Automatic Exchange of Information (AEoI)

Key elements

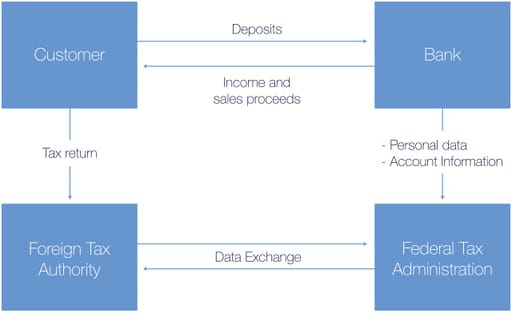

The automatic exchange of information (AEOI) is a standard process developed by the OECD in order to prevent tax evasion. Participating countries share data with one another about taxpayers’ bank accounts and securities custody accounts. Switzerland has undertaken to take part. Consequently, Investec Bank (Switzerland) AG is obliged to report details of the accounts of clients whose tax domicile is located abroad to the Swiss Federal Tax Administration (SFTA) each year, provided that Switzerland has signed an AEOI agreement with the relevant partner state.

Information to be exchanged

If the tax domicile of a client is located abroad, Investec Bank (Switzerland) AG transmits the following information to partner states via the FTA:

Personal data

- Name

- Address

- Country of tax domicile

- Tax identification number

- Date of birth

Account information

- Account number

- Total gross income from dividends, interest and other revenue

- Total gross proceeds from the disposal of assets

- Total balance or value of the account at the end of the relevant calendar year

Impact on Investec Bank (Switzerland) AG customers

From 1 January 2017, all clients must declare their tax domicile to Investec Bank (Switzerland) AG by means of self-certification when entering into a new business relationship or if their situation changes (e.g. change of domicile address) so that Investec Bank (Switzerland) AG can document this information accordingly.

Persons affected by the automatic exchange of information

The automatic exchange of information concerns natural persons and legal entities whose tax domicile is in a country with which Switzerland has signed an agreement on the automatic exchange of information.

Partner states with which Switzerland has signed an AEOI agreement

The list of partner states with which Switzerland has signed an agreement on the automatic exchange of information is continually updated by the State Secretariat for International Financial Matters (SIF).

Click here for more information

Rights of persons obliged to provide information

In accordance with the law on AEOI and the Federal Act on Data Protection (FADP), persons obliged to provide information have the following rights:

1. With regard to Investec Bank (Switzerland) AG

Persons obliged to provide information can claim full legal protection in accordance with the FADP with regard to Investec Bank (Switzerland) AG. In other words, they can request details about the information about themselves that has been reported to the SFTA as collected by Investec Bank (Switzerland) AG.

If so requested, Investec Bank (Switzerland) AG must issue persons obliged to provide information with a copy of the report sent to the SFTA. Fiscally-relevant information that has been reported to the SFTA may differ from the data that has been collected. Furthermore, persons obliged to provide information may ask for incorrect data to be rectified in Investec Bank (Switzerland) AG systems.

2. With regard to the SFTA

The only right that a person obliged to provide information can assert with regard to the SFTA is the right to information, under which they may request the rectification of incorrect data due to transmission errors.

If the transmission of data results in disadvantages that the person obliged to provide information cannot reasonably be expected to accept due to insufficient constitutional guarantees, such persons shall be granted rights in accordance with article 25a of the Administrative Procedure Act.

Persons obliged to provide information are not entitled to exercise the right of access to documents with regard to the SFTA. Consequently, they have no right to prevent the disclosure of personal data to the SFTA. In addition, the person obliged to provide information cannot verify the legality of the disclosure of information abroad or demand the prevention of unlawful disclosure or the destruction of data which has been processed without sufficient legal grounds.

Validity in Switzerland and effects on other regulations

The AEOI will come into effect on 1 January 2017. It replaces the international withholding tax agreements between Switzerland and Austria and Switzerland and the United Kingdom respectively, as well as the EU agreement on the taxation of savings income.

Additional information

More information on swissbanking.org

More information on oecd.org