Executive summary

- Following a very difficult month for equities, markets recovered part of the ground lost in October after registering significant gains -FTSE 250 gained 6.7%, S&P 8.9%and CAC 40 6.2%–amid better than expectedmacroeconomic data

- 16 sectors registered gains this month, notably Household Goods and Support Goods, which benefited from current interest rate expectations for 2024 and better than expected inflation reading

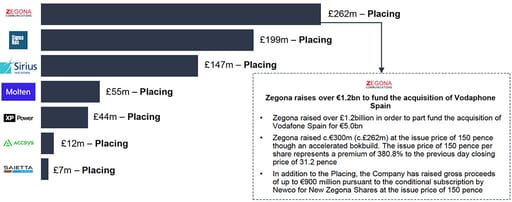

- November was better month for primary issuance, which has been significantly subdued over the course of the year, as over £700m of primary funds were raised

- UK public M&A remained strong over the course of October as 11 transactions were announced

- Investec is pleased to have acted for both XP Power and Videndumwith regards to their £44m and £125m equity raises

- Please contact your usual Investec contact if you would like to discuss the contents of this pack

Market drivers in November

Market sentiment over the course of the month was dented by disappointing macroeconomic data and growing geopolitical tensions

Economic headlines in October

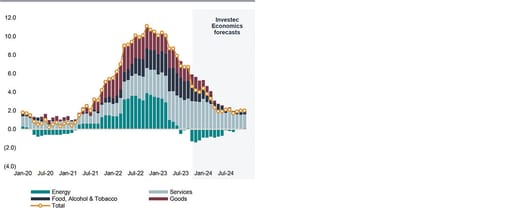

- CPI inflation plunged in October to 4.6% from 6.7% in September. The ‘core’ measure, which excludes food, energy, tobacco and alcoholic beverages, slipped to 5.7% from 6.1%.

- Chancellor Hunt unleashed some £14.3bn of fiscal stimulus next year, including two major tax cuts, including a 2% cut in the main rate of National Insurance, amounting to £11.4bn.

- Nationwide and the Halifax series reported an increase in house prices of 0.9% and 1.1%, respectively. October’s RICS housing market survey saw some improvement in conditions, albeit at still subdued levels.

- BoE kept the Bank rate on hold for the second consecutive meeting today, at 5.25%, its highest level in 15 years, after 14 consecutive hikes previously.

- US headline CPI inflation declined by more than expected, reported at 3.2% in October (consensus: 3.3%, September: 3.7%).

- Euro area activity picked-up in November, although output remained in contractionary territory, with the Composite PMI rising to a two monthhigh of 47.1.

A strong November helps wider markets recover the losses registered in October; UK continues to lag behind

