It seems like the only “normal” in today’s global supply chains are surprises and constant disruptions. Europe is battling with increasing energy costs and supply constraints while China faces similar constraints and to make matters worse, a fresh outbreak of Covid in multiple cities will further hamper their manufacturing output.

Volumes have been declining on major trades such as Asia to Europe, but there is at least a positive – it allows ports an opportunity to clear backlogs and reduce port congestion. It will be interesting to observe how carriers react to the shifts in demand. We can expect blank sailings to be implemented as a counter to dwindling demand and reduced vessel utilisation.

Sea freight update

The seas appear to be calmer relative to 2022 when one considers port congestion, bottlenecks, capacity, and freight levels. Shipping lines are in for a rougher year from an earnings perspective because demand and freight rates have declined. There is no doubt that supply chains will be confronted with new challenges and unpredictable events that could change the landscape at any time.

Capacity:

In general, the situation has somewhat improved compared to last year, especially on the Far East trade.

We are also seeing spot capacity open on the Europe trade and a slight improvement on the India trade. Capacity on the South America trade remains very tight with limited carrier options available. North America also remains tight with limited spot capacity available.

We encourage bookings to be made well in advance of the required shipment dates and factor in longer lead times.

Despite the challenging environment, we have, in general, managed to consistently secure space through our extensive global network. With our expanded global network, we have gained access to additional capacity which strengthens our service offering to our clients.

Equipment imbalance:

Equipment availability remains relatively stable, though there a few cases of equipment shortages due to the affects of trucking constraints and port congestion.

Sailing schedules:

There has been a slight improvement in general. Port congestion has eased off to some degree at major ports such as Antwerp and Rotterdam which is encouraging as this improves the carriers on-time performance and predictability. Hamburg port is still recovering from the August strikes and vessels have been delayed as a result. The congestion also forced some carriers to omit some EU ports to avoid further delays to their sailing schedules.

Transshipment delays have also eased off to some degree, most notably in Las Palmas. Some carriers are experiencing up to 4 weeks in transshipment delays in Singapore. This has partly been driven by blank sailings on various trades resulting in a lack of capacity to load transshipment cargo in Singapore. Some carriers continue to frequently bypass Cape Town resulting in longer lead times for imports.

Typhoon Hinnamor has forced the temporary closure to the ports of Shanghai, Ningbo and Kwangyang and Busan. Port and vessel operations will be impacted, and we can expect vessel departures to be delayed by a few days.

Freight rates:

Rate levels remain at elevated levels when compared to pre-Covid, but they continue to trend downwards from last year’s historical highs. The biggest decreases have been on the Far East trade and this trend has continued into September. We have also seen spot rates from Europe and India start softening. The USA rates remain relatively stable.

SCFI (Shanghai Container Freight Index)

