Investec Wealth & Investment

Conflict of Interest Policy

In accordance with the requirements of the Financial Advisory and Intermediary Services Act 37 of 2002 (“FAIS”), and subsequent amendments to the General Code of Conduct, Investec Wealth & Investment (“W&I”) is required to establish and communicate to clients its Conflicts Management Policy.

The purpose of such policy is to identify, avoid, and (where avoidance is not possible) mitigate and manage the conflicts of interest that may arise when W&I and its Representatives provide investment services and advice to clients.

W&I is committed to ensuring that its business and relationships with clients are conducted in an ethical and equitable manner in accordance with good business practice and in a way that safeguards the interests of all stakeholders.

The Conflicts Management Policy must contain mechanisms for the identification of conflicts of interest and measures and procedures for the avoidance, disclosure and mitigation of such conflicts.

-

What is meant by conflicts of interest?

Conflicts of interest are inherent in almost all aspects of economic activity.

In our context, a conflict could include any situation in which W&I or any of its Representatives have an actual or potential interest that may:

- influence the objective rendering of a financial service to a specific client or group of clients; or

- prevent them from rendering an unbiased and fair financial service to that client, or prevent them from acting in the best interests of that client.

- These potential interests include, but are not limited to:

- financial interests;

- ownership interest;

- any relationship with a third party, including an associate.

-

Where could conflicts of interest occur?

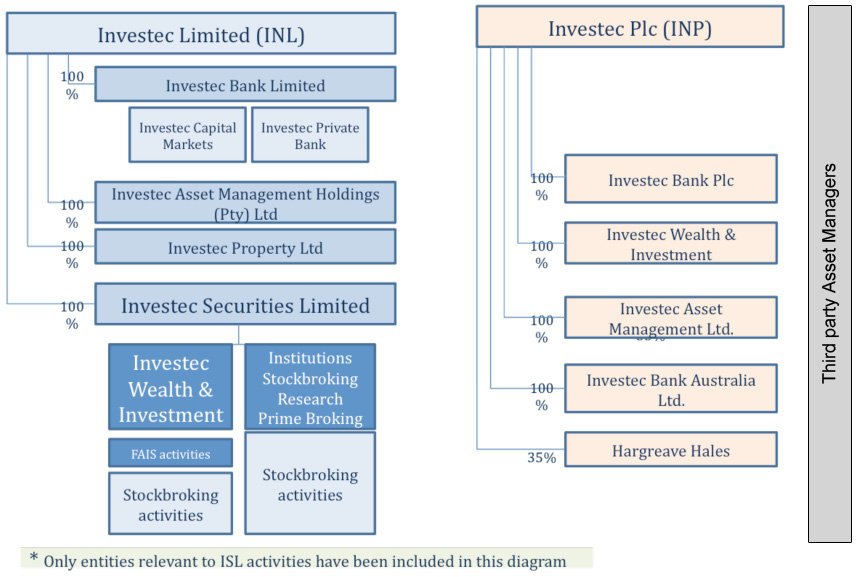

Investec Wealth & Investment is a division of Investec Securities (Pty) Limited (“ISL”), itself a fully owned subsidiary of Investec Bank Limited. ISL is an authorised user of the JSE Limited.

W&I is registered as an authorised Financial Services Provider (FSP number 15886) under FAIS.W&I forms part of the Investec Group. As an international, specialist banking group that provides a diverse range of financial products and services to a select client base, potential conflicts of interest can arise. As such the avoidance, and where avoidance is impossible, the mitigation and management of conflicts of interest are inherent to the Investec business. Given the nature of Investec’s business, that simultaneously conducts the activities of investment research and advice, proprietary trading, portfolio management and corporate finance business (including advising on mergers and acquisitions and underwriting and selling an offering of securities) conflicts of interest management is paramount.

In particular, W&I is the natural distribution channel for products created by various Investec companies or divisions such as Investec Corporate and Investment Bank, Investec Life Limited, Investec Specialised Investments, Investec Private Bank and Investec Asset Management.

