What's inside

Industry news

- Chinese reopening boosts air traffic recovery

- North American airlines beat pre-pandemic Q4 profits

- Mixed news for Boeing

Global air traffic summary

Q1 aircraft orders

Q1 debt capital markets deals

Key market insights

Reopening of China boosts continued traffic recovery

The post-pandemic recovery in air traffic was boosted in Q1 2023 by the reopening of China’s borders on 8th January. In aggregate, global air traffic figures show a 67% YoY growth in January and are now 84% of pre-pandemic January 2019 levels.

At the Dublin Airfinance Journal conference in mid-January, Lessor CEOs from Avolon and AerCap predicted that the loosening of Covid-19 restrictions in China would allow international passenger traffic to recover to 2019 levels by the middle of the year, earlier than IATA had previously forecast. It was noted that China represents ~15% of global travel and of that 85% is intra-Asia travel. As such, Asian carriers are anticipated to benefit from a surge in passengers over the coming months. Furthermore, the recovery of the Chinese-related Asian and intercontinental markets are seen as a key driver in a recovery in demand for widebody aircraft.

The recovery in Europe and the US was inconsistent, partly as a result of airlines placing aircraft into deep storage, laying off staff and shutting down infrastructure. On the other hand, China, albeit at significantly lower utilisation, has been operating much of its fleet domestically for the last two years. Accordingly, a reopening of Asian international markets is anticipated to be smoother than that experienced in other markets.

North American airlines reporting Q4 profit levels greater than pre-pandemic Q4 2019

Three of the four US majors (American, Delta and United) have reported Q4 2022 operating profits in excess of pre-pandemic levels in Q4 2019. Delta led the group, reporting Q4 operating profits of $1.5bn (up 7% on Q4 2019), followed by American and United both reporting operating profits of $1.4bn (up 48% and 38% on Q4 2019, respectively), driven by higher yields and strong demand for premium services. Meanwhile, Southwest under-performed, reporting a Q4 operating loss of $0.4bn after cancelling more than 16,700 flights in December due to severe weather, staff shortages and system issues. The profit boost for the three majors came amidst a tightening of capacity compared to pre-pandemic. United's capacity in Q4 was down 10% versus Q4 2019. Delta's was reduced by 9%, American's by 6% and Southwest's by 2%.

2023 forecast aircraft deliveries

Commercial aircraft deliveries in 2023 are forecast to exceed pre-pandemic levels, with 1,540 scheduled to be delivered, up 300 units (24%) on 2022 (Cirium). The largest portion of the YoY increase in 2023 relates to North American and European orders. In 2023, North America (primarily the US) is forecast to be the recipient of a third of the deliveries, followed by Europe (27%) and Asia Pacific (24%; mainly China and India). This contrasts with the pre-pandemic trends, where for a number of years Asia Pacific accounted for the largest proportion of aircraft deliveries (39% share in 2019). The reduction in deliveries to Asia-Pacific likely reflects the delayed recovery from the pandemic, a result of prolonged Covid-19 outbreaks and travel restrictions.

Looking to aircraft type, which provides insight into the evolution of airline business models and network development – in 2023, 75% (1,149 aircraft) of deliveries are expected to be narrowbody aircraft, designed primarily for short haul routes. This compares to 14% (213 aircraft) of deliveries being widebody aircraft. Widebody deliveries are up 28% YoY, however, they are lagging their pre-pandemic levels. The delayed recovery in widebody aircraft deliveries is reflected across all regions.

The rebound in the number of scheduled aircraft deliveries in 2023 suggests a promising outlook for the aviation industry, underpinned by a firm commitment and drive to improve the efficiency of the global fleet.

Due to the shortage of new deliveries, airlines are seeking lease extensions on existing aircraft to guarantee capacity supply in the coming years. The renewal lease rates being negotiated continue to strengthen due to the combination of a shortage of supply and high and stable interest rates, underpinning the financing of these aircraft. These conditions are precipitating a recovery of mid-life aircraft values following several years of decline due to the Covid pandemic.

