Summary of 2024 Budget Review:

- The Gold and Foreign Exchange Contingency Reserve Account (GFECRA) – By far the most important aspect of the budget this year. National Treasury has reduced the GFECRA account by R250bn, allocated as follows:

- R150bn for debt

- R100bn for the Reserve Bank (SARB) contingency reserve

- Primary surplus – First primary surplus since 2009 (a situation where non-interest expenditure is lower than government revenue), underpinning commitment to reigning in expenditure (for example, grants increased by between 4.8% and 5%, below current levels of inflation).

- Debt-to-GDP – Debt-to-GDP revised downwards and to peak at 75.3% in 2025/26. Debt service costs as a percentage of revenue to peak in 2025. A reduction in debt-service costs from 2025 is positive for the delivery of services and investments in infrastructure. Revisions down, primarily driven by the GFECRA allocation to debt.

- Fiscal anchor – Initial discussion on the introduction of legislation to create a fiscal cap (can be through mandated caps to debt-to-GDP, deficits, etc).

- Financial Action Task Force (FATF) greylisting – National Treasury still sees broad addressing of the issues by the end of October 2024 (over the next seven months or so).

- Taxes – Net of R15bn achieved through bracket creep and the lack of an adjustment to fuel levies. National Treasury similarly indicated that they were no longer looking to increase taxes as taxes are already elevated.

- Eskom – National Treasury sees incremental improvements at Eskom, and solar panels imported in 2023 will play an integral role in greater energy security. For example, loadshedding was significantly lower at the tail-end of 2023. This underpins better GDP growth projections for 2024.

- Transnet – Transnet granted a guarantee of R47bn to meet its borrowing requirements. Initially GFECRA was punted as a possible source for an equity injection, but National Treasury has opted to rather provide a guarantee.

- Macroeconomic assumptions – Better growth seen in 2024 underpinned by lower inflation expectations and better energy security.

- Hidden in the detail of the Budget documents was National Treasury’s intention to lower South Africa’s inflation target range. In principle, the move would be positive for price stability and wage setting, and incrementally increase South Africa’s competitiveness; but achieving the lower band of the range may require interest rates to remain higher for longer.

Four key takeaways

The Budget presented by Finance Minister Enoch Godongwana was well received by the market initially, with both yields on 10-year government bonds and the rand/dollar exchange rate responding positively. Our view is that the Budget was well-balanced, considering the myriad of fiscal risks facing South Africa, and showed an impetus by the state to 1) deal with South Africa’s debt problem, 2) contain expenditure and ultimately reduce the risk premium attached to South Africa by implementing long-term structural changes to deal with South Africa’s debt problem.

In this note we deal with GFECRA, the primary surplus, the revised debt-to-GDP trajectory and the proposed adjustment to the inflation target.

1. Gold and Foreign Exchange Contingency Reserve Account (GFECRA)

Initial commentary around the potential tapping of the GFECRA began in earnest in 2023 just before the Medium-Term Budget Policy Statement, when the account was sitting on a surplus balance of around R540bn, driven by significant rand depreciation against the dollar over the last decade and an appreciation in the price of gold. By that time, it was clear that South Africa’s fiscal position was materially deteriorating, driven by lower commodity prices, energy insecurity and logistics constraints. Concerns about the GFECRA included the quantum and how the potential drawdown would be allocated (general expenditure versus debt reduction), the subsequent impact on inflation, its impact on the currency and currency outlook, and the overall impact on reserve coverage.

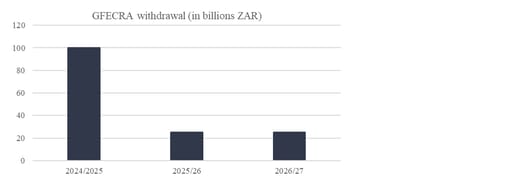

In the end, the government opted to reduce the GFECRA by R250bn. The reduction is structured as follows:

- R150bn allocation to the National Revenue Fund (NRF) between 2024/25 and 2026/27.

- R100bn allocation to the SARB’s contingency reserve as a buffer.

The R150bn allocation over three-years implies a staggered approach towards using the proceeds. Primarily, the withdrawal will be used by the government to reduce borrowing and reduce debt-service costs. The GFECRA withdrawal will be formalised through legislation, and through a framework agreed upon between the National Treasury and the SARB.

Chart 1: GFECRA withdrawal

Date sampled: 21 Feb 2024

Source: Investec Wealth & Investment, National Treasury

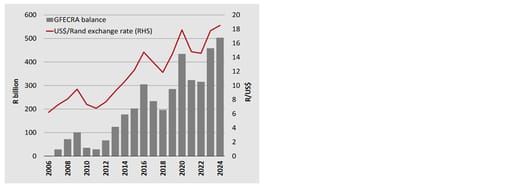

We acknowledge the risks to GFECRA linked to fluctuations in the exchange rate (rand strength) and the price of gold (weakness). However, National Treasury has indicated that the settlement agreement is still to be finalised and will ensure sufficient buffers and sterilisation costs are covered. The chart below illustrates the fluctuations in the GFECRA account balance as a function of the changing exchange rate, which highlights the risks to the account in the event of significant rand appreciation. We should note that our South African asset allocation team is of the view that the rand should strengthen against the US dollar this year, which would be a negative for the GFECRA balance.

