While we cannot ignore the uncertainty that’s been created by current economic and political trends, both globally and locally, there appears to be a greater sense of calm across the air and sea freight markets. One of the driving factors that have created this sense of calm is the decline in global demand and the likelihood that demand will remain subdued in the coming months. So while this doesn’t bode well for economic growth, it does mean that we can expect market conditions for air and sea freight to remain stable.

We will continue to work very closely with all our partners and service providers, to ensure that all your shipments are delivered as efficiently as possible.

The impact of the following key factors needs to be continually assessed and considered:

- Stable freight rates

- Possible blank sailings

- Improved schedule reliability

- Importing alternative energy products

Sea freight update

The current sea freight market appears calm for now and some would even go as far to say it’s like the “good old days”. Securing space and equipment at competitive rate levels across most trades has almost become seamless. Port congestion across the globe has subsided for the most part and vessel schedules have become more stable. This is all very encouraging and positive from a supply chains and logistics point of view, but as we have learnt, conditions can change overnight.

Capacity:

Carriers have started reporting a slight pick-up in demand for volumes on the Far East trade, to the extent that they are fully booked weeks in advance. It has been rumoured that carriers may start introducing blank sailings at short notice. Demand ex-Europe remains consistent, and trucking capacity has also improved. The severe bottlenecks are no longer prevalent, and disruptions have been limited in recent times.

With our expanded global network, we have access to additional capacity and alternative routings which strengthens our service offering to our clients.

Sailing schedules:

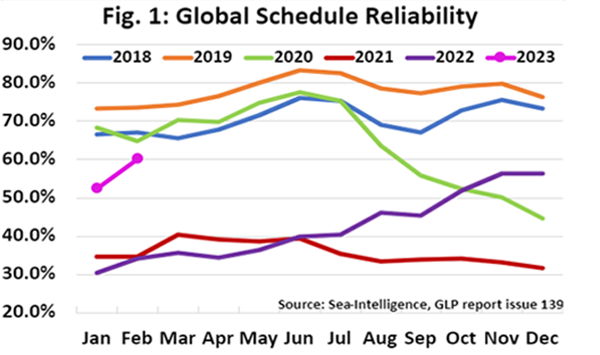

The general trend of improved schedule reliability continues, and this also translates into a higher capacity availability as fewer vessels are delayed, as previously experienced when port congestion was a major factor.

According to the latest Sea-Intelligence schedule reliability report, global schedule reliability improved by 7.7% to 60.2%.

Transshipment delays have also reduced significantly, with minimal delays being reported. This situation could change should carriers start implementing blank sailings. The one stand-out exception has been Cape Town port, which continues to experience lengthy berthing delays and some carriers have opted to bypass Cape Town on occasion. Time-sensitive cargo can be routed into Coega or Durban and trucked to Cape Town as an alternative.

Freight rates:

