Global markets remain volatile and growth forecasts for 2023 continue to be adjusted downwards, which is concerning. China’s import and export trade data for April points to a slowdown and in many aspects a reflection of what the global economy is experiencing from a growth perspective. This outlook doesn’t bode well for air and sea freight carriers and it’s no surprise that merger and acquisition activity within the supply chain sector is buoyant. We are likely to see further consolidation within this industry and shipping lines will continue broadening their logistics service offerings to diversify their business portfolios.

We will continue to work very closely with all our partners and service providers, to ensure that all your shipments are delivered as efficiently as possible.

The impact of the following key factors needs to be continually assessed and considered:

- Declining freight rates

- Increasing vessel capacity

- Improved schedule reliability

- Problematic rail service

Sea freight update

The ocean freight market has taken a dramatic turn over the past 12 months and the outlook doesn’t appear to be very exciting for shipping lines from a volume and revenue perspective. Competition among carriers to attract volumes remains strong and at the same time, they need to find new revenue generation avenues as well as improve efficiencies and contain costs. Earnings for this financial year are set to decline dramatically compared to the past financial year. This comes at a time when a significant amount of new build vessel capacity will be deployed over the period 2023 to 2025.

The rail service in South Africa remains problematic and operational inefficiencies and constraints such as cable theft have made the rail service unreliable. This situation has partly created additional pressure on the ports and our road infrastructure as too much cargo is moving via road instead of via rail.

Transnet: Runaway train?

In this episode of No Ordinary Wednesday, Henk Langenhoven, Chief Economist of the Minerals Council of South Africa, Tertia Jacobs, Investec Treasury Economist, and Denys Hobson, Head of Logistics at Investec for Business, discuss the extent of the Transnet crisis, its impact on the economy and possible solutions.

Capacity:

There is no shortage of capacity in the market and demand remains lackluster, especially from China. Demand from the US and Europe is stronger, but this can also be attributed to fewer carrier options being available.

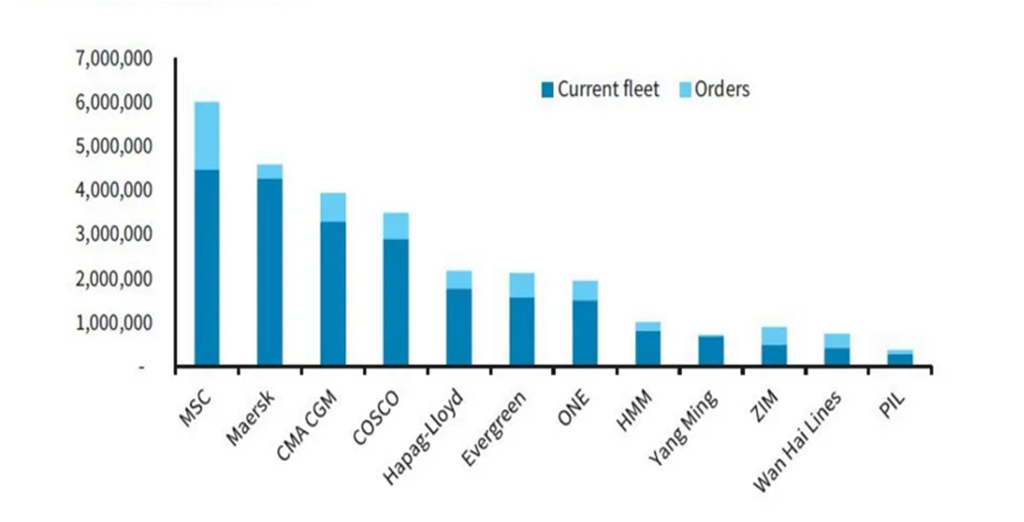

Some shipping lines will push to implement blank sailings to reduce capacity availability. This can lead to rolling pools and strengthen demand for proceeding sailings. Slow steaming is also becoming more prevalent and is another tactic deployed by shipping lines to reduce costs and capacity. The market is aware of new vessel build capacity coming into the market. The global container vessel fleet is expected to increase by 11% in 2023 and is forecasted to be 30% above the pre-pandemic levels by 2025 according to Barclays (the charts below show the TEU volumes). It is also important to highlight that a significant amount of these new vessels will be operating on alternative fuels, such as biofuels and LNG for example, to reduce carbon emissions.

Source: BARCLAYS

Source: BARCLAYS

With our expanded global network, we have access to additional capacity and alternative routings which strengthens our service offering to our clients.

