05 Oct 2020

Portfolio positioning for the post-Covid economy

Our strategic approach in the face of inflation

With 2020 still far from over, the year has already produced events that few could have predicted. As Vladimir Lenin once said, “There are decades where nothing happens – and there are weeks where decades happen.”

A black swan event?

To many, Covid-19 is a “black swan” event – a phrase coined by Turkish American economist Nouriel Roubini to describe an unforecastable event with far-reaching ramifications.

But is it a black swan in the truest sense? It is convenient for world governments to blame the coronavirus for the economic malaise we find ourselves in but this ignores two significant facts:

- The potential for a catastrophic global pandemic has been talked about for years (see Bill Gates’s 2015 TED talk)

- The global economy was already on the brink of recession as we entered 2020

An unprecedented fiscal response

Without underplaying the very real human cost that Covid-19 continues to exert on societies around the globe, the fiscal and monetary response to the pandemic is truly astronomical.

Ten years ago, the quantitative easing (QE) response to the financial crisis was described as a monetary experiment, but today’s “QE4ever” is of a whole different order of magnitude, and this time the crisis is in the real economy, rather than confined to the banking system.

Recovery reliant on quantitative easing

The consensus is that the probable shape of recovery remains somewhere between a ‘V’ and a ‘U’, but this is dependent upon continued liquidity injections to fill the void until such time as normal service resumes, at which point government balance sheets can be reduced and tax receipts recover.

But there is “nothing so permanent as a temporary government programme” (Milton Friedman, ‘Tyranny of the Status Quo’, 1984), and I fear that the necessary economic response to the crisis will prove impossible for governments to wean themselves off.

A surplus of consumer cash

With all this money being digitally alchemised is it any wonder that household incomes have risen this year, and that some of this money has found its way into savings, retail spending, and the stock market?

A new generation of millennial speculators has been spawned, with over 5 million new brokerage accounts opened in the USA since March. With the Federal Reserve doing ”whatever it takes” and with surplus cash in the hands of the young, this momentum trade will take some stopping.

Inevitability of inflation

At some stage, this money printing will result in inflation - because it is basic economics that if you create more of something, you reduce its value. This is possibly why we are beginning to see a decline in the dollar.

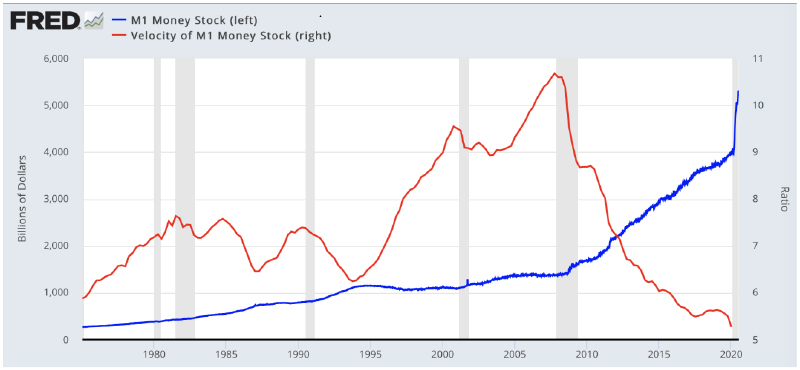

But do not expect inflation to emerge imminently. Despite the massive expansion of the monetary base (see blue line on the chart below), the velocity of money remains at ultra-depressed levels, reflecting global demand destruction caused by the response to Covid-19. But when the red line below starts to tick up, watch out.

Source: Federal Reserve Economic Data. The website is https://fred.stlouisfed.org/

Overvaluation of equities

So the status quo persists, with stock prices in some cases appearing absurd (e.g. Tesla). But, we have seen this before – indeed, former Chair of the Federal Reserve Alan Greenspan talked of “irrational exuberance” in 1996, a full three years before the dot com bubble of 1999-2000.

The stock market, in essence, is a popularity contest driven by liquidity. Over time, true value is created and rewarded but over short periods, anything is possible. The bond markets are far larger and more significant to the global economic plumbing, and they are still warning of troubled times ahead, as attested by ultra-low yields.

A bond market bubble

Portfolio positioning for current market conditions is, therefore, trickier than for some considerable time because stock market valuations, at first sight, seem divorced from fundamentals, whilst the becalmed bond markets are in bubble territory when judged by history.

Real interest rates (= bond yields minus inflation) are now negative in most countries (i.e. circa +0.6% US 10yr Tr minus circa 0.8% US CPI) implying that the rationale for buying government bonds has moved from the expected return ‘on’ your money to the hope of the return ‘of’ your money.

The debt dilemma

The elephant in the room is the unsustainable level of debt that has been allowed to balloon over the last few decades, and which has more recently become out of control.

Inflation is the only real solution to the debt problem (which governments would seemingly welcome with open arms!). Indeed, modern monetary theory (MMT) is now openly countenancing yield curve control as a future measure for controlling the effects of inflation when/if it comes, but this would simply add even more debt to government balance sheets.

Our strategic approach

Equities:

In the current environment, global equities with low debt and sound franchises, and positioned in growing sectors, represent the best defence as well as attack.

Quality growth companies in sectors proving to be the winners in a post-Covid world, such as technology and pharmaceuticals, have the pricing power and consistency of earnings to ward off the threat of inflation when it comes, albeit their valuations may fluctuate.

Bonds:

In the fixed interest space index-linked “govvies”, unlike cash or conventionals, will offer protection, if not yield, and for the adventurous, emerging market debt should fare well if the dollar continues to slide. Infrastructure, renewable energy, structured products, and certain property assets can also prove resilient whilst also maintaining a healthy yield which has become harder to find amongst equities.

Commodities:

Of course, there is gold and silver, (and their much more volatile respective mining equities). Equities remain fair value when compared to long-term bond yields, which are unlikely to change course any time soon, but the chart below (albeit a little out of date) explains the rationale for most client portfolios now containing a healthy allocation to commodities where appropriate, despite gold having hit an all-time high this year.

Source: Professor Dr. Torsten Dennin, Lynkeus Capital, Incrementum AG

It pays to get advice. Whether you are looking to invest for the first time, or have an investment portfolio already, if you don’t know where to begin, or know exactly what you are looking for, we can help. Contact your local Investec experts in Cheltenham today, to discover how we can help you to fulfil your financial goals, and live life the way you want to.

About the author

To contact or read more about Ed Mawle, visit his biography here.

Find out more

Whether you are looking to invest for the first time, or have an investment portfolio already, if you don’t know where to begin, or know exactly what you are looking for, we can help. Contact your local Investec experts in Cheltenham today, to discover how we can help you to fulfil your financial goals, and live life the way you want to.