Recently, we were set a challenge by the Global Head of Investec Wealth & Investment to write down our thoughts about how this most recent crisis has affected/changed us as individuals. While ruminating on this I have also been thinking about what I have learned from the crisis as an adviser. It is primarily this: we need to help our clients to think deeply about what risk really means to them and to prepare them for its inevitable appearance on their investment journey.

Financial advice 101

When you engage with an investment manager from Investec Wealth & Investment for the very first time, we would typically commence our advisory process with fact-finding/gathering data about yourself before developing and presenting financial planning recommendations and/or alternatives. This includes, among other things: determining your personal and financial goals (e.g. capital appreciation; provision of income or some combination of the two), determining your time frame for results (short-; medium-; long-term) and determining your ‘appetite for risk’. (It is the determination of ‘appetite for risk’ which I will focus on for the remainder of this article).

We might use a ‘Financial Assessment’ to assist with this fact-finding process. Often the assessment will contain box ticking next to some description of a risk categorisation, e.g. ‘Cautious’; ‘Moderate’; ‘Aggressive’. You would then tick the categorisation and it is off to the races in terms of developing and presenting financial planning recommendations and/or alternatives.

Under normal circumstances the above exercise might work perfectly well, however, and as Warren Buffett famously quipped: “You only find out who is swimming naked when the tide goes out…”. In this context I use this quote in reference to the folly of ‘box ticking’ a risk categorisation which might well be exposed in a time of crisis.

So how can we better prepare you our client for the day when the proverbial tide goes out?

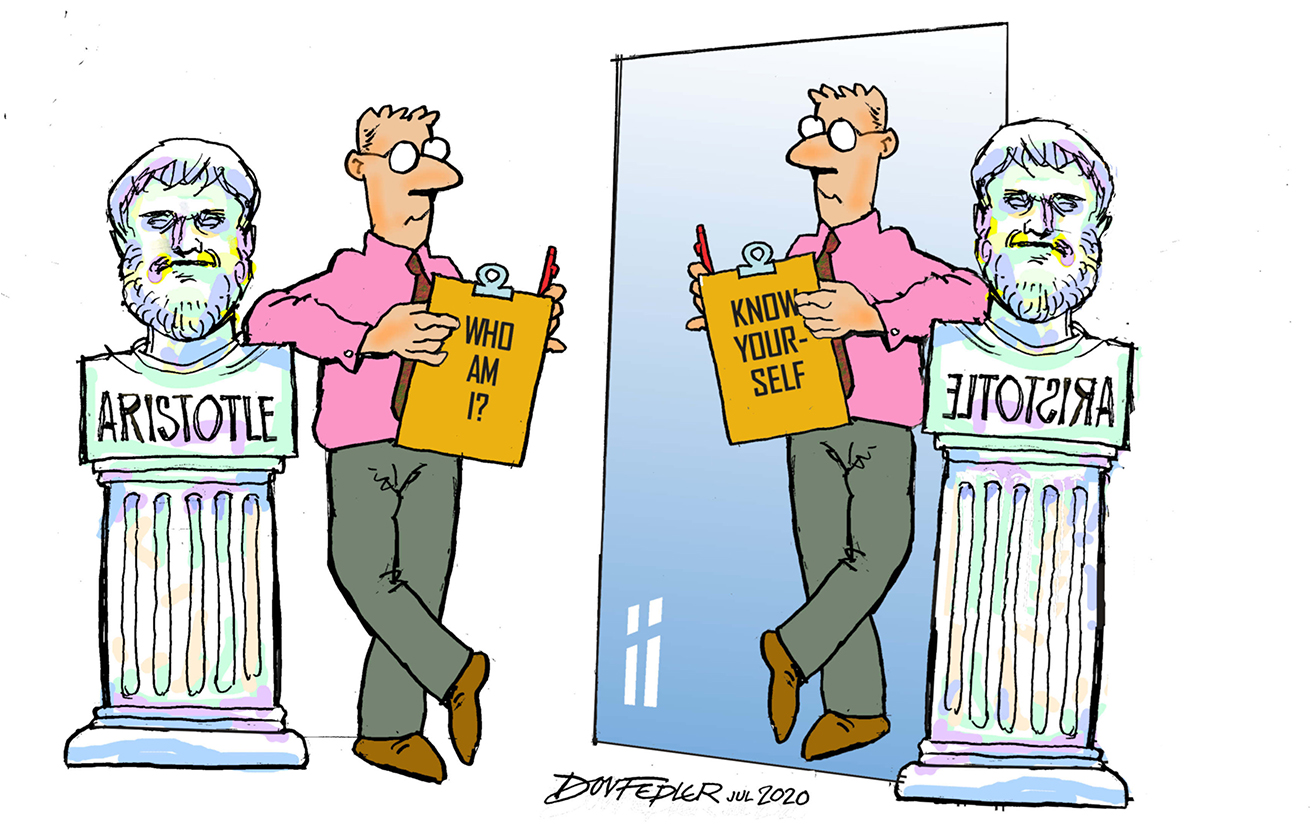

Know thyself!