Mixed news for Boeing

Boeing have suffered another recent production setback, with some 737 MAX-8 aircraft reported to have problems with the fittings for the vertical stabiliser. A non-standard manufacturing process affecting two of the eight fittings on structures manufactured by Spirit Aerosystems has been identified and may affect many 737 MAX-8 aircraft built since 2019. Whilst the anomaly will not have an immediate impact on flight safety or structural integrity, in the longer term those in-service aircraft identified as being delivered with the affected fittings will need retrospective action at some time in the future. The FAA will need to approve the repair scheme, which is still being evaluated by Boeing and Spirit. The immediate impact may result in a slowdown of MAX-8 deliveries due to the rework needed before aircraft still in production or storage can be approved by the FAA as conforming to type design and delivered by Boeing.

There has been some good news for Boeing on the 787 front, however. One of the issues that affected several 787 aircraft was a design modelling issue with the forward pressure bulkheads. This resulted in a four-year temporary operating limit (TOL) being imposed on certain aircraft whilst engineering activity was performed to ensure the aircraft as produced met all load requirements or would otherwise be subject to repairs. The result of the analysis has now proved that there is no impact on the integrity of the bulkheads and that the TOL can safely be removed with no requirement for any additional maintenance or repair action to be performed.

Despite the high inflation environment, airlines in the US and Europe have reported consistently strong bookings in recent quarters, bolstered by passengers’ willingness to pay higher ticket prices. Beyond Covid pent-up demand, the strength in demand is also underpinned by a new generation of consumers who prioritise spending on in-person experiences.

Derek Wong adds: “In the meantime, supply side shortages in pilots, crew, ground staff, new aircraft deliveries, maintenance capacity etc, mean airlines have not been able to add capacity as quickly as they wish. The tight capacity supply has boosted airline yields and this is expected to continue through 2023. Lower jet fuel prices and the weaker USD are also positive news for airlines.

We are pleased to have launched a new aviation debt platform in Q1 2023. It demonstrates our unique position to match diverse aircraft debt opportunities with a growing set of investors with distinct risk/return requirements, helping them to build portfolios with stable, attractive returns.”

The FAA continues to be sensitive to any issues or anomalies identified by its own and Boeing’s quality assurance processes. Where in the past such issues may not have had an immediate impact on production, where no immediate safety concern is apparent but longer-term structural integrity may be impacted and subsequently remedied, the FAA is now halting production and taking a more robust approach to the immediate resolution of findings as well as mandating retrospective action on the delivered fleet as necessary. The result of this action is a “stop-start” production line and may lead to a level of uncertainty in the production rates, but all for the right reasons.

David Louzado adds: “The imposition and subsequent lifting of the 787 TOL is a clear indicator that the FAA is taking a more detailed and cautious approach than before, demonstrating its oversight role thoroughly in the wake of the criticism it received after the MAX groundings..”

Trends

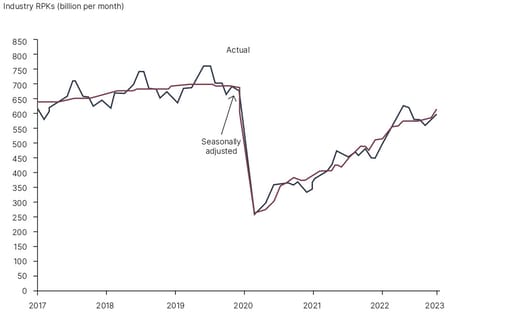

Global air travel accelerated its recovery trend in January, boosted by the gradual lifting of travel restrictions in China. Air traffic, as measured by Revenue Passenger Kilometres (RPKs), an indicator of global passenger demand, grew by 67% YoY. Global air travel numbers are now 84% of pre-pandemic January 2019 levels. Capacity, as measured by Available Seat Kilometres (ASKs) increased 36% YoY, with industry-wide passenger load factors trending at near pre-pandemic levels at 78% for the month.

Air Passenger Traffic (RPKs)

Sources: IATA Economics, IATA Monthly Statistics

The Chinese National Immigration Authority reported that during the Spring Festival (21 – 27 January 2023) total inbound air passengers increased 242% to 0.33 million. However, this was still less than 30% of pre-pandemic levels.

