Receive Focus insights straight to your inbox

Sign up to the Focus newsletter for regular insights from Investec experts.

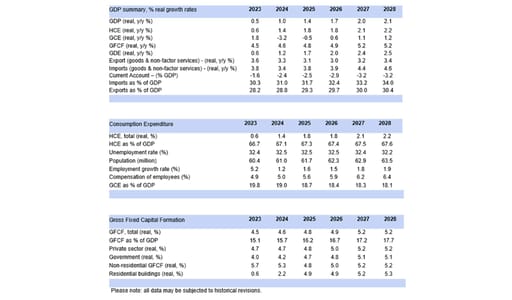

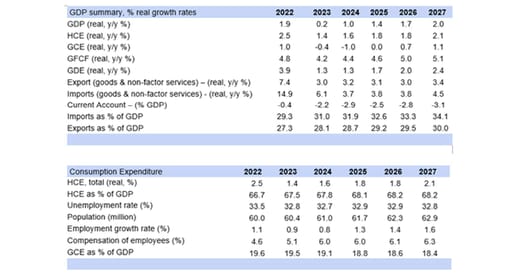

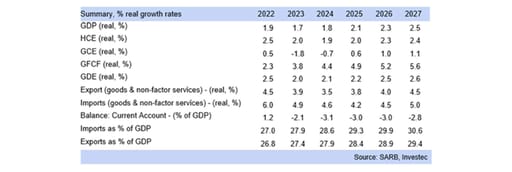

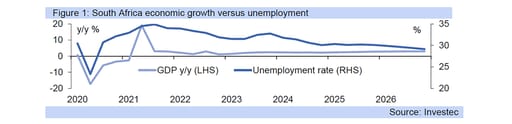

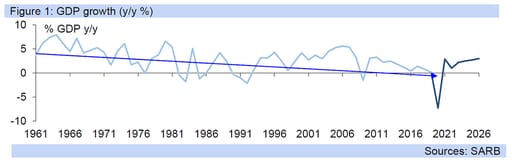

2023 was a hard year for the SA economy, and 2024 looks to see some improvement from the most likely 0.5% y/y economic growth outcome of last year, with the Q4.23 GDP due in March. 2024 is still set to see 1.0% y/y growth overall.

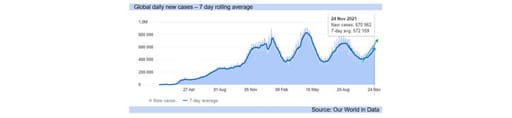

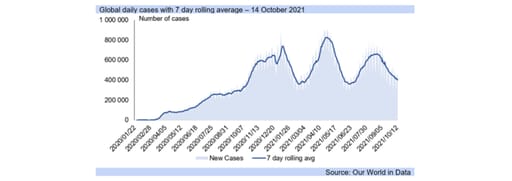

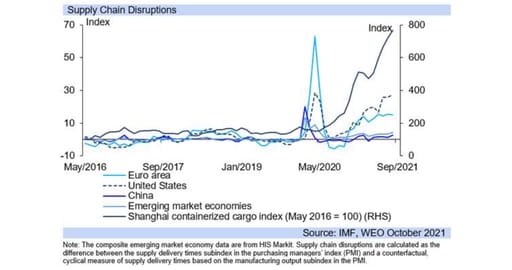

Globally, world trade is at risk from the disruptions to shipping through the Suez canal and drought in the Panama Canal, both of which carry substantial shipping traffic and the disruptions will cause longer transit times and higher costs.

The WTO (World Trade Organisation) is cutting its forecast for merchandise trade growth, both the likely outcome of 2023 due to the worsening disruptions in 2023, and for 2024, while tensions in the Middle-East have escalated.

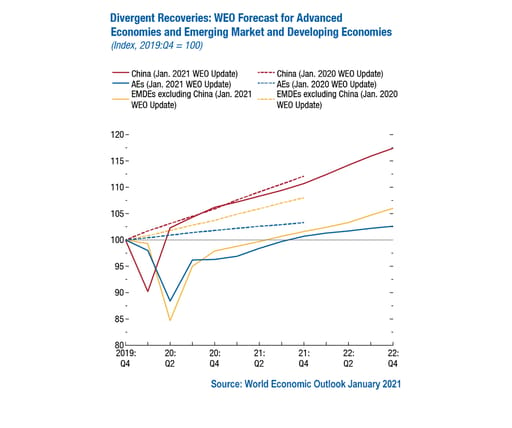

However, global economic growth has seen some positive developments which, on balance caused recent global growth forecasts to be revised up, in spite of risks, and the IMF shows no dip in growth from 2023, with a 3,1% outcome expected from both.

Worries of a global and US recession have died off, while both the US and a number of emerging-market economies experienced economic strength, causing the upwards revision to the IMF’s 2023 global growth forecast as well as its 2024 forecast.

The IMF highlights that “(w)hat we’ve seen is a very resilient global economy in the second half of last year, and that’s going to carry over into 2024”, particularly from the large EM’s India, Russia and Brazil, upgrading Asia’s growth forecast overall.

Noting “Asia is set to grow at 4.5% in 2024, up from October’s projection of 4.2%, the IMF said in a REO update for Asia today. The continent remains on track to drive about two-thirds of global growth in 2024, as it did last year”.

The “upward revision of 0.3 percentage point for Asia’s growth rate is due to positive momentum carried forward from 2023, sizeable policy stimulus announced by countries such as China and Thailand, and robust external demand.”

For South Africa, improved global growth expectations support an acceleration in its own growth rate, but freight and energy supply constraints will persist over the year as well, if lessening somewhat, providing potential growth limitations.

PREVIOUS SA ECONOMIC OUTLOOK COMMENTARY:

Budget Preview: expected to maintain deteriorated projections of MTBPS

2 Feb 2024

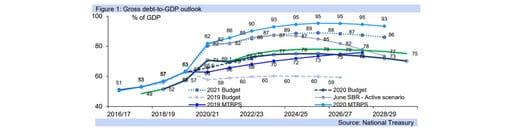

The Budget on 21st February is expected to see very similar fiscal ratio projections to 2023’s MTBPS revisions, as the marked fiscal slippage highlighted in November last year becomes entrenched, and so fiscal consolidation remains delayed.

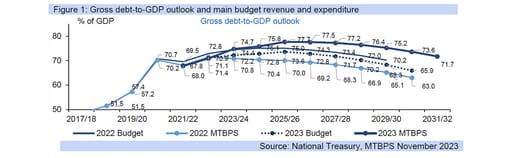

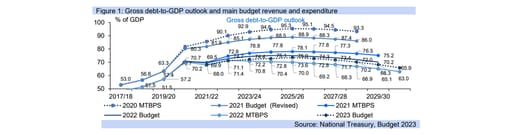

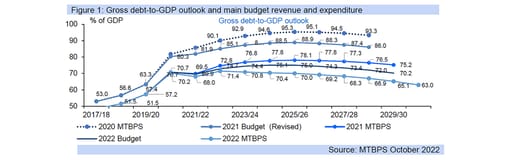

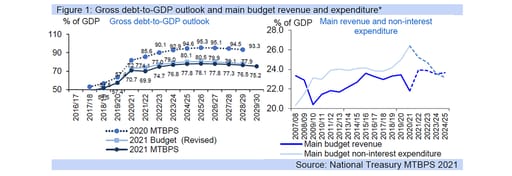

In November 2023’s MTBPS, gross debt was projected to peak at 77.7% of GDP in 2025/26, substantially higher than February 2023’s Budget estimate, of 73.6% of GDP for the same year.

Worryingly, gross debt was projected above 70.0% of GDP in 2031/32, and this reduces the sustainability of government finances, with a debt ratio of 60% of GDP instead seen as the maximum sustainable debt ratio for an EM economy.

For this fiscal year (2023/24), the 2023 February Budget projected gross debt at 72.2% of GDP, which was then pushed up to an estimate of 74.7% of GDP in 2023’s November MTBPS.

With the first three quarters of 2023/24 showing expenditure at 74.2% of budget, ahead of the 70.1% of the same period of 2022/23, and revenue at 71.5% of budget, under the 72.2% of the comparable period, a marked drop in the projected debt to GDP ratio for this year is unlikely.

The 2023/24 budget deficit was revised weaker, at -4.9% of GDP in the MTBPS versus -4.0% of GDP, further evidence of fiscal slippage, and the deteriorated budget deficit projections of later years won’t have improved substantially.

South Africa’s October MTBPS growth forecast for 2023 was overly strong, at 0.8% y/y, with the outcome most likely to be 0.5% y/y, which will add to the upwards pressure on the gross loan debt to GDP ratio, not detract from it.

For 2024, the MTBPS’s growth forecast is aligned to ours, at 1.0% y/y, but for 2025 the MTBPS’s 1.6% y/y is likely to prove too strong, given persistent load shedding, risking lifting the gross loan debt projection to GDP for 2025/26 too.

However, any lowering of nominal GDP estimates would increase the gross loan debt projections, worsening fiscal slippage. Credit rating downgrades are not expected after this month’s Budget, if it does see materially worse projections than the MTBPS.

MPC Update: SARB keeps rates unchanged at 8.25%

25 Jan 2024

The SARB’s monetary policy committee (MPC) kept the repo rate unchanged at 8.25% at its January meeting, in line with Investec’s projection.

The MPC's decision was unanimous, with all committee members choosing to keep rates on hold. The outcome is aligned with the Federal Reserve Bank’s last monetary policy decision in December 2023.

