There’s an old military adage that generals often end up “fighting the last war”, taking little account of how the battlefield may have changed. A similar observation may be made about central bankers, notably the Fed, who continue to concentrate on a danger that has passed.

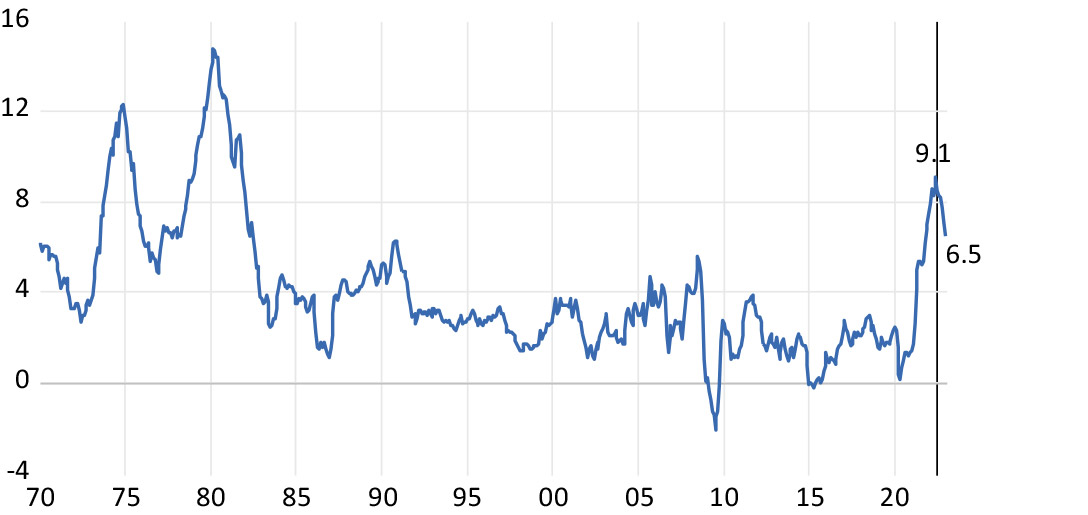

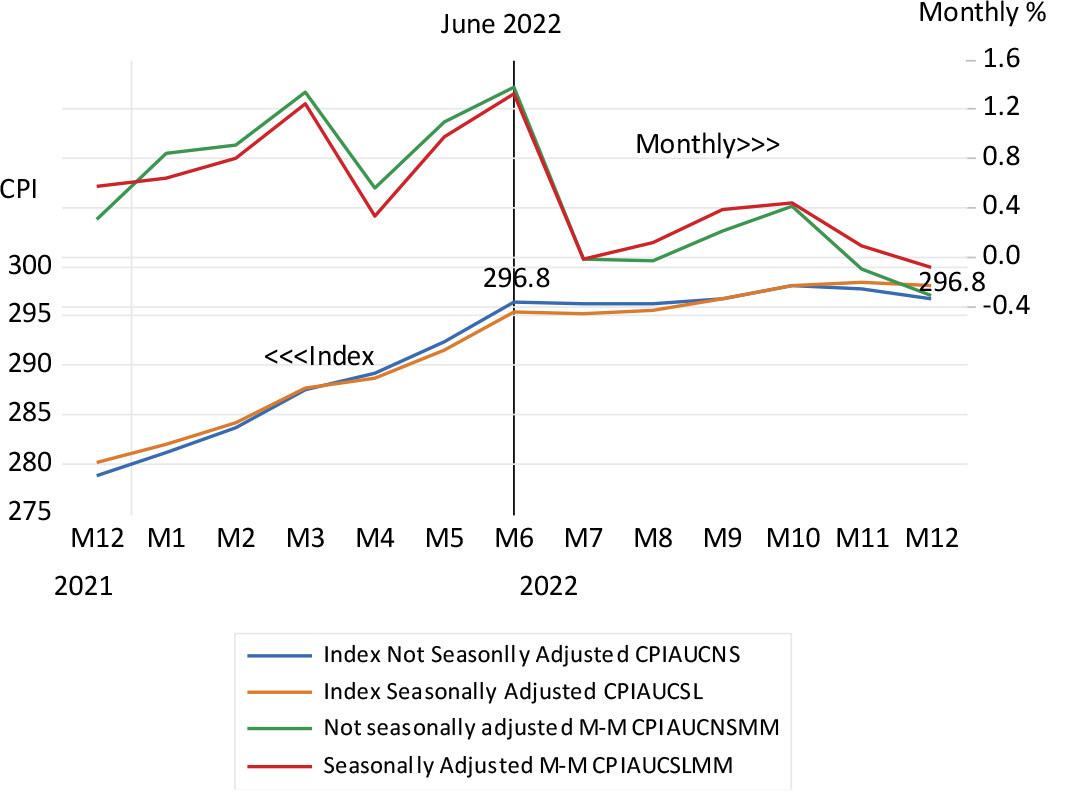

Recent US data show that there has been no inflation in the US for six months. The headline inflation rate in the US peaked at 9.1% in June last year. It fell rapidly and was 6.5% in December 2022. Month-on-month increases in the price level slowed down significantly after June. Month to month, the consumer price index (CPI) is now falling.

In short, the index was no higher in December than it was in June. Seasonally adjusted, it was only slightly higher over the six months and both versions of the CPI fell in December (see figures 1 and 2 below).

Figure 1: US headline inflation 1970-2022

Source: Federal Reserve Bank of St Louis and Investec Wealth & Investment, 12/01/2023

Figure 2: The US CPI, unadjusted and seasonally adjusted, monthly percentage change from January 2021 to December 2022

Source: Federal Reserve Bank of St Louis and Investec Wealth & Investment, 12/01/2023

The convention of measuring inflation as the year-on-year growth in the CPI has not helped to understand the inflation dynamics under the currently unusual and volatile circumstances. Six months can be a long time for an economy. Waiting a year to see what happens may be too long for a business or a central bank to make a judgment and adjust accordingly. If these monthly increases in the CPI remain at these levels for another six months, the headline inflation will recede to close to zero by June.

There is no good reason to expect a reversal of these trends, absent any new supply-side shocks to the economy over which the Fed has no influence. They should be ignored by the Fed because they are temporary and can reverse, just as the post-Covid supply side shocks have now reversed.

