The recent T20 World Cup in the United Arab Emirates (UAE) provided exciting cricket. The financial future of cricket and cricketers clearly lies with mastering the shortest formats. No longer will youngsters only be taught how to defend a good length ball – but rather how to hit it over the boundary fences whether in front, square of, or even behind the batter. What bowlers should be taught, other than not to offer what will no longer be described as a good length delivery, is more uncertain.

In cricket, as in life, the higher the expected return, the more risk will be taken. The risk in cricket is of getting out – the potential reward (return) is the runs scored per ball. The fewer the balls on offer the more risk will be taken. To win a 20-over contest, a score of 180 would usually be a winning one. That is equal to an expected return of 1.6 runs per ball faced. A 50-over game would require 300 runs or more, or a run a ball, and a test match with a large number of balls, would likely be won scoring at 3 per over or achieving a return of 0.5 runs per ball or more. Every reason for batters to take on much less risk and bowlers more.

But if the cricket was compelling, so were the crowds watching. Fervent crowds of Pakistanis, Bangladeshis, Indians, Afghanis and Sri Lankans cheered on their heroes. They were clearly not tourists up for the cricket, but workers in the UAE, attracted by the opportunity to work and earn more than they could hope to find at home. Also impressive were the backdrop of skyscrapers rising out of the desert.

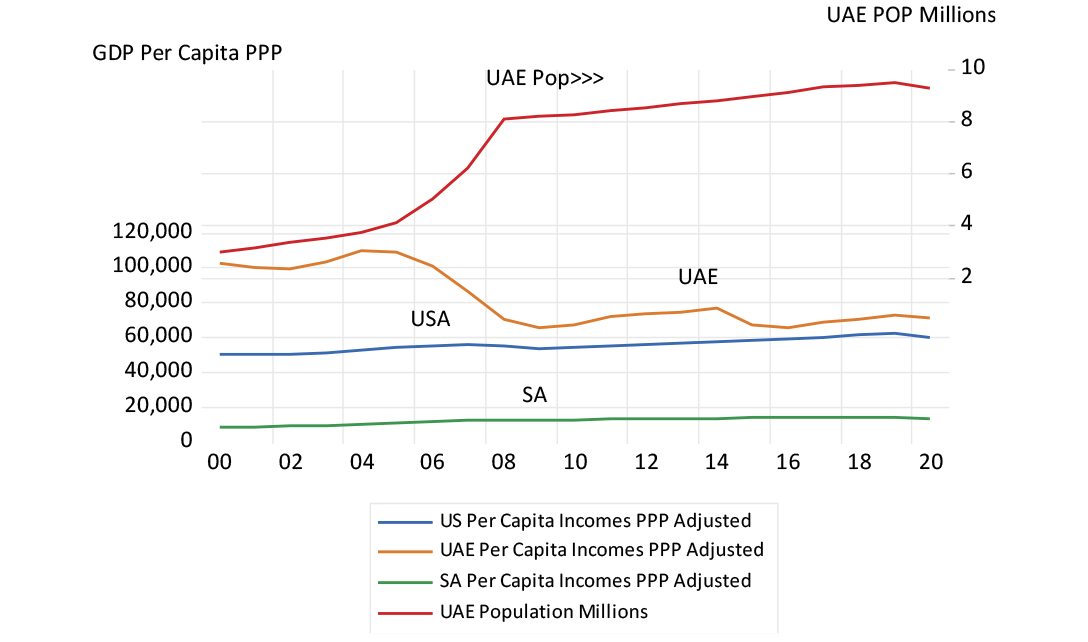

Milton Friedman in the early eighties in his influential television series, Free to Choose, pointed to the example of Hong Kong and Singapore in uplifting their people. These were tropical enclaves once undeveloped and with no obvious advantages other than the incentives they provided to their people to uplift themselves. The UAE has managed something similar, without many people to start with. Immigrants, with a variety of skills and many without any obvious advantages of education or training, followed the opportunity made available to them and were permitted and encouraged to do so. The population of the UAE has risen from 3 million in 2000 to over 9 million today. And per capita incomes – purchasing power adjusted by the IMF – compare more than favourably with those of the US. The purchasing power parity (PPP) exchange rate to convert GDP at current prices into the equivalent in US dollars is 2.1 for the UAE and a favourable 7.8 for SA (See figures below).

