Few industries will have felt the negative impact of the global pandemic as acutely as the hospitality and airline industries. With all forms of long distance travel abruptly shut down to prevent the spread of the coronavirus, business leaders were faced with probably the biggest challenges of their professional careers.

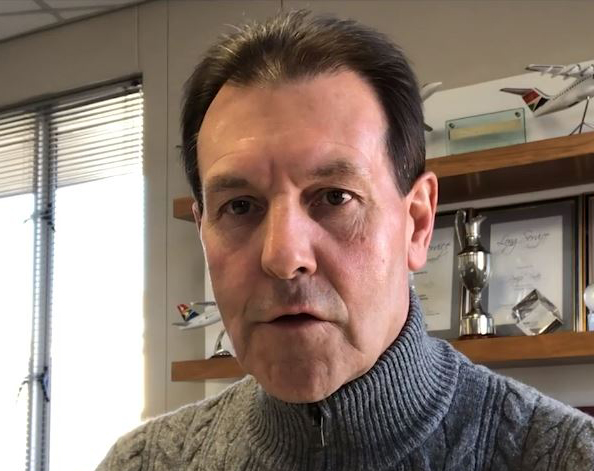

Head of Investment Banking and Investments at Investec, Nick Riley, spoke to Rodger Foster, CEO of SA Airlink and Marcel van Aulock, CEO of Tsogo Sun, in the first of our series, The Other Side. They shared their experiences and spoke about the outlook for their industries in a frank and absorbing exchange.

Listen to the full discussion on the go

You can listen to the full discussion between Investec's Nick Riley, Tsogo Sun's Marcel von Aulock and SA Airlink's Rodger Foster on this podcast.

Subscribe to Investec Focus Radio SA

Highlights of the discussion:

On having to respond quickly to the lockdown

Von Aulock: “In the space of 48 hours …. they announce[d] the shutdown and we had to close 103 hotels in three days. So I guess the toughest part of the whole thing was shutting it down quickly. We also had to realise very quickly that we were going to zero revenue for at least three months.”

On comparing Covid-19 to previous crises

Foster: “Our business has been confronted by serious issues previously: 9/11, the SARS virus pandemic, and the financial contagion with 2008. [But] this is the first time we’ve ever been confronted, in my 28 plus years of being here as the CEO of Airlink and, as far as I know, the first time in the history of aviation, that there has been a total shutdown of all air travel in South Africa and most parts of the world.”

On managing cash flows in a crisis

Von Aulock: “No business can last two or three years without cash flow. So what’s the worst case scenario [in which] you can survive? How long can you go with no revenue and realistically still keeping staff either on low or no pay without actually defaulting? If you can last another three months, six months without burning into your cash reserves that is a victory in itself.”

In the space of 48 hours, they announced the shutdown and we had to close 103 hotels in three days. So I guess the toughest part of the whole thing was shutting it down quickly.

On the willingness to travel

Foster: “[According to a survey by the International Air Travel Association], 83% of travelers were concerned about contracting Covid-19 whilst on board an aircraft or experiencing the air travel value chain. 65% believed that they could be infected while on board an aircraft only. Only 12% of the customers would be ready to jump back into an aircraft immediately without any concerns and 83% elected to postpone their travel requirements.”

On the experience so far of opening up for business travel

Von Aulock: “We focused on hospitality because the travel experience I think is going to be relatively traumatic from the minute you leave home. We focused more on the warmth and hospitality and less on telling people how we were changing the protocols, because everybody’s changing those protocols.”

On consolidation in the market

Von Aulock: “Could there be some consolidation? There could be, but quite frankly, the Hospitality Fund was probably the biggest acquisition we ever did in hotels before and I don’t think there’s too much out there, unless you’re buying up small individual properties.”

Foster: “The market will not be able to absorb all of the capacity that was there pre-Covid and one just has to look around the world and have a look at aircraft owners and lessors, aircraft operators and the extent to which aircraft have been parked all over the world. Not all of those aircraft are going to get up and fly again, so my opinion … there needs to be some consolidation and some rationalisation.”

“I also predict that some 40% of the world’s aircraft that existed pre-Covid are not going to be flying again, so some 60% will return to service over time.”

I predict that some 40% of the world’s aircraft that existed pre-Covid are not going to be flying again, so some 60% will return to service over time.

On the controversy around insurers not paying out on business interruption claims

Von Aulock: “I expect they (insurers) are going to fight every inch of the way no matter what judgments come, everything is going to be appealed, so insurance is unlikely to keep you alive in the medium term. You're going to have to talk to your bankers and you will have to ensure your own liquidity plans are in place.”

On what the future holds for the consumer

Von Aulock: “Most people in South Africa I think are going to get cheaper hotels and I think you're going to get proper good value in travel. Everyone will have to reduce their cost base and be able to operate at lower rates. There’s an element of travel at the real top end, which has always been completely price insensitive, and I think that part will still boom.”

Foster: “We think in the shorter term it’s going to be much more affordable to travel by air, mainly because of oversupply and under demand. At the moment the margins are all negative, but once they all normalise we will get a blend of destinations. We have some high end destinations, tourist destinations that includes some business tourist destinations.”

Get Focus insights straight to your inbox

About the author

Patrick Lawlor

Editor

Patrick writes and edits content for Investec Wealth & Investment, and Corporate and Institutional Banking, including editing the Daily View, Monthly View, and One Magazine - an online publication for Investec's Wealth clients. Patrick was a financial journalist for many years for publications such as Financial Mail, Finweek, and Business Report. He holds a BA and a PDM (Bus.Admin.) both from Wits University.