Investec Life

Conflict of Interest Policy

1. Introduction

Investec Life Limited is a registered life insurer and an authorised Financial Services Provider (47702).

In terms of the Financial Advisory and Intermediary Services Act (FAIS) General Code of Conduct Board Notice 80 of 2004 as amended by Board Notice 58 of 2010, it is required that a Financial Services Provider (FSP) must maintain and operate effective controls and measurements, taking reasonable steps to identify, monitor and manage conflict of interest to safeguard its clients’ interest and ensure fair treatment of clients.

It is the objective of this policy to provide a framework for adequate conflict of interest management where all providers, Key Individuals, Representatives, associates and administrative processes will ensure that the quality of financial services is not compromised, professionalism levels will be maintained and client will receive best advice. It will further ensure that full disclosures are made to the client where a conflict of interest exists.

The purpose further of this document is to provide our clients with appropriate information in relation to the policies we have in place to manage conflicts of interest.

The policy is applicable to Investec Life and its representatives and consultants.

-

2. Commitment

Investec Life Limited commits itself to conducting its business honestly, fairly and ethically wherever we operate in the world. We strive to create and maintain our reputation for honesty, fairness, respect, responsibility, integrity, trust and sound business judgment. No illegal or unethical conduct on the part of officers, directors, employees or affiliates is in the business’ best interest.

The business will not compromise its principles for short-term advantage. The ethical performance of this business is the sum of the ethics of the men and women who work here; thus, we are all expected to adhere to high standards of personal integrity.

We acknowledge that operating a business naturally creates conflicts which might increase reputational risk; it is further for this reason that a Conflict of Interest Policy is fully subscribed to by all stakeholders.

Investec Life does not offer any financial interest to its representatives and intermediaries for:- giving preference to the quantity of business secured for Investec Life to the exclusion of the quality of the service rendered to clients;

- giving preference to Investec Life, where a representative or intermediary may recommend more than one product supplier to a client; and

- giving preference to a specific product of Investec Life, where a representative or intermediary may recommend more than one product of Investec Life to a client.

Any breaches to the policy will be investigated and appropriate steps taken.

-

3. Policy availability

This policy is available to Investec Life’s representatives, clients and employees on the Investec website (www.investec.co.za/life), or as a copy, on request, from the representatives or compliance officer on lifecompliance@investec.co.za.

-

4. Definitions

The key definitions as set out in the FAIS General Code of Conduct:

Conflict of interest: Means any situation in which a provider or a representative has an actual or potential interest that may, in rendering a financial service to a client:

a) influence the objective performance of his/her obligations to that client; or

b) prevent a provider or representative from rendering an unbiased and fair financial service to that client, or from acting in the interests of that client, including, but not limited to:

i. a financial interest;ii. an ownership interest;

iii. any relationship with a third party.

Financial interest: includes any cash, cash equivalent, voucher, gift, service, advantage, benefit, discount, domestic or foreign travel, hospitality, accommodation, sponsorship, other incentive or valuable consideration, other than:

a) an ownership interest;b) training, that is not exclusively available to a selected group of providers or representatives, on:

i. products and legal matters relating to those products;

ii. general financial and industry information;

iii. specialised technological systems of a third party necessary for the rendering of a financial service; but excluding travel and accommodation associated with that training.

Immaterial financial interest: means any financial interest with a determinable monetary value, the aggregate of which does not exceed R1, 000.00 in any calendar year from the same third party in that calendar year, received by:

a) a provider who is a sole proprietor;

b) a representative for that representative’s direct benefit;

c) a provider, who for its benefit or that of some or all of its representatives, aggregates the immaterial financial interest paid to its representatives.

Ownership interest:

a) An equity ownership interest, for which fair value was paid by the owner, other than equity or ownership interest held by an approved nominee on behalf of another person; and

b) includes any dividend, profit share or similar benefit derived from that equity or ownership interest.

Third party: means

a) a product supplier;

b) another provider;

c) an associate of a product supplier or a provider;

d) a distribution channel;

e) any person who in terms of an agreement or arrangement with a person referred to in paragraphs (a) to (d) above provides a financial interest to a provider or its representatives.

Associate: means

a) in relation to a natural person, means:

i. a person who is recognized in law or the tenets of religion as the spouse, life partner or civil union partner of that person;

ii. a child of that person, including a stepchild, adopted child and a child born out of wedlock;

iii. a parent or stepparent of that person;

iv. a person in respect of which that person is recognized in law or appointed by a Court as the person legally responsible for managing the affairs of or meeting the daily care needs of the first-mentioned person;

v. a person who is the permanent life partner or spouse or civil union partner of a person referred to in subparagraphs (ii) to (iv);

vi. a person who is in a commercial partnership with that person.

b) in relation to a juristic person:

i. which is a company, means any subsidiary or holding company of that company, any other subsidiary of that holding company and any other company of which that holding company is a subsidiary;

ii. which is a close corporation registered under the Close Corporations Act, 1984 (Act No. 69 of 1984), means any member thereof as defined in section 1 of that Act;

iii. which is not a company or a close corporation as referred to in subparagraphs (i) or (ii), means another juristic person which would have been a subsidiary or holding company of the first-mentioned juristic person