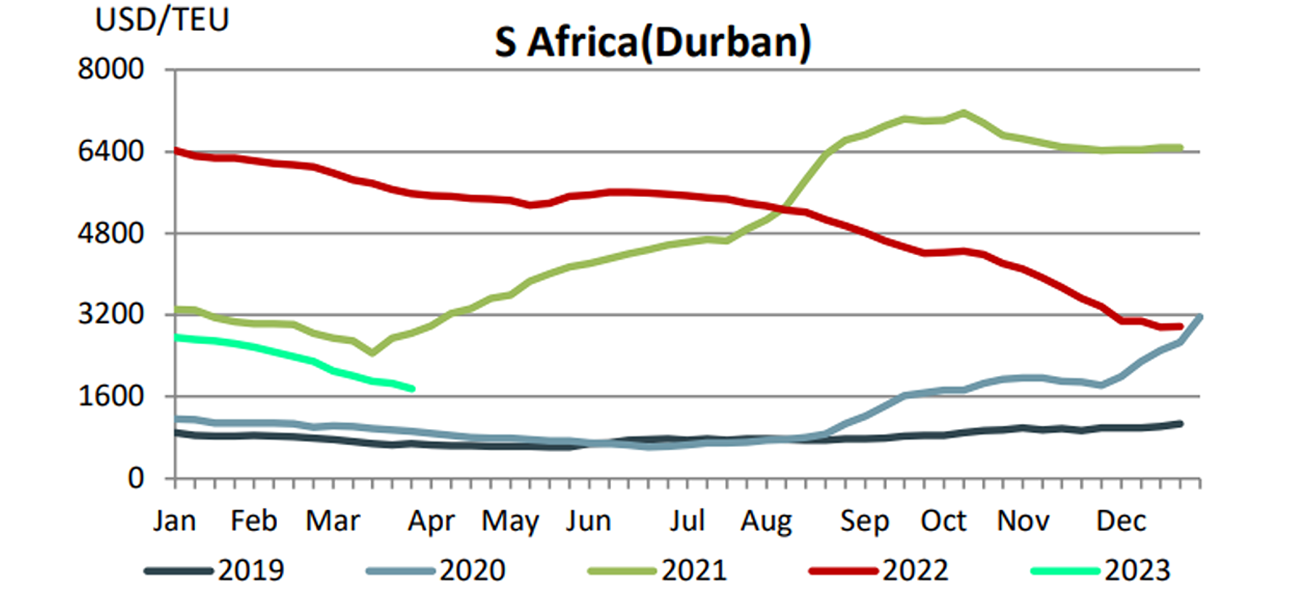

Rates have continued to soften on the Far East and India trades, albeit at a slower pace compared to the past few months. We are expecting rate levels to stabilise, and carriers will be looking for opportunities to increase rates, but we don’t expect large incremental increases in the coming weeks. The market is aware of subdued demand and global economic pressures as well as significant additional new build vessel capacity being deployed into trade over the next 12-18 months.

SCFI (Shanghai Container Freight Index):

The below graph demonstrates the freight rate movement per TEU ex-China to South Africa

Due to our long-standing strategic relationships throughout our global network, we continue to secure very competitive pricing relative to market.

Air freight update

The landscape has not changed much in terms of significant disruptions, besides the recent strikes in Germany and France. The market conditions are favorable for importers in terms of price and capacity availability.

Capacity:

There is sufficient capacity available with minimal backlogs reported. As the European summer approaches, we expect demand for passenger travel to increase, which will reduce cargo capacity availability on passenger aircraft.

Our airfreight network enables us to continue offering flexible solutions that meet our clients’ import requirements

Transit times:

Service levels are being maintained and shipments for the most part are moving timeously.

We encourage you to provide your required arrival dates in advance for us to offer you optimal routings and rates to meet your business import requirements.

Freight rates:

Rates have in general either softened or remained stable across most routes. We expect the rate levels to remain range bound for the coming weeks, assuming there are no major disruptions, and the sea freight market remains stable.

With our expanded network we are well-positioned to offer a variety of options to meet our clients' airfreight requirements.

Importing of alternative energy products

The demand for alternative energy products has skyrocketed in recent times because of the havoc that loadshedding has caused. We have seen an increase in enquiries for importing of products such as inverters, lithium-ion batteries, and solar panels among other products. There are some key factors that need to be considered when importing of these products. We have a strong presence in this sector and will be happy to offer guidance and support should you have a need to import these products.

Get Focus insights straight to your inbox

Comprehensive offerings to support your business growth

Our working capital finance is designed to boost and free up cash for optimising or growing your business. We offer a number of tailored financing solutions to suit your business needs.

Trade Finance

We provide financing for the purchase of stock and services on terms that closely align with your working capital cycle. For importers, our fully integrated solution provides a single point of contact for the end-to-end management of your imports, including order tracking, the hedging of foreign exchange risk, the physical supply of product, and the provision of a consolidated landed cost per item on delivery.

Debtor Finance

Funding the needs of your business by leveraging your balance sheet (debtors, stock, and other assets) to provide you niche asset-based lending or longer-term growth funding to assist you in growing your business and creating shareholder value.

Asset Finance

Niche funding for the purchase of the productive assets and other capital requirements needed to grow your business. We alleviate the requirement for the upfront capital investment in these assets.