“Exxon is rated top ten best in the world for environment, social & governance (ESG) by S&P 500, while Tesla didn’t make the list! ESG is a scam.”

Elon Musk’s ill feelings towards ESG are common. How can it be that a company making electric vehicles ranks lower than one extracting fossil fuels?

“A company with a good ESG score, might not be a sustainable company. For example, a company heavily invested in fossil fuels, but mitigating that risk well, may get a good ESG score but sustainability means moving away from environmental and social degradation completely.”

Investec Group Sustainability lead Melanie Janse van Vuuren.

The temptation is to use such outcomes as evidence that ESG scoring systems are broken and therefore irrelevant. But ESG scores are about so much more (the forest) than a company’s position in an index (the trees).

Before we unpack that value, let’s first educate Elon on what an ESG score measures and what it means.

What an ESG score is, and isn’t

In the context of investing, ESG is just a deeper level of research around how well a company identifies, measures, and mitigates its non-financial risks that can potentially impact future profitability.

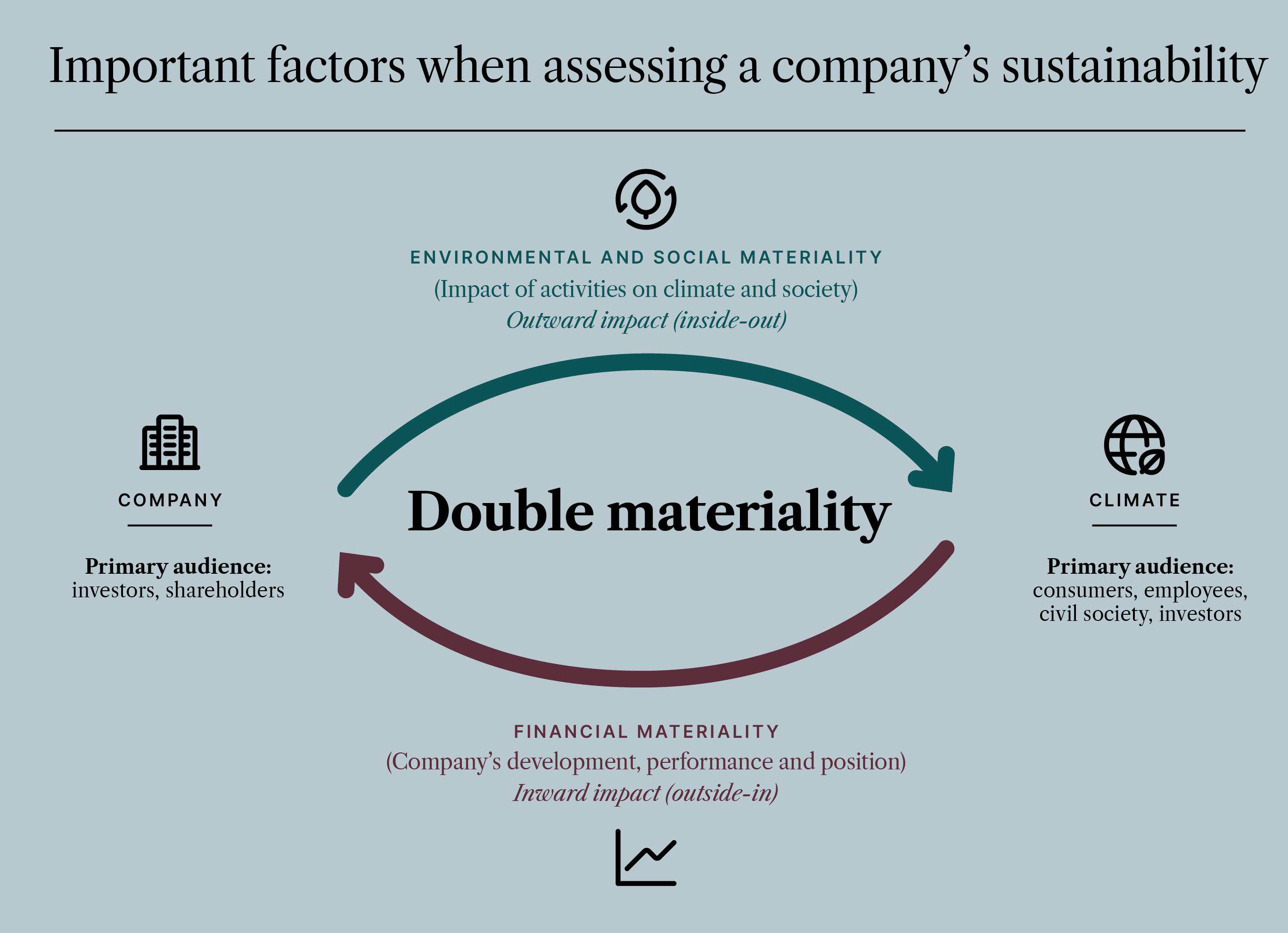

In other words, a good ESG score is more indicative of healthy risk management (internal) and less about whether the business makes a positive impact (external). Yes, the former often causes the latter, but not always. With that understanding, it’s almost predictable that Tesla can lose to Exxon – when your oil has spilt into oceans, risk management naturally becomes a priority. When Shamley and the Global Sustainability Equity team take a position in a company, they use a 'double materiality’ approach that combines the inward with the outward impact.

Running Exxon and Tesla through both those spheres would likely produce a different winner.

It follows that investors who care about sustainability and impact should arguably use a double materiality approach, rather than invest in ESG indices that, because of their focus on ESG scores, can for example channel more capital to Exxon than Tesla.

Standardisation is a red herring

The concept of ‘materiality’ is foundational to ESG scoring, but what does it look like in the real world?

“So, a simple example is air quality. It isn’t as material for a tech company as it is for a transport company. In a bank like ours, the development and retention of human capital is key, so our recruitment, development and retention policies would be considered material,” explained Shamley.