-

What is required by W&I under FAIS legislation?

W&I is required to avoid and, where this is not possible, mitigate any conflicts of interest between itself and its representatives on the one hand and client(s) on the other hand.

More specifically:

- we will take all reasonable steps to prevent conflicts of interest from giving rise to a material risk of damage to the interests of clients;

- we implement and operate a written policy for identifying and managing conflicts of interest;

- we specify in the conflicts policy certain procedures and measures to ensure appropriate independence and further steps if these prove inadequate;

- we require disclosure of the conflict to the client if the arrangements under the policy are not adequate to prevent material risks of damage to a client;

- in considering our policy in respect of duties to clients, we take account of any circumstances, of which we are or should be aware, which may give rise to a conflict arising as a result of the structure and business activities of other Investec companies.

-

How does W&I avoid or mitigate conflicts of interest?

The 1st step is to identify the type of conflicts that may arise in the course of providing advice and rendering services under FAIS.

The 2nd step is to identify which conflicts can be avoided.

The 3rd step is to assess the reasons why conflicts cannot be avoided and manage such conflicts to mitigate the risks that could be detrimental to clients.

-

What mechanisms does W&I have in place to ensure that all conflicts are identified?

- Investec Compliance maintains a Matrix Index of potential conflicts of interest risks within ISL, including W&I. This index is a sub set of the Investec Matrix Index of potential conflict of interest risks at Investec, maintained by Group Compliance, which takes into consideration all business areas and income streams within the Investec Group. This Index is a matrix of conflicts classified by conflict type, business area and conflicting business area with documented controls. The Index is updated with all new conflicts identified and, to ensure completeness, is reviewed on an annual basis;

- all employees are required to disclose, both on employment and throughout the course of their employment, any interest outside of Investec’s employment that they are party to. No material conflict in this regard is allowed;

- all employees, including compliance officers and management, are additionally responsible for identifying any specific instances of conflict. They are required to notify their business unit compliance officer (or Group Compliance) of any conflicts they become aware of. Business unit compliance officers will escalate the conflict to Group Compliance to assess the implications of the conflict, whether the conflict can be avoided and, if avoidance is not possible, how the conflict should be managed.

-

What conflicts have been identified and mitigated through these mechanisms?

- W&I could favor its own transaction, or those of specific clients, through deal orders and allocation methodologies other than Best Execution.

- W&I, or its Representatives, could be unduly influenced by Gifts and Entertainment received, or could unduly influence clients through Gifts and Entertainment offered (for example, preference in deal allocation or execution).

- W&I, or its Representatives, could be unduly influenced by incentives or inducements received from product suppliers, whether internal (i.e. Investec companies or divisions) or external (i.e. asset managers or other product suppliers in South Africa or abroad).

- Conflicts of interest could arise as a result of Personal Account Dealing or Off-market (or non-market related) transactions with Employees.

- Conflicts of interest could arise through a Representative’s conflicting Outside Business Interests or through W&I or their Representative’s participation in deals alongside clients.

- Communications and marketing can give rise to conflicts of interest through incorrect or inadequate disclosure.

- Investec could issue research or recommendations in a way that could induce Clients to participate/enter into transactions to the benefit of Investec or companies in which Investec has an interest.

- Research or recommendations could be made on investments or shares that are or may become assets in a fund managed by Investec

- Dealing errors, or misdeals, could be hidden or managed in a way that favours W&I’s interests.

- Fees and charges are open to unfair treatment.

- Remuneration or rewarding of employees could be based on criteria which do not encourage acting in the client’s best interests, for example by encouraging the marketing of certain products or incentivizing employees to give preference to specific types and volumes of business.

- Conflicting duties can arise in dealing, where W&I (for example) is:

- acting as agent for both the buy and the sell side of a transaction;

- acting for clients and for Investec or parties related to Investec;

- acting for a client in preference to another client;

- dealing ahead of a client or proprietary Trade

- Activities that could fall within the definition of Market Abuse, including Market Manipulation, Spreading of Rumours and Insider Trading, can also give rise to potential conflicts of interest where W&I, or its Representatives, favour their interests over those of clients.

