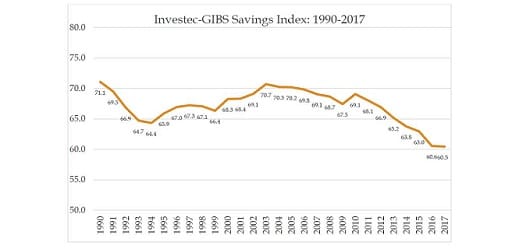

Investec and the Gordon Institute of Business Science (GIBS) have released the latest results of the Investec GIBS Savings Index, which measures South Africa’s savings rate and the country’s savings behaviour. The headline index figure for 2017 Q3 was announced today at 60.5 points at the end of 2017, which marks a low point in South Africa’s savings track record for 27 years.

A core argument behind the Investec GIBS Saving Index is that for South Africa to achieve the kind of elevated and inclusive growth that shapes economic competitiveness, our economy needs an investment rate in excess of 30%. “A savings index score of 100 represents a ‘pass mark’ for South Africa in terms of savings to support our economic growth objectives. The latest figure of 60.5 points shows we still have a long way to go towards laying the foundation for that kind of growth,” comments René Grobler, head of Investec Cash Investments, who spearheaded the creation of the Investec GIBS Savings Index in 2016 with the aim of creating more visibility around the importance of savings in South Africa and to provide a global benchmark for SA with the rest of the world.

“Given the tough political environment towards the end of last year and the near-recessionary conditions that loomed over the economy towards the end of 2016 and much of 2017, this is not a surprising result,” comments Professor Adrian Saville, professor of economics, finance and strategy at GIBS and chief executive of Cannon Asset Managers and who also co-authors and prepares the Index. “However, our sense is that we are on the cusp of a story that has a silver lining.”

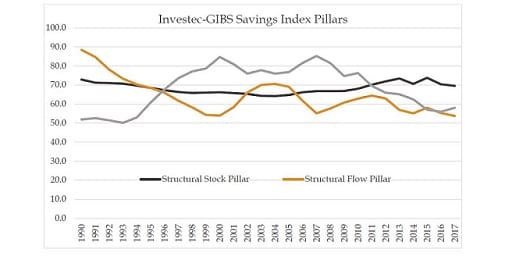

The Index measures the performance of the South African economy in terms of its capacity to fund critical investment through savings and is structured around three key pillars, namely:

- The Structural Environmental Pillar measures the propensity of the South African environment to encourage and promote savings;

- The Structural Flow Pillar measures the consequent flow of savings that fund required investment; and

- The Structural Stock Pillar measures the accumulated stock of savings that is the result of historical flows.

In the latest results, the Structural Flow pillar remains in a long-term downward trend from 1990 to present, and underlines the need for South Africa to structurally reform the economy. “The Index score for this economically sensitive sub-component resembles the levels for the late 1990s, when we saw the emerging market crisis and the late 2000s, when we saw the global financial crisis,” he says.

Furthermore, the other two pillars also influence South Africa’s ability to save and attract investment. “We tend to underestimate the impact environmental, economic and political factors can have on individuals, corporates and government’s ability to save, and this is reflected in the latest disappointing figures,” adds Grobler.

“A propensity to save and the ability to invest are intertwined, and both are required for long-term wealth creation – in the case of individuals – or economic growth – in the case of nations,” says Grobler.

“A culture of saving at every level of society is critical to the well-being of our citizens, and to the sustained economic health of our country. Programmes that promote personal saving and financial education are as important as sound economic policies.”

“Tax-free savings accounts, tax incentives for retirement savings, initiatives like Savings Month and the like are positive means of promoting a savings culture, but they are not enough to reach South Africans who are still financially illiterate,” warns Grobler.

Her hope is that Ramaphosa’s government will recognise the importance of introducing financial literacy curricula to children even at primary school level, and find innovative ways to improve basic financial education of youth and adults that may support entrepreneurs in small business growth and encourage South Africans to save and spend wisely.

As much as South Africa needs to work on structural elements to repair the organisational make-up of the economy, there is a prospect of near-term improvement. “Business confidence plays a big role in savings and investment decisions, both for South Africans and foreign investors,” adds Grobler. “An improvement in 2018, following the positive indications on the political and economic stability of the country in December and January, could bolster business sentiment and confidence in the country.”

Adds Saville, “We anticipate that as soon as the next quarter we will start seeing encouraging signs of life from the Index and its underlying components such as the Structural Flow and Structural Environmental Pillar indicators.”

The capital funding for investment, he goes on to say, can only come from savings. “The importance of this element is recognised by Cyril Ramaphosa in his New Deal, which targets 3% GDP growth in 2018 and rising to 5% growth by 2023,” Saville explains. “To put this ambitious plan in place, we need to massively increase levels of investment from around 20% of GDP currently to the National Development Plan (NDP) target of 30%.”

“Although this quarter’s result is the lowest we have for the index from 1990-2017 and does not make for great reading, the reading itself underscores the need for the Index as a robust measurement tool,” Saville points out.

“As a barometer to track and evaluate our country’s savings performance, we believe the Index is becoming increasingly relevant,” agrees Grobler. “In short, it does not only reflect our overall savings culture but also shows the influence of environmental factors. While we are seeing those influences in the latest figures, we can also be encouraged that it may lag the positive changes that lie ahead and help us emerge from the savings trap.”

“We believe that savings has to be firmly on the agenda as we go into 2018,” Grobler concludes. “For a more inclusive economy and elevated economic growth, we need more investment and to achieve that, we need higher savings.”