European private equity activity strengthens but UK struggles to keep its crown

17 December 2018

CMBOR research shows PE-backed acquisitions in continental Europe hits highest level since 2007, with total value of €79.3bn.

4 min read

What is driving buyout activity in manufacturing and leisure, as well as the TMT and support services segments? Read insights into how a combination of macro-economic and structural challenges continue to hit the retail industry hard. Combined with analysis of the trends that are driving private equity investment in these key markets .

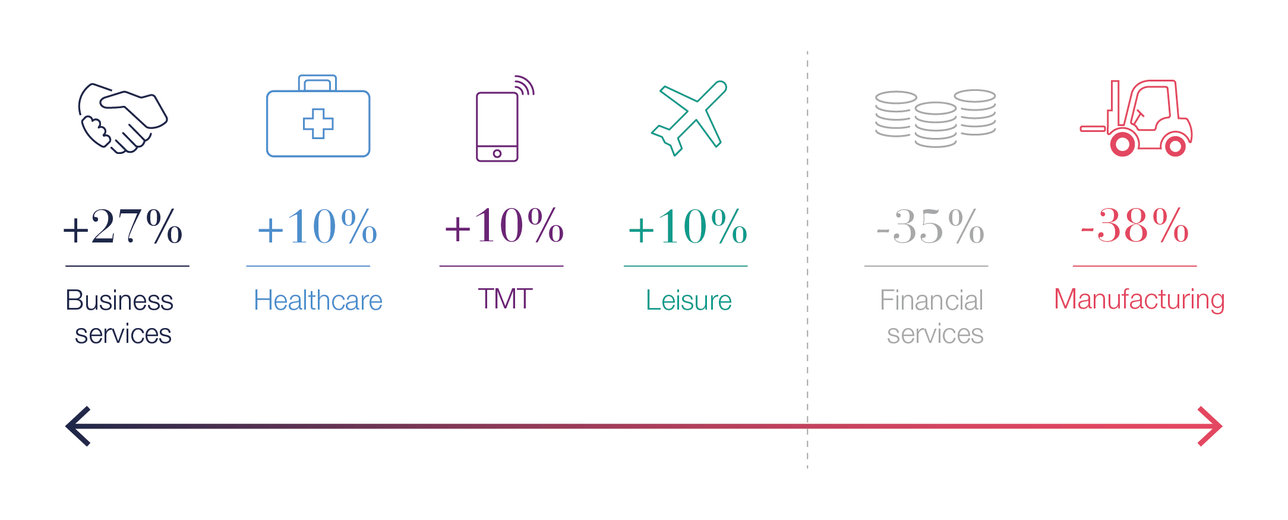

Manufacturing accounted for just under a third of all private equity-backed buyouts across Europe in 2018, the sector’s largest share by volume since the financial crisis nine years ago. Manufacturing was also the most significant sector by value with €19.2bn of deals completed, although this did represent a fall from €25.2bn in 2017.

The picture is somewhat different in the UK where just 26 deals were completed, accounting for 13.9% of all investment activity by volume, compared to 42 deals at 21.4% last year and against a five-year average of 18.8%.

The overall value of UK manufacturing deals declined less steeply. A total of £1.8bn of transactions completed compared to £2.2bn in 2017. And 2018’s tally actually is a higher proportion of activity by value, at 9.4% compared to 8% last year.

Manufacturing accounted for just under a third of all private equity-backed buyouts across Europe in 2018The export-orientated UK manufacturing sector has undoubtedly been impacted by Brexit uncertainty. But the continued dominance of manufacturing as a source of private equity deals in Europe, as a whole, reflects key long-term trends that are offsetting the negatives of competition from low-cost economies and any Brexit-induced turbulence.

Massive global demand for new and improved infrastructure is also supporting the manufacturing sector, as is technological advancement in areas such as automotive. Private equity also continues to be attracted to European manufacturing businesses because of the growth opportunity that technology has provided to enable manufacturers to package and market lucrative services alongside their products.

AI, in particular, is proving revolutionary for the sector. “Investors are assessing the role impact of AI investment in the business, and AI investment from competitors, in particular,” commented Investec’s Jonathan Arrowsmith. “This increases the uncertainty over the direction of the plan and makes investment decisions trickier. But it can represent significant potential upside.”

Technology, media and telecoms deals was the second most significant source of European buyouts by volume, with a total of 124 deals completed with an aggregate value of €12.1bn. This is a slight fall on 2017 when 131 deals worth €12.4bn were recorded.

The impressive total was driven by a number of large transactions including Silverlake’s €2.5bn take-private of ZPG and HgCapital and ICG’s €1.2bn buyout of Iris Software Group in the UK’s largest ever private equity-led software deal.

In the UK, 2018 has been another superlative year for the TMT sector. TMT achieved a record post-crisis share of all deals completed at 20.9 per cent by volume. The value of TMT deals also increased significantly, from £3.3bn to £5.5bn year-on-year. TMT buyouts accounted for just under 30% of all UK deals, by value, compared to just 10.8 per cent in 2017, the highest share of completed deals since 2009.

TMT has long been an attractive sector for private equity, with 14% and 17.3% of all deals, by value, in Europe and the UK respectively over the past five years. But the trend is only accelerating.

“With typically high levels of organic growth and significant bolt-on M&A opportunities, conditions are ripe for TMT to continue to dominate UK and European deal-making in 2019,” commented Investec’s Sebastian Lawrence.