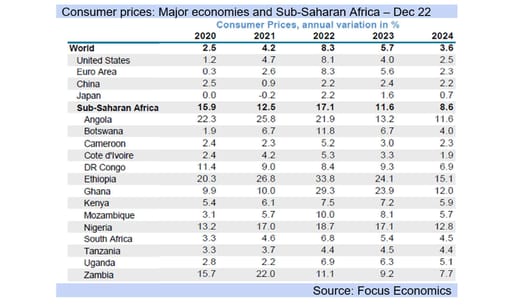

Globally, while inflation has decelerated, core inflation remains sticky. Supply side constraints, weighing on prices from heightened geopolitical tensions remains a key upside risk, while “advanced economies continue to experience strong wage growth”. Consequently, interest rates are likely to remain higher for longer and markets do not expect the Fed to alter rates at its next meeting (next week).

Joining CNBC Africa for a post-MPC panel analysis is Annabel Bishop, Chief Economist, Investec, Johann Els, Chief Economist, Old Mutual and Carmen Nel, Head of Multi-Asset Strategy, Terebinth Capital.

Domestically, the fuel price inflation forecast has been lowered somewhat and is now expected to average less than 1.0% this year (at the previous MPC meeting, 3.2% was projected). The food price inflation forecast has however been lifted modestly to 5.7% for the year, “but remains broadly unchanged over the forecast period”.

Core inflation averaged 4.9% last year and is projected to decelerate to 4.6% and 4.5% in 2024 and 2025 respectively. The 2024 forecast for services inflation remains unchanged at 4.8%, while core goods inflation is projected to ease notably from 6.1% in 2023 to 4.5% this year.

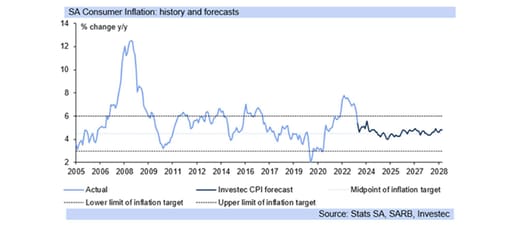

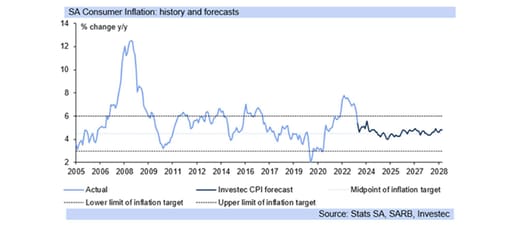

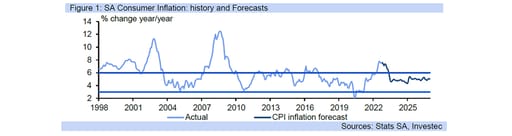

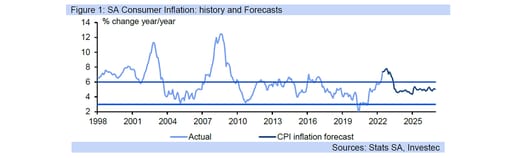

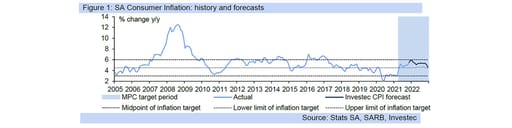

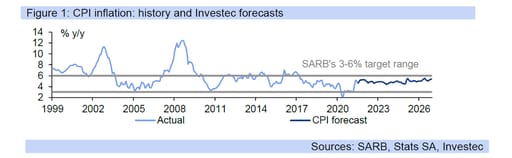

After reaching an average of 6.0% in 2023, the headline inflation number is expected to fall to 5.0% this year. Thereafter, the SARB projects the inflation reading to move towards the midpoint of the inflation targeting band (with 4.6% and 4.5% forecast for 2025 and 2026 respectively).

The SARB has however emphasised that risks to the inflation trajectory remain to the upside. Imported goods inflation “remains sensitive to currency weakness”. “The uncertainties of the global environment, and various South Africa-specific factors, including sluggish growth and dependence on commodity export prices continue to weigh on the value of the currency,” according to the SARB.

Food price inflation (while it has moderated somewhat) is still elevated at 8.5% (latest print) and is vulnerable to changes in global food commodity prices. Extreme weather conditions remain a considerable risk. Administered price inflation, notably electricity prices, presents an upside risk to inflation as the electricity supply predicament persists, while the country’s logistical challenges, especially the operation of SA’s ports and railways remains a key constraint. Moreover, “risk still attaches to the forecast for average salaries”, given the uncertainty attached to the direction of fuel and food prices.

On the global growth front, “advanced and emerging economies are likely to see modest economic growth this year, despite better than expected outcomes in 2023”, with the longer-term growth outlook highly uncertain given the geopolitical situation (and other factors). The Reserve Bank projects growth of 2.6% for this year.

Domestically, the economic environment remains subdued. Households remain constrained, while load shedding and logistical constraints continue to impede optimal economic activity, with marginal growth expected this year. The SARB’s GDP forecast for 2023 is slightly down at 0.6% (it was 0.8% at the previous meeting). The Reserve Bank’s growth expectations for 2024 and 2025 have remained unchanged at 1.2% and 1.3% respectively. The SARB gauges the risks to the medium-term domestic growth outlook to be balanced.

“At the current repurchase rate level, policy is restrictive, consistent with the inflation outlook and the need to address rising inflation expectations,” according to the SARB. “Future committee decisions will be data dependent and sensitive to the balance of risks to the outlook.”

Household finances: the declining trend in real incomes remains

17 Jan 2024

Average salary increases slowed in October, to 1.8% y/y from 4.1% y/y in September (nominal, actual terms), below the inflation rate.

In real (inflation adjusted) terms October saw a -3.4% y/y drop in real take home pay (BankservAfrica data).

The average real salary fell to R13 942 a month in October, from R14 226 (revised) in September, still on a declining trend from R16 124 in February 2021, weakening HCE (Household Consumption Expenditure) growth and so GDP growth.

CPI inflation rose in October, to 5.9% y/y, from 5.4% y/y in September and 4.8% y/y in August, cutting into real incomes (and so real expenditure) as nominal take home pay increases did not rise by the same amount.

That is, average salaries in nominal (actual terms) rose by only 4.1% y/y in September, below the 5.2% y/y inflation rate, and so dropped by -0.8% y/y in real terms in September, and fell by -3.4% y/y in October in real terms.

The BankservAfrica calculates average take-home pay “by dividing the total value of salaries paid into the bank accounts of (around 4 million) employees (excluding salaries greater than R100K per month) by the total number of salary payments”.

The Q4.23 BER Retail Survey shows that “durable goods and non-durable goods retailers in fact reported lower sales volumes compared to the previous festive season”, indicating consumer financial strain in a higher interest rate environment.

In December 2022, the prime lending rate was at 10.50%, while in December 2023 it had risen to 11.75%, a relentless upwards momentum from 7.25% in December 2021, and 7.0% in December 2020.

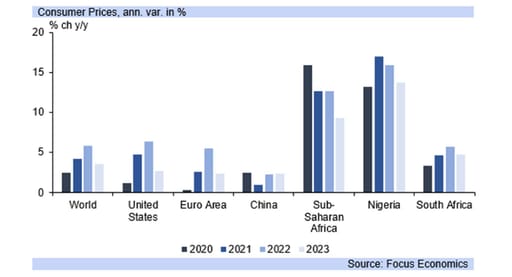

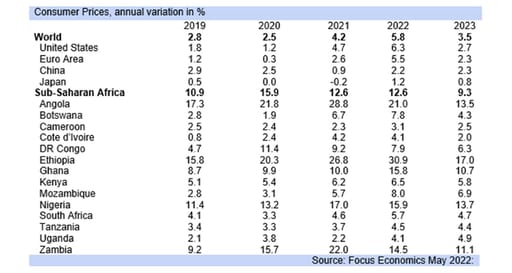

High inflationary pressures in SA have come from the supply side, mainly fuel and food costs, and South Africa’s CPI inflation rate has been uneven in its descent, but the trend is still one overall of falling inflation (i.e. disinflation).

Indeed, higher operating costs for businesses, including self-generation of electricity in the case of load shedding, have weighed on businesses. BankservAfrica Economic Transactions Index (BETI) showed a contraction of -2.3% q/q in Q4.23.

About the author

Annabel Bishop

Chief Economist of Investec Ltd

Annabel holds an MCom Cum Laude (Economics and econometrics) and has worked in the macroeconomic, risk, financial market and econometric fields, among others, for around 25 years. Working in the economic field at Investec, Annabel heads up a team, which focusses on the macroeconomic, financial market and global impact on the domestic environment. She authors a wide range of in-house and external articles published both abroad and in South Africa.

Macro-economic outlook: 2024 growth likely double that of 2023

3 January 2024

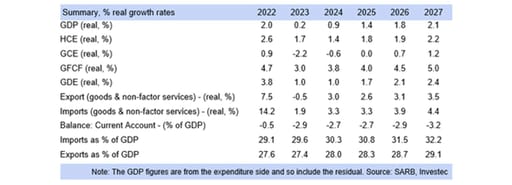

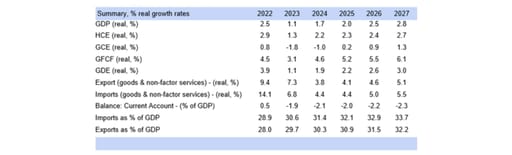

South Africa’s economic growth outlook for 2024, at 1.0% y/y, is stronger than 2023’s likely 0.5% y/y outcome

South Africa’s economic growth outlook for 2024, at 1.0% y/y, is stronger than 2023’s likely 0.5% y/y outcome, with 2024 expected to see the start of an interest rate cutting cycle, as well as lower inflation on average, and improvements to infrastructure.

Economic growth will be lifted by a reduction, to planned eventual elimination, of congestion at the ports, although electricity supply is not expected to fully, and consistently, meet demand this year, and higher stages of load shedding are likely.

