Group Strategy

Our strategic goals and objectives are based on the aspiration to be recognised as a distinctive bank.

Investec Bank is a values-driven organisation, dedicated to its core purpose of creating enduring worth. We deliver exceptional service to our clients, striving to create long-term value for all of our stakeholders and contributing meaningfully to our people, communities and planet.

Our distinction

The Investec distinction is embodied in our entrepreneurial culture, supported by a strong risk management discipline, client-centric approach and an ability to be nimble, flexible and innovative. We do not seek to be all things to all people. Our aim is to build well-defined, value-adding businesses focused on serving the needs of select market niches where we can compete effectively and build scale and relevance

Our unique positioning is reflected in our iconic brand, our high-tech and high-touch approach and our positive contribution to society, macro-economic stability and the environment. Ours is a culture that values innovative thinking and stimulates extraordinary performance. We take pride in our depth of leadership and we employ passionate, talented people who are empowered and committed to our mission and values.

Our strategic direction

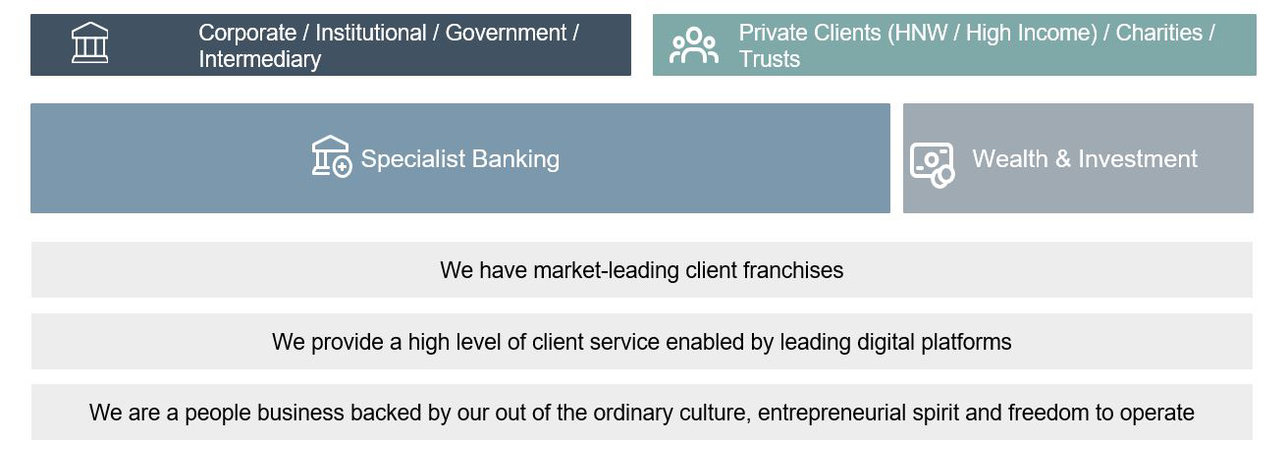

Our long-term commitment is to One Investec; a client focused strategy.

First and foremost, the strategy is a commitment to drawing on the full breadth and depth of relevant capabilities to meet the needs of each and every client, regardless of specialisation or geography.

One Investec is also about improving internal operating efficiencies; ensuring that investments in infrastructure and technology support our differentiated service offering across the entire group, not just within specific operating units or geographies.

And in our allocation of capital, the One Investec strategy demands a disciplined approach to optimising returns, not merely for one region or business area but for the group as a whole.