Figure 1: UAE, USA and SA per capita incomes (in US dollars, adjusted for purchasing power) and UAE population

Source: IMF World Economic Survey Data Base and Investec Wealth & Investment, 18 November 2021

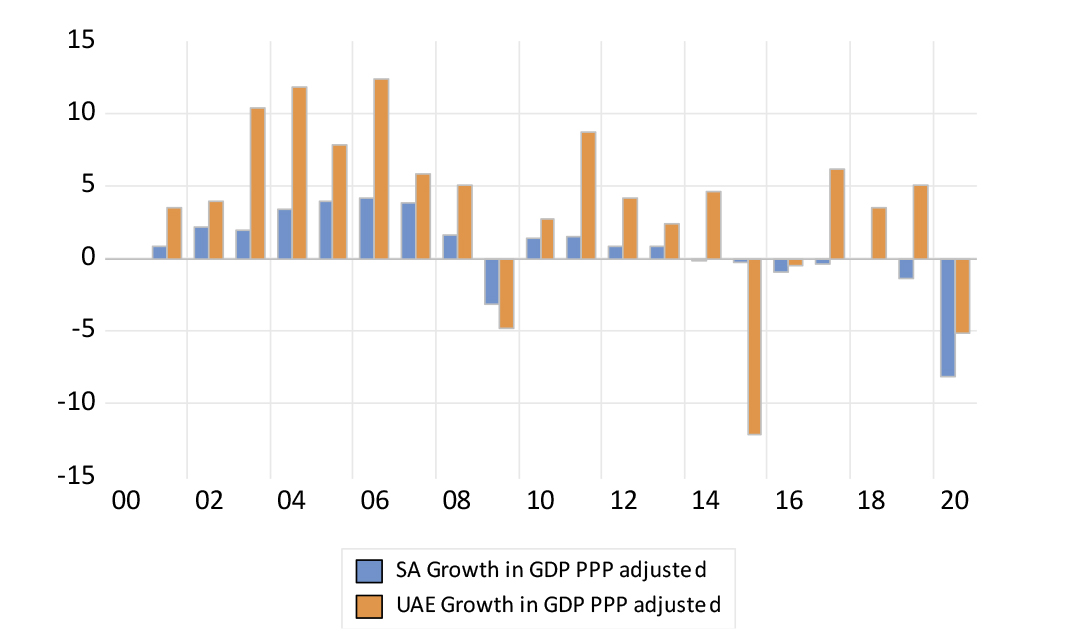

Figure 2: Growth in GDP for SA and UAE (adjusted for purchasing power)

Source: IMF World Economic Survey Data Base and Investec Wealth & Investment, 18 November 2021

Resources (in this case oil and gas) helped to get things started, as they did in South Africa. And the wealth from these resources wasn’t allowed to get in the way of good government, as it can do so easily without the right disciplines. Investing in ports and airports to facilitate trade with the rest of the world was essential. But it applied the same well-known free-market recipe that turned the undeveloped western world from being poverty ridden and disaster prone, to widespread affluence over a period of 200 years. This is a providence that is easily taken for granted. The recipe is always under threat from interests that would preserve their economic status rather than allow for competition to threaten it. The many nations that have failed to grow prove this point.

South Africa could emulate the UAE. Our nation is failing for want of mixing the essential ingredients that the recipe calls for. Perhaps it could start doing better, with a Dubai-like experiment of our own. Proclaim a relatively undeveloped area of the country as a free port and airport. Make it an income tax-free zone – company and personal income tax. Invite immigrants and start-ups from everywhere, including South Africa, to enter and then provide law and order. Without order, even the best laws become irrelevant. And most important, do not in any way tell them how to run their businesses, such as whom to employ. And then watch our desert bloom.

About the author

Prof. Brian Kantor

Economist

Brian Kantor is a member of Investec's Global Investment Strategy Group. He was Head of Strategy at Investec Securities SA 2001-2008 and until recently, Head of Investment Strategy at Investec Wealth & Investment South Africa. Brian is Professor Emeritus of Economics at the University of Cape Town. He holds a B.Com and a B.A. (Hons), both from UCT.

Get Focus insights straight to your inbox