That is, load shedding is likely to persist through 2024, at risk of worsening from stage 3/4 as insufficient capacity comes online, but 2025 should see more capacity from private sector generation, with further build-up over subsequent years.

Global economic growth is expected to provide some support to the SA economy, with the OECD highlighting the likelihood of only a mild slowdown in growth in 2024, to 2.7% y/y (versus 2.9% y/y in 2023) and so not a recession and lifting to 3.0% y/y in 2025.

For the US, the OECD forecasts growth at 1.5% y/y this year (after 2023’s likely outcome of 2.4% y/y), lower on the effects of prior monetary tightening but monetary policy is expected to begin easing in 2024. In 2025 the OECD sees growth lift to 1.7% y/y.

“In the euro area, which had been relatively hard hit by Russia’s war of aggression against Ukraine and the energy price shock, GDP growth is projected at 0.6% in 2023, before rising to 0.9% in 2024 and 1.5% in 2025.”

“China is expected to grow at a 5.2% rate this year, before growth drops to 4.7% in 2024 and 4.2% in 2025 on the back of ongoing stresses in the real estate sector and continued high household saving rates.”

Financial markets’ appetite for risk taking increased into the end of 2023, and the rand strengthened to R18.30/USD, with the JSE gaining close to 12% from early November, but both have since weakened somewhat on market jitters this year to date.

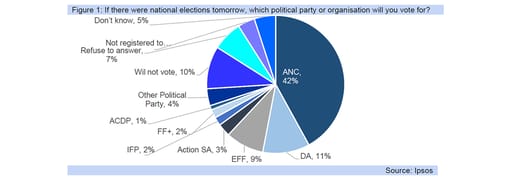

Domestically sentiment concerns also centre around the nature of the coalition government after the national elections, likely in Q2.24, which is also dulling business confidence, while uncertainties over the global environment persist, adding to volatility.

MTBPS: higher borrowing projections increases rating risk

1 Nov 2023

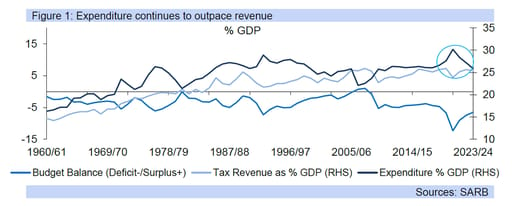

2023’s Medium–Term Budget Policy Statement has seen deterioration in the fiscal metrics (key of which are government’s debt to GDP and fiscal deficit projections).

Over the medium-term, gross debt is projected to now peak at 77.7% of GDP in 2025/26, versus February’s Budget estimate of 73.6% of GDP for the same year.

The current fiscal year (2023/24) has seen a substantial reduction in projected revenue collection as expected, by -R56.8bn lower, raising the budget deficit.

The 2023/24 budget deficit is now projected at -4.9% of GDP versus the -4.0% of GDP estimated for this fiscal year in February, while expenditure is cut by R85bn over two years (2024/25 and 2025/26).

The following three medium-term years of 2024/25 to 2026/27, see the budget deficit projected at -4.6% of GDP, -4.2% of GDP and -3.6% of GDP versus the February 2023 Budget estimates of -3.8 % of GDP and -3.2% of GDP for the first two. A significant degree of fiscal slippage is evident consequently.

Worryingly, gross debt is projected to still remain above 70.0% of GDP in 2031/32, and the expanding debt ratio has reduced the sustainability of government finances, with a debt ratio of 60% of GDP instead seen as the maximum sustainable debt ratio for an emerging market economy.

The budget is credit negative, with the risk of credit rating downgrades having risen for South Africa, and the three key rating agencies, Fitch, Moody’s and S&P to potentially give their country reviews this month.

The expenditure cuts have been favourably received by the markets, along with planned tax measures to raise revenue, as lower commodity prices and higher VAT refunds weakened revenue.

While personal income tax collections have seen resilience this year, National Treasury warns on the weak outlook for employment, while corporate taxes have already seen significant under collection this year, and this is anticipated to continue out to 2026/27.

Higher VAT refunds come as renewable energy infrastructure has been ramped up, along with spend to bolster capacity as the country’s freight transport system and fuel refining capacity weakened.

The next two years, 2024/25 and 2025/26 see revenue projections lowered by R152bn, and in contrast only R85bn is cut from expenditure, which has widened the budget deficit and debt projections as % of GDP.

The rand has strengthened in relief at the modest nature of the proposed tax measures, with the additional R15bn likely to come from no change to tax brackets to account for bracket creep (the effect of higher inflation on earnings), with the tax buoyancies estimated lower over the medium-term.

Higher civil servant renumeration is a key factor in preventing further expenditure cuts, and additional spend of R128.4bn partly counteracts the planned R213.3bn in cuts over the next two years.

On the expenditure cut front, this includes the R133.6bn cut from government departments, and unassigned provisional allocations. The higher spending of R128.4bn comes from R57.2bn in higher than budgeted for civil servant increases this year, and the R33.6bn due to the prior extension of the SRD grant.

The expenditure ceiling has dropped by R36.9bn, in 2024/25, and by a further R47.3bn in 2025/26, which has added to the efforts to contain the fallout from lower revenue collections and the rand has strengthened in response, reaching R18.55/USD in some relief straight after the MTBPS release.

However, the domestic currency has since retreated, near its close of R18.65/USD yesterday. Markets have shown some relief at the proposed areas of government restraint, although the credit rating agencies are likely to place SA back on negative outlooks, with risks for downgrades. The rand is also likely stronger today as the Fed is not expected to hike.

National Treasury sees quicker GDP growth from next year, in line with our view but points particularly to the weak economic outlook as having a key impact on the deteriorated fiscal projections of today’s MTBPS.

Higher bond yields, along with planned increased borrowings, have seen projected debt service costs rise by R51.5bn, along with the effects of rand depreciation.

Specifically, debt servicing costs are projected to reach a notable R385.9 billion in 2024/25, rising to R455.9 billion by 2026/27, further crowding out expenditure on vital areas of the economy.

National Treasury cautions that “(a)lthough many countries are contending with rising debt levels in the wake of the pandemic, over the past 15 years South Africa has had one of the largest increases in government debt as a share of GDP”.

As a mark of the fiscal weakness, the tax to GDP ratio is forecast to decline from 25.1% logged in 2022/23 to 24.7% in 2023/24. Indeed, a marked improvement in the ratio is linked to the sustainable lift in GDP growth.

Again, balancing the fiscal deterioration in some areas with efforts to still strive for eventual fiscal sustainability, the projections show a primary budget surplus is still achievable this year as planned revenue collections exceed planned expenditure, less the expected expenditure on borrowing repayments.

The budget is likely the best it could be in the current circumstances but is a poor budget from a fiscal consolidation point of view, with the debt ratios projected substantially higher than in February’s Budget Review.

National Treasury however notes a 1% rise in inflation and the same rise in interest rates, along with R1 depreciation in the ZAR/USD raise gross loan debt by R54.6bn and debt service costs by R8.2bn, stressing “successful fiscal consolidation will reduce the risks”.

Macro-economic outlook: SA's potential improves

29 Sep 2023

South Africa's forecasts are still held back by crime, logistics and power crises, but potential improves.

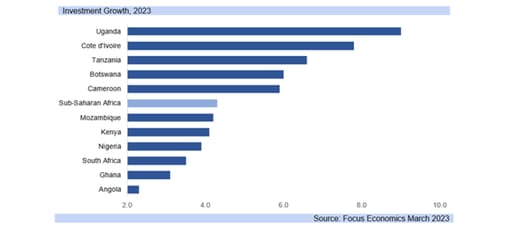

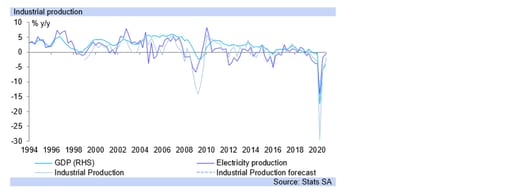

South Africa’s economic growth outlook has lifted marginally for this year, to 0.5% y/y from 0.2% y/y, as globally economies around the world tended to see stronger economic activity than was initially anticipated, although 0.5% y/y is still very weak.

Growth is generally proving to be below trend in OECD countries, while In SA severe crime hinders performance, as does insufficient electricity and freight capacity. The Global Organized Crime Index 2023 found SA “has a high criminality score”.

“South Africa boasts a number of pervasive criminal markets, heightened by the influence of criminal actors, especially state-embedded actors – responsible for years of state capture – and criminal networks that are highly interconnected.”

“South Africa also scores the highest in the Southern Africa region (on resilience), driven by the efforts of non-state actors to resist organized crime, robust national policies and laws, and strong economic regulatory capacity” – 2022 data.

The index measures levels of organized crime in a country and assesses their resilience to organised-criminal activity, with SA showing falling ability to combat the criminal activity it faces that contributes to smothering its economic growth rate.

The state consequently in 2023 enlisted the aid of the private sector in addressing the “key challenges of energy, logistics, and crime and corruption”, and the traction to date raises the potential for stronger growth in SA, but not actual forecasts yet.

Successful implementation of the many goals of the workstreams will be the only way to raise the economic growth forecasts, as economic growth depends on the actual availability of supportive factors such as a fully functioning transport network.

Next year growth of around 1.0% y/y instead of 0.5% y/y is forecast, lifting to 2.0% y/y in the medium-term. Underbidding on cost hamstrings the rollout of renewable energy and government needs to reduce stringent requirements, and rapidly improve the running of Transnet.

The temporary, mild elevation in CPI inflation to around 5.0% y/y until February 2024 does not necessitate higher interest rates in SA, but the MPC will likely follow the US interest rate decision, with domestic household consumption weak this year.