Our strategic framework

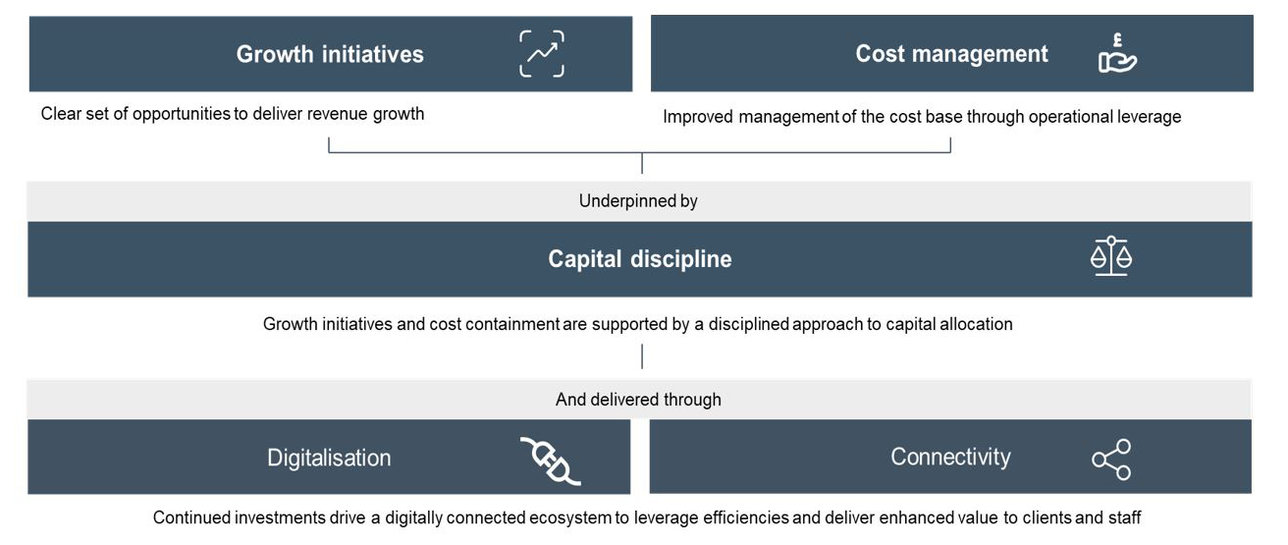

Two years ago, we set out to simplify our structure, heighten our focus and improve our growth trajectory. We organised our strategy into five key areas, which have evolved as illustrated below:

For details on the progress on the strategic objective, please refer to Annual report, DLC vol I

Our medium term targets

| Medium term targets | 31-Mar-21 | 31-Mar-20 | |

| ROE | 12% - 16% | 6.60% | 8.30% |

| Cost to income ratio* | < 63% | 70.90% | 68.20% |

| CET1** | 10% > | plc: 11.2% | plc: 10.7% |

| Ltd: 12.2% / 12.8% | Ltd: 10.9% | ||

| Dividend payout ratio | 30% to 50%45.00% | 45.00% | 38.1%*** |

* The group has changed its cost to income ratio definition to exclude operating profits or losses attributable to other non-controlling interests. As such, the cost to income ratio is calculated as: operating costs divided by operating income (net of depreciation on operating leased assets and net of operating profits or losses attributable to other non-controlling interests).

** CET1 target of >10% applies separately to both Investec plc (based on Standardised approach) and Investec Ltd (based on Foundation Internal Ratings Based approach).

^ Proforma after the approval from Prudential Authority in South Africa to measure SME and Corporate under Advanced Internal Ratings-Based (AIRB) approach from 1 April 2021, engaged on further AIRB conversion that is expected to result in 100bps to 150bps CET1 uplift.

*** In light of regulatory guidance provided to banks in both South Africa and the UK, the board decided not to declare a final ordinary dividend for the 2020 financial year. The 11.0 pence in FY2020 reflects the interim dividend per share which was prior to the demerger of the asset management business (Ninety One).The dividend payout ratio and dividend yield are therefore calculated with reference to the corresponding adjusted earnings and closing share price, respectively, for the six months ended 30 September 2019.

Strategic review and demerger of the Investec Asset Management business

As announced on 14 September 2018 following a strategic review, the group made a decision to demerge and separately list the Investec Asset Management (IAM) business. The demerger and the listing of IAM (now 'NinetyOne') was subject to regulatory and shareholder approvals, and was completed during the first quarter of 2020.