Shoprite is a successful South African business, as its results to December 2023 confirm. It has grown both its rand revenues and volumes of goods sold, by taking an increased share of the retail market. This success has been achieved despite its exposure to a slow-growing economy. The return on the capital invested in the business remains impressively high.

While the real cash flow return on investment declined from a heady peak in 2009 to about half that rate by 2020 yet is still above the cost of capital for South African-exposed businesses – which we judge to be about 15% a year. The returns on capital invested by Shoprite declined in response to what was a well-justified acceleration in capex. Post-Covid returns on capital invested have encouragingly picked up again.

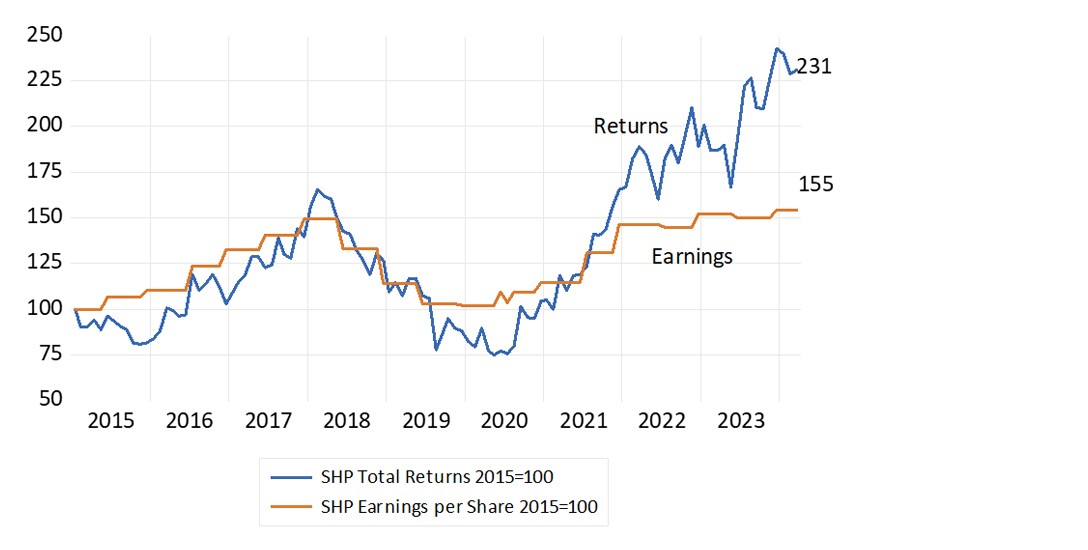

These trends are reflected in its earnings and share market returns since the pandemic. We note that the total returns to shareholders declined markedly pre-Covid and have improved since the pandemic. Shoprite is a post-pandemic success story, perhaps thanks to its mastering of home deliveries, which has become a growing preference among customers.

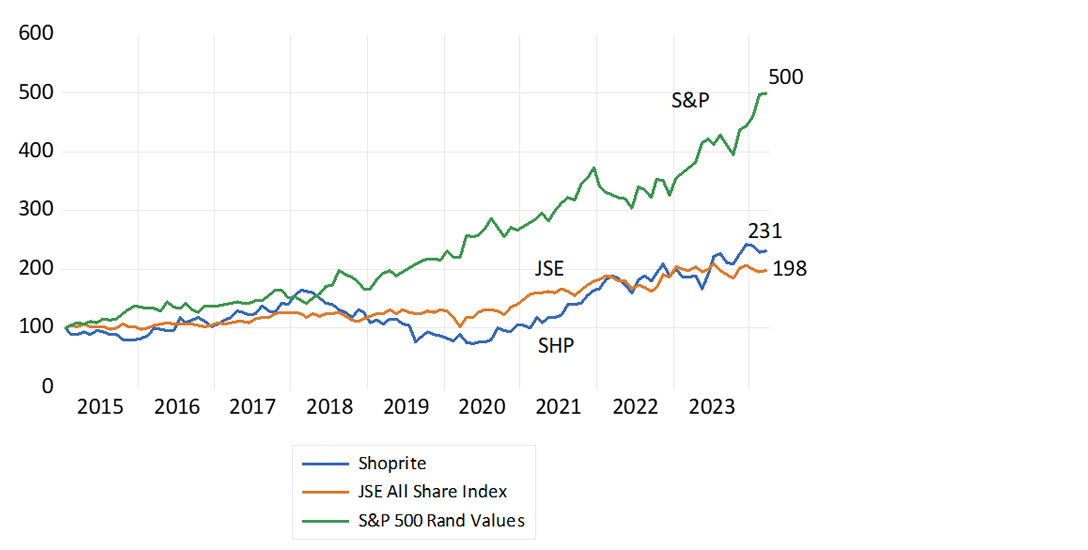

R100 invested in Shoprite shares in 2015, with dividends reinvested, would have grown to R231 by early March this year. Earnings per share have grown by 55% since January 2015. The same R100 invested in the JSE All Share Index would have grown to R198 over the same period. Shoprite’s bottom-line earnings per share seem to have reached something of a plateau recently – load shedding and the associated costs of keeping the lights on have raised costs.

