What lies in store for us in 2022? We have once again asked our panel of Investec Wealth & Investment strategists and other investment brains (from as far afield as Cape Town, Johannesburg and London) to answer a list of questions about the outlook for the year.

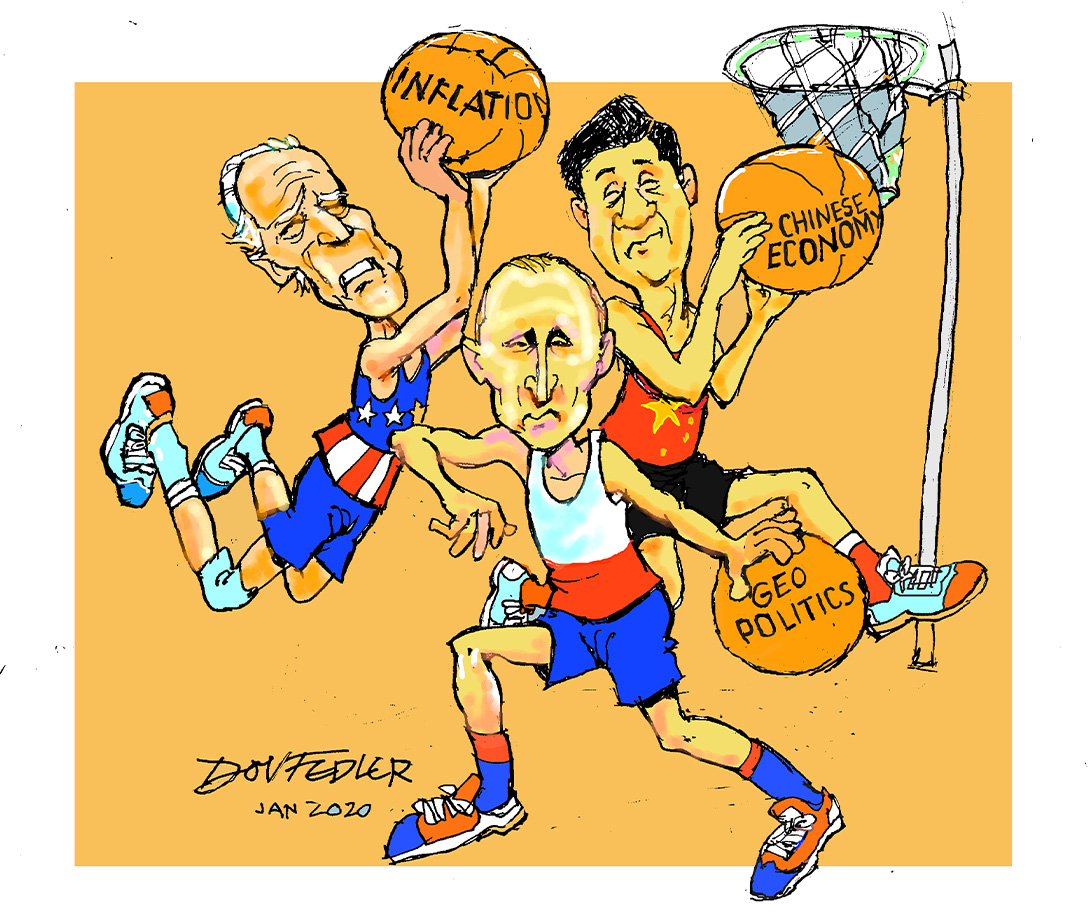

The questions cover the outlook for a (we hope) post-Covid world, the prospects for taming inflation and the world’s supply chain problems, China vs the US, Russia vs US and the role of ESG. They also discuss some of the sectors and themes to watch.

A few words on the broad range of views in this Q&A. We continue to contend that a range of different opinions is a strength of our business, since it implies a healthy and robust debate around the key investment issues of the day. Importantly though, this means this Q&A should not be considered as a “house view” – for that purpose, please refer to our latest Global Investment View, which provides a consolidated view of our Global Investment Strategy Group (GISG) and asset allocation teams.

(We should add that many of those who offered their views are members of the GISG and asset allocation teams, where their broad range of ideas and opinions contribute to the overall risk score, commentary and asset allocations of our different committees. The result is a well-distilled process that guides the way we manage your money.)

Our panel is made up of the following:

- Professor Brian Kantor (economist and strategist)

- Barry Shamley (portfolio manager and head of the ESG Committee)

- Bradley Seaward (portfolio manager)

- Chris Holdsworth (chief investment strategist)

- John Wyn-Evans (head of investment strategy, Investec Wealth & Investment UK)

- Richard Cardo (portfolio manager)

- Zenkosi Dyomfana (portfolio management assistant)

BS = Barry Shamley

BSE = Bradley Seaward

CH = Chris Holdsworth

JWE = John Wyn-Evans

RC = Richard Cardo

ZD = Zenkosi Dyomfana

Listen to podcast

In this episode of Investec's No Ordinary Wednesday podcast, Chris Holdsworth, John Wyn-Evans and Denvin Naidoo look at the impact of the geopolitical fallout and rising inflation on the local and global investment lanscapes.

I suspect central banks have it covered and in 12 months, we’ll be looking at much closer to normal levels of inflation.

Certain value segments are likely to be better rewarded by the market than others, such as financials and those associated with rising commodity prices, as the rotation out of growth into value plays over the course of the year.

The Democrats will lose both houses and this will mean legislative gridlock for two years – probably just as well as we don’t need more “stimulus”.

Russia’s response could include restricting European access to natural gas and cyber-attacks. This would present an upside risk to energy prices, exacerbate Europe’s current energy crisis and harm European economic conditions and risk assets.

Local markets will be driven by global consumer defensives with pricing power (eg. tobacco), the ongoing push towards green economy metals (positive for the miners) and undervalued mid and small caps.

Given current geopolitical developments, I think defensives in the short term, but cyclical and value in the medium to longer-term.

The differentiator will remain how well companies manage the data available to them - the opportunity is large.

About the author

Patrick Lawlor

Editor

Patrick writes and edits content for Investec Wealth & Investment, and Corporate and Institutional Banking, including editing the Daily View, Monthly View, and One Magazine - an online publication for Investec's Wealth clients. Patrick was a financial journalist for many years for publications such as Financial Mail, Finweek, and Business Report. He holds a BA and a PDM (Bus.Admin.) both from Wits University.

Receive Focus insights straight to your inbox