03 Nov 2021

COP26 and the journey to net zero

An opportunity to review the targets set in 2016 and discuss future strategies.

With the COP26 UN Climate Change Conference commencing from Sunday 31 October in Glasgow, climate change is at the top of the news agenda, and it’s a fitting time to think about the global energy transition and the race to reach carbon net zero.

The time pressure is on

The world is slowly beginning to wake up to the severity of change required to meet net zero targets by 2050. Unfortunately, speed is of the essence. Looking back to the 1880s, it took 100 years from the discovery of oil until it hit 50% of the overall energy mix. We are trying to pack a similarly radical energy transition into just 30 years. This time, we do not have much of a choice if we want to prevent global warming.

The cost is substantial

Reaching the net zero targets will require developed countries to commit $100bn a year (a figure first pledged in 2009) to help developing countries cut their own carbon emissions. This is just a fraction of the estimated $4tr a year total spending required to limit global warming to less than +1.5ᵒC, the primary commitment of the Paris Agreement.

Prime Minister Boris Johnson recently said that “people need to understand that this is crucial for the world.” However, he also said that there is a “six out of ten chance” of getting other countries to sign up to financial and environmental targets ahead of next week’s conference, leaving a 40% chance of failure.

COP must be a catalyst

COP26 is a large part of the process of spurring governments into action, as world leaders will review both targets and strategies. As the conference occurs every five years, this year will be the first event since the signing of the Paris Agreement and the first opportunity to formally review the targets from 2016.

A recent United Nations report showed, rather than achieving the required reduction of 45%, carbon emissions are actually set to increase by 16% by 2030 (with China being a large contributor).1

This puts us on track for global warming of +2.7ᵒC, well above the 2016 target. To counteract this, a Carbon Tax is expected to be introduced to prompt corporations to take more action now, and certain targets may become legally binding.

The UK must take more action

The UK is ahead of the curve when it comes to fulfilling net zero targets and only contributes 1% to global emissions.