Market hype may have centred on the disruptive, consumer-led businesses such as Uber and Tesla, as well as the gargantuan VC funding rounds across artificial intelligence, machine learning, autonomous vehicles and robotics, but private equity remained primarily focused on TMT investments driven by the big trends of the current decade.

From big data to cloud and SaaS to digital commerce, the Internet of Things and the consumerisation of IT, these mega-trends continue to disrupt markets and fuel activity levels.

The vast business and support services sector continues to be a major source of European buyout activity, representing 15.8% of all deals in 2018. A total of 112 business and support services deals were completed in Europe, compared to 82 last year. The value of deals fell from €12.3bn to €10.8bn.

But it is in the UK, where the service economy accounts for the lion’s share of GDP, that the business and support services sector really dominates, accounting for more than a quarter of all completed deals over the past 12 months.

A total of 47 deals were recorded, ten more than in 2017 and the highest number reached in five years. A record total of £7bn of buyouts were completed in 2017, driven by a number of mega deals. The £4.1bn total recorded in 2018 was nonetheless the second highest reached since the financial crisis.

“Services are a natural bedfellow for private equity investors, with light balance sheets and highly cash generative,” said Investec’s Arrowsmith. “The UK has a bigger service base than other countries, but services remain strong across Europe and private equity interest in high quality service companies remains high.”

the sector has claimed the biggest share of deals by value for each of the last three years.

Support services, and in particular business services, will continue to be a mainstay of the UK buyout scene – the sector has claimed the biggest share of deals by value for each of the last three years. Opportunities created by disruptive technology and new regulation designed to prevent the major auditing companies providing conflicting services, will continue to bolster private equity interest.

European buyout activity in the retail sector plummeted to its lowest levels by both volume and value in 2018. Just 20 deals valued at a total of less than €1bn were completed, compared to 46 deals with an aggregate value of €4.2bn last year. Retail accounted for only one per cent of European buyouts by value. In 2015 the sector accounted for more than ten per cent.

In the UK, a perfect storm continues to rage across the high street. Positive like-for-like growth is proving evasive for many, with consumer confidence at its lowest level in five years, which, together with increased competition online, has impacted high street footfall.

Coupled with a tidal wave of cost inflation, including wage inflation from the increased National Living Wage and impact of reduced labour supply from Europe, a weakened pound driving up import costs, business rate revaluations and the introduction of the Apprenticeship Levy, and the trading environment remains challenging with significant pressure on profits.

Brexit is creating too much uncertainty to place a bet on the UK high street at the present time.

Against this backdrop, private equity appetite in the sector has been muted, with just 9 buy-outs completing in 2018 with a total value of £444 million. Retail deals accounted for just 2.4% of all UK buy-outs by value in 2018, versus 13.7% four years ago. Across the whole of Europe, just 20 buy-outs were completed in the retail sector in 2018, accounting for only 1% of all European buy-outs versus 10% in 2015.

Guy Gillett, Head of Consumer, Retail & Leisure at Investec, commented “Private equity has set a much higher bar for UK retail deals, particularly businesses with UK-only offerings and a significant high street exposure. Brexit is creating too much uncertainty to place a bet on the UK high street at the present time.”

With the reduced interest in the sector from private equity, some have been exploring alternative exit routes in parallel. The Works is one such example, with Investec running a dual-track process for shareholders that resulted in a £100m main market IPO in July 2018.

In the UK leisure sector, the buy-out story is mixed. In 2018, 17 buy-outs were completed with a total value of £2.4 billion, compared with 15 deals valued at £4.9 billion in 2017. Some sub-sectors are hot, whilst others are certainly out of favour with private equity.

Travel continues to attract significant investment from private equity, accounting for over half of the buy-outs that completed in the UK leisure sector in 2018. A steady stream of travel businesses changed hands, including Love Holidays, Travel Counsellors, Great Rail Journeys and Neilson, with Platinum Equity’s $1.3 billion acquisition of Wyndham European Vacation Rentals the largest of the year.

The restaurant sector, once one of the hottest sectors for private equity, is certainly out of favour, with oversupply and falling demand.

The restaurant sector, once one of the hottest sectors for private equity, is certainly out of favour, with oversupply and falling demand, together with significant cost inflation, creating the worst trading conditions that many operators can remember in their lifetimes. Deals are still happening, but with a stronger focus on proven (but smaller) concepts with strong management teams that can demonstrate both roll-out potential and resilient LFL performance.

While there has been a detectible shift in private equity interest from food-led to wet-led offerings, private equity faces greater competition from strategic buyers in the pubs & bars sector, with examples including Stonegate’s acquisition of BeAtOne and Brewdog’s acquisition of Drafthouse.

Some of the largest leisure deals in 2018 were completed by strategic buyers, including Stars Group’s £3.4 billion acquisition of SkyBet and The Restaurant Group’s £559 million acquisition of Wagamama. Gaming is not a sector of strong interest for private equity, due to the regulatory and reputational risks, with strategic buyers dominating M&A in a consolidating sector. Investec advised GVC on the largest gaming deal of 2018, the £4 billion acquisition of Ladbrokes Coral.

“Whilst not as pronounced as the decline in private equity interest in UK retail, there are certainly sub-sectors in UK leisure that are attracting greater interest than others. Anything with a large leasehold portfolio is going to have a higher bar for private equity in the current market”, according to Guy Gillett, Head of Consumer, Retail & Leisure at Investec.

Browse articles in