Source: Bloomberg, FactSet, Macrobond, Calastone, Investec Economics

Drop in energy prices drives inflation down

Source: Bloomberg, FactSet, Macrobond, Calastone, Investec Economics

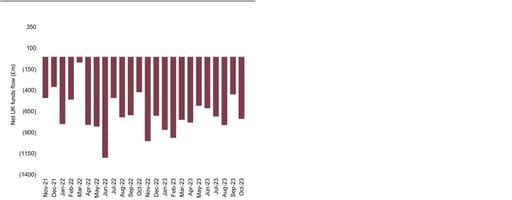

UK focussed equity funds outflows – a never ending story

Source: Bloomberg, FactSet, Macrobond, Calastone, Investec Economics

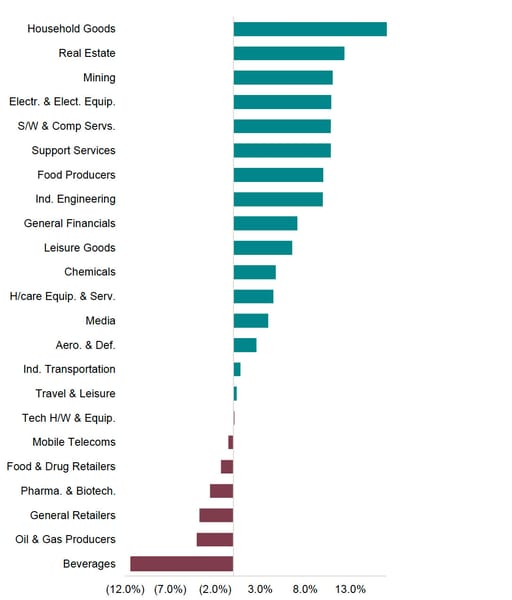

Sector performance in November

Household Goods and Real Estate stocks were the clear winners in November with both sectors registering clear double-digit gains

Monthly sector snapshot

Drivers of sector performance in November

- Household Goods stocks benefited from encouraging inflation data and interest rate expectations. Most stocks in the sector reported double digit gains with Persimmon and Barratt Developments’ share prices increasing by over 20%

- Support Services stocks recovered some of the losses registered in October aided by the more upbeat macroeconomic data. Diploma was the sector’s winner, increasing by over 19%, following the release of a strong set of results

- Oil prices continue to be a tailwind for Oil & Gas Producers. The oil price tumbled following the push back of the meeting to discuss the difference on

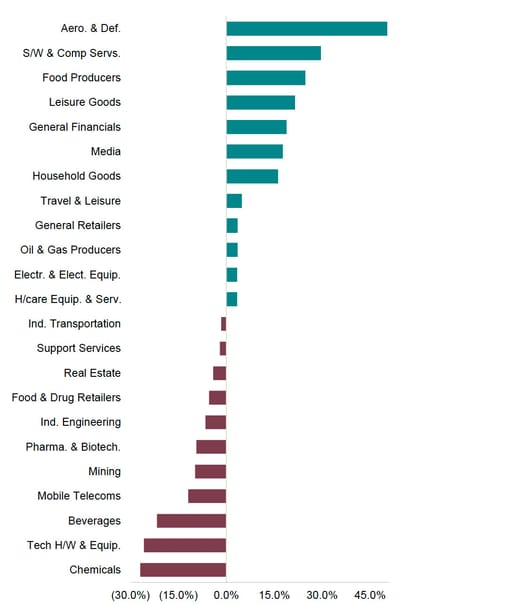

Sector performance (Year to date)

Source: FactSet, Financial Times, Investegate, ONS, Investec Economics

Sector performance (November 2023)

Source: FactSet, Financial Times, Investegate, ONS, Investec Economics

UK ECM activity slows down in November

Despite total value of funds raised dropping, activity in November was driven by only primary issuance which reached £724m

ECM activity snapshot

Primary ECM issuance across the deal size spectrum in November

Public equity fund-raises by sector and highlighted deals

Selldowns in November 2023

Announced IPOs in November 2023

Source: Dealogic. Analysis and commentary only includes transactions greater or equal to £5m, and only includes transactions involving an issue of new shares i.e. primary share issuances.

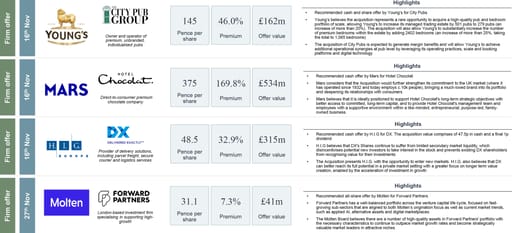

UK Public M&A activity in November

2023's scorecard

Selected deals

Source: Company announcements, FactSet, Practical Law.

Note: Scorecard includes competing offers, withdrawn offers and formal sales processes of companies subject to the Takeover Codequoted on AIM or the Main Market. From November 2023, we have included 2.4 announcements with undisclosed premia data

Get the monthly Investec Market Review delivered to your inbox

Contact our Corporate Broking & PLC Advisory team