As an investor, it's important to consider all available investment opportunities to maximise the potential of your portfolio. One such opportunity that's been on the rise in recent years is private market assets. These investments, which were once reserved for institutional investors, are now accessible to high-net-worth individuals and offer a range of benefits.

According to Braam van Heerden, from the Alternatives and Specialist Opportunity Investment Division at Investec Investment Management, "Private market assets can provide an excellent opportunity for high-net-worth investors to diversify their portfolios and potentially generate higher returns over the long term."

"The number of listed stocks globally has almost halved over the past 20 years, which has led many investors to explore alternative sources of return. Private market investments have become an increasingly popular choice for investors seeking higher returns and diversification in their portfolios."

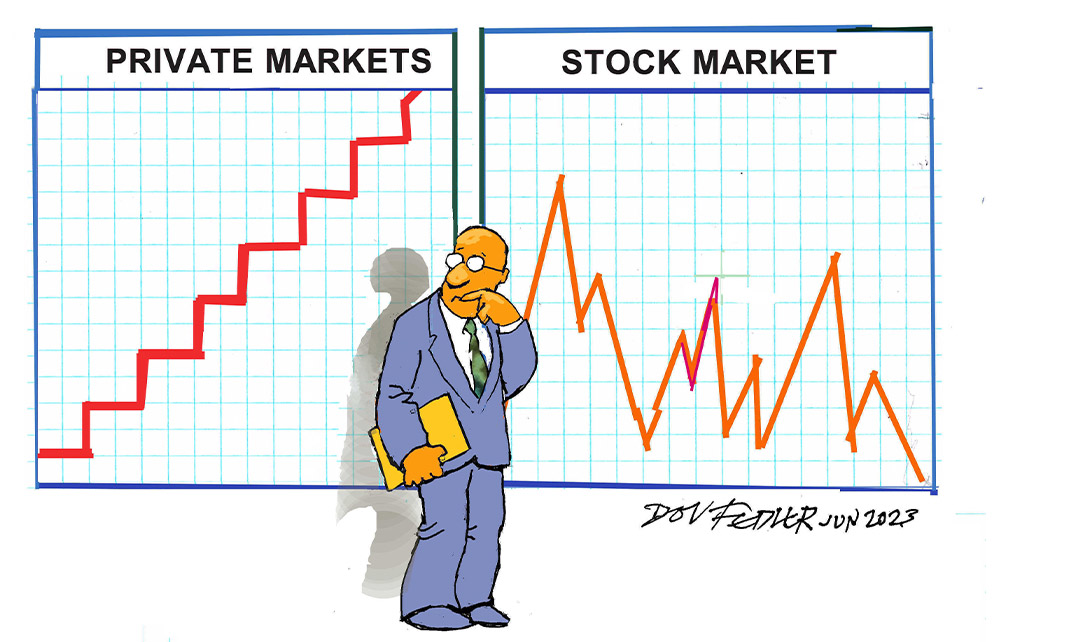

One of the key benefits of private market assets is the potential for better risk-adjusted returns. These investments are not subject to the same short-term market fluctuations as traditional public market investments and can often generate higher returns over the long term. As van Heerden explains, "Private market investments typically have a longer investment horizon than public market investments, which allows for more time for the investment to grow."

Private market assets also offer diversification benefits. "Many high net-worth individuals have significant exposure to public market investments such as listed equities and bonds. By adding private market assets to their portfolios, they can diversify their investments as private market assets may have different risk-return profiles from public markets," says van Heerden. This is particularly important in today’s economic climate, where traditional public market investments are subject to greater volatility.

Van Heerden explains how investors can obtain additional diversification benefits from the various underlying private market asset classes. “It's important to note that different classes of private market assets have different risk and return characteristics. Private equity, for example, tends to offer higher potential returns but also carries higher risk due to the equity nature of these investments. On the other hand, private debt investments can offer more stable returns with lower risk, as these investments are typically backed by collateral and have more predictable cash flows.”

Private market assets can provide an excellent opportunity for high-net-worth investors to diversify their portfolios and potentially generate higher returns over the long term.