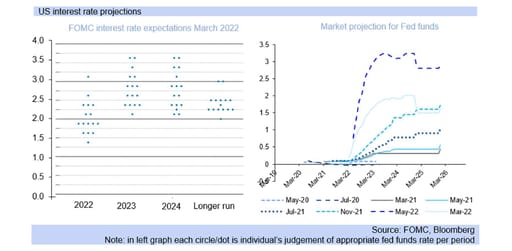

2024 is expected to see lower interest rates and inflation overall, both globally and domestically, with interest rate cuts in the US sparking EM currencies strength. The higher for longer stance of the US on its rate cycle has undermined these currencies.

Inflation globally is weakening, with disinflation also in core measures, and hawkish communication from Central Banks persist, aimed at curtailing inflation expectations and consumption led-inflation itself, to regain actual and implied inflation targets.

Domestically, demand led inflation is already very subdued, with indebted consumers evidencing the severe effects of the upwards interest rate cycle over close on two years now, as rates of default rise rapidly, especially for higher income earners.

The Reserve Bank’s interest rate increases are already having a highly suppressing effect on demand led inflation, with higher interest rates of typically less direct relevance to low income earners in SA who account for most non-durable goods consumption.

Indeed, the Eighty20 Credit Stress Report 2023 Q2 finds for South Africa that across most areas the defaults and overdue balances continued to escalate, and further interest rate hikes will cause even greater impact in an already high default environment.

With lower interest rates anticipated over 2024., and lower inflation rates on average, this should support nominal and real expenditure, and so economic growth, with household consumption expenditure (HCE) accounting for two thirds of GDP.

South Africa has also experienced declining fiscal revenue collection this year, and the OECD notes members’ “(g)overnments are faced with mounting fiscal pressures from rising debt burdens and additional spending on ageing populations, the climate transition and defence.”

“Enhanced near-term efforts to rebuild fiscal space and credible medium-term fiscal plans are needed to better align near-term macroeconomic policies and help ensure debt sustainability.”

South Africa faces a severe risk to its economic growth next year on higher taxation and failure to cut back on wasteful, needless and inefficient expenditure, as well as severely rooting out corruption, which leaches monies out the fiscal space.

MPC preview: SARB expected to keep rates on hold again

19 Sep 2023

South Africa’s Reserve Bank is expected to keep interest rates on hold this week, although the risk of a 25bp hike remains, particularly after the Fed lifted its rates by 25bp at its last meeting.

Lowering the difference between SA and US interest rates (narrowing the interest rate differential) weakens the rand, which in turn places upwards pressure on inflation. Foreigners have been net sellers of SA bonds most of this year, and particularly of SA equities.

The low economic growth environment, populist policies of government and insufficient provision of state services such as electricity and freight transport have negatively affected investors interest, particularly on equities.

South Africa’s interest rates have remained unchanged since May after a 50bp hike in that month, while the US hiked by 25bp in both May and July, but the US has seen more monetary policy meetings in its interest rate hike cycle than SA, raising its Bank rate by 5.25% in total, versus SA’s 4.75%.

While this would indicate room for a further interest rate hike, of up to 50bp, inflation in SA has dropped rapidly, while inflation is likely to average close to 4.5% y/y next year, indicating no need for a hike.

However, the risk is to the upside for inflation as drier conditions from the El Nino weather pattern could put pressure on food prices, although it is too early yet to determine the degree.

An interest rate hike would narrow the differential between US and SA interest rates, but heavily indebted consumers and the increased financial vulnerability of households mean higher interest rates are lowering economic growth.

Consequently, an interest rate lift this week could cause little to no lasting appreciation in the rand, and instead, could well cause rand weakness.

If no increase transpires, which is very widely seen as likely, markets will be heavily influenced by the Fed outcome tomorrow night, and the tone of the FOMC meeting, as well as that of the SARB.

Both Central Banks are however expected to evince hawkish tones as they seek to influence inflation expectations, and so consumer actions, by implying more interest rate hikes could be likely.

Inflation likely to fall further, but climate change poses risks

2 August 2023

This month should see CPI inflation fall further in South Africa, below 5.0% y/y as the general downward trend begun a year ago persists albeit with some stickiness in certain months. SA’s CPI has proved less sticky than the core measure.

July 2022 saw CPI (headline or targeted) price inflation rise to the peak in the current inflation cycle of 7.8% y/y, creating a high base for this July’s CPI inflation rate to be calculated off, with inflation a year on year measurement for a basket of prices.

With the electricity tariff increase taking effect in July, 18.49% on the 1st of July 2023 for municipalities, this will contribute to the bulk of the rise in the headline inflation rate, while petrol prices remained essentially flat, falling by only 17c/litre last month.

Otherwise, July sees insurance costs surveyed for buildings and household contents, while food prices are also likely to contribute on the month, and indeed there are a number of areas likely contributing to the inflation rate outcome in July.

This results in the possibility of the inflation rate ranging between 4.5% y/y and 5.0% y/y, although food price inflation has seen some moderation this year, from 14.0% y/y in March to 11.0% y/y in June, with SA experiencing favourable weather conditions.

The El Nino period, of below average rainfall, is expected to see some pressure on agricultural production going forward, although SA has come from a lengthy LA Nina (above average) rainfall period, which has substantially bolstered soil moisture.

In combination with the effects of climate change, which have been very marked this year in the northern hemisphere summer, South Africa’s summer crop production does hold some uncertainty, and could see stickiness in food price inflation.

The high price inflation of 2022 (the highest for South Africa since 2009), created base effects that aided the subsequent descent, or disinflation (falling inflation), but these base effects will wear out from August, and particularly over Q4.23.

While CPI inflation is expected to average around 4.5% y/y in 2024, there are risks, particularly from food price inflation, with retailers seeing margin squeeze on the costs of load shedding, while climate change is escalating globally and locally.

July 2022 saw CPI (headline or targeted) price inflation rise to the peak in the current inflation cycle of 7.8% y/y, creating a high base for this July’s CPI inflation rate to be calculated off, with inflation a year on year measurement for a basket of prices.

With the electricity tariff increase taking effect in July, 18.49% on the 1st of July 2023 for municipalities, this will contribute to the bulk of the rise in the headline inflation rate, while petrol prices remained essentially flat, falling by only 17c/litre last month.

Otherwise, July sees insurance costs surveyed for buildings and household contents, while food prices are also likely to contribute on the month, and indeed there are a number of areas likely contributing to the inflation rate outcome in July.

This results in the possibility of the inflation rate ranging between 4.5% y/y and 5.0% y/y, although food price inflation has seen some moderation this year, from 14.0% y/y in March to 11.0% y/y in June, with SA experiencing favourable weather conditions.

The El Nino period, of below average rainfall, is expected to see some pressure on agricultural production going forward, although SA has come from a lengthy LA Nina (above average) rainfall period, which has substantially bolstered soil moisture.

In combination with the effects of climate change, which have been very marked this year in the northern hemisphere summer, South Africa’s summer crop production does hold some uncertainty, and could see stickiness in food price inflation.

The high price inflation of 2022 (the highest for South Africa since 2009), created base effects that aided the subsequent descent, or disinflation (falling inflation), but these base effects will wear out from August, and particularly over Q4.23.

While CPI inflation is expected to average around 4.5% y/y in 2024, there are risks, particularly from food price inflation, with retailers seeing margin squeeze on the costs of load shedding, while climate change is escalating globally and locally.

MPC preview: SARB expected to keep rates on hold

12 July 2023

The South Africa’s Reserve Bank is likely to keep interest rates on hold this month, after the Fed’s pause in its interest rate hike cycle

The South Africa’s Reserve Bank is likely to keep interest rates on hold this month, after the Fed’s pause in its interest rate hike cycle at the June FOMC meeting, with South Africa’s MPC decision due next week Thursday, 20th July.

The meeting takes place as SA has hiked interest rates by 4.75% in its current hiking cycle, while CPI inflation, which is due for release for June next week Wednesday is likely to show inflation falling back within the inflation target range.

June’s CPI inflation is likely to fall to around 5.5% y/y, significantly affected by base affects from rapidly rising inflation of a year ago, and these statistical base effects will also influence the July inflation outcome, seeing it likely drop towards 4.5% y/y.

With a three to four quarter lag between the impact of interest rates on the economy and inflation, the SARB also needs at least a pause in its interest rate hike cycle to assess the impact on both inflation and the economy.

Already, there is evidence of distress borrowing amongst households, whilst the financial vulnerability of consumers has increased while salary and wage increases are well below inflation in SA, the last in particular having a suppressing effect on consumer demand and so on demand led inflation.

From March next year CPI inflation should more permanently remain at, or very close to, 4.5% y/y. From this perspective further interest rate hikes in SA are not needed.

However, what will also be key is the movements in the US interest rate cycle, particularly given the effect this has on rand depreciation, and so the risks for the inflation outlook.

With the SARB not hiking in July, and the US potentially hiking by 25bp, although we think it is possible that the Fed may choose to extend its pause in its interest rate hike cycle over July as well, SA would still remain below the US in terms of the actual rise in interest rates it has delivered.

This would continue to undermine the rand, while US interest rate hikes add to market risk aversion and so weaken risk assets, including EM curries and so the domestic currency.

While we expect no hike in interest rates this month for SA, or for the rest of the year, marked rand weakness would change this view, and remains a key risk.

SA economy benefits from expansionary credit growth despite higher interest rate

30 June 2023

Macro-economic outlook: South Africa’s economic growth outlook remains weak, and we have not changed our forecast of the economy essentially stalling, at 0.2% y/y in 2023

South Africa’s economic growth outlook remains weak, and we have not changed our forecast of the economy essentially stalling, at 0.2% y/y in 2023, with headwinds still coming from key productive factors and tighter monetary conditions.