Shoprite: total returns and earnings (2015=100)

Source: Bloomberg and Investec Wealth and Investment, 08/03/2024

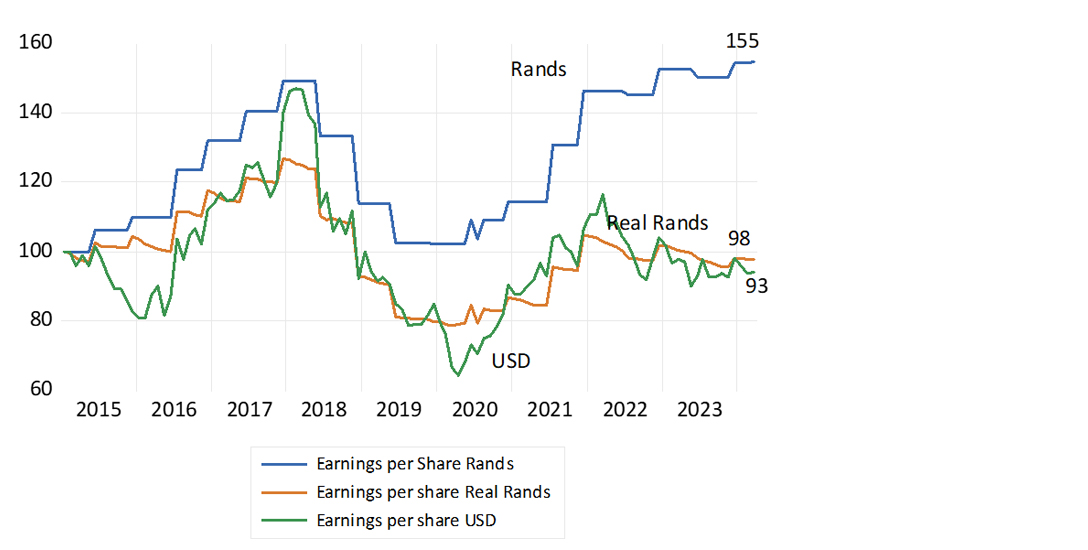

But earnings and returns for shareholders in rands that consistently lose purchasing power need an adjustment for inflation. The performance of Shoprite in rands in real terms or US dollars has not been nearly as imposing. Recent earnings when adjusted for inflation or when converted into US dollars are still marginally below the levels of January 2015 and well below the real or dollar earnings that peaked in 2017.

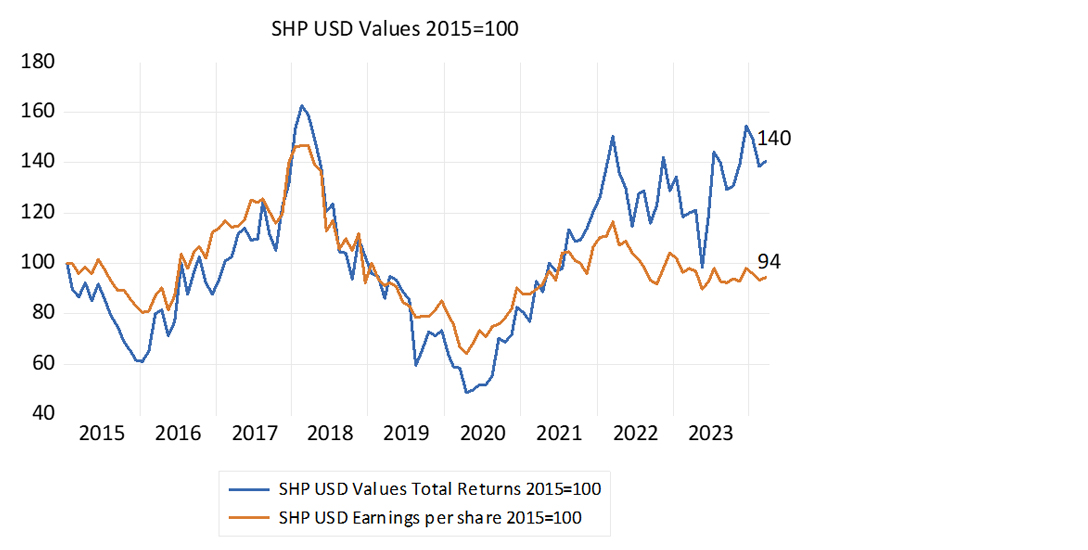

The average annual returns for a US dollar investor in Shoprite since 2015 would have been about 6% a year, compared with 10.6% on average for a rand investor. Shoprite’s earnings in US dollars are now 6% below their levels of 2015.