-

What happens when a conflict of interest that cannot be avoided has been identified?

Once it is established that a conflict has been identified as unavoidable, it is analysed to establish the reasons for such unavoidability. W&I Compliance identifies and assesses any such conflicts, including whether the conflicts are actual or perceived, what the value of the conflicts or exposure are and the potential reputational risk. W&I Compliance then propose that management measures that appropriately and adequately mitigate and manage the conflict. Management then agrees on the controls that need to be put in place to manage the conflict and delegates the ownership of such controls. Compliance then documents the measures approved by management and monitors the controls for effectiveness on an ongoing basis.

-

What processes, procedures and internal controls are in place to generally manage conflicts?

W&I has various internal controls to manage and mitigate Conflicts of Interest, including:

- group business practices - Confidentiality and Representing the Group;

- information barriers (“Chinese Walls”) - Restrictive access control to certain areas; separate IT systems and IT folders, IT access control policy and “Clean Desk” policy;

- disclosure - Clear and concise disclosure to enable the recipient to fully understand its relevance.

- In addition, W&I has various internal policies to manage and mitigate Conflicts of Interests that relate to Representatives, including:

- Personal Account Dealing Policy, which manages the conditions under which Representatives can trade for their own account (or accounts of their family members);

- policy on Outside Business Interests, which manages the disclosure and approval of a Representatives outside business interest; and

- Gifts and Entertainment Policy, which manages the disclosure and approval of the giving and receiving of Gifts and Entertainment by a Representative.

- Specific instances of conflict may require management intervention in addition to the documented controls already in place. These can include escalation to a management forum, like the Executive Risk Review Forum (“ERRF”), for a decision on how the conflict should be managed, for example, disclose to the client or decline to act.

-

What are the consequences of non-compliance with the Management of Conflicts of Interest policy?

A Representative’s failure to comply with the above internal policies, including this Management of Conflicts of Interest policy is regarded as an offence and will be fully investigated. Depending on the severity, such offence may result in disciplinary proceedings.

-

What is in place to protect the client in circumstances where the conflict of interest cannot be avoided and managed through the above processes or procedures?

- In such cases, W&I, or as applicable the specific representative, will provide full clear disclosure of the conflict of interest to clients. In most circumstances, these disclosures are standard and will be included in a specific FAIS disclosures document that will be handed to you by your adviser or included in the Investment Proposal/Record of Advice made to you. Where the disclosures required are specific to the person with whom you are dealing, such person will make disclosures as appropriate.

- In addition, representatives are made aware of the consequences of conflicts and non- compliance through regular mail notifications and training.

-

How are advisers remunerated for services rendered to clients?

Representatives of W&I are all employees of Investec Limited, and as such, they receive remuneration packages made up of three components, namely base salary and benefits, variable annual performance bonuses and long-term share incentive plans. This is in accordance with the Remuneration Policy of the Investec Group, which is set out in detail in the Investec Integrated Annual Report. Remuneration is managed through the W&I Remuneration Committee and is determined by a number of factors, including qualitative and quantitative performance as well as team performance and the profitability of the division as a whole. Representatives are prohibited from receiving any other financial interest which could give rise to a conflict.

-

What relationships does W&I have with 3rd parties and associates that could give rise to conflicts?

The following organogram positions W&I in the broader Investec Group of companies and includes details of all relationships relevant to potential conflicts of interest, including:

- associates (holding companies and subsidiaries);

- third parties, which include:

- product suppliers {and their associates};

- other FSP’s {and their associates};

- distribution channels;

- any person, who in terms of an arrangement or agreement with any of the above, either provides a financial interest to W&I or its Representatives; or holds an ownership interest in FSP’s name, or that W&I holds an ownership interest in.

The specific relationship with group companies, divisions and, associates are specific to each client and are detailed in the client’s specific documentation, with 3rd parties being listed on the W&I website.