Sailing schedules:

Schedule reliability continues to improve globally. We can expect berthing delays and possible temporary port congestion across some of the South African ports as we approach the winter season. Some shipping lines have been experiencing transshipment delays in Singapore because of previous blank sailings implemented on the Far East trade.

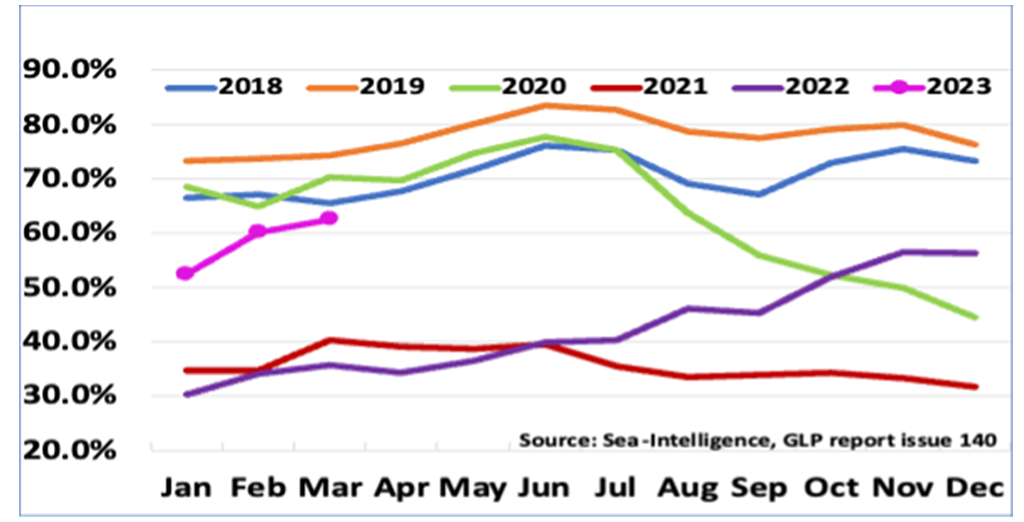

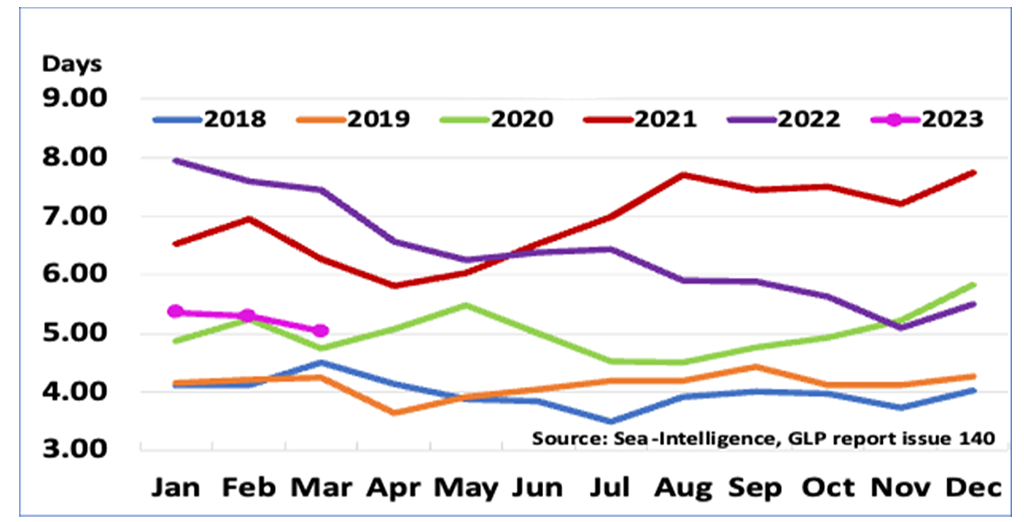

According to the latest Sea Intelligence schedule reliability report, global schedule reliability improved by 2.4% to 62.6% and average delays dropped to 5.03 days for late vessel arrivals. See charts below.

Figure 1: Global Schedule Reliability

Figure 2: Global Average Delays for Late Vessel Arrivals

Freight rates:

Our freight rates have remained relatively stable on the US and Europe trade routes. We have seen rates declining on the Far East trade; however, the quantum by which rates are declining has been reducing. The rate differential between twenty-foot (20ft) and forty-foot (40ft) has also narrowed. Shipping lines are offering attractive 40ft non-operating reefer rates from the main ports in China. These rate levels are below the 20ft rate levels which is an attractive option to consider.