The full recovery timeline for China’s international air traffic remains uncertain due to remaining restrictions in many countries in Europe and the Americas impeding airlines from serving the pent-up demand for travel to China. Travel document backlogs and entry requirements for Chinese travellers have also limited the pace of the recovery.

Domestic air travel recovery was dominated by the lifting of the zero-Covid policy in China. Pre-Covid domestic travel within China accounted for 27% of all domestic travel worldwide. With the lifting of restrictions in China, industry wide domestic RPKs reached 97% of pre-pandemic levels in January. Europe and the US continue to be the top-performing domestic markets, with traffic 19% and 3% above pre-pandemic January 2019 levels, respectively. India is near full recovery, with domestic traffic 99% of pre-pandemic levels and in Brazil, traffic grew 3% YoY to bring domestic traffic to 97% of pre-pandemic levels. In Japan and Australia domestic traffic is now 90% and 89% of pre-pandemic January 2019 levels, respectively.

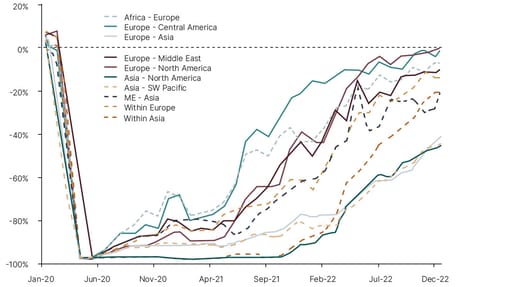

International air travel continued its steady growth trajectory. Global international traffic grew 104% YoY and is now 77% of pre-pandemic January 2019 levels. The annual growth in ASKs in January was 54%, approximately half the pace of the passenger growth and as such international load factors increased 19 ppts to 79% (1 ppt less than pre-pandemic January 2019). The re-opening of China’s borders on 8th January had an immediate effect on ticket sales. Airlines in the Asia Pacific region continued to record the strongest growth in international traffic, with RPKs increasing 376% YoY, to 56% of pre-pandemic levels. Airlines in North America are the best performers with traffic at 94% of pre-pandemic levels. European and Latin American airlines have reached 85% and 81% of pre-pandemic November levels respectively.

International RPKs, YOY changes from 2019, Top 10 2019 routes

Source: IATA Statistics

IATA noted that the recovery has proceeded at a similar pace for both premium and economy (including premium economy) classes. Economy class RPKs, which include premium economy and accounts for 92% of total RPKs, reached 80% of pre-pandemic levels. Premium RPKs, which includes first and business class, reached 74% of pre-pandemic levels.

Global Air Traffic versus pre pandemic January 2019

(as measured by RPKs)

84%

97%

77%

78%

How has the market responded?

During the quarter, there were a number of sizable aircraft orders from the large airline groups, continuing the trend seen over the last 12 months.

On January 13th, two B737 MAX-8s made the first commercial flights by Chinese airlines in China after a hiatus of almost four years. The first flights were operated by China Southern Airlines on domestic routes from Guangzhou to Zhengzhou and Wuhan. The flights mark another milestone for Boeing on the path to rebuilding its presence in the Chinese market. The B737 MAX was grounded in March 2019 following fatal crashes in Indonesia and Ethiopia but has since returned to service around the world except for China and Russia after modifications to the aircraft and pilot training.

In mid-February, Air India, now under the ownership of Tata Group and Singapore Airlines, placed the largest ever order by an Indian airline for 470 Boeing and Airbus aircraft. 220 Boeing aircraft valued at a list price of $34 billion and 250 Airbus aircraft. The order is Boeing’s third-largest of all time in dollar value and underlines the anticipated demand for air travel in a nation with a rapidly increasing middle class. Air India, which is India’s largest international carrier and second-largest domestic carrier, is seeking to reinvent itself by expanding its operations and modernise its fleet.

