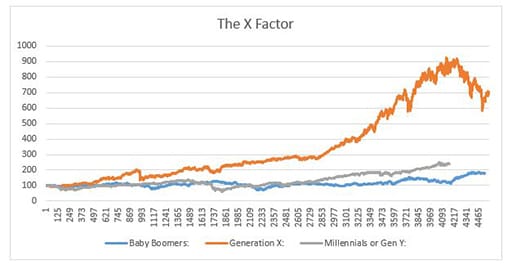

They’ve been described as narcissistic and self-entitled, but maybe Millennials have some mitigating circumstances – compared with Generation X, they’ve had a much less inspiring experience of investing in the stock market, though they have done a little better than the Baby Boomers.

This is based on a comparison of returns for the three well-known generational cohorts – Baby Boomers, Generation X and Millennials – and the market returns they experienced over similar ages. As our chart below shows, Generation X has outperformed both of the other generational cohorts by some margin, though Millennials do seem to be ahead of Baby Boomers over a similar period.

Source: Investec Wealth & Investment and Bloomberg

We tried to capture the stock market’s performance over a comparable age for each cohort. The idea was to start at an early enough age and to do the analysis over a meaningful period of time (ages 22 to 39) in order to capture the formative years during which attitudes to the markets are set.

The 17-year period more or less corresponds with this formative timespan and – perhaps more meaningfully – allows for a fully comparable period for Millennials. We’ve used the S&P 500 as it’s the best-known equity market measure.

The table of ages and investment periods is shown below

| Born from | To | Investment from | To | No of years | |

| Millennials or Gen Y | 1982 | 1999 | 2002 | 2019 | 17 |

| Generation X | 1964 | 1981 | 1984 | 2001 | 17 |

| Baby Boomers | 1946 | 1963 | 1966 | 1983 | 17 |

Why did Generation X do so well?

The main reason is the favourable tailwind GenXers they enjoyed over the late 1980s and 1990s. This tailwind was so strong that even the 1987 crash and the tech crash of the early 2000s were not enough to throw them off course.

By comparison, Baby Boomers, starting in 1966, had to contend with the high inflation and low growth years of the 1970s, while Millennials had to contend with the tech crash aftermath and the financial crisis of 2008.

It should be noted that, in order to draw direct comparisons between the generations, particularly to include Millennials, we ended up with the oldest members of each generation.

A different picture may have emerged if we’d taken the midpoint of each generation – though it would mean an incomplete picture for Millennials. A different picture may also have emerged had we used a different equity market index.

The point remains, though, that just as one’s musical tastes are often shaped (and entrenched) in our teenage and young adult lives, so our attitudes to investing can be shaped by our experience in those formative years – making us too confident, or too fearful, depending on our experience.

The importance of a long-term view

This brings us to the final, most important point: investing is a longer-term game than a mere 17 years. Those Baby Boomers who invested beyond the 1970s would have enjoyed the good years of the late 1980s and 1990s. Equally, Generation X still has many more years of investing to look forward to – and Millennials even more so. With life spans and working lives getting longer, the case for a long-term view cannot be understated.

*The author, a true Generation Xer in every sense, would like to thank Kyle Lasarow, a Millennial, for his invaluable inputs into this article and for proving that the generations can work together.

About the author

Patrick Lawlor

Editor

Patrick writes and edits content for Investec Wealth & Investment, and Corporate and Institutional Banking, including editing the Daily View, Monthly View, and One Magazine - an online publication for Investec's Wealth clients. Patrick was a financial journalist for many years for publications such as Financial Mail, Finweek, and Business Report. He holds a BA and a PDM (Bus.Admin.) both from Wits University.

Receive Focus insights straight to your inbox