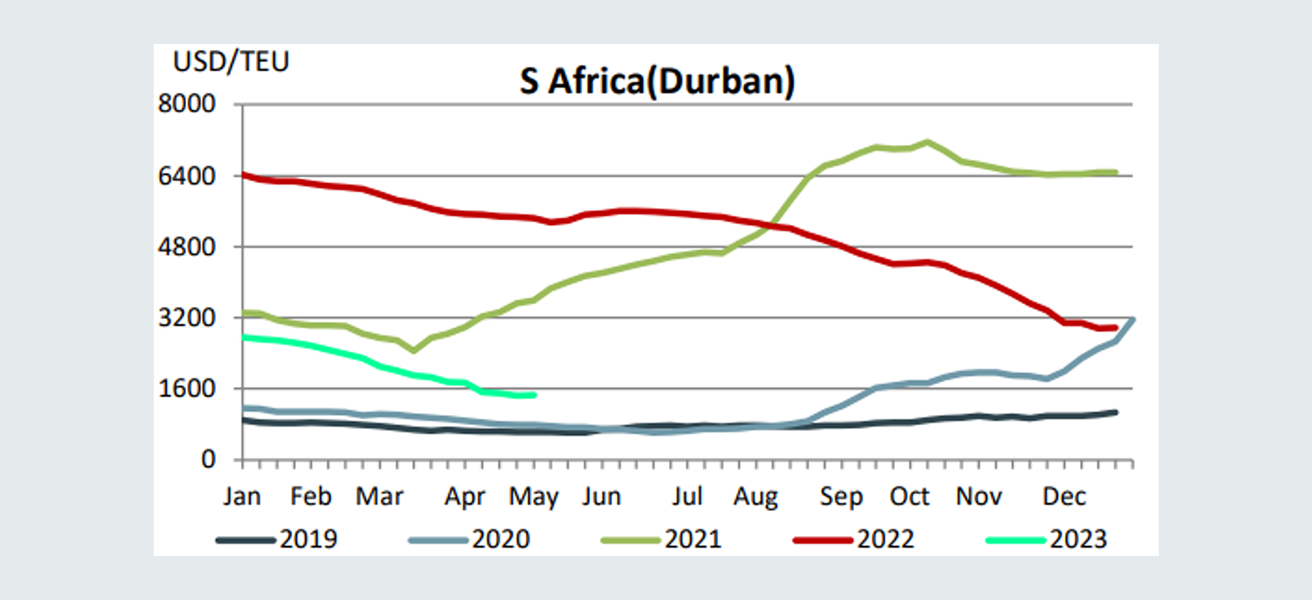

SCFI (Shanghai Container Freight Index):

The below graph demonstrates the freight rate movement per TEU ex-China to South Africa

Due to our long-standing strategic relationships throughout our global network, we continue to secure very competitive pricing relative to market.

Air freight update

The air freight market remains under pressure from a volume growth perspective. Market indications for the coming months are for the volumes to remain subdued.

Capacity:

Capacity availability is not a concern now, and we have not experienced any significant backlogs or bumping of cargo. If the sea freight market remains stable, we don’t expect airfreight capacity to be impacted.

Our airfreight network enables us to continue offering flexible solutions that meet our clients’ import requirements.

Transit times:

Service levels are being maintained and shipments for the most part are moving timeously.

We encourage you to provide your required arrival dates in advance for us to offer you optimal routings and rates to meet your requirements.

Freight rates:

Rates have generally softened over the past month and spot rates have been attractive. We anticipate rate levels to remain stable.

With our expanded network we are well-positioned to offer a variety of options to meet our clients' airfreight requirements.

Get Focus insights straight to your inbox

Comprehensive offerings to support your business growth

Our working capital finance is designed to boost and free up cash for optimising or growing your business. We offer a number of tailored financing solutions to suit your business needs.

Trade Finance

We provide financing for the purchase of stock and services on terms that closely align with your working capital cycle. For importers, our fully integrated solution provides a single point of contact for the end-to-end management of your imports, including order tracking, the hedging of foreign exchange risk, the physical supply of product, and the provision of a consolidated landed cost per item on delivery.

Debtor Finance

Funding the needs of your business by leveraging your balance sheet (debtors, stock, and other assets) to provide you niche asset-based lending or longer-term growth funding to assist you in growing your business and creating shareholder value.

Asset Finance

Niche funding for the purchase of the productive assets and other capital requirements needed to grow your business. We alleviate the requirement for the upfront capital investment in these assets.