(1) had such first-mentioned juristic person been a company; or

(2) in the case where that other juristic person, also, is not a company, had both the first mentioned juristic person and that other juristic person been a company;iv. means any person in accordance with whose directions or instructions the board of directors or members of, or in the case where such juristic person is not a company or close corporation, the governing body of such juristic person is accustomed to act.

c) in relation to any person:

i. means any juristic person of which the board of directors or members, or in the case where such juristic person is not a company or close corporation, of which the governing body is accustomed to act in accordance with the directions or instructions of the person first-mentioned in this paragraph;

ii. includes any trust controlled or administered by that person.

-

5. Conflict of Interest

A conflict of interest may exist when a director, employee or a consultant is involved in an activity or has a personal interest that might interfere with his or her objectivity in performing business duties and responsibilities.

Such conflicts may appear as favouritism or otherwise damage the reputation of the business or its employees.

An actual conflict of interest does not need to be present to constitute a violation of this procedure. Activities that create the appearance of a conflict of interest must also be avoided to ensure that the reputation of the business and its employees are not harmed.

For purposes of this policy, conflict of interest focuses around relationship between the client and the representative and/or the FSP (Investec Life).

Personal interests of employees must not influence or appear to influence business transactions.

Where a conflict of interest exists, disclosure must be made to Investec Life and interested parties and a management programme is launched to mitigate the conflict of interest.

-

6. Representative Incentives and Remuneration

Our representatives are remunerated by means of earning a monthly salary. No commissions are paid on new or existing business.

We strive to ensure that our employees remain motivated and believe that this remuneration scheme discourages inappropriate behaviour. We recognise remuneration as a potential conflict and therefore it is the policy of the business that no representative shall be remunerated or receive a financial interest as part of an incentive structure with its main or sole aim to increase sales. Investec Life commits to taking into account Treating Customer Fairly principles in respect of its remuneration strategy.

Incentives and production bonuses must take into account:

A combination of quantitative and qualitative criteria; and not limited to a specific product supplier; and not limited to a specific product.

Representatives in terms of the FAIS General Code of Conduct are prohibited from receiving a financial interest in excess of R1,000.00 (either as a single or cumulative value) from a single provider in any given year. Financial interests include anything included in the definition above. FAIS compliance officers will additionally maintain a register of financial interest received by the Representatives on their FAIS license to ensure that the R1,000.00 threshold is not breached in any calendar year. In the rare circumstance where the threshold is exceeded, the financial interest cannot be regarded as an immaterial interest. As such, the FAIS Representative and compliance officer must ensure that the relevant potential conflict disclosure is made to any affected clients. Which clients are affected will depend on the circumstances, and should be considered by the compliance officer on a case by case basis.

-

7. Relationship with intermediaries

Investec Life and its representatives may only receive from or offer to intermediaries, the following financial interest:

i. Financial considerations authorised under the Long-Term Insurance Act or the Insurance Act, as amended;

ii. Fees for the rendering of a financial service in respect of which the above fees are not paid, if those fees:- are specifically agreed to by a client in writing; and

- may be stopped at the discretion of that client;

iv. Subject to any other law, an immaterial financial interest; and

v. A financial interest, not referred to above, for which a consideration, fair value or remuneration that is reasonably commensurate to the value of the financial interest, is paid by another provider or representative at the time of receipt thereof.

-

8. Identifying conflict of interest

To adequately manage conflicts of interest, the business must identify all relevant conflicts timeously.

Two levels of identification are employed:

Business level: The managing body will annually compile a register of potential conflict risks. The register is updated with all new potential conflicts identified, and to ensure completeness, is reviewed on an annual basis.

Employee level: All employees, including compliance officers and management, are responsible for identifying specific instances of conflict and are required to notify their manager of any conflicts they become aware of. They are further required to disclose all conflict of interest as they may arise and where there is no conflict of interest attest to the fact.

-

9. Management of potential or actual conflict of interest

The risk of conflicts of interest not being properly managed and controlled is, amongst others, that clients may not be adequately protected particularly where FSPs do not act with due care and diligence and in the best interest of their client. In addition, confidence in Investec Life’s services could be undermined and legal claims asserted.

In managing conflicts of interest, Investec Life’s procedure is to:- Identify the conflicts of interest;

- Assess and evaluate those conflicts; and

- Decide upon, and implement, an appropriate response to those conflicts.

The following is a list of possible management strategies to manage the potential or actual conflict of interest:- Avoid the conflict of interest

- Mitigate the impact

- Full disclosure of the Conflict of interest to clients, Investec Life management and other affected parties.

Material conflicts

Where a conflict will have a serious potential impact on our clients or our business, it must be avoided. Only the Chief Executive Officer or a person authorised by him may make the final decision regarding a material conflict and whether the management process must be followed.