Appetite for credit from households is substantial, and banks continue to lend at a more rapid pace than economic growth this year, which aided the modest growth outturn of 0.2% y/y, 0.4% qqsa (quarter on quarter, seasonally adjusted) in Q1.23.

The (revised) Q4.22 GDP qqsa contraction also gave a boost to the Q1.23 economic growth outcome. Household Consumption Expenditure (HCE which makes up two thirds of GDP) also recorded 0.4% qqsa in the first quarter of this year.

Indeed, household borrowings accelerated materially in the post-COVID-19 period (October 2021 to available data, i.e. April 2023), exceeding both the pre-COVID-19 trend (January 2016 to December 2019) and the COVID-19 period in between.

This has mitigated some of the tightening effect of monetary policy (the 4.75% increase in interest rates since end 2021) on GDP, with commercial banks “extending more credit in an environment of weakening economic growth” (SARB).

The expansion of loans and advances to households underpinned the expansion in HCE, which the SARB notes “thus far in 2023 reflected strong growth in loans to companies which outpaced the more moderate growth in loans to households”.

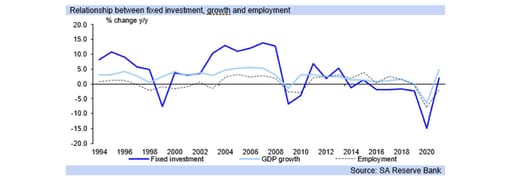

The growth rate in fixed investment (gross fixed capital formation) was a hefty 5.9% qqsa in H1.23 (although GFCF only accounts for 15% now of GDP, down from 21% in 2008), while government also increased its borrowings in Q1.23.

Growth in PSCE (Private Sector Credit Extension) at 7.0% q/q, markedly outpaced economic growth, in Q1.23, providing a stimulatory effect to the economy and somewhat lessening the stricture on financial conditions due to higher interest rates.

While there has been some mild slowdown in credit extension in Q2.23 to date, it is still well above the expected GDP qqsa outcome. For 2024 we continue to expect GDP growth of close to 1.0% y/y, as global growth and energy supply improves.

Rand Outlook: further rand strength expected over the medium-to longer-term

28 June 2023

The 50bp hike at the MPC meeting and drop in inflation to 6.3% y/y, has lifted South Africa’s interest rate/ CPI inflation differential by 1.0% y/y, adding support to the rand

The 50bp hike at the May MPC meeting and drop in inflation to 6.3% y/y (from 6.8% y/y), has lifted South Africa’s interest rate/ CPI inflation differential by 1.0% y/y, adding support to the rand, and aiding it in pulling back from R20.00/USD, along with a number of other factors.

Key amongst these additional factors has been the greatly reduced stages of load shedding, and the improved balance SA is striking in geopolitics, with a number of key Western state officials received by government in South Africa in recent weeks, along with the President travelling to Europe as well.

The pause in the US interest rate hike cycle has been particularly significant for the rand, aiding its retreat towards R18.00/USD, dipping even to R17.85/USD momentarily in June. The domestic currency has remained volatile however, pulling back to R18.78/USD last week, and today reached R18.60/USD.

The rand is undervalued, and we expect it to return to R17.50/USD this year. Additionally, we expect June’s CPI inflation rate (published only in July) is likely to drop towards 5.5% y/y on severe base effects.

This return to the inflation target should provide an underpin to rand strength, although international events will remain dominant drivers, particularly the US interest rate cycle. SA’s monetary policy will also be key for the exchange rate.

The rand retains substantial weakness, with fair value closer to R15.00/USD - R14.50/USD. The interest rate differential between the Fed’s funds rate and SA’s repo rate has widened to 4.75%, with a narrow differential a key driver of rand weakness.

The rand moved substantially away from fair value as the US-SA interest rate differential narrowed from March last year, falling to 2.50%. US interest rates rose rapidly since March 2022, and SA did not keep up with the total size of the US hikes, nor their rapidity.

The rand retains substantial weakness, with fair value closer to R15.00/USD - R14.50/USD. Movements in the USD have also been instrumental in the domestic currency’s weakening trajectory, and US economic data and FOMC communications will remain key for the rand.

The implied Fed funds futures are pricing in one more 25bp hike in the fed funds rate this year and have mostly priced out the possibility of interest rate cuts in the latter part of this year.

These recalibrations contributed to some rand weakness over the past week, and the domestic currency is likely to remain volatile over this quarter and the next. The Fed has indicated current expectations of two more interest rate hikes.

However, this is not set in stone, and will be determined by the rapidity of disinflation (falling inflation), along with other economic variables likely to impact inflation, with lower US inflation figures (particularly core) than expected likely to aid rand strength this year.

CPI update: a good inflation print, further drops to come

21 June 2023

May’s CPI inflation rate dropped to 6.3% y/y (0.2% m/m), from 6.8% y/y in April.

The CPI inflation rate is likely to continue to subside over most of 2023, reaching the midpoint of the inflation target of 4.5% y/y in 2024, and then remaining around 4.5% y/y over the forecast period.

With the petrol price rising by only a relatively small 37c/litre it did not add much to price pressures, while June recorded a petrol price cut of 72c/litre, which will exert downwards pressure on that month’s inflation outcome. July is on course to see a small petrol price cut currently.

Food and alcoholic beverage prices did not contribute to the inflation outcome on the month, despite the weakness of the rand in May as the inflation figures are calculated from the 7th of the month back and so the substantial rand weakness against the US dollar over the full month of May is not included.

The inflation rate for food in May dropped to 12.0% y/y from 14.3% y/y in April, up 0.3% m/m, but benefiting from high base effects as food prices began a steep upwards ascent a year ago. Food (and non-alcoholic beverages) prices still contributed a third (2.1% y/y) of the overall CPI inflation rate.

Food price pressures are seeing some stabilisation in Q2.23 now as expected, which is aiding CPI inflation lower, and base effects will be key in pulling cost of living increases (the CPI inflation rate) down to below 5.0% y/y by year end for 2023.

The Reserve Bank is likely to be happy with the drop in the CPI inflation rate, but cautious as the core inflation rate ticked up to 5.4% y/y. We expect flat interest rates for the remainder of this year, and a cut only in 2024.

With the implied point in the SARB’s model of R18.68/USD, and a lower rand exchange rate now, gains in the US dollar will likely be positive for the SARB’s inflation forecast too, and so for its monetary policy decisions, with the SA reserve bank targeting CPI inflation, not the core measure.

We expect that CPI inflation will average near 6.0% y/y for this year, and if the rand does not see further, marked weakness, it could come out just below 6.0% y/y, at 5.7% y/y.

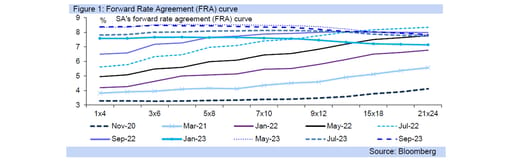

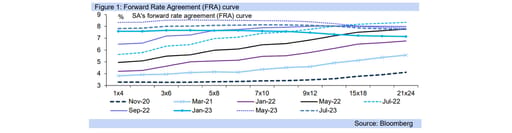

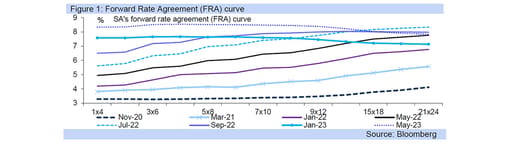

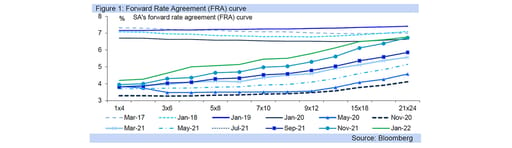

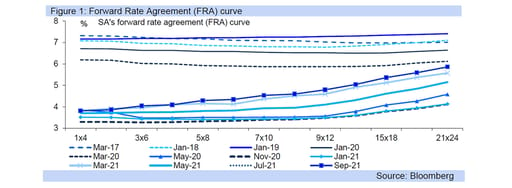

Looking forward, South Africa’s financial markets, as indicated by the FRA (Forward Rate Agreement) curve, have factored in one more 25bp hike in the current interest rate cycle, at year end, but we think this is currently unlikely and that SA has reached its terminal interest rate in the current cycle.

The FRA curve also indicated the likelihood of a 25bp cut in SA’s repo rate by the end of next year, if not only in 2025, but this is likely to occur earlier to prevent SA’s monetary policy from becoming restrictive as inflation falls towards 4.5% y/y.

SA business confidence dips further as economic conditions deteriorate

7 June 2023

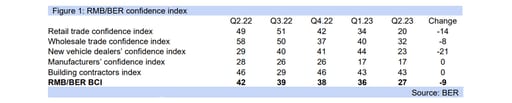

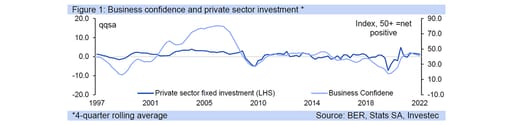

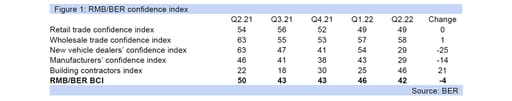

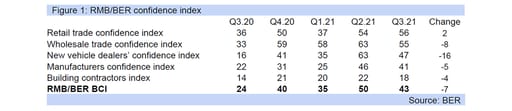

The latest RMB/BER survey reveals an alarming drop in business confidence, with 73% of firms dissatisfied with the current business landscape. Domestic growth concerns are echoed by the IMF

The latest RMB/BER Business Confidence Index (BCI) has delivered yet another blow to the already gloomy business landscape. The index, which measures the sentiment of South African businesses, dropped from 36 in the first quarter of 2023 to a dismal 27 in the second quarter. This indicates that a staggering 73% of businesses are dissatisfied with the current state of affairs and the profitability of their operations.

