“What’s true of all the evils in the world is true of plague as well. It helps men to rise above themselves.” – Albert Camus, The Plague

At the start of the pandemic, there was no shortage of prognostications about how the world had changed forever, and how things we took for granted would now be discarded, to be replaced by completely new ways of doing things.

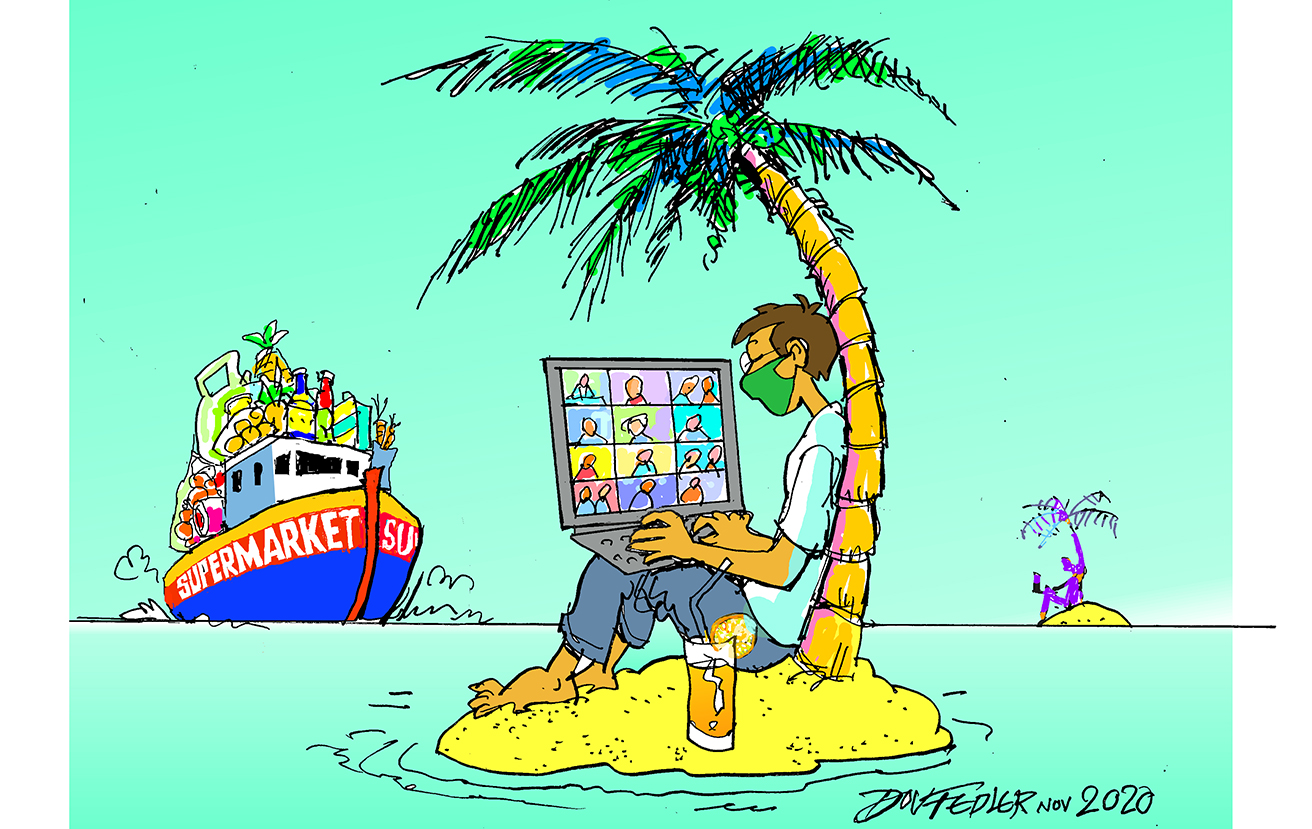

Where before working from home may have been frowned upon, it’s now the norm. Meetings over Teams or Zoom are also normal now, even with customers or business partners who before may have seen such a meeting as an affront.

