The desire to make a meaningful contribution to the world we live in is at the heart of our values at Investec.

Making an unselfish contribution to society, nurturing an entrepreneurial spirit, embracing diversity, and respecting others, underpin our aim to live in, not off society.

As a financial services organisation with a strong footing in both the developed and developing world, we believe we can make a meaningful contribution to society and the environment. We believe that the United Nations (UN) Sustainable Development Goals (SDGs) provide a solid framework for us to assess, align and prioritise our activities.

Our strategy is to harness the expertise in our various businesses and identify opportunities to maximise impact. We do this by partnering with our clients, investors and stakeholders to support ambitious delivery of the SDGs and build a more resilient and inclusive world.

Purpose matters. It affects how we treat others, it affects how we do what we do, and it affects the impact we can have in life on people and the planet.

Our approach

Positively impacting on climate change and inequality by focusing on doing well and doing good.

1. Positively contribute to the Sustainable Development Goals

2. Operate responsibly and ethically and within the planetary boundaries

3. Partner with our clients and philanthropy partners to maximise positive impact

4. Provide profitable, impactful and sustainable products and services

5. Actively advocate for industry alignment and best practice.

Our sustainability framework is based on the SDGs

Addressing climate and inequality is fundamental to the success of our business. We have eight priority SDGs: two impact SDGs, climate action (SDG 13) and reduced inequalities (SDG 10), supported by six core SDGs. These priority SDGs are globally aligned yet locally relevant to our core geographies and also reflect our growth strategy to fund a stable and sustainable economy. Our approach coordinates, assesses and reports on the Group’s progress in terms of our contribution to our priority SDGs.

Our two impact SDGs

Climate action

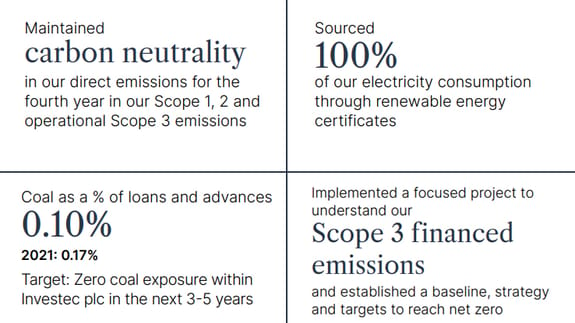

- Net-zero in our direct operations and publicly disclosing our Scope 3 financed emissions.

- Minimal exposure to fossil fuels: Investec plc committed to zero coal in 3-5 years

- Investec Wealth & Investment joined Climate Action 100+ and Group joined the UN Net-Zero Banking Alliance

Reduced inequalities

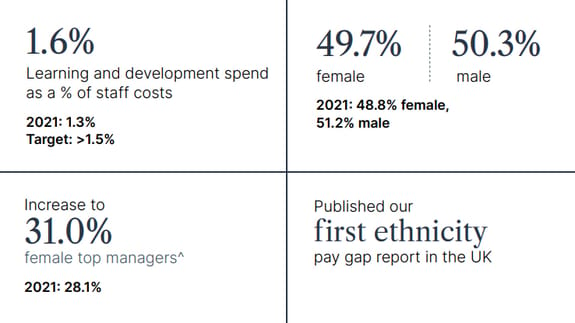

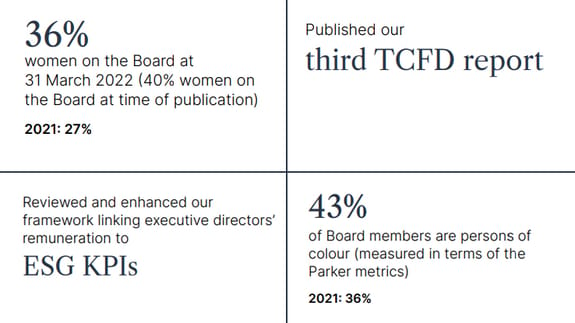

- DLC Board: 36% women and 43% Board members are persons of colour (measured in terms of the Parker Review)

- IBP: Female Bank Chief Executive

- IBL: Level 1 BBBEE

- Anchor limited partner investor in an impact fund focused on infrastructure in emerging markets

Our six core SDGs

Our impact is evident through our sustainable finance and investment initiatives, some of which include:

$600mn

Investec Bank plc successfully closed a $600 million sustainability-linked term loan facility (3x oversubscribed)

Impact fund

Anchor limited partner investor in the Acre Impact Capital Export Finance Fund focused on infrastructure in emerging markets

$600mn

Investec Bank Limited successfully closed a $600 million sustainability-linked term loan facility (2.5x oversubscribed)

R1bn

R1 billion raised for renewable energy projects through Investec Bank Limited's first green bond (3.8x oversubscribed)

$35mn

$35 million raised by Investec Wealth & Investment at 31 March 2022 through the launch of a Global Sustainable Equity Fund

R53.6mn

Investment philanthropy offering derived income for distribution on behalf of clients to the value of approximately R53.6 million, of which 40% went to educational initiatives