Officers, directors and employees must avoid representing the business in any transaction with others with whom there is any outside business affiliation or relationship. Officers, directors, and employees must avoid using their business contacts to advance their private business or personal interests at the expense of the business, its clients or affiliates.

Officers, directors, and employees of the business must never permit their personal interests to conflict, or appear to conflict, with the interests of the business, its clients or affiliates. This may include but is not exclusive to:- Real or perceived financial gain resulting from recommendations to our clients at a cost to the client.

- An outcome in service delivery or a transaction that may differ from the real interest of the client.

- Any non-cash incentives that may be received by the business from affecting any transaction and/or product.

- Effecting a transaction and / or product that may result in a benefit to another party at the cost of the client.

-

10. Disclosure and record keeping

It is this business policy to avoid all possible conflicts of interest with clients, but if this is not possible, then full disclosure of this conflict must be made in writing to our clients where the conflict can impact on the clients.

Our clients will be adequately informed about any conflicts of interest that might affect the provision of financial services to them. This means providing clear, concise and effective disclosure so that clients can make an informed decision about how the conflict might affect the relevant service.

Where a conflict is identified and a decision made on the appropriate action, the nature of the decision must be communicated to the third party in writing as soon as possible. This applies regardless of whether the decision was made to stop doing business or continue with the business, despite the existence of the conflict.

Written records of how conflicts of interest are managed, together with all reports referred to, must be kept for a period of at least 5 years and be available for inspection by the compliance officer or the regulator on request (for example, records of disclosures made and actions taken over any breaches of policies and procedures).

-

11. Staff training, general awareness and monitoring

All the staff of Investec Life must be made aware of this policy and receive training on this policy.

A copy of the policy will be provided to each staff member at inception of that staff member’s duties and updated versions must be circulated as and when they are updated. Staff need to sign an acknowledgement that they received this policy and are committed to the policy.

All staff will sign an affidavit declaring that no conflict of interest exists between themselves and Investec Life and where there is a conflict of interest, such conflict is declared to ensure the proper management thereof.

Compliance with this policy will be monitored on an on-going basis and reported accordingly.

-

12. Consequences of non-compliance

Non-compliance with this policy by representatives and other employees will be subject to Investec Life’s disciplinary process.

Further, non-compliance with this policy by representatives may result in the termination of their contract and debarment with the Financial Sector Conduct Authority.

-

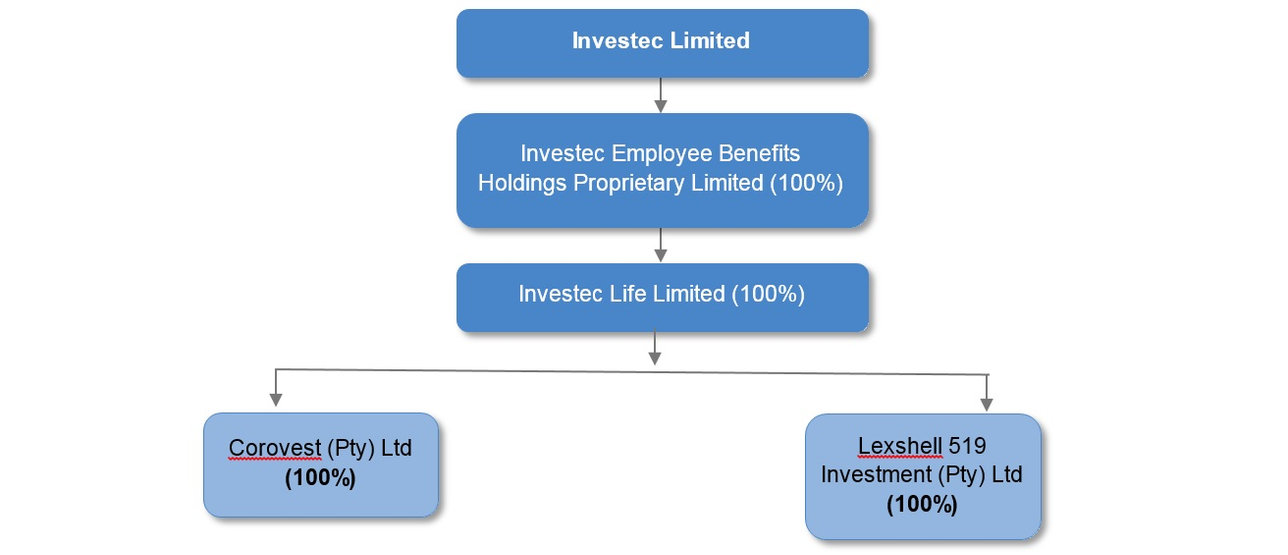

13. Names of third parties

Names of third parties holding an ownership in Investec Life or that Investec Life holds an ownership interest in.

-

14. Conclusion

The Policy should be read with other related policies including the Group Conflict of Interest Policy, available on the Investec website (www.investec.com).