But now, as new breakthroughs are being announced on the vaccine front, we can start to contemplate what our new world will look like. How much of the change will become entrenched and how much of it will fall by the wayside as we start to contemplate a so-called normal life?

I suspect that we may have to wait a while before finding out the full extent of change. There is bound to be some experimentation in ways of doing things before we settle on new conventions. However, the pandemic will also trigger new ideas and technologies that may take some time to develop into fundamental changes to the way we do things.

Morgan Housel, partner at the Collaborative Fund and author of the book “The Psychology of Money” makes this point in a recent blog entitled “We have no idea what happens next”. Housel tells the story of the Mt Tambora volcanic eruption in what is today Indonesia, in 1815. The eruption not only killed thousands of people in the vicinity, but it also released up to 120 million tons of sulphur into the stratosphere, which had a disastrous impact on the world’s weather.

The sulphur debris created what is called a stratospheric sulphate aerosol veil, diluting the rays of the sun and reducing global temperatures. 1816 was known in the Northern Hemisphere as the year without a summer. There was snow and frost in Europe in July, crops failed and this led to famine and food shortages in many countries.

But the eruption also had an impact on a young German boy, Justus von Liebig. On seeing the devastation it caused to farming, he decided to pursue a career in agricultural chemistry. Known as the father of modern fertilisers, von Liebig revolutionised agriculture through the use of nitrogen, trace elements and ammonia to help crops to grow better. His fertilisers helped improve yields and in that way ramped up food production, allowing for population growth while avoiding a Malthusian trap.

Some of the developments on the vaccine front may hasten similar processes for tackling other diseases, such as cancer.

There may or may not be a von Liebig out there devoting his or her life to fixing the world’s ills, but there’s a good chance that Covid-19 has kick-started the sorts of thinking that may in time be channelled into the big challenges of our times. In a similar vein, some of the developments on the vaccine front may hasten similar processes for tackling other diseases, such as cancer.

Bill Gates and the seven changes

More mundanely perhaps, there are a number of changes we can expect to entrench themselves in the near future. In a recent podcast, former Microsoft CEO and philanthropist Bill Gates spoke to Dr Anthony Fauci, director of the US National Institute of Allergy and Infectious Diseases, about how the world would change, and came up with seven predictions:

Remote meetings will become the norm: These already happened before the pandemic, but the pandemic helped to normalise them. Remote meetings look to be here to stay, with all that this implies.

The technology of remote interaction will improve: From better software to hardware like virtual reality sets, the technology will quickly improve, says Gates, to make the experience better and easier to use. This opens up a world of applications, such as telemedicine (doctor’s consultations online) and the technologies needed to assist remote diagnosis.

Offices will be shared on rotation: To make the most of the office vs work from home dynamic, firms will rotate their staff between working from home and working at the office, perhaps even rotating with other firms. This will change things for landlords, office designers and for firms and their staff. More on this a little later.

We will choose to live in different places: With no need to be in an office a lot of the time, people will have more choices for where they want to live. There are already signs of the housing market in SA’s popular seaside towns picking up as city dwellers look to live and work in more pleasant environments. This has implications for cities and urban planning.

We will socialise more with our communities than with our companies: It makes sense that if we are spending most of our time at home or in the communities where we live, then that’s where we will bond with people. Besides, sitting alone working at home will make us more willing to spend our evenings or weekends in the pubs, coffee shops and sports clubs in our neighbourhoods. This could make us more civic and community minded than before.

The eradication of Covid-19 may take longer than we think: Even the best vaccines take time to roll out, so while infection rates will come down, there are likely to be outbreaks from time to time. Many people – especially those who feel vulnerable – may err on the side of caution when it comes to going out to crowded venues for a while. This could limit the extent of the economic recovery.