Another benefit of private market assets is the potential for greater control. Private market investments are often made in companies or projects where the private equity fund can have a more direct say through board and advisory committee representation. "This level of control can allow investors to influence the direction of their investments and potentially reduce their risk and increase their returns," notes van Heerden.

Finally, private market assets offer an opportunity to invest in a specific theme that an individual has an interest in, but which may not be readily accessible through traditional public markets. This is especially relevant for individuals who want to invest in causes and projects that align with their values. "Many private market investments are focused on impact investing or investing in companies or projects that have a positive social or environmental impact. This type of investing can be particularly appealing to high-net-worth individuals who are looking for ways to make a difference in the world," explains van Heerden.

It’s important to highlight that private market assets are not without their risks. Private market investments are typically less liquid than public market investments, meaning that investors may not be able to access their capital as easily as they would through a liquid, listed security. Private market investments may also be subject to greater regulatory and legal risks and may require more specialised knowledge to evaluate.

However, high-net-worth individuals will generally have the capacity to place a portion of their portfolio in long-term private investments as they usually will not need to access or liquidate a large portion of their assets at any time. This long-term investing philosophy often adds compounding benefits to the overall portfolio.

To effectively incorporate private market assets into a high net-worth portfolio it's important to have a trusted partner who can help navigate the complexities of this investment space. According to Marc Romberg, from Investec Wealth Management, "Private market investments require a deep understanding of the underlying assets, as well as the risks and potential returns associated with them.”

Romberg says it’s important to interrogate the credentials of your partners when looking at private market assets, "Does your partner have access to a range of global opportunities that have been thoroughly evaluated for risk and potential return, including private equity, private debt, real estate, and infrastructure? Are they able to work closely with you to ensure that the investments are suitable for you and that your portfolios are properly diversified? These are some of the questions you need to ask."

Romberg notes that the trend to add private market assets to portfolios is reflected in the asset allocation strategies of large global family offices, which have raised their allocations to private assets over the past decade. "Fifteen years ago, many family offices allocated only about 15-20% of their assets to private market investments. Today, it's not uncommon to see allocations of around 35% or higher," notes Romberg.

In conclusion, incorporating private market assets into a high net-worth portfolio requires careful consideration and expertise. Working with a trusted partner can help investors navigate the complexities of this space and maximise the potential benefits of private market investments. As Romberg notes, "As a way for investors to achieve their long-term financial goals, we believe that private market investments can be an important component of a well-diversified portfolio."

Receive Focus insights straight to your inbox

Disclaimer

Although information has been obtained from sources believed to be reliable, Investec Wealth & Investment International (Pty) Ltd or its affiliates and/or subsidiaries (collectively “W&I”) does not warrant its completeness or accuracy. Opinions and estimates represent W&I’s view at the time of going to print and are subject to change without notice. Investments in general and, derivatives, in particular, involve numerous risks, including, among others, market risk, counterparty default risk and liquidity risk. The information contained herein is for information purposes only and readers should not rely on such information as advice in relation to a specific issue without taking financial, banking, investment or other professional advice. W&I and/or its employees may hold a position in any securities or financial instruments mentioned herein. The information contained in this document does not constitute an offer or solicitation of investment, financial or banking services by W&I . W&I accepts no liability for any loss or damage of whatsoever nature including, but not limited to, loss of profits, goodwill or any type of financial or other pecuniary or direct or special indirect or consequential loss howsoever arising whether in negligence or for breach of contract or other duty as a result of use of the or reliance on the information contained in this document, whether authorised or not. W&I does not make representation that the information provided is appropriate for use in all jurisdictions or by all investors or other potential clients who are therefore responsible for compliance with their applicable local laws and regulations. This document may not be reproduced in whole or in part or copies circulated without the prior written consent of W&I.

Investec Wealth & Investment International (Pty) Ltd, registration number 1972/008905/07. A member of the JSE Equity, Equity Derivatives, Currency Derivatives, Bond Derivatives and Interest Rate Derivatives Markets. An authorised financial services provider, license number 15886. A registered credit provider, registration number NCRCP262.