, even as the inflation outlook was marginally better.

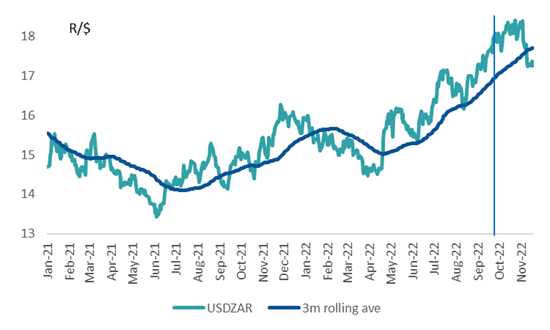

The key driver was international factors. The persistent repricing of Fed rate hike expectations and interest rate spreads favouring the USD, led to a sharp depreciation in the ZAR. At the time of the meeting, the ZAR was trading at R17.74/$, compared to the starting point in the model of R16.90/$ (November starting point likely to be at R17.50/$).

The corollary was a material increase in the petrol (51c/l) and diesel (143c/l) prices in November, which was exaggerated by an increase in global diesel prices. The starting point for the USDZAR in the November inflation forecast could be R18.10/$. Hence the expected upward revision to the SARB inflation forecast. Another factor the SARB considered was an expected deterioration in the merchandise trade balance as commodity prices were revised lower.

What has changed:

International developments

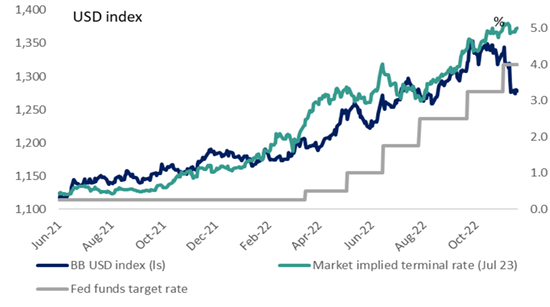

• The USD has depreciated by 5.8%, and US inflation surprised to the downside for the first time since May (7.7% vs forecasts of 7.9%). The market is pricing in a 50bp and 25bp rate hike at the December 2022 and January 2023 FOMC meeting, with a terminal rate of 5.02% in May/June 2023.

• The December FOMC meeting is likely to see an upward revision in the median dot plot forecast of 4.6%. Repricing risk at current levels appear to be smaller, but the risk is for implied rates to reprice higher in 2H 23 (current year-end implied rate is 4.59%). There is volatility risk with one more set of US labour market conditions (2/12), CPI inflation (13/12) ahead of the FOMC decision on December 14th.

• China has announced a 16-point plan to support a struggling property sector, and eased Covid 19 restrictive measures. With Covid-19 infections rising and the health sector unable to cope with a significant increase in cases, this remains a risk, although growth prospects in 2023 could improve as the economy opens.

Domestic dynamics

• Incoming demand indicators show that retail spending has lost momentum. Retail sales contracted by 1.9%q/q in 3Q 22. We note that corporate demand for bank credit increased over this period but can most likely be ascribed to demand for working capital and more activity in the renewable energy space.

• While mining and manufacturing production recorded positive quarterly growth rates of 2.2% and 1.9% in 3Q 22, the operational environment remains challenging with the electricity and logistic crisis intensifying. Electricity production contracted for the second consecutive quarter by 1.9%, as load shedding reached record highs. While there is a risk of the economy entering a technical recession in 3Q 22, we forecast an increase in GDP of 0 to 0.2%q/q (seasonally adjusted).

Figure 1 - DXY index retreats as terminal rate hike expectations stabilise at 5.02%

Source: Bloomberg, ICIB

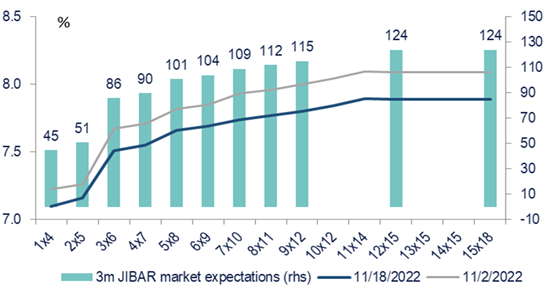

Figure 2 - SA FRA curve

Source: Bloomberg, ICIB

Figure 3 - ZAR has receded to September MPC levels when the MPC flagged upside risks to the inflation forecast

Source: Bloomberg, ICIB

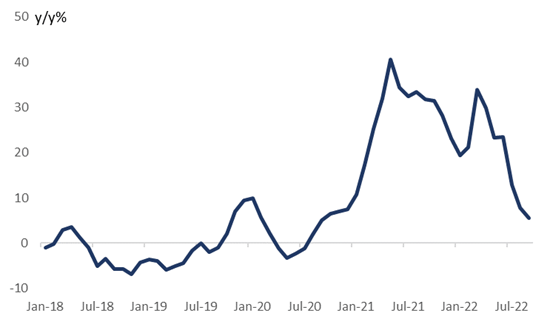

Figure 4 - Global food prices have receded

Source: Bloomberg, ICIB

With the MPC data dependent, market volatility has declined in the aftermath of the November FOMC and US CPI. While the level of external and internal uncertainty remains elevated, the balance of inflation is likely to remain to the upside. The FRA curve remains positively sloped but the curve has flattened. The 9 x 12 FRA rate has declined to 7.80% from a high of 8.63% in September. This includes six MPC meetings. ICIB forecast the terminal rate at 7.0%.

SARB’s neutral rate: The SARB’s QPM projects a neutral rate of 6.75% in Q4 24, to return CPI inflation to the mid-point of the target band. However, the MPC remains non-committal to provide any forward guidance as where the terminal rate could end.