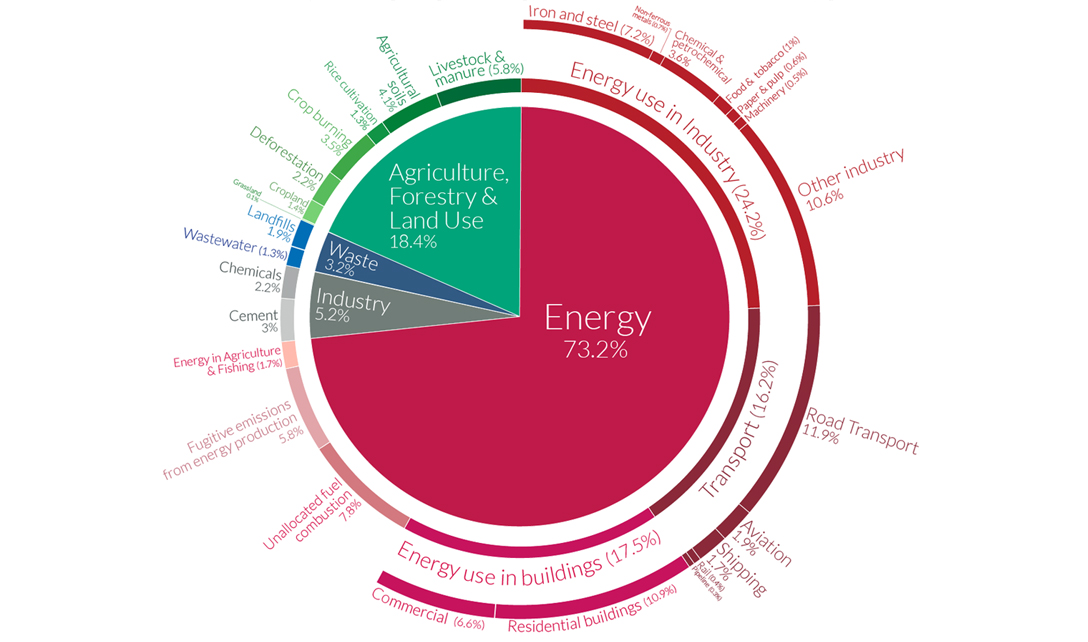

Source: IEA, Breakthrough Energy, May 2021

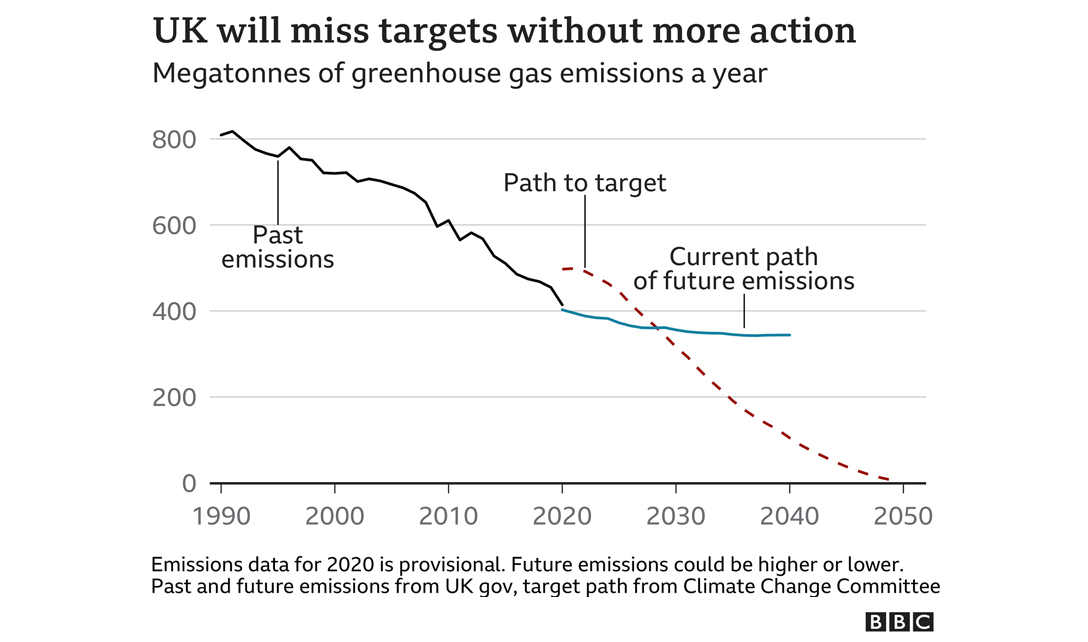

However, despite reducing our emissions by 40% since 1990, there’s still a long way to go. The government recently announced its plans to cut greenhouse gas emissions, but there was notably no reference to either meat consumption or aviation - two areas that contribute around 10% to global emissions and must be addressed if we are to reach our targets.

Source: Dept. for Business, Environment & Industrial Strategy, CCC

The profitability of carbon neutrality

Whilst this narrative carries a pessimistic tone, there are many governments and companies which see the competitive advantage of being carbon negative. One example is BrewDog, which has become the first carbon-negative brewery. The company now owns a 9,308-acre plot of land in Scotland and plans to plant 3 million trees by 2025. BrewDog has a market share of 21% of UK craft beers and a market cap of circa $2billion according to recent fundraising - not bad for a company founded in 2007.

Investing for good

At Investec, we recognise that we have a role in the allocation of capital that comes with certain obligations. We can use our influence to call for progress and demand action from the companies we invest in.

If you’d like to discuss what we can do with your investments to support the fight against climate change, or any other ethical or environmental considerations, please get in touch with your dedicated investment manager.

1 National determined contributions under the Paris Agreement. Synthesis report by the secretariat (unfccc.int) under point 10 of the exec summary for the 16% increase

Summary for Policymakers — Global Warming of 1.5 ºC (ipcc.ch) under point C.1. for the 45% required reduction

About the author

To contact or read more about Mike Radford visit his biography here.

Find out more

Whether you are looking to invest for the first time, or have an investment portfolio already, if you don’t know where to begin, or know exactly what you are looking for, we can help. Contact your local Investec experts in Cheltenham today, to discover how we can help you to fulfil your financial goals, and live life the way you want to.