Receive Focus insights straight to your inbox

The July MPC delivered a 25bps rate cut in a unanimous decision, lowering the repo rate to 6.50%. The tone of the post- MPC statement was neutral and the balance of risks to inflation was deemed to be largely balanced. The decision to lower the repo rate was in line with the QPM’s implied policy rate forecast for Q4 2019, although implemented in 3Q.

South Africa’s inflation rate has become more stable and volatility has declined. Near term inflation outcomes have consistently surprised on the downside in 2019 due to contained food price increases, a decline in oil prices in May 2019 and a lack of demand pull pressures.

The medium term inflation forecast of the SARB showed inflation settling at 4.6% in 2021. The MPC emphasised that future policy decisions will be highly data dependent and sensitive to the assessment of the balance of the outlook risks.

What has changed since the July MPC meeting

1. Geopolitical risks remain elevated

The global backdrop remains challenging and global GDP growth forecasts continue to experience downside revisions.

The slowdown in global trade and the manufacturing sector continues while the services sector of advanced economies continues to perform well.

A tentative thawing in US-Sino trade tensions due to “good will” gestures by both sides in September, monetary stimulus from China, upside surprises to incoming US data, provided support to commodity and high yielding currencies such as the ZAR.

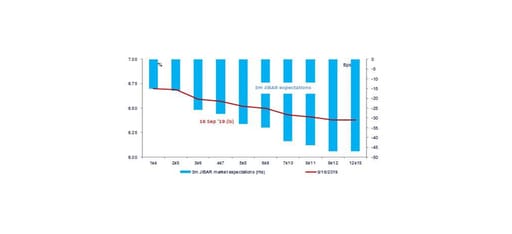

Central banks around the world continued with a coordinated response to lower interest rates as inflation remained contained with downside risks to the growth outlook of many emerging market countries.

In July and August, central banks in emerging economies such as Turkey, Chile, Russia, Brazil, Mexico, Indonesia, the Philippines and South Africa cut rates.

In advanced economies, the ECB’s decision to reduce the deposit rates by 10bps to 0.50% and restart an open ended asset purchase programme of EUR20bn a month, was expected.

The Fed is expected to deliver a second 25bps rate cut at the FOMC meeting on 18 September after August’s decision to lower the policy rate by 25bps was deemed to be an “insurance” cut against external risks.

However, tensions in the Middle East have increased after unmanned drone attacks on Saudi Arabian production facilities. The price of Brent spot increased by 10% to $65.5/bbl. The duration of tensions is important as there are implications for inflation, terms of trade and the current account balance.

Figure 1: Central Bank rate cuts in 2019

Central banks around the world continued with a coordinated response to lower interest rates as inflation remained contained with downside risks to the growth outlook of many emerging market countries.

2. Near-term inflation trajectory could be lowered

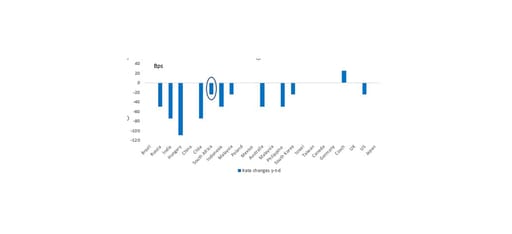

The starting point for the SARB’s new inflation forecast has been lowered. The outcome of July’s CPI inflation rate of 4.0% was below market expectations of 4.4% with electricity and water tariffs coming in lower than our forecast input assumptions. The SARB’s Q4 19 forecast of 4.4% could be lowered to 4.2%, in our view.

3. ZAR more undervalued

The exchange rate of the ZAR has depreciated by 3.3% against a basket of currencies. The implied starting point for the rand in the July inflation forecast was 14.30/$. This could be revised to 14.70 with the rand trading in a range of 13.87 to 15.46/$ (currently trading at 14.65/$).

4. Upside risks to oil price

The possibility of a lower oil price forecast for 2019 was assumed until this weekend. The SARB’s forecast for 2019 of an average of $67/bbl. is running above the year-to-date average of $64.8/bbl. However, forecast risk has increased with the intensification of tensions in the Middle East.