Chart 2: Outstanding GFECRA balance

Source: National Treasury, Budget Review, 21/02/2024

Our fixed income analyst, Awongiwe Booi, gave the following insight on the implications of a rand appreciation against the US dollar:

“The biggest risk is a possible appreciation of the rand, which is currently undervalued and could move closer to its fair value of USD/ZAR17.50 (Investec Wealth & Investment's fair value assessment). Such a move would erode the value of the GFECRA balance, which is highly sensitive to exchange rate fluctuations. Historically a R2 appreciation could wipe out R100bn from the balance. A move from the current level of 18.90 to 17.50, a USD/ZAR1.40 appreciation, could reduce the balance by R70bn. Therefore a buffer size is important.”

Currently the GFECRA balance, post the reduction, is just over R250bn, which implies a sufficient buffer. The key concern is potential speculative bets on the currency given lower reserve coverage. To wipe out the remaining GFECRA balance, the rand would need to appreciate in the order of R4.75 against the US dollar, which seems unlikely, in our view.

Overall, the withdrawal was positively received as the allocation achieved the following:

- The GFECRA allocation will be used to primarily pay down debt;

- The drawdown will not be inflationary;

- The SARB has protection, thanks to the R100bn allocation to its contingency reserve account;

- Overall positive for the currency and bond market given an improved fiscal outlook.

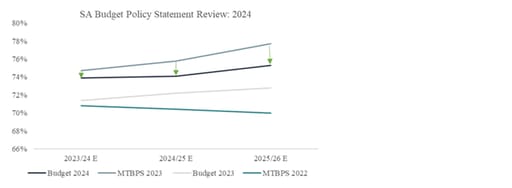

2. Debt-to-GDP trajectory

The debt-to-GDP trajectory has been revised downwards (see chart below), which came as a pleasant surprise to the market. This follows significant revisions upwards at the time of the Medium-Term Budget Policy Statement. The debt-to-GDP trajectory is now expected to peak at 75.3% in 2025/26, having previously been expected to peak at 77.7% in 2025/26. This is indicative of the results of the GFECRA withdrawal mentioned above, which saw GFECRA funds used for paying down debt.

Chart 3: Revised debt-to-GDP trajectory

Date sampled: 21 Feb 2024

Source: Investec Wealth & Investment, Bloomberg, Treasury

The significance of revisions to the debt-to-GDP outlook is underpinned by two factors:

- Lower debt levels, which should result in lower interest payments by the government. Lower interest payments imply that the government should have greater capacity to allocate funding towards service delivery and infrastructure projects.

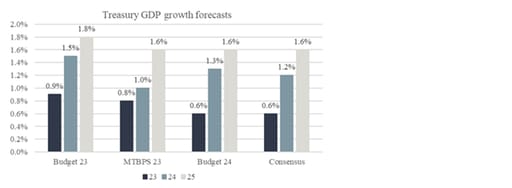

- The revised debt-to-GDP projections are also underpinned by a better growth outlook, particularly for 2024. National Treasury revised growth expectations for 2024 upwards, from 1% to 1.3% (see chart below) driven by two factors: better energy security and lower inflation, both of which should boost overall demand in the economy.

Chart 4: Growth expectations over the last three Budget presentations and consensus forecasts

Date sampled: 21 Feb 2024

Source: Investec Wealth & Investment, Bloomberg, National Treasury

3. Primary surplus

The government is expected to record its first primary surplus since 2009. The primary surplus is a situation whereby government revenue exceeds non-interest expenditure.

This was arguably the second most significant thing to happen in the Budget, particularly during an election year. The government was expected to continue to spend despite a fragile fiscal position given that it is an election year.

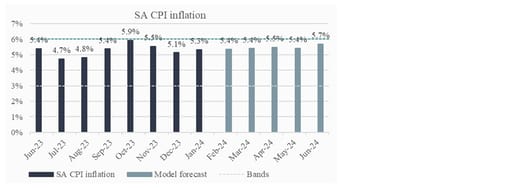

The government, for example, managed to contain increases in social grants to between 4.8% and 5%, despite inflation continuing to hover around the 5.4% level. The internal forecast (see chart below) implies that inflation should remain at around the top-end of the central bank target range for the next six months. However, a commitment by the government to these proposed structural changes would be positive for the currency and therefore positive for inflation.

As a final point on this topic, there are risks to the primary surplus, given the possibility that National Treasury has potentially underestimated expenditure over the coming years. It is a particular risk during an election year. National Treasury may be underestimating the extent to which the fiscus may need to provide further support to state-owned enterprises.