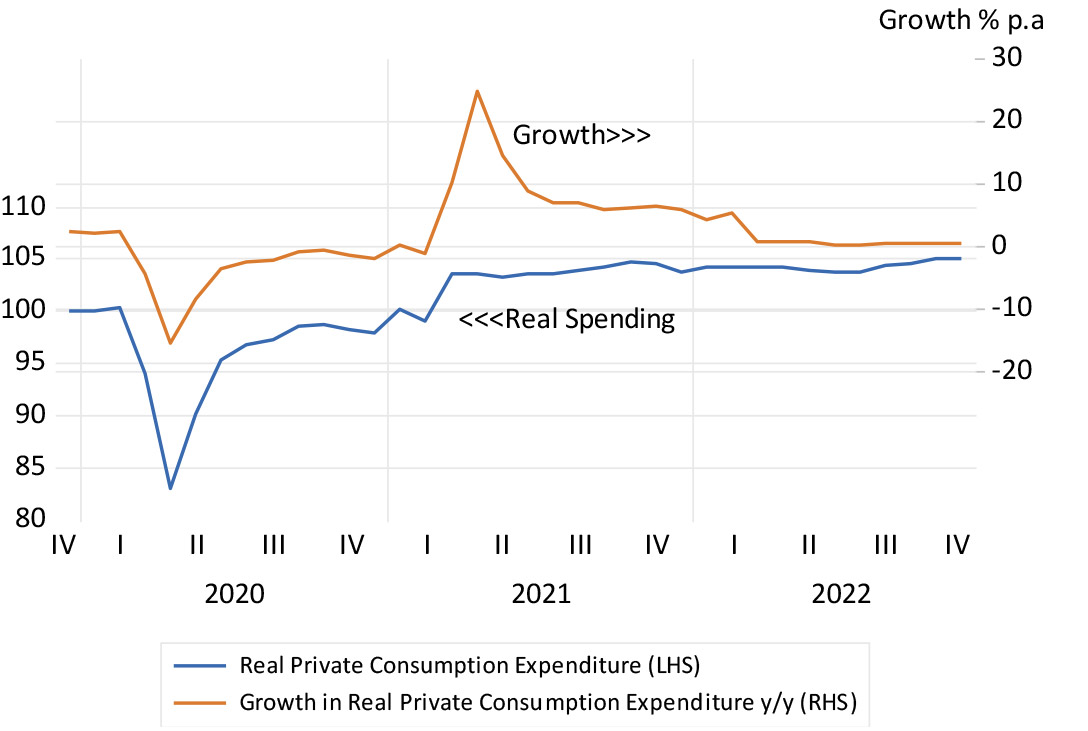

The demand side of the US price equation will not pose an inflationary danger if recent subdued trends in spending and the money supply (and bank credit) are maintained. Real private consumption expenditure, which accounts for 70% of all spending in the US, has not increased since the second quarter of 2021. The US money supply is now lower than it was in early 2022. Without any sharp reversal of short-term interest rates, any pick-up in aggregate demand seems unlikely. Any further and likely increase in interest rates will depress demand further.

The Fed has done what it needed to do to control inflation and that was to contain increases in aggregate spending. The absence of further growth in the money supply and bank credit in 2022 has helped, with higher prices themselves, to restrain the growth in real private consumption expenditure (PCE). Other measures of economic activity, for example, the monthly surveys of activity in the manufacturing sector and now also for the service sector, indicate that the US economy is shrinking.

The cause of higher prices is typically the result of too much demand (relative to constrained supplies of goods and services) and will inevitably be the result of excessive money supply growth. The effect of higher prices, as it has in the US, is to restrain volumes of goods and services demanded, reduce real disposable incomes, and will limit further price increases, provided no more money is pumped into an economy, which is the case in the US.

Figure 3: US Real private consumption expenditure and growth

Source: Federal Reserve Bank of St Louis and Investec Wealth & Investment, 12/01/2023

Unfortunately, the Fed greatly underestimated inflation and its persistence on the way up and has almost as egregiously overestimated it on the way down. One hopes for the sake of the US economy and its financial markets that the Fed will recognise that inflation is down, possibly out, for the foreseeable future, and that they will react accordingly.

There seems to be no good reason for the Fed to risk a recession to maintain low rates of inflation in 2023 by raising interest rates further. The Fed should rather be reducing them, given the likely state of the US economy. Nor should the Fed frighten investors and businesses about such possibilities, given the inflation outlook. The fright has been severe enough to remove trillions of dollars off the value of US equities, government and other bonds. There is good reason for the Fed and the market to expect satisfactorily low rates of inflation in 2023. On the current evidence of inflation and its causes, the Fed's guidance should be on the likely and reassuring prospect of a soft landing.