Figure 2: Lower starting point for the inflation forecast

Other considerations

A further downward revision to the SARB’s inflation forecast?

The SARB’s 2019 inflation forecast could be lowered (from 4.4% to ~4.2%). The 2020 forecast of 5.1% also faces marginal downside revision risk to ~4.9%, depending on the SARB’s rand and oil forecasts.

GDP growth forecast

The SARB’s 2019 GDP growth forecast of 0.6% is likely to remain unchanged after the rebound in 1Q 19 GDP growth of 3.1%q/q (saar). However, there is downside risks to 2020’s GDP forecast of 1.8%. The implication for the output gap is for it to become more negative in 2020 and 2021.

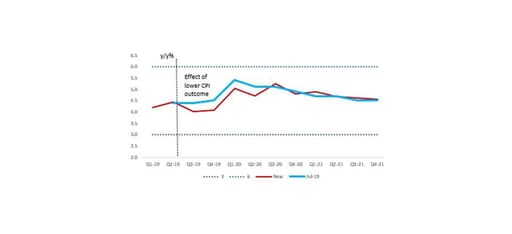

The real policy rate and the QPM’s implied interest rate trajectory

The QPM model’s implied rate trajectory of one 25bps rate cut in 4Q 19 (which was delivered in July) was the result of:

(1) CPI inflation expectations moving closer to the midpoint of the target band of 4.5% (the SARB uses BER’s quarterly inflation survey; and

(2) CPI inflation receding below 4.5% in 2021 if the repo rate was left unchanged at 6.75%. The BER inflation expectation survey for 3Q 19 will be published on 19 September and will be an important consideration in the MPC’s debate on interest rates.

The 2Q 19 surveys showed inflation expectations moderating to 4.8% in 2019, 5.0% from 5.2% in 2020 and 5.2% from 5.3% in 2021. Five-year-ahead inflation expectations have receded to a historic low of 5.1%.

Real interest rates have widened due to the moderation in inflation

The current real repo rate (adjusted for July’s CPI inflation rate of 4.0% and a repo rate of 6.5%) has widened to 2.5% from 2.25% in July. The current rate adjusted for a 12 month CPI forecast of 4.5%, suggests a real rate of 2.0%.

We think this allows the MPC space to reduce the repo rate by 25bps but there are important event risks in October and November.

Figure 3: Policy rates adjusted for 2020 Bloomberg consensus CPI forecast

Arguments for a 25bps rate cut

- A wider negative output gap.

- A downward revision to the near term inflation forecast.

- Wider effective real rates.

Arguments for keeping rates on hold (Bloomberg consensus expected the MPC to keep rates unchanged)

Wider twin deficits

South Africa’s twin deficits on the current account and government’s budget, are expected to increase in 2019 and 2020. The slowdown in global trade and domestic production have

exerted downward pressure on exports and we forecast the current account deficit to widen from 3.6% of GDP in 2018 to 3.9%.

The main budget deficit is forecast to witness a marked deterioration compared to National Treasury’s February forecast of 4.6% of GDP, rising to 5.9%. South Africa’s event risk in October is high as we are waiting for Eskom’s strategic turnaround plan, the Medium Term Budget Policy Statement (tentatively on October 23) and the outcome of Moody’s rating review on 1 November.

Geopolitical risks and foreign portfolio flows

Foreign portfolio flows and bank lending remain the key sources of funding of the current account deficit with FDI inflows low. Geopolitical risks with the recent elevation in the Middle East, could see foreign investor sentiment remain fragile even as the Fed continues to reduce interest rates.

Oil price and rand uncertainty

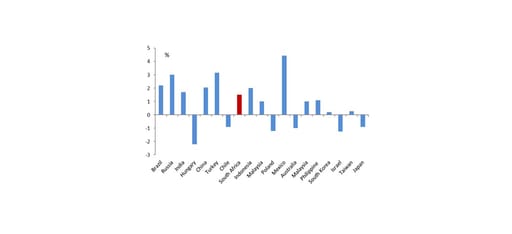

Figure 4: Market expectations – FRA rates assign a 60% probability to a Sep MPC rate cut and 100% to a Nov MPC rate cut