The primary surplus is the key variable in anchoring our Budget deficit expectations lower. Treasury expects the Budget deficit to fall from 4.9% of GDP to 3.3% over the medium term. The potential for over-expenditure or under-collection of revenue this presents a significant risk to the fiscal framework and fiscal sustainability.

That said, the Budget still encapsulated what the market was looking for from National Treasury. Government has long given guidance on bringing expenditure under control, and this is the first indication of a firm commitment to that objective.

Chart 5: Past inflation and Investec Wealth & Investment's inflation forecasts

Date sampled: 26 Feb 2024

Source: Investec Wealth & Investment, Bloomberg

As mentioned in our 2024 outlook piece last month, the key risks to inflation currently are geopolitical conflicts in the Middle East and Eastern Europe, which can have spillover effects that affect supply chains and ultimately the price of Brent crude. However, we remain of the view that high interest rates have had little impact on supply shocks.

4. Inflation Target

National Treasury indicated its intention to revise the inflation target downwards. This is not the first time this has been punted, with the governor of the SARB indicating as much three years ago. There are various pros and cons to lowering the inflation target, however, it does potentially achieve the underlying objective of improving financial stability in South Africa.

The goal of the inflation targeting system is to contain the fluctuations and volatility in prices, both from a price-setter’s perspective and a wage-setter’s perspective. A volatile pricing environment erodes the credibility of the central bank as far as the effectiveness of the tools it uses to achieve price stability. It was for this reason that in response to escalating price pressures following the Covid-19 pandemic and geopolitical conflict in Eastern Europe, central banks across the globe opted to increase interest rates.

The idea of lowering the target is premised upon trying to ensure further containment of prices below the current intended levels of between 3% and 6%. Developed markets, broadly speaking, have an inflation target of 2% while developing markets broadly have a target range. Among the reasons for lowering the inflation target range is that other developing markets over time have lowered their inflation target ranges while South Africa’s target range has remained the same since the adoption of inflation targeting in 2000.

Higher inflation targets result in erosion of consumer spending power, which has the knock-on effect of consumers demanding higher wages in order to be adequately compensated for more expensive goods (i.e. your income level maintains, at the very least, the same quality of life). A lower inflation target could result in less erosion of spending power, while having the added benefit of enabling better financial planning for consumers.

While acknowledging the benefits of reducing the inflation target, some tough decisions would need to be made in order to achieve a lower inflation target range. For example, if the target is reduced to between 3% and 5%, current levels of inflation (last print 5.3%) would imply that interest rates should be increased. To get inflation to the midpoint of that target range (i.e. 4%) would mean the central bank may need to keep interest rates higher for longer. As noted above, inflation in South Africa has largely been driven by exogenous factors, and higher interest rates for longer would lead to even greater demand destruction.

The revision of the inflation target would require legislative approval and may need some time to finalise, however, on the face of it, the revised inflation target would be positive, leading to:

- Increased competitiveness;

- Greater price stability and lower volatility of inflation;

- Lower anchor inflation expectations and lower anchor interest rate expectations (in the long run);

- Enabling a more volume-driven economy as opposed to a price-driven economy. Volumes require added productive capital which can be good for employment.

- Increased spending power by consumers, particularly if company profitability is driven by volumes. In such a situation, consumers can spend less on more.

Overall, the 2024 Budget has resulted in greater credibility, which is positive for the South African fixed-income market. Actions indicate that there’s an impetus to reduce the sovereign risk premium.

Get Focus insights straight to your inbox

Disclaimer

Although information has been obtained from sources believed to be reliable, Investec Wealth & Investment International (Pty) Ltd or its affiliates and/or subsidiaries (collectively “W&I”) does not warrant its completeness or accuracy. Opinions and estimates represent W&I’s view at the time of going to print and are subject to change without notice. Investments in general and, derivatives, in particular, involve numerous risks, including, among others, market risk, counterparty default risk and liquidity risk. The information contained herein is for information purposes only and readers should not rely on such information as advice in relation to a specific issue without taking financial, banking, investment or other professional advice. W&I and/or its employees may hold a position in any securities or financial instruments mentioned herein. The information contained in this document does not constitute an offer or solicitation of investment, financial or banking services by W&I . W&I accepts no liability for any loss or damage of whatsoever nature including, but not limited to, loss of profits, goodwill or any type of financial or other pecuniary or direct or special indirect or consequential loss howsoever arising whether in negligence or for breach of contract or other duty as a result of use of the or reliance on the information contained in this document, whether authorised or not. W&I does not make representation that the information provided is appropriate for use in all jurisdictions or by all investors or other potential clients who are therefore responsible for compliance with their applicable local laws and regulations. This document may not be reproduced in whole or in part or copies circulated without the prior written consent of W&I.

Investec Wealth & Investment International (Pty) Ltd, registration number 1972/008905/07. A member of the JSE Equity, Equity Derivatives, Currency Derivatives, Bond Derivatives and Interest Rate Derivatives Markets. An authorised financial services provider, license number 15886. A registered credit provider, registration number NCRCP262.