About the author

Prof. Brian Kantor

Economist

Brian Kantor is a member of Investec's Global Investment Strategy Group. He was Head of Strategy at Investec Securities SA 2001-2008 and until recently, Head of Investment Strategy at Investec Wealth & Investment South Africa. Brian is Professor Emeritus of Economics at the University of Cape Town. He holds a B.Com and a B.A. (Hons), both from UCT.

Get Focus insights straight to your inbox

Disclaimer

Although information has been obtained from sources believed to be reliable, Investec Wealth & Investment International (Pty) Ltd or its affiliates and/or subsidiaries (collectively “W&I”) does not warrant its completeness or accuracy. Opinions and estimates represent W&I’s view at the time of going to print and are subject to change without notice. Investments in general and, derivatives, in particular, involve numerous risks, including, among others, market risk, counterparty default risk and liquidity risk. The information contained herein is for information purposes only and readers should not rely on such information as advice in relation to a specific issue without taking financial, banking, investment or other professional advice. W&I and/or its employees may hold a position in any securities or financial instruments mentioned herein. The information contained in this document does not constitute an offer or solicitation of investment, financial or banking services by W&I . W&I accepts no liability for any loss or damage of whatsoever nature including, but not limited to, loss of profits, goodwill or any type of financial or other pecuniary or direct or special indirect or consequential loss howsoever arising whether in negligence or for breach of contract or other duty as a result of use of the or reliance on the information contained in this document, whether authorised or not. W&I does not make representation that the information provided is appropriate for use in all jurisdictions or by all investors or other potential clients who are therefore responsible for compliance with their applicable local laws and regulations. This document may not be reproduced in whole or in part or copies circulated without the prior written consent of W&I.

Investec Wealth & Investment International (Pty) Ltd, registration number 1972/008905/07. A member of the JSE Equity, Equity Derivatives, Currency Derivatives, Bond Derivatives and Interest Rate Derivatives Markets. An authorised financial services provider, license number 15886. A registered credit provider, registration number NCRCP262.