In ancient Greece, the philosopher Socrates famously declared that the unexamined life was not worth living. Asked to sum up what all philosophical commandments could be reduced to, he replied: “Know yourself.”

It’s not clear whether he was the first to utter these words (Aeschylus and Plato were others to use them), but so profound was the aphorism regarded in ancient Greek culture that it was even inscribed at the Temple of Apollo at Delphi.

Knowing yourself has extraordinary prestige in our culture too. It has been framed as quite literally the meaning of life.

This sounds, when you hear it, highly plausible, yet so plausible that it’s worth pausing to ask a few more questions. Just why is self-knowledge such a prestigious quality? What are the dangers that come with a lack of self-knowledge? And what do we in fact need to know about ourselves? How do we come to learn such things? And why is self-knowledge difficult to attain?

When we speak about self-knowledge, we’re alluding to a particular kind of knowledge – generally of an emotional or psychological kind. There are a million things you could potentially know about yourself.

Not everything that we can know about ourselves is all that important to find out. Here we want to focus on the areas of self-knowledge that matter most in life: the areas concerned with the inner psychological core of the self.

If you have solid answers to these issues, you will be able to speak of yourself as someone with an adequate degree of self-knowledge.

Why does self-knowledge matter?

Self-knowledge is important for one central reason: because it offers us a route to greater happiness and fulfilment.

A lack of self-knowledge leaves you open to accident and mistaken ambitions.

Armed with the right sort of self-knowledge, we have a greater chance of avoiding errors in our dealings with others and in the formulation of our life choices.

The role of an investment manager as a “financial physician” in helping you acquire greater self-knowledge

I heard the term “financial physician” used for the first time in a presentation from our Co-Head of Wealth Management at Investec Wealth & Investment and I just love it because, and apart from sounding a lot grander than investment manager (and that I fancy being called Dr. Duggan!) if we look at what a physician does: examines patients; takes medical histories; prescribes medications; and orders; performs and interprets diagnostic tests we could assimilate many of these processes to those undertaken by an investment manager when he/she looks at the financial wellbeing of a client.

In a foreword to a February 2008 report on behavioural finance entitled “Behavioural Finance: The Psychology of Financial Decision Making” Greg Davies, then Head of Behavioural Analytics at Barclays Wealth, wrote the following:

Over the past decades, academics and financial practitioners alike have devoted significant resources to trying to identify investment strategies that are successful regardless of wider economic and financial market conditions. Only a small percentage of this vast output has been devoted to an area which we view as being fundamental to the successful long-term management of wealth – behavioural finance. Behavioural finance uses our knowledge of psychology to improve our understanding of how individual investors make financial decisions, and how these individual decisions cause markets to behave in aggregate.

Even though behavioural finance is more popular than it was a decade ago, it is still considered a niche area within the financial services world. There are few behavioural finance funds or strategies available to individual investors. In the institutional arena, behavioural finance is slightly more popular, but is still far from being considered a core approach. This is unexpected, as systematic psychological patterns – such as the herd mentality or the tendency for retail investors to buy investment funds simply because they have performed well in the past – are evident in financial markets every day, and have been documented for decades. Perhaps more fundamentally, it has been clear for some time that the majority of investors exhibit loss aversion – so the pain arising from a loss is felt much more keenly than the pleasure derived from a gain of equal magnitude. And yet, the majority of traditional investment strategies are based on the assumption that we are all willing and able to participate in losses to the same extent that we are in gains, with no allowance made for the fact that losses may have a significantly greater impact – both financially and psychologically – than gains.

In simple terms, we do not think it is possible to separate an investor’s personality and the investment decisions that he or she may make; for us, they are two sides of the same coin. Investment and its outcomes, like all human activity, is ultimately governed by individual biases (‘the market’ after all, is just the summation of thousands of individual investor’s views). Individual psychological biases and traits exert significant influence every time we make – or choose not to make – an investment decision, and influence how we view and react to the outcome of those decisions.

Academic research into the psychology of finance has dramatically increased our ability to understand individual financial behaviour in recent years, but this knowledge has until now been a largely untapped resource in commercial applications.

Your financial personality

Understanding your financial personality is vitally important. It can help you understand why you make the decisions you make, how you are likely to react to the uncertainty inherent in investing, and how you can temper the irrational elements of investment decisions while still satisfying your individual preferences.

We at Investec Wealth & Investment have long believed that risk categorisations are generalisations.

Taking the time to understand your personal risk situation may require self-discovery on your part, along with some financial planning. While attaining your personal and financial goals is possible, reason and judgment can be clouded when personal feelings are left unchecked. Therefore, working with your ‘Financial Physician’ at Investec Wealth & Investment may prove very helpful.

About the author

Patrick Duggan

Wealth manager: Investec Wealth & Investment

Patrick is a senior private client wealth manager with Investec Wealth & Investment, specialising in providing holistic investment planning advice to some of South Africa’s high net worth and ultra-high net worth individuals, families and their associated entities.

Get Focus insights straight to your inbox