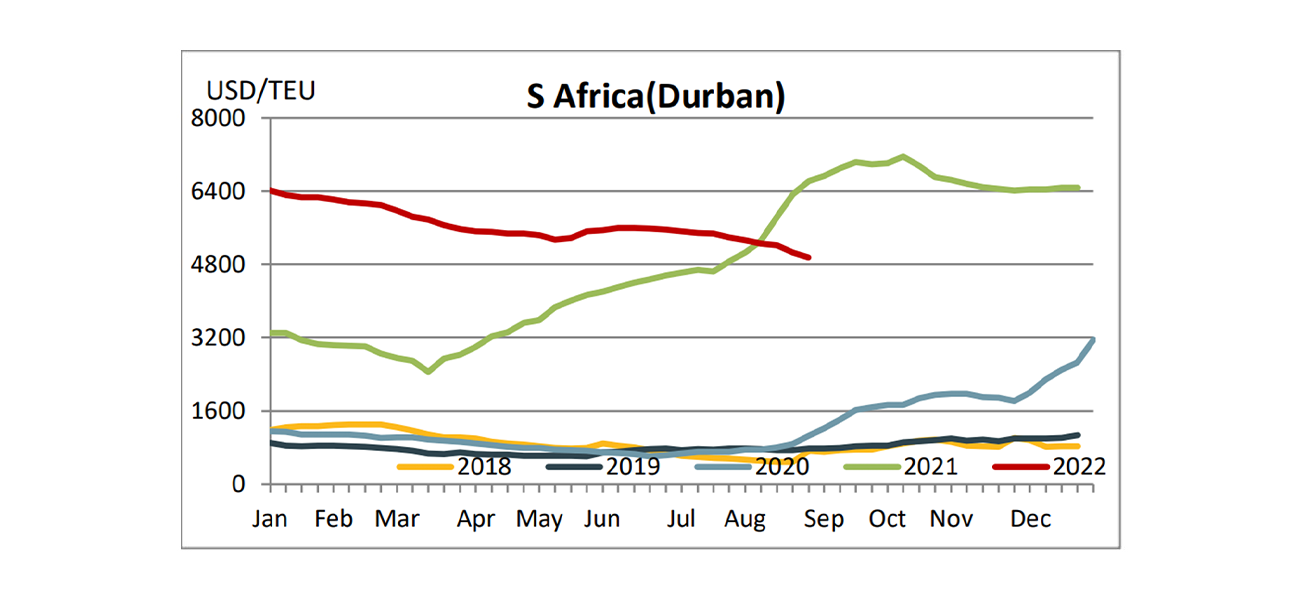

The below graph demonstrates the freight rate movement per TEU ex-China to South Africa

Due to our long-standing strategic relationships throughout our global network, we continue to secure very competitive pricing relative to market.

Air freight update

The market remained stable with relatively few disruptions experienced such as the Lufthansa pilot strike and flight cancellations in Shanghai caused by Typhoon Hinnamor. Challenges with moving hazardous cargo remain.

Lufthansa Cargo pilots to join strike on Friday 2 September - FreightWaves

Capacity:

We have not experienced any significant capacity challenges in securing capacity across the various trades. A few carriers have increased passenger capacity into South Africa ahead of the tourist season which also means potential increase for cargo capacity. We do expect demand to pick up as we approach the Chinese Golden Week and there is likely to be some cargo converted from sea freight to air freight on the back of the production delays experienced in Europe and China.

Our airfreight network enables us to continue offering flexible solutions that meet our clients’ import requirements.

Transit times:

Transit times have been relatively stable with the a few exceptions of cargo being bumped. Total lead times for hazardous cargo are more susceptible to longer lead times and delays. Severe weather conditions are common for this time of the year across areas such as Asia which could impact lead times from time to time and create temporary backlogs of cargo.

We encourage you to provide your required arrival dates in advance for us to offer you optimal routings and rates to meet your requirements.

Freight rates:

We have seen some relief in rate levels across most trades. The lower fuel surcharges have partly contributed to the lower rate levels. We can expect increases to come through as we approach the Chinese Golden Week.

With our expanded network we are well positioned to offer a variety of options to meet our clients' airfreight requirements.

Durban port free storage change

Transnet Port Terminals (TPT) will be implementing a change in the free storage rules for Pier 1 and Pier 2 to improve the transport flow of containers and the overall terminal efficiencies. Below is the quoted statement from TPT’s official notification dated 19 August 2022. Free time will be calculated from the time of container discharge instead of from the time when the vessel completes discharge

TPT’s Tariff Book clarifies the storage of containers in the container terminals under item 11 of section 1. On page 13, item 11.1.1 the tariff book prescribes the current application of the free period as follows, “First 3,25 days (78 hours) free, the free period is applied from 00h01 on the day the vessel completes discharge until the container leaves the gate.” With effect from 01 October 2022 the rule will change to the “First 3,25 days (78 hours), the free period being applied from 00h01 on the day following the container being discharged until the container leaves the gate.”

Get Focus insights straight to your inbox

Comprehensive offerings to support your business growth

Our working capital finance is designed to boost and free up cash for optimising or growing your business. We offer a number of tailored financing solutions to suit your business needs.

Trade Finance

We provide financing for the purchase of stock and services on terms that closely align with your working capital cycle. For importers, our fully integrated solution provides a single point of contact for the end-to-end management of your imports, including order tracking, the hedging of foreign exchange risk, the physical supply of product, and the provision of a consolidated landed cost per item on delivery.

Debtor Finance

Funding the needs of your business by leveraging your balance sheet (debtors, stock, and other assets) to provide you niche asset-based lending or longer-term growth funding to assist you in growing your business and creating shareholder value.

Asset Finance

Niche funding for the purchase of the productive assets and other capital requirements needed to grow your business. We alleviate the requirement for the upfront capital investment in these assets.