On February 23rd, International Airlines Group (IAG) announced that it had reached a deal to pay €400 million to Spain’s Globalia to acquire the remaining 80% of Air Europa that it did not already own. Air Europa owns 50 aircraft with a further 15 on order. IAG aims to build on its leading position in the Europe-Latin America market by incorporating Air Europa into Iberia. IAG anticipates the deal to be finalised within the next 18 months pending approval from antitrust authorities, which is far from assured given the combined Iberia-Air Europa market power on south Atlantic routes. IAG dropped a previous attempt to take over Air Europa in late 2021 after objections by European authorities.

In early-March, Lufthansa Group announced orders for 22 new generation long-haul aircraft (10 x A350-1000, 5 x A350-900 and 7 x B787-9) at a total list price of $7.5 billion. The group will take delivery of 108 new generation long-haul aircraft over the next few years, pending production delays which have hindered both Boeing and Airbus. The new aircraft will lead to fleet simplification, lower unit costs and lower carbon emissions. On average the new aircraft will consume 2.5 litres of fuel per passenger per 100 kms, some 30% less than their predecessor aircraft. As part of the fleet rationalisation, six older aircraft types are to be withdrawn from service in the medium-term including the four-engines B747-400, Airbus A340-600 and Airbus A340-300 aircraft.

Lufthansa noted that bookings remain strong for travel in both Q1 and Q2. Easter, in early April was looking extremely strong. Asia remains far behind 2019 traffic levels, though management noted that it is starting to see improvement in key markets like Japan and is hopeful about a revival in China. Worldwide, leisure demand is driving the current strength, with many leisure passengers booking premium seats. Yields overall are running about 20 percent above 2019 levels, although costs are up significantly too. Unit costs are expected to reduce as Lufthansa brings capacity back to close to 2019 levels.

Mid-March, Boeing and Riyadh Air announced that the new Saudi Arabian airline has chosen the B787 Dreamliner for its global launch and to support its goal of operating one of the most efficient and sustainable aircraft fleets. The airline has ordered 39 B787-9s, with options for an additional 33. Riyadh Air is owned by Saudi Arabia’s Public Investment Fund and is part of the country’s ambitious plans to develop its aviation and tourism sectors. The new airline aspires to link the country’s capital Riyadh to more than 100 destinations worldwide by the end of this decade. The carrier will join Saudia, based in Jeddah, another government-owned airline.

Recent debt capital market deals, include

- 9 January, Air Lease Corporation issued a $700m 5-year senior unsecured note. The issuance has a coupon of 5.300% and will be used for general corporate purposes.

- 9 January, Air France-KLM issued a EUR500m 3-year and EUR500m 5-year sustainability linked note. The issuances have a coupon of 7.250% and 8.125%, respectively. The issuances will be used for general corporate purposes.

- 9 February, Atlas Air secured a $800m 7-year Term Loan B with a SOFR plus 425 bps rate.

- 9 February, Atlas Air issued a $850m 7-year senior secured first-lien note with a yield of 8.500%. The issuance had a spread of 479 bps above treasury and priced at par. The issuance will be used for general corporate purposes.

- 15 February, American Airlines issued a $750m 5-year note with a coupon of 7.250%. The issuance was led by a consortium of banks and will be used to refinance existing debt.

- 20 February, aircraft lessor Avation concluded its tender offer by repurchasing $7m of ~3.5-year debt at a fixed price of $0.86. The proceeds will be used for general corporate purposes.

- 21 February, Castlelake Aviation secured a $635m ~4.5-year Term Loan B with a SOFR plus 275 bps rate. The financing will be used to repay existing debt.

- 14 March, EVA Air issued a NTD48m convertible bond. The issuance will be used for general corporate purposes.

- 15 March, China Airlines announced plans to issue NTD8bn of fixed rate unsecured notes. The issuance will be used to refinance existing debt.

- 16 March, Air Lease Corporation issued a $600m 5-year senior unsecured Sukuk note. The transaction is rated BBB by Fitch and has a coupon of 5.850%. The proceeds will be used for general corporate purposes.

- 21 March, Air France-KLM announced plans to refinance EUR320m of existing debt through a new issuance of perpetual hybrid bonds with the French state.