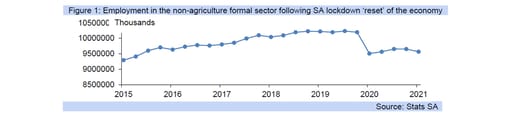

Conducted between the 10th and 30th of May, the survey revealed that 83% of respondents in the manufacturing industry continue to be disappointed by trading conditions in the second quarter. Profitability has become a major concern for virtually all manufacturers surveyed, with negative implications for job creation and retention as well as the viability of the businesses themselves. These worrying signs suggest an increased risk of deindustrialisation. Employment figures have already taken a hit, dipping to a discouraging -12, which indicates a likely reduction in jobs.

The retail, wholesale, and vehicle sales sectors have also suffered sharp declines in business conditions, experiencing drops of -14, -8, and -21 points, respectively. Meanwhile, building confidence has remained stagnant in a depressed state.

In a separate development, the International Monetary Fund (IMF) has released its annual Article IV consultation report on South Africa, in which it projects a meagre 0.1% real GDP growth for 2023. The report attributes this sluggish growth to a significant increase in power outages, weaker commodity prices, and an unfavourable external environment. Looking ahead, the IMF expects the country's annual growth to hover around 1.5% in the medium term. However, it cautions that this rate is insufficient to generate enough jobs for new entrants to the labour market. The persistence of long-standing structural impediments, including rigid product and labour markets, as well as constraints on human capital, offset the expected improvements in energy supply, private spending on energy-related infrastructure, and the external environment.

To address these challenges, the IMF recommends a series of reforms. First and foremost, it suggests easing the burdensome regulatory framework for corporations and creating a level playing field. Additionally, it calls for decisive action to combat corruption and strengthen governance, particularly in the network industries where inefficient state-owned enterprises (SOEs) dominate. The IMF also emphasises the need for labour market reforms to enhance flexibility and promote job creation.

Against this grim economic backdrop, it is likely that the South African Reserve Bank (SARB) has reached the end of its interest rate hike cycle. The weak state of the economy simply cannot withstand further rate increases this year. Furthermore, consumer price inflation (CPI) is expected to drop significantly in the coming months, bringing it back within the 3-6% year-on-year target range as early as this month. The most recent CPI reading for April stood at 6.8% year-on-year, but it is anticipated to decline to 5.0% year-on-year next month.

Given the circumstances, the next move from the SARB is anticipated to be an interest rate cut. It is expected that a 50 basis point reduction will be implemented at the beginning of 2024. However, if economic growth deteriorates at a faster rate or inflation falls more rapidly than anticipated, the rate cut may be brought forward.

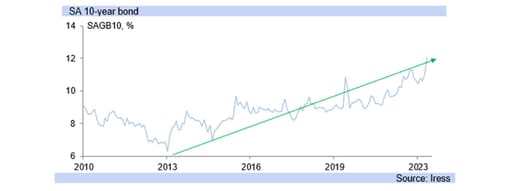

SA bond yields deteriorate sharply on fiscal risks and geopolitical concerns

2 June 2023

SA faces mounting financial risks as bond yields rise and foreign capital inflows decline. The Reserve Bank has warned of possible financial instability, urging urgent action to restore confidence and safeguard the nation's economy.

Yields on South Africa’s benchmark ten-year government bonds have risen by more than 2% since the beginning of this year, reflecting an accelerated decline in investor confidence in the country. The Reserve Bank (SARB) has raised a red flag, warning about growing risks to financial stability, citing "capital outflows and declining market depth and liquidity," and highlighting that foreign participation in South African government bonds has dropped from 42% to 25% in the past five years.

Headline fiscal risks stem from factors such as above-inflation wage settlements, weakening domestic economic growth prospects, reduced revenues due to lower commodity prices and export volumes, as well as contingent liabilities associated with implicit and explicit guarantees for state-owned enterprises (SOEs).

The situation has been further compounded by idiosyncratic risk factors such as frequent power outages and the country’s recent greylisting by the FATF (Financial Action Task Force). The country's high levels of electricity load shedding have devastated economic growth projections for the current year. This, in turn, has dampened the country's fiscal revenue collection outlook.

This combination of factors explains the lacklustre demand for new bond issuances from non-resident investors. Foreign investors have already sold off approximately -R20.3 billion worth of their South African bond holdings this year, following a net sale of -R19.6 billion in 2022. In contrast, in 2021, foreigners only sold -R0.1 billion worth of South African bonds (net of purchases) after purchasing R76.7 billion in 2019.

The SARB also highlights another concerning factor: South Africa's non-aligned stance in the war between Russia and Ukraine. Perceptions that the country is siding with Russia could potentially pose a future threat to the participation of South African financial institutions in the global financial system. It also increases the likelihood of secondary sanctions being imposed on South Africa.

The deterioration in South Africa's bond yields, along with the warning signals from the Reserve Bank, has called into question the country's financial stability. These developments should serve as a wake-up call for policymakers and market participants alike to address the underlying issues and restore confidence in the country's economic prospects.

MPC preview: rand weak on insufficient rate hikes

9 May 2023

Recent commentary from the Reserve Bank on higher inflation and rand depreciation shows these are front of mind for the SARB

Recent commentary from the Reserve Bank on higher inflation and rand depreciation shows these are front of mind for the SARB, which is widely expected to hike the repo rate again this month on 25th.

Governor, Lesetja Kganyago highlights the feed through effect of rand weakness into higher inflation in SA, in particular noting “as the dollar has strengthened, the inflationary impact of currency depreciation has resurfaced”.

Adding, “this limits the benefits of slowing global inflation to domestic inflation the SARB has revised its inflation projections upwards – headline inflation is now forecast to decelerate at a slower rate, averaging 6.0% in 2023 (5.4% previously)”.

Foreigners have sold -R11.4bn (net of purchases) of SA bonds for this year to date, undermining the domestic currency. SA’s ‘real return’ on interest rates is low, and not attractive to investors comparatively, adding to rand weakness.

The Reserve Bank Governor warns “higher fuel and food price inflation are a direct consequence of a more depreciated exchange rate. Domestic food price inflation continues to rise despite normalising global agricultural commodity prices.

“If the expectations that firms and households hold for future inflation stray from the inflation target, then higher nominal wages and consumer prices are likely to emerge.” “This implies that we need to continue the normalisation of interest rates".

“As inflation rises, and growth slows, a central bank that fails to respond to rising prices will face the prospect of compounding inflationary shocks. Currencies depreciate and investment falls.”

The SARB could surprise again with another 50bp hike on 25th May, but this would still leave SA’s interest rate hikes (4.75% if it hikes this month by 50bp) below that of the US which has hiked by a full 5.00% in the current rate hike cycle.

The May MPC meeting may be the last one the SARB could deliver a larger (50bp) hike at, with SA GDP statistics also due out in early June, and likely to show Q1.23 contracted on the harsh load shedding regime, and other deteriorating factors of production.

President reaffirms state power and freight plans at SA Investment Conference

14 April 2023

Despite exceeding its five-year investment goal, the conference took place against the backdrop of an SA economy contracting in response to dwindling electricity and transport supply.

With the completion of its fifth round last week, the South African Investment Conference (SAIC) has exceeded its objective of attracting R1.2 trillion in private sector fixed investment in South Africa, with investment commitments reaching a reported R1.51 trillion for the five-year period. Last week’s conference took place amidst a severe backdrop of insufficient electricity supply from Eskom and inadequate freight services from Transnet to meet the demands of the economy, resulting in a contraction in GDP in Q4.22, and expectations of another contraction in Q1.23.

The President of South Africa acknowledged the state's constrained energy supply that has resulted in persistent load shedding, stating that "government, through the Energy Action Plan has announced several interventions to turn around the situation." The state has been implementing wide-ranging reforms in the electricity sector to enable private investment in electricity generation and accelerate the procurement of new generation capacity from solar, wind, gas, and battery storage.

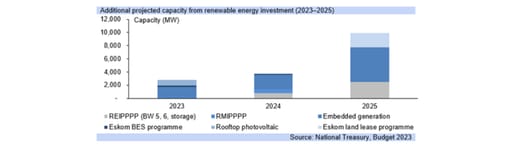

The removal of the licensing threshold for embedded generation, with measures to streamline regulatory processes, has enabled a surge of new projects, with the pipeline of committed projects now representing over 10,000 MW of new capacity. The President highlighted that "what we are witnessing in the energy sector is an undeniable surge of investment that will not only address the electricity supply shortfall in years to come but will propel growth and create jobs."

On the freight deficit, Ramaphosa added that "Transnet’s railway and port constraints are significantly affecting the mining, agriculture, forestry, automotive, and manufacturing sectors." The private sector Resource Mobilisation Fund is providing support for the Energy Action Plan, and indications from businesses show that they are prepared to support the government in fixing the logistics system. The president stressed that the government is prioritising port and rail efficiencies as part of the structural reform process. The new National Rail Policy provides for third-party access to the freight rail network, which will allow private rail operators onto the network to increase investment and improve efficiency.

Furthermore, Transnet is in the process of establishing private-sector partnerships at the Durban and Ngqura Container Terminals, expected to be concluded in the coming weeks. The President also mentioned that government has agreed with key stakeholders to establish a National Logistics Crisis Committee to drive the implementation of a comprehensive roadmap for the freight logistics sector. The President expressed confidence that, working together with the private sector and organised labour, Transnet and government will be able to overcome these constraints to improve efficiencies.

Despite the positive tone at the conference, however, it’s clear that will take several years to sort out the deficiencies, incapacities, and deficits in Transnet’s rail and port services, adding to low business confidence and weakening the investment impetus. The private sector is already taking on, or planning, self-generation where possible, with several municipalities making use of regulatory changes to procure power independently of Eskom.