YOU WILL ALSO INTERESTED IN: "How ESG goes beyond but also embraces profitability"

Where things get complicated is that there are multiple organisations, agencies and third-party rating providers computing ESG ratings – more than 140 in the US alone – each with slightly different methodologies and scoring algorithms.

Toby Heaps, Founder of Corporate Knights, a firm that produces research, rankings, and reports on the world's 100 most sustainable companies, provided perspective on the challenge of heterogenous disclosure methodologies:

“Well, it’s taken us more than 100 years to get to some form of standardised accounting framework in place. Given the complexity of ESG and sustainability, maybe we’ll get there by the year 10,000.”

His tongue was in cheek and he acknowledges that big strides are being made towards standardisation. But Heaps sees the current disclosure disparities as a red herring.

Don’t overcomplicate things. As a stakeholder, you want the businesses you engage with to offer relevant products or services in categories where demand is growing not shrinking, and make investments that allow it to keep doing that on a sustainable basis.

ESG FAQs

The past and future of greenwashing

In a recent series of altruistic adverts, HSBC highlighted their $1 trillion worth of investment into climate-friendly initiatives. But they failed to mention their equally massive investments in heavy carbon emitters, resulting in the banning of these ads by the UK’s advertising watchdog.

Should the danger of greenwashing be a reason to throw the ESG baby out with the bathwater? Heaps provides perspective: “The motivation behind greenwashing is as old as we are. People have always misrepresented themselves when financial gain is at stake. But since when do we stop solving problems just because bad actors are in town?”

Negative headlines and our love of sharing them skew the reality that many businesses are using ESG for its intended purpose: sustainability.

“Where Investec has done a great job is in measuring and disclosing the emissions of our clients, known as Scope 3 emissions. We’re ahead of even our international competition on that metric,” said Shamley.

READ INVESTEC'S 2022 SUSTAINABILITY REPORT

That practice makes for a more sustainable bank in two ways:

1. It encourages the bank to lend to clients with a low-carbon footprint, or to those that have a plan in place to reduce their emissions.