Finally, future pandemics won’t be as bad: A combination of our learnings from this pandemic, better medical technologies and a willingness of governments to invest in healthcare, will mean that we’ll be better able to manage testing, tracking, shutdowns, treatments and vaccine development in future.

From tourism to tenants

These changes have implications for the economy and for different sectors, meaning that businesses and governments will need to make wise choices in the future. From a policy point of view, governments will be concerned about issues such as unemployment and inequality, as well as dealing with long-standing problems like climate change.

It’s clear that the pandemic has had less of an economic effect on knowledge workers than on other workers. Some jobs may never fully recover from the blow and while new jobs will emerge to replace them – as they always have – there is likely to be some disruption along the way and governments will need to respond intelligently.

With companies also looking at ways to reduce their carbon footprint, slashing the business flying budget may be an easy decision to make. Gates reckons business travel could be reduced by half.

The travel and tourism sectors will take a while to recover, for a number of reasons. As noted above, the time taken to completely eradicate the disease will make many consumers reticent to travel. Furthermore, businesses people, having made the transition to interacting with clients and colleagues digitally, may feel less of a need to make as many business trips as before. With companies also looking at ways to reduce their carbon footprint, slashing the business flying budget may be an easy decision to make. Gates reckons business travel could be reduced by half.

The property sector has widely been reported as being among the most vulnerable in a Covid-19 and post-Covid-19 world, across many sectors. Less business travel of course reduces demand for hotel accommodation. But working from home will have an even more dramatic effect, especially on the office sector. With staff on rotation, businesses will need less space, leading to higher vacancies and further squeezes on revenue for the landlords.

This is not just a problem for the landlords, but to their investors as well, including the pension funds that hold large real estate portfolios. According to MSCI, the size of the professionally managed global real estate investment market grew from US$8.9 trillion in 2018 to US$9.6 trillion in 2019 (of which South Africa made up US$50.2bn).

Data centre REITs could draw renewed interest in the future following the pandemic.

A different way of looking at assets

The different industries needn’t be passive bystanders, however. The big social changes that the pandemic has brought about present opportunities for innovation across a number of fields. Interior designers, architects, engineers, software developers and even fashion designers will respond to the new challenges with exciting new tools and products to help us adapt to new ways of working and interacting. “Form follows function” has always been the designer’s mantra and this will guide the design of the future.

Those in the clean energy and related sectors will respond with even better applications. Research and development into electric aeroplanes will probably be ramped up too. According to the publication Quartz, this is still an industry in its infancy but shows promise: electric aircraft firm Eviation recently managed an 814km flight on a single charge for a nine-seater aeroplane.

And there is significant potential in the real estate sector. Those funds specialising in warehousing or storage have done better this year than real estate overall. And as people choose to work from home, so more opportunities are likely to arise in in investing in residential developments such as multifamily and retirement villages.

The bigger opportunities may come from sectors not traditionally seen as part of the real estate universe. Globally, there are a number of real estate investment trusts (REITs) geared towards solar plants, wind farms and other renewable energy installations. Data centre REITs are a kind of hybrid between tech and real estate – they manage large, climate controlled buildings housing servers on behalf of the likes of Microsoft and Amazon. Both of these types of REIT were in existence before the pandemic, but could draw renewed interest in the future.

Doubtless, as our new ways of working, living and socialising develop, so new opportunities for investment will present themselves. There will also be new ways to make the world a better place, and, as Camus said, to rise above ourselves.

About the author

Patrick Lawlor

Editor

Patrick writes and edits content for Investec Wealth & Investment, and Corporate and Institutional Banking, including editing the Daily View, Monthly View, and One Magazine - an online publication for Investec's Wealth clients. Patrick was a financial journalist for many years for publications such as Financial Mail, Finweek, and Business Report. He holds a BA and a PDM (Bus.Admin.) both from Wits University.

Get Focus insights straight to your inbox