Walmart, the well-known US retailer by contrast earned 51 US cents per share in January 2015 and now earns 68 US cents per share, for an average compound annual growth rate of 3.9%, better but not exactly shooting the lights out. The total annual average (US dollar) return on Walmart since 2015 has been a decent 10.9% a year, though it lags the S&P 500 by an average of 2% a year.

Shoprite earnings in rands, real rands and US dollars (2015=100)

Source: Bloomberg and Investec Wealth and Investment, 08/03/2024

Shoprite performance in US dollars (2015=100)

Source: Bloomberg and Investec Wealth and Investment, 08/03/2024

The Shoprite returns for shareholders compare closely to those of the JSE All Share Index but lag behind the rand returns realised on the S&P 500 index. Even a great South African business such as Shoprite has not rewarded local investors well in recent years when compared to the returns realised in New York. It would have taken a great business in a growing economy to have done that. The slow growth rates expected of the South African economy are implicit in the undemanding valuations of JSE-listed enterprises that earn the bulk of their income in South Africa. The investment case for Shoprite and every South African economy-facing business at current valuations would have to be made on the possibility of economic growth surprising on the upside.

Faster growth might transpire in response to effective structural reforms and improved delivery by government agencies of all kinds. This would demand greater involvement by private businesses and capital. Here we refer to reforms that are currently on the agenda – described officially as public-private partnerships and as “crowding in private capital” – which would help raise the growth potential of the economy. A sustainable fiscal policy, one that constrains growth in government spending and tax revenues to below the expected growth in nominal GDP, would help growth over the longer term. National Treasury, in its Budget review, strongly makes the case for less government spending and a lesser tax burden to raise South Africa’s growth potential. This is the danger well-addressed by the latest Budget proposals. Help in the form of lower interest rates and a stronger rand would come sooner if these Budget proposals were regarded as credible.

Lower long-term interest rates (after inflation) would then reduce the high real cost of capital that South African businesses now must hurdle over, which fewer businesses are understandably attempting to do, with Shoprite perhaps an exception. Without faster growth in the demand for their goods and services, the case for business capex is diminished and the current lack of capex severely undermines the growth potential of the economy over the long term.

There is one policy intervention that would immediately raise growth rates, and that is to lower short-term interest rates, including mortgage rates, which so heavily depress spending by households. South Africa doesn’t just have a supply-side problem. It suffers also for the want of any growth in spending by households. Demand leads supply as much as supply constrains income and demand for goods and services. The case for significantly lower short-term interest rates – especially in the light of an austere Budget and the absence of any demand-side pressures on prices – is a strong one.

Total returns in rands (2015 = 100)

Source: Bloomberg and Investec Wealth and Investment, 08/03/2024

Receive Focus insights straight to your inbox

About the author

Prof. Brian Kantor

Economist

Brian Kantor is a member of Investec's Global Investment Strategy Group. He was Head of Strategy at Investec Securities SA 2001-2008 and until recently, Head of Investment Strategy at Investec Wealth & Investment South Africa. Brian is Professor Emeritus of Economics at the University of Cape Town. He holds a B.Com and a B.A. (Hons), both from UCT.

Disclaimer

Although information has been obtained from sources believed to be reliable, Investec Wealth & Investment International (Pty) Ltd or its affiliates and/or subsidiaries (collectively “W&I”) does not warrant its completeness or accuracy. Opinions and estimates represent W&I’s view at the time of going to print and are subject to change without notice. Investments in general and, derivatives, in particular, involve numerous risks, including, among others, market risk, counterparty default risk and liquidity risk. The information contained herein is for information purposes only and readers should not rely on such information as advice in relation to a specific issue without taking financial, banking, investment or other professional advice. W&I and/or its employees may hold a position in any securities or financial instruments mentioned herein. The information contained in this document does not constitute an offer or solicitation of investment, financial or banking services by W&I . W&I accepts no liability for any loss or damage of whatsoever nature including, but not limited to, loss of profits, goodwill or any type of financial or other pecuniary or direct or special indirect or consequential loss howsoever arising whether in negligence or for breach of contract or other duty as a result of use of the or reliance on the information contained in this document, whether authorised or not. W&I does not make representation that the information provided is appropriate for use in all jurisdictions or by all investors or other potential clients who are therefore responsible for compliance with their applicable local laws and regulations. This document may not be reproduced in whole or in part or copies circulated without the prior written consent of W&I.

Investec Wealth & Investment International (Pty) Ltd, registration number 1972/008905/07. A member of the JSE Equity, Equity Derivatives, Currency Derivatives, Bond Derivatives and Interest Rate Derivatives Markets. An authorised financial services provider, license number 15886. A registered credit provider, registration number NCRCP262.