2. It creates an opportunity for the bank to help their clients transition to and prepare for a low-carbon world.

“Given our load-shedding ritual, it’s not difficult to convince our clients to make the move to renewable energy. South African businesses are going to transition faster than we’d hoped for. It’s a fantastic side-effect of Eskom’s malaise.”

The value of a good ESG score

Yes, the construction methodology of ESG indices can be confusing. Yes, fragmented disclosures and greenwashing are challenges. But if you’re an investor, employee or customer of a business, its ESG score, or ranking is valuable

If you’re an investor

- Don’t lose money is the not-so-secret mantra of famous investors; a good ESG score may be indicative of strong risk management and governance in a business or a commitment to long-term sustainability.

- The lower a business’s cost of capital the easier it is for the company to finance its growth; a good ESG score results in cheaper debt and equity financing.

- Management teams that are open to external views make more informed decisions; a good ESG score talks to their willingness to listen to and engage with third parties

Evidence that links the management of ESG risks to strong share price performance continues to proliferate and gain credence. Indeed, The Corporate Knights Global 100 Index, created by Heaps using his annual ranking of the world’s 100 most sustainable listed corporations, has outperformed the MSCI ACWI Index by 1% per annum since inception in 2005, with greater annual outperformance in recent years, a sign, perhaps, that the smart money is beginning to take ESG seriously.

“If a company is thinking about ESG as a compliance issue, I would short that stock and go long on its competitors seeing it as an opportunity. In fact, we have almost twenty years of performance data that supports such a strategy."

Toby Heaps, Corporate Knights Founder

If you’re an employee

- Personal and professional growth are the bedrocks of a fulfilling and memorable career; a good ESG score is suggestive of a growth culture.

- Work satisfaction rests on both the stimulation of the daily inputs and the impact of the output; a good ESG score generally means a company is thinking about its broader impact on society and the environment.

- A more profitable company creates the potential for greater financial remuneration; a good ESG score can result in a sustainable competitive advantage.

“Today, the best talent cares about the legacy they will leave through their work. They want to look back and say they were part of the solution,” said Heaps.

If you’re a customer

- People want to buy goods and services from businesses that care about all stakeholders; a good ESG score suggests they are thinking about long-term profitability

- Consumers say something about themselves through the brands they choose to associate with; a good ESG score reflects well on them.

- There is often a cost to switching between service/product providers; a good ESG score improves the chances the business with remain relevant.

“Companies that rate well on ESG metrics will be the ones producing things in five years' time that people will want. They are better at adapting and evolving to serve consumer preferences that are always in flux,” said Shamley.

Let’s get evangelical about ESG

Due to the confusion around what ESG is and how its measured, a lot of the good that the top-rated banks are doing goes unnoticed.

Investec, for example, was rated among the world’s 100 most sustainable companies by Corporate Knights, coming 76th globally but first in South Africa.

Do you know the difference between ESG, sustainable and impact investing? Experts unpack the full spectrum of responsible investment options in this Investec podcast. Listen to Ep 1 of Future Impact podcast series.

Businesses need to perform across a range of rankings and ratings because they all represent different sustainability strengths and weaknesses. It’s also important to do consistently well across the same set of rankings and ratings to ensure you are not just picking the ones that make you look favourable.

“For 20 years we’ve demonstrated excellence in ESG. But I don't think we're leveraging it sufficiently. When our people see their clients, ESG should be part of the conversation because of what it means. It’s a massive opportunity to create and drive sustainable business,” concluded Shamley.

Asked about the big-picture importance of banks being sustainability champions, Heaps concluded his argument for sustainability and ESG with the following:

“We have crises in capitalism, democracy, climate, and affordability. We need change. But you can’t change the world without changing finance, and what gets funded gets done. ESG, while imperfect, is the best tool we have to incite the change we need.”

That’s a more convincing argument than Elon’s.

Get Focus insights straight to your inbox