The Cabinet has approved the Electricity Regulation Amendment Bill, which will soon be tabled in Parliament, to establish a competitive market for electricity generation. The National Transmission Company is expected to be fully operational shortly. Through the renewable energy programme, it has signed agreements for approximately 2,800 MW from bid windows 5 and 6, with several large projects already in construction and others on track to reach financial close. The government recently released a request for proposals for over 500 MW of battery storage and will soon open further bid windows for wind and solar, battery storage and gas power.

The President confirmed that the government is working to close the electricity supply shortfall and end load shedding in the short term while laying the foundation for fundamental reform of the energy sector in the longer term: “Even as we work to improve the performance of our existing coal-fired power stations to address load shedding, we remain committed to a just energy transition and our target of achieving net zero emissions by 2050. We will implement our Just Energy Transition Investment Plan, which outlines our investment needs to support a just and inclusive transition towards cleaner forms of energy. We will soon be completing the review of the Integrated Resource Plan to lay the foundation for a fundamentally transformed energy landscape that transitions us along a low-carbon, climate resilient developmental path.”

On the country’s recent “greylisting” by the Financial Action Task Force, the President noted that “the South African Police Service, the Special Investigating Unit and the NPA’s Investigating Directorate are making notable progress in dealing with cases of serious corruption. This work has resulted in arrests, asset forfeitures, successful convictions and the recovery of misappropriated funds. Since its inception, the work of the Fusion Centre has led to the preservation and recovery of approximately R1.75 billion in criminal assets. These developments highlight the importance of South Africa’s efforts to be removed from the Financial Action Task Force’s ‘grey list’ as soon as possible."

“Yesterday,” he continued, “I met with business leaders from some of South Africa’s leading companies to discuss the challenges that are holding up growth in our economy. We agreed to undertake practical joint action in three immediate priority areas: energy, logistics, and crime and corruption. In doing so, we will be building on the collaborative model that we used so successfully in managing our response to Covid-19 and in our vaccine rollout. We are confident that if we can address these three issues, we will be able to turn our economy around and unleash its full potential.”

While the President did seem more task-orientated towards the multiple crises facing the country, this would not be the first time that he has acknowledged that the parlous state of security of electricity and freight services is harming economic growth and job creation. Until there is significant evidence of progress in these two crucial areas, business confidence will continue to decline, along with levels of fixed investment.

Macro-economic outlook: electricity crisis dims growth

24 March 2023

South Africa’s economic growth outlook has tipped lower on the weakening in GDP in Q4.22 which creates a low base for 2023 to roll off on, and on the deepening energy crisis. Combined this is expected to limit 2023’s GDP growth to 0.2% y/y.

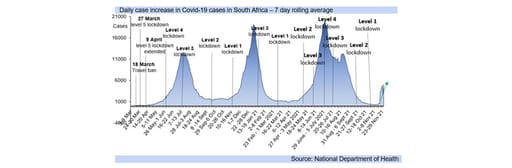

Q1.23 is likely to see economic activity contract further, by -0.5% qqsa (quarter on quarter, seasonally adjusted) from Q4.22’s -1.3% qqsa, which will yield a recession on a technical basis as loadshedding cuts into productive capacity.

Electricity supply is failing to consistently meet demand, giving rise to severe bouts of load shedding, with 2023’s Energy Availability Factor (EAF) at 52.8% of the potential output of installed capacity available, on deteriorated production ability.

Last year the country’s EAF was higher, at 58%, although lower than forecast in Eskom’s October 2022 Medium Term System Adequacy Outlook (MTSAO), which “expects a downward trend in plant performance to continue in the medium term”.

This is seen to be “fueled by increasing unplanned full and partial load losses”, while “Eskom’s generation fleet is expected to reduce by 5 288 MW between 2023 and 2027 because of plants reaching their turbine dead-stop dates (DSD).”

Loadshedding has added to input costs for production in SA, with self-generation more expensive, while production losses (and wastage particularly for food) increase, with food the highest weighted item and biggest driver of inflation.

March is likely to see the MPC deliver a 25bp hike, following the FOMC’s move of the same magnitude this week. The rand gained somewhat from the Fed’s less hawkish tone but is still trading above R18.00/USD, reaching R18.23/USD today.

The domestic currency is likely to remain volatile, with the Fed leaving the door open for further rate increases. The dot plot of members’ expectations shows one further 25bp lift, but markets are less certain, factoring in cuts this year.

South Africa’s energy crisis is having a severely suppressing effect on growth and job creation, and shows little immediate likelihood of being resolved, reducing business and consumer confidence, and further weakening the growth outlook.

Economic growth: insufficient fixed investment stymieing growth outlook

7 March 2023

Fitch has recently highlighted that “private infrastructure investment risks in South Africa include physical security challenges, particularly “organised crime groups in construction and infrastructure” which “reduces investment attractiveness”.

Fitch further highlights “Implications for firms in the sector include the potential loss of income through disruptions, delays and forceful cooperation as well as elevated expenditure on private security to protect projects”.

“Against this backdrop, despite frequent reports of intimidation and violent attacks affecting construction projects, the capability of state security forces to guard against these risks is limited, largely due to corruption risks and underfunding” (Fitch).

Fitch is one of the three key global credit rating agencies, and its Solutions arm further warns “Eskom’s rolling blackouts remain the main strategic threat to … economic performance impacting all sectors, including construction.”

“In the absence of a sound recovery plan to stabilise the market's power supply, infrastructure investments (such as .. new railways, roads and ports, and energy-intensive upgrades) risk losing their viability, increaseing cost overruns “.

The rand weakened today after last night’s cabinet reshuffle, to R18.39/USD, R22.06/GBP and R19.61/EUR with some further strength from the USD too as the risk averse global financial market persists.

International investors are aware of the security challenges in SA, with Fitch Solutions further highlighting “that developers and employees are threatened with demands including requests for a percentage of the construction contract”.

“Key risk areas for firms operating in South Africa's construction and infrastructure sector are intimidation and project disruption by active criminal groups (also locally known as the ‘construction mafia' or ‘local business forums’).”

The disincentivising effect on investment reduces economic growth and job creation. Fitch adds “an understaffed, underfunded and perceptibly corrupt police force is a fundamental aspect in the continued operation of organised criminal groups.”

Greylisting note: it's not the end of the world

24 February 2023

SA’s greylisting by the Financial Action Task Force (FATF) highlights the country's shortcomings in preventing money laundering, terrorist financing, and proliferation financing. But addressing these urgent issues quickly could help solve some of the systemic problems hobbling economic growth.

The anticipation of greylisting has been building for some time, and following FATF's announcement today the currency reached R18.49/USD from its open of R18.24/USD, with the event largely factored in. The news will also not necessarily result in any adverse moves by the rating agencies, which have worked this into their calculations, noting in prior reports that SA was likely to be greylisted, and that, on a standalone basis, the greylisting does not add to the likelihood of a downgrade.

Apart from the greylisting being priced in, the negative impact on markets and the currency was also likely somewhat offset by a well-received national budget announcement earlier in the week. In his annual statement, South Africa's finance minister outlined plans for relieving Eskom's debt, with very sensible conditions designed to ensure that the utility cleans up the rampant corruption and mismanagement that has hobbled it for the past decade or more -- a prerequisite to the sustainable resolution of the electricity crisis. More broadly, the budget demonstrated that fiscal consolidation remains on track and is even running ahead of schedule on some ratios. Eskom’s debt, along with other SOE debt government guarantees, was already included under the state debt and so the bail-out is credit neutral.

But if the greylisting is not expected to dent SA's growth directly, it will have some indirect consequences, possibly including reduced portfolio flows, as well as deterring foreign direct investment (FDI). SA’s FDI is already exceptionally low, with foreigners selling SA portfolio assets in anticipation of today's news over the course of the past twelve months.

The key question now is whether and how quickly SA is able to get off the FATF grey list. This is where the credit rating agencies and others have expressed concern.

It should be noted that the purpose of greylisting is not to punish or damage a country. Inclusion on the list of "Jurisdictions under increased monitoring", as the list is officially termed, is not intended to make the economic environment more difficult, prevent flows of monies in and out of borders, or bring impediments to legal businesses. It is rather intended to raise the standard of compliance in a country. It's worth noting that, in South Africa's case, both the banking sector and the relevant legislation by and large already meet the FATF requirements. Many South African banks are indeed well placed to help clients with what will amount to likely extra paperwork and some delays due to additional due diligence requirements.

More persistent problems include SA's poor track record of successful prosecutions for crimes including money laundering and terrorist financing, along with a systemic failure to provide assistance to international investigations into financial crimes.

National Treasury notes that “following engagements with FATF, it assessed that the country needed to make further and sustained progress in addressing the eight areas of strategic deficiencies related to the effective implementation of South Africa’s Anti-Money Laundering/Combating the Financing of Terrorism (AML/CFT) laws as set out in the FATF’s statement.”

The action items in question are as follows:

(1) demonstrate a sustained increase in outbound Mutual Legal Assistance requests that help facilitate money laundering/terrorism financing (ML/TF) investigations and confiscations of different types of assets in line with its risk profile;

(2) improve risk-based supervision of Designated Non-Financial Businesses and Professions (DNFBPs) and demonstrate that all AML/CFT supervisors apply effective, proportionate, and effective sanctions for noncompliance;

(3) ensure that competent authorities have timely access to accurate and up-to-date Beneficial Ownership (BO) information on legal persons and arrangements and applying sanctions for breaches of violation by legal persons to BO obligations;

(4) demonstrate a sustained increase in law enforcement agencies’ requests for financial intelligence from the Financial Intelligence Centre for its ML/TF investigations;

(5) demonstrate a sustained increase in investigations and prosecutions of serious and complex money laundering and the full range of TF activities in line with its risk profile;

(6) enhance its identification, seizure and confiscation of proceeds and instrumentalities of a wider range of predicate crimes, in line with its risk profile;

(7) update its TF Risk Assessment to inform the implementation of a comprehensive national counter financing of terrorism strategy; and

(8) ensure the effective implementation of targeted financial sanctions and demonstrating an effective mechanism to identify individuals and entities that meet the criteria for domestic designation.

According to the statement by National Treasury, "Minister of Finance, Mr Enoch Godongwana informed the FATF President, Mr Raja Kumar, that the South African Cabinet has considered the Action Plan and committed to actively work with the FATF and The Eastern and Southern Africa Anti-Money Laundering Group (ESAAMLG) to swiftly and effectively address all outstanding deficiencies and strengthen the effectiveness of its AML/CFT regime.”

Treasury's statement goes on to point out some of the steps that have already been taken to address FATF's concerns, including the speedy enactment of two major pieces of legislation, which in turn amended six Acts of Parliament: the General Laws (Anti-Money Laundering and the Combating the Financing of Terrorism) Amendment Act and the Protection of Constitutional Democracy Against Terrorism and Related Activities Amendment Act. These two key p[ieces of legislation should go a long way toward solving the technical deficiencies identified in FATF's Mutual Evaluation Report (MER).

The government seemingly recognises that addressing the action items will be in the interest of South Africa and that doing so is consistent with our existing commitment to rebuild the institutions that were weakened during the period of state capture -- institutions that are essential to addressing crime and corruption.

The action items as formulated in the Action Plan, therefore, form part of the broader commitment of the Government to combat financial crime and corruption, as announced by President Ramaphosa in October last year in response to the findings and recommendations of the Zondo Commission on state capture.

The need to address the action items is also consistent with the national strategy on AML/CFT which was adopted by Cabinet in November 2022, which stressed the urgent need to strengthen the fight against financial crimes in the country and assist in preserving the integrity of the country’s financial system.

National Treasury also notes that the increased monitoring will have a limited impact on financial stability and costs of doing business with South Africa. There are no items on the action plan that relate directly to the preventive measures in respect of the financial sector, which reflects the significant progress in the application of a risk-based approach to the supervision of banks and insurers.

The statement concludes with an assurance that "the costs of increased monitoring will be substantially lower than the long-term costs of allowing South Africa’s economy to be contaminated by the flows of proceeds of crime and corruption.”

South Africa’s Reserve Bank (SARB) has also reaffirmed its commitment to the fight against money laundering, the financing of terrorism, and proliferation financing. "The SARB and the South African government more broadly, maintain a close and open relationship with the FATF," said SARB in its official response to the greylisting announcement. "Since the FATF Mutual Evaluation of South Africa in October 2021, our coordinated government stakeholders have undertaken substantial and far-reaching efforts, led by the National Treasury, to enhance our anti-money laundering, counter financing of terrorism, and counter proliferation financing (AML/CFT/CPF) regime and its implementation.

"South Africa’s hard work resulted in most of the identified deficiencies being addressed within the 12-month observation period afforded to South Africa. South Africa’s 2021 MER highlighted several recommended actions linked to supervision and preventive measures applicable to financial institutions and designated non-financial businesses and professions.

"As a result of strategic efforts and numerous initiatives undertaken by the SARB, all pertinent action items received extensive attention. The Prudential Authority as well as the Financial Surveillance and National Payment System departments of the SARB are responsible for overall AML/CFT/CPF supervision across all banks, life insurers, mutual banks, cooperative banks, authorised dealers with limited authority, and clearing system participants.

"The FATF has acknowledged that the Prudential Authority has made the most progress in terms of the application of a risk-based approach to supervision. Some of the work undertaken included the issuance of sector-specific guidance, conducting a second round of sectoral risk assessments, instituting a new risk rating tool, enhancing the frequency of inspections, holding regular outreach and awareness sessions with banks and life insurers, as well as seeking to engage foreign supervisors in host jurisdictions concerning cross-border subsidiaries and their respective money laundering and terrorist financing (ML/TF) risks. Going forward, the SARB will further strengthen its supervision and further enhance the dissuasiveness and proportionality of administrative sanctions issued.

"The SARB has a zero-tolerance approach when addressing the abuse of the financial system by money launderers or terrorist financiers. The SARB, just as the South African government, commits to further intensify its efforts to combat all manners of financial crime and ensure the full compliance with global AML/CFT/CPF standards. The SARB echoes the sentiment of the FATF, which has stated unequivocally that it “does not call for the application of enhanced due diligence measures to be applied to these jurisdictions. The FATF Standards do not envisage de-risking or cutting off entire classes of customers, but call for the application of a risk-based approach.”

For South Africa, the greylisting is not the end of the world. But it comes at an unfortunate time, against the backdrop of a risk-averse global financial market environment, which has added to jitters on the back of the resignation of Andre de Ruyter from Eskom this week, and his public allegations of endemic fraud and corruption in the energy sector. It also represents more bad news heaped onto the worsening energy crisis and other critical failings in areas such as transport and water which are essential to a functioning economy. But the hope is that a concerted effort to cooperate with FATF in addressing failings in monitoring and controls, and getting off the grey list as quickly as possible, will be a positive step towards resolving the systemic problems that have for too long beset South Africa's economy and its people.

Budget Update: a better than expected budget

22 February 2023

A better than expected budget, Eskom debt relief and some fiscal consolidation

2023’s Budget Review saw a weakening in government’s debt to GDP projections and fiscal deficits (with close to three quarters of debt relief for Eskom on the R350bn the state guarantees).

Gross debt of government is consequently now projected to stabilise at 73.6% of GDP in 2025/26. Previously the projection was estimated to peak at 71.1% in 2022/23 in October’s MTBPS.

The key credit rating agencies (Fitch, Moody’s and S&P) already rate SA’s debt as including all Eskom and other SOE debt which government holds guarantees over, and so the impact should be credit neutral.

Some improvements in fiscal projections did occur, with the budget deficit for 2022/23 lowered to -4.2% of GDP, dropping from the prior estimate of -4.9 % of GDP, and still expected to reach -3.2% by 2024/25.

The downwards revision of National Treasury’s economic growth forecast for 2023 to 0.9% y/y from 1.4% y/y is in line with the consensus once a couple of outliers are removed. 2024 sees a slight drop to 1.5% y/y from 1.7% y/y.

This has only a mild effect on the fiscal ratios while the overall improvement is that a primary surplus occurred earlier, in the current fiscal year, instead of in 2024/25 and “consolidated debt narrows at a faster pace”.

Fitch did say prior to the Budget SA’s “low growth potential … at 1.2%, remains a key credit weakness … a further weakening of trend growth … or a … shock that further undermines fiscal consolidation efforts … could result in negative rating action.”

“There is some headroom at the sovereign’s rating of ‘BB-’ to absorb a temporary impact on economic metrics from load-shedding, but a failure to address the problem over the medium term could add to downward pressure on the rating”.

Today’s Budget is credit neutral to slightly positive on the improvement in the primary balance, projected quicker debt consolidation, with the negative impact on the debt ratios mainly coming from Eskom’s debt relief. The rand was at R18.28/USD before the Budget, reaching R18.20/USD in some relief.

For ongoing coverage of Budget 2023, please visit our Budget 2023 Series.

SONA: sober assessment, markets uninspired

10 February 2023

SONA: sober assessment of SA’s persistent challenges, market reaction muted to negative

2023’s State of the Nation Address (SONA) was sober, highlighting the ongoing problems South Africa faces, and the hope that the country overcomes them, with the country seeking a workable set of detailed plans for the multiple crises it faces.

The President outlined a plan the energy crisis, operating under the parameters of a national state of disaster which is more likely to be successful than previous interventions for the electricity sector, as SA tends to be weak on implementation.

Eliminating red tape and reducing the regulatory burden to sustainably end load shedding is key, as is oversight to prevent corruption, using the best expertise and skills. Prioritising the energy crisis to a national state of disaster is necessary.

However, key also will be the level of technical skills and experience deployed, with both the transmission and production capacity of electricity currently too weak to cope with requirements.

The SONA noted interventions focused on climate change, poverty, unemployment, the water crisis, along with insufficient rail and port capacity, as well as support for SMME growth, improving skills/education and continuing the SDR.

Many of the same topics of previous years were repeated in the SONA, stretching back further than 2016. The SONA’s was comprehensive and positive in its messaging but did not inspire markets, who take a wait and see approach to delivery.

That is, South Africa’s slow, and often poor, implementation of its goals (promises) has been the key determinate of its weak economic growth rate, and hence of exacerbating unemployment.

The state has numerous plans, insufficient delivery and a poor track record overall, making the state of disaster seemingly necessary for resolution of the electricity crisis.

But after over a decade of costly expenditure on electricity and a poor-quality result, markets fear additional cost and debt for the state and a deterioration of state finances, negatively impacting SA’s bond market and so weakening the rand.

MPC preview: SARB to hike again, likely by 50bp

13 January 2023

South Africa’s Monetary Policy Committee (MPC) will see its next interest rate decision on 26th January, while the FOMC’s next rate decision will be announced on 1st February.

This comes after the FOMC dropped its interest rate increase in December, from 75bp to 50bp, with SA potentially doing the same this month. Market expectations for the next expected US rate hike have now dropped to close to 25bp.

Yesterday showed US core CPI inflation drop to 5.7% y/y in December, from 6.0% y/y. This measure, CPI excluding food and energy, is still well above 2.0% y/y however and does not signal an end to US interest rate hikes, nor definitely a drop to hiking in 25bp increments.

In South Africa, CPI inflation is expected to fall to 7.2% y/y in December’s publication due out next week Wednesday, dropping from 7.4% y/y, while core inflation could drop to 